Weekly News Wrap: India-US Trade Deal, Mahindra’s Rs 15,000 Crore Bet, Honda’s Europe Export Plan, Automechanika 2026

From a preferential quota for auto parts into the US to Mahindra’s biggest integrated plant in Nagpur, the week reset the export-and-investment narrative.

If last week was about momentum, this one was about structure. India and the US sketched an interim trade framework that explicitly makes room for Indian auto parts via a preferential tariff-rate quota, an export lever the component industry has long wanted in writing.

At home, Mahindra put a decade-long manufacturing marker in Maharashtra with a ₹15,000-crore integrated facility plan around Nagpur, signalling that the post-GST 2.0 upcycle is now pulling capex decisions forward.

Meanwhile, Honda’s export plans (mid-size motorcycles from India to Europe from 2026) added another data point to India’s “build here, ship out” story at a time when global supply chains are being re-priced by geopolitics.

Overlay all of this on January’s sales growth, and a common thread emerges: the industry is quietly reorganising itself for the next growth phase. Companies are sharpening portfolios, strengthening export backbones and locking in capacity for the long term. Hero MotoCorp’s articulation of five pillars, scooters, premium motorcycles, global markets, electric vehicles, and parts and accessories, as the basis of its next expansion cycle captures this mood well.

The message across boardrooms is similar: growth will be less about one-off festive spikes and more about structural bets on exports, premiumisation, electrification and new revenue streams.

Here’s the detailed round-up of all major developments from this week:

India, US agree on interim trade deal; Auto exports to get preferential quota

India and the United States have reached a framework for an interim trade agreement, under which the US will grant a preferential tariff-rate quote for automotive parts imported from India. Under the framework, the US will also reduce its tariffs on Indian imports on a wide range of products to 18% from the existing 50%.

India and the United States have reached a framework for an interim trade agreement, under which the US will grant a preferential tariff-rate quote for automotive parts imported from India. Under the framework, the US will also reduce its tariffs on Indian imports on a wide range of products to 18% from the existing 50%.

“Consistent with US national security requirements, India will receive a preferential tariff rate quota for automotive parts subject to the tariff imposed to eliminate threats to national security found in Proclamation 9888 of May 17, 2019 (Adjusting Imports of Automobiles and Automobile Parts Into the United States), as amended,” both countries said in a joint statement.

Auto Inc Welcomes India-US Trade Deal

Zero Duty on Nearly 50% of Indian Auto Parts Exported to US: Piyush Goyal

Following the announcement of an interim trade agreement between India and the United States, Commerce and Industry Minister Piyush Goyal said on Saturday that some elementary auto part exports from India to the US will attract zero duty, with more than half of India’s auto component exports set to fall under the duty-free category.

Following the announcement of an interim trade agreement between India and the United States, Commerce and Industry Minister Piyush Goyal said on Saturday that some elementary auto part exports from India to the US will attract zero duty, with more than half of India’s auto component exports set to fall under the duty-free category.

“Some auto parts exports will attract zero duty, while others will face an 18% tariff. Around 50% of exports will be duty-free,” Goyal said on Saturday while explaining the framework of the interim trade agreement, which reduces reciprocal tariffs on Indian goods exported to the US imports to 18% and zero percent for certain products, from 50%.

Exports Critical Pillar of Auto Component Industry, Says ACMA President

Exports continue to be a critical pillar of growth for India’s auto component industry, with nearly 30% of the sector’s output shipped to overseas markets, according to ACMA President Vikram Raghupati Singhania. His comments come as the country has entered into FTAs with multiple countries, which is expected to further integrate India's auto component industry with global automotive value chains.

Exports continue to be a critical pillar of growth for India’s auto component industry, with nearly 30% of the sector’s output shipped to overseas markets, according to ACMA President Vikram Raghupati Singhania. His comments come as the country has entered into FTAs with multiple countries, which is expected to further integrate India's auto component industry with global automotive value chains.

Speaking at the sixth edition of ACMA Automechanika on Wednesday, Singhania said the Indian auto component industry, valued at around $80 billion, has demonstrated resilience and adaptability despite global challenges such as geopolitical disruptions, supply chain volatility, inflationary pressures and rapid technology shifts.

ACMA Automechanika New Delhi 2026 Opens with Focus on Aftermarket Growth

India Scraps Small Car Exemption in Emissions Rules After Automaker Complaints

India has eliminated a planned concession for small cars in its upcoming fuel-efficiency rules after automakers including Tata Motors and Mahindra & Mahindra argued it would benefit only one company, Reuters reported.

India has eliminated a planned concession for small cars in its upcoming fuel-efficiency rules after automakers including Tata Motors and Mahindra & Mahindra argued it would benefit only one company, Reuters reported.

A September draft had proposed leniency for petrol cars weighing 909 kg (2,004 lb) or less—a carve-out widely seen as favouring Maruti Suzuki, which controls 95% of India's small-car market.

India's Power Ministry has now removed that exemption and tightened other parameters, increasing pressure on all automakers to ramp up electric and hybrid car sales, according to the latest 41-page draft reviewed by Reuters.

Maruti Suzuki to Set Up Automated Driving Test Tracks in Four Andhra Pradesh Cities

Government Notifies WLTP Cycle for BS-VI Emission Testing From April 2027

In a bid to tighten the way vehicle emissions are measured, the government has notified the use of the Worldwide Harmonised Light-duty Vehicles Test Procedure (WLTP) for testing emissions under the Bharat Stage VI norms for M1 and M2 categories from April 2027.

In a bid to tighten the way vehicle emissions are measured, the government has notified the use of the Worldwide Harmonised Light-duty Vehicles Test Procedure (WLTP) for testing emissions under the Bharat Stage VI norms for M1 and M2 categories from April 2027.

This has been notified through an amendment to the Central Motor Vehicles Rules, 1989. The draft norms were issued by the Ministry of Road Transport and Highways on April 28, 2025.

Honda to Begin Exporting Mid-Size Motorcycles from India to Europe in 2026

Honda plans to start exporting mid-size displacement motorcycles from India to Europe beginning in 2026, as it steps up efforts to position the country as a key export hub for global markets.

Honda plans to start exporting mid-size displacement motorcycles from India to Europe beginning in 2026, as it steps up efforts to position the country as a key export hub for global markets.

In its Corporate Update 2025, the company said India is evolving into a global export base and that shipments of mid-size motorcycles to Europe will commence in a phased manner during the year. The move forms part of Honda’s broader strategy to build an efficient global supply system that addresses regional demand by optimising the use of global resources.

Yamaha Launches EC-06 Electric Scooter in India at ₹1.67 Lakh

Hero MotoCorp Identifies Five Pillars to Drive Next Phase of Expansion

Hero MotoCorp Ltd has identified scooters, premium motorcycles, global markets, electric vehicles and parts and accessories as key pillars to accelerate growth and gain market share over the next few years.

Hero MotoCorp Ltd has identified scooters, premium motorcycles, global markets, electric vehicles and parts and accessories as key pillars to accelerate growth and gain market share over the next few years.

Speaking during an analyst call held after the company’s Q3 FY26 results, Chief Executive Officer Harshavardhan Chitale said these segments offer significant headroom for expansion and will anchor the company’s next phase of growth.

Hero MotoCorp Export Volumes Jump 50% on Premium Product Push

Hero MotoCorp sees double-digit industry growth in Q4; flags slower FY27

Hero MotoCorp Ltd expects the domestic two-wheeler industry to post double-digit growth in the March quarter and moderate to high-single-digit expansion in FY27, supported by GST-led recovery, improving rural demand and traction across scooters and premium motorcycles.

India’s largest two-wheeler manufacturer said demand momentum has remained strong since October and is likely to stay firm through the remainder of the current financial year.

“We remain confident about the growth prospects of the two-wheeler industry and expect the industry to grow by double-digit during the current quarter,” Vivek Anand, Chief Financial Officer at Hero MotoCorp, said during an analyst call held to discuss the company’s Q3 FY26 performance.

Hero MotoCorp Sees Input Cost Pressure Persist in Q4; to Take Calibrated Price hikes

Ather Energy Says Staying Outside PLI Makes Business More Resilient

Electric two-wheeler maker Ather Energy sees the absence of Production Linked Incentive (PLI) benefits for the company as a long-term structural advantage, with CEO Tarun Mehta arguing that operating without policy-linked subsidies allows it to build a more robust pricing and profitability framework. According to him, operating outside the PLI framework has forced Ather to take pricing decisions proactively, rather than deferring them in anticipation of incentives, as some peers do.

Electric two-wheeler maker Ather Energy sees the absence of Production Linked Incentive (PLI) benefits for the company as a long-term structural advantage, with CEO Tarun Mehta arguing that operating without policy-linked subsidies allows it to build a more robust pricing and profitability framework. According to him, operating outside the PLI framework has forced Ather to take pricing decisions proactively, rather than deferring them in anticipation of incentives, as some peers do.

“Us not having PLI is actually one of the strongest and one of the biggest reasons to be optimistic about us in the mid-term, because we are already operating on the cleanest pricing principle,” Mehta told investors after announcing the third-quarter results. He said the lack of PLI support, though a short-term challenge, reduces business risk over time by insulating the company from future policy shifts.

Ather Prepares For Commodity Headwinds As Profitability Comes Into View

Ather’s EL Signals a Shift From Fixing Margins to Scaling the Business

For much of its journey as an electric two-wheeler maker, Ather Energy’s product roadmap has been closely tied to improving unit economics in a young and volatile EV market. In the December quarter, however, the commentary around the upcoming EL platform suggested a shift in emphasis shaped as much by timing as by technology.

In Q3 FY26, Ather reduced EBITDA losses to (-3%), reported adjusted gross margins excluding incentives of 23%, and lifted non-vehicle revenue to 14% of total income. Revenue was just shy of ₹1,000 crore, while volumes stood at about 68,000 units. Together, the numbers point to a business that is already showing operating leverage from its existing portfolio.

Ather Energy to Set up Subsidiary in Hong Kong to Strengthen Supply Chain

Ola Electric Begins Deliveries of India-Made Home Battery Storage System

Tata Motors Sierra Bookings cross 1 lakh mark; Focus Shifts to Capacity Ramp-up

“We had declared 70,000 bookings on day one. Bookings have been pouring in and the number has become inconsequential because the focus is now on supply,” Shailesh Chandra, Managing Director and Chief Executive Officer of Tata Motors PV, said during a media call held to discuss the company’s Q3 FY26 performance. He added that bookings have moved into “six-digit numbers” and the production of the model is in the ramp-up phase.

Tata Motors to Begin JLR Assembly at Chennai Plant

Tata Motors will soon begin assembling Jaguar Land Rover (JLR) vehicles at its Panapakkam plant near Chennai, marking an expansion of its luxury vehicle manufacturing footprint in India, the company said during its earnings call.

Tata Motors will soon begin assembling Jaguar Land Rover (JLR) vehicles at its Panapakkam plant near Chennai, marking an expansion of its luxury vehicle manufacturing footprint in India, the company said during its earnings call.

The automaker did not disclose which JLR models will be assembled at the new facility. Company executives said only that production would start with JLR vehicles, with further details to be shared at a later stage. Media reports earlier in the day had suggested that the Range Rover Evoque could be the first model to be assembled at the plant.

JLR Production Normalised, Demand softness now key Risk: CFO

Compact SUVs Largest Beneficiary of GST 2.0, Hatch Share Declining: Hyundai

Recent GST rate reforms have triggered a sharp recovery in India’s passenger vehicle market, reviving demand across segments after a prolonged slowdown. While expectations were high for a turnaround in small cars and hatchbacks, Hyundai Motor India says compact SUVs have emerged as the biggest beneficiaries of the tax cut, even as the hatchback segment continues to lose share.

Recent GST rate reforms have triggered a sharp recovery in India’s passenger vehicle market, reviving demand across segments after a prolonged slowdown. While expectations were high for a turnaround in small cars and hatchbacks, Hyundai Motor India says compact SUVs have emerged as the biggest beneficiaries of the tax cut, even as the hatchback segment continues to lose share.

“On the question of small cars, GST has given a strong momentum to the industry. But we have noticed growth across segments. Even if you look at other segments, for example, in Aura, we had the highest-ever monthly sales in January. So, quite clearly, we are seeing traction across segments,” Hyundai India MD and CEO Tarun Garg told reporters.

Hyundai Venue Garners 80,000 Bookings as Compact SUVs Lead Market Growth

Hyundai’s Rural Sales Hit Record High in Q3 as SUVs Gain Ground

Karnataka to Establish EV City Near Bengaluru

The Karnataka government is moving forward with plans to establish dedicated electric vehicle manufacturing hubs near Bengaluru as part of its ambitious Clean Mobility Policy 2025-2030, according to The Hindu Business Line.

The Karnataka government is moving forward with plans to establish dedicated electric vehicle manufacturing hubs near Bengaluru as part of its ambitious Clean Mobility Policy 2025-2030, according to The Hindu Business Line.

Three strategic locations have been designated as clean mobility clusters under the policy. The primary site is located in Harohalli, Ramanagara district, spanning 700 acres approximately 40 kilometers from Bengaluru. Two additional clusters have been identified at Chikkamalligewada in Dharwad district (1,000 acres, 30 kilometers from Hubballi airport) and Gauribidanur in Chikkaballapur district (825 acres, 70 kilometers from Bengaluru).

Kia India Partners with BPCL to Expand EV Charging Network to 15,000+ Points

Horse Powertrain Plans India Entry; Puts Hybrids at Core

Global powertrain supplier Horse Powertrain, backed by France’s Renault and China’s Geely, is evaluating multiple ways to enter the Indian market as the company looks at India as a key strategic growth market.

Global powertrain supplier Horse Powertrain, backed by France’s Renault and China’s Geely, is evaluating multiple ways to enter the Indian market as the company looks at India as a key strategic growth market.

The €15 billion company is placing hybrid technologies at the centre of its powertrain strategy, positioning strong hybrids, plug-in hybrids and range-extender systems as its main commercial focus for markets such as India.

VE Commercial Vehicles Open to Invest in Charging Point Operators as e-bus Push Deepens

VE Commercial Vehicles (VECV) is open to investing in charging point operators (CPOs) as part of its broader effort to strengthen India’s electric bus ecosystem, even as it continues to focus primarily on vehicle manufacturing and captive charging solutions, Vipin Gupta, Business Head – Electro Mobility, VE Commercial Vehicles, told Autocar Professional in an exclusive conversation.

VE Commercial Vehicles (VECV) is open to investing in charging point operators (CPOs) as part of its broader effort to strengthen India’s electric bus ecosystem, even as it continues to focus primarily on vehicle manufacturing and captive charging solutions, Vipin Gupta, Business Head – Electro Mobility, VE Commercial Vehicles, told Autocar Professional in an exclusive conversation.

“We have invested, but it is primarily on captive side of charging infra. But we are open for any such opportunity if it comes, then we will look into those types of facilities and will be keen to work with those partners,” Gupta said.

Ashok Leyland, PT Pindad Sign MoU for Electric Buses and Defence Vehicles

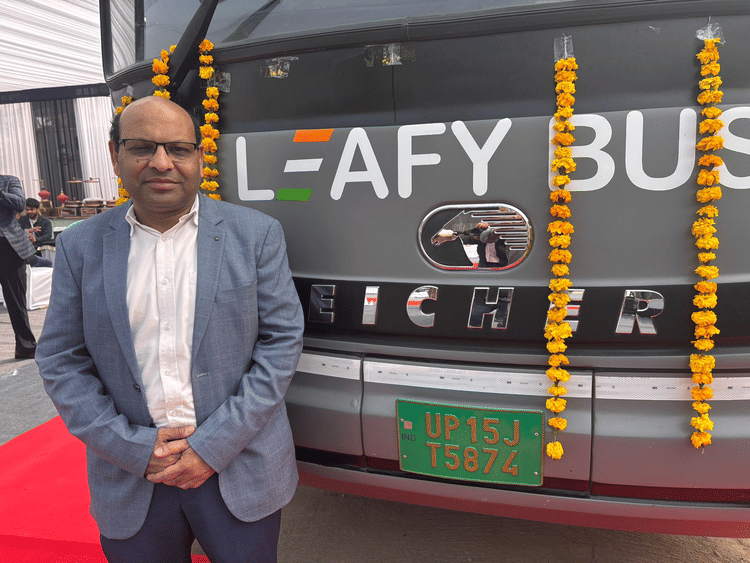

Leafy Bus Is Setting up Private Bus Terminals in India

As India’s intercity bus market begins its gradual transition towards electric mobility, the biggest constraint is no longer the availability of electric buses but the ecosystem that supports them. Charging reliability, turnaround times, land access and passenger experience remain fragmented, particularly for long-distance operations. Delhi-based electric intercity operator Leafy believes the solution lies in building private bus terminals designed specifically for electric buses.

As India’s intercity bus market begins its gradual transition towards electric mobility, the biggest constraint is no longer the availability of electric buses but the ecosystem that supports them. Charging reliability, turnaround times, land access and passenger experience remain fragmented, particularly for long-distance operations. Delhi-based electric intercity operator Leafy believes the solution lies in building private bus terminals designed specifically for electric buses.

Rohan Dewan, founder and CEO of Leafy Bus, told Autocar Professional in an exclusive conversation that the company’s strategy is centred on combining electric intercity operations with captive infrastructure, allowing it to control charging, turnaround times and passenger experience as it scales.

Bain Capital-backed Dhoot Transmission Files Confidential IPO Papers With Sebi

Auto components manufacturer Dhoot Transmission, backed by private equity firm Bain Capital, has filed draft papers with the Securities and Exchange Board of India (Sebi) under the confidential pre-filing route, signalling the company’s intent to tap the primary markets.

Auto components manufacturer Dhoot Transmission, backed by private equity firm Bain Capital, has filed draft papers with the Securities and Exchange Board of India (Sebi) under the confidential pre-filing route, signalling the company’s intent to tap the primary markets.

The development was disclosed through a public filing advertisement issued by the company, a regulatory requirement under Sebi norms for issuers opting for the confidential filing mechanism. The move allows companies to keep sensitive business and financial details out of the public domain during the early stages of the IPO process.

Chinese Automakers Extend Car Loans to Eight Years to Boost Sales

Automakers operating in China are extending vehicle repayment terms to as long as eight years in an effort to attract consumers amid stagnant demand in the world's largest auto market, according to Reuters.

Automakers operating in China are extending vehicle repayment terms to as long as eight years in an effort to attract consumers amid stagnant demand in the world's largest auto market, according to Reuters.

Nissan's joint venture with Dongfeng joined at least 10 other car brands, including Xpeng, Xiaomi and Geely, on Tuesday in offering longer-term low-interest financing plans, Reuters reported following checks of the offers.

Dongfeng Nissan's eight-year plan requires zero down payment and advertises that customers buying its Sylphy Classic model would only need to make a daily repayment of as low as 27 yuan ($3.89), roughly the cost of a daily coffee.

Lamborghini Delivers Final Huracán to Indian Market After Decade-Long Run

Spinny Partners with Tesla to Facilitate Electric Vehicle Adoption in India

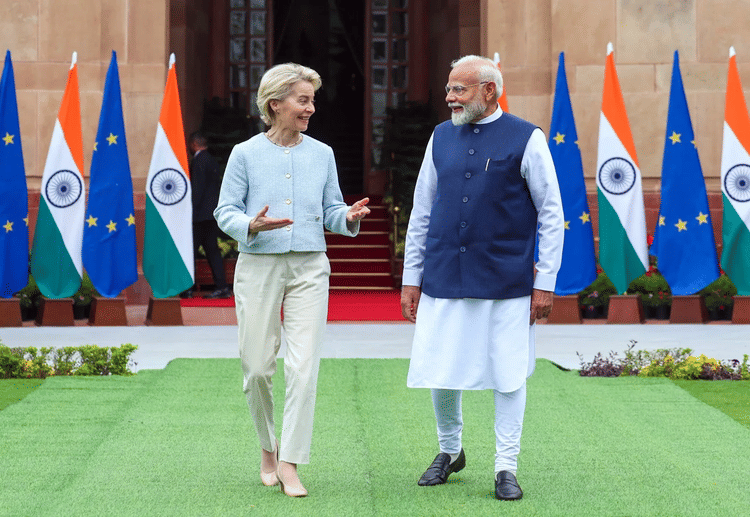

India-EU Free Trade Agreement Signed After 20 Years of Negotiations

India and the European Union finalized a free trade agreement in January 2026 after nearly 20 years of negotiations, eliminating tariffs on over 90% of goods exchanged between the two regions. The agreement establishes a large free-trade zone and represents a significant development for Indian sectors currently facing EU import duties ranging from 4% to 26%.

India and the European Union finalized a free trade agreement in January 2026 after nearly 20 years of negotiations, eliminating tariffs on over 90% of goods exchanged between the two regions. The agreement establishes a large free-trade zone and represents a significant development for Indian sectors currently facing EU import duties ranging from 4% to 26%.

The EU has granted India preferential zero tariff access on 97% of its tariff lines, covering 99.5% of India's export value. About 70% of EU tariff lines, covering approximately 90% of India's exports, will see immediate duty elimination upon enforcement. Another 20% of tariff lines, covering around 3% of exports, will become zero duty over a three-to-five-year period.

TAGMA India to Host Die & Mould India Expo 2026 in Mumbai

Investments, Orders & Pacts

Mahindra to Invest ₹15,000 Cr in Maharashtra Manufacturing Facility

Mahindra & Mahindra announced on Friday that it will establish its largest integrated manufacturing facility for automobiles and tractors in Nagpur, Maharashtra, with an investment of ₹15,000 crore over 10 years. The announcement was made at Advantage Vidarbha, a three-day event positioning the region as an industrial growth hub.

Mahindra & Mahindra announced on Friday that it will establish its largest integrated manufacturing facility for automobiles and tractors in Nagpur, Maharashtra, with an investment of ₹15,000 crore over 10 years. The announcement was made at Advantage Vidarbha, a three-day event positioning the region as an industrial growth hub.

The facility will be developed across 1,500 acres in Vidarbha, with a 150-acre supplier park in Sambhajinagar. Once operational in 2028, the plant will have an annual production capacity of over 5 lakh vehicles and 1 lakh tractors, making it Mahindra's largest integrated manufacturing footprint in the country.

Mahindra Secures Record 35,000-Unit Export Order for Indonesia Cooperative Project

Mahindra & Mahindra has announced a landmark export deal to supply 35,000 Scorpio Pik Up vehicles to Indonesia in 2026, marking the company's largest-ever export order.

Mahindra & Mahindra has announced a landmark export deal to supply 35,000 Scorpio Pik Up vehicles to Indonesia in 2026, marking the company's largest-ever export order.

The vehicles will be delivered to Agrinas Pangan Nusantara, an Indonesian state-owned enterprise, as part of the Koperasi Desa/Kelurahan Merah Putih (KDKMP) Project. The order exceeds Mahindra's total export volume from the previous fiscal year.

JK Tyre to Invest Rs 1,130 Crore to Expand Capacity by FY28

JK Tyre & Industries Ltd’s board today approved a Rs 1,130 crore investment to expand the capacity of truck and bus radial (TBR), all-steel light truck radial (LTBR) and passenger car radial (PCR) tyres, with the additional output slated to come on stream by the second quarter of the financial year 2027-28.

JK Tyre & Industries Ltd’s board today approved a Rs 1,130 crore investment to expand the capacity of truck and bus radial (TBR), all-steel light truck radial (LTBR) and passenger car radial (PCR) tyres, with the additional output slated to come on stream by the second quarter of the financial year 2027-28.

The company will add TBR capacity at its Vikrant Tyre Plant and Laksar Tyre Plant, while LTBR capacity will be expanded at the Vikrant facility. Additional PCR capacity will be created at the Banmore Tyre Plant, according to an exchange filing.

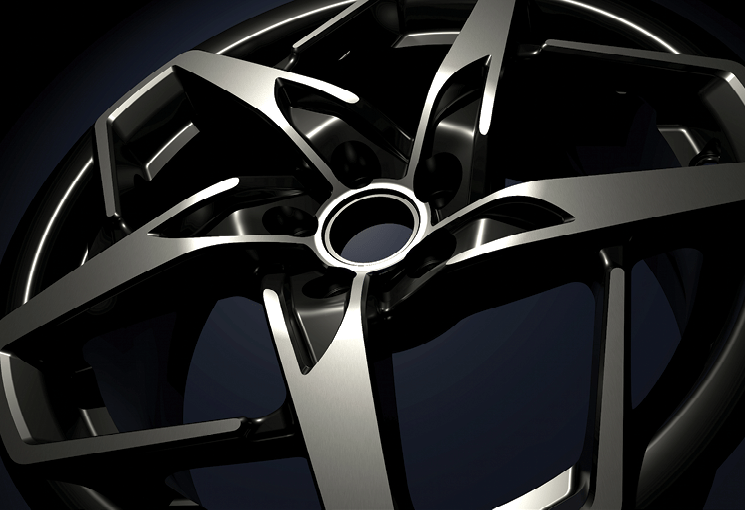

Uno Minda Approves Rs 764 Crore Capex for New Alloy Wheel Plant

Auto component major Uno Minda on Thursday announced projected capex of Rs 764 crore for setting up of a greenfield four-wheeler alloy wheel manufacturing facility for a mix of Gravity Die Casting (GDC) technology and Low Pressure Die Casting (LPDC) technology wheels. The capacity of the plant, which is expected to come up in a phased manner over four years, will have a capacity of around 1.8 million Wheels per annum.

Auto component major Uno Minda on Thursday announced projected capex of Rs 764 crore for setting up of a greenfield four-wheeler alloy wheel manufacturing facility for a mix of Gravity Die Casting (GDC) technology and Low Pressure Die Casting (LPDC) technology wheels. The capacity of the plant, which is expected to come up in a phased manner over four years, will have a capacity of around 1.8 million Wheels per annum.

The new plant is planned to be set up near Chhatrapati Sambhaji Nagar in Maharashtra. The new plant will meaningfully expand the company's LPDC-based alloy wheel manufacturing capability, strengthening its position with OEMs who prefer LPDC technology and hence enabling us to further grow our market share in this segment, the company noted.

Hero MotoCorp to Invest ₹275 Crore More in Euler Motors, Raises EV Bet

India’s largest two-wheeler manufacturer, Hero MotoCorp Ltd, on Thursday announced an additional investment of ₹275 crore in electric vehicle maker Euler Motors, reinforcing its push into the fast-growing electric mobility space.

India’s largest two-wheeler manufacturer, Hero MotoCorp Ltd, on Thursday announced an additional investment of ₹275 crore in electric vehicle maker Euler Motors, reinforcing its push into the fast-growing electric mobility space.

The investment will be made in one or more tranches by April 2026 and will include a mix of primary and secondary transactions, the company said in an exchange filing. Following the proposed infusion, Hero MotoCorp’s stake in Euler Motors will rise to about 36% from 34.1% on a fully diluted basis.

DrivN Secures USD 80 Mn Financing Commitment From Nomura

Talbros Automotive Secures Orders Worth Over Rs 1,000 Crore

Talbros Automotive Components Limited (TACL) and its joint ventures have secured orders valued at over Rs 1,000 crore from leading original equipment manufacturers (OEMs) for both domestic and export markets. The orders are scheduled to be executed over the next five years, with commercialization beginning in FY27.

Talbros Automotive Components Limited (TACL) and its joint ventures have secured orders valued at over Rs 1,000 crore from leading original equipment manufacturers (OEMs) for both domestic and export markets. The orders are scheduled to be executed over the next five years, with commercialization beginning in FY27.

The company disclosed the development through a regulatory filing to stock exchanges on February 6, 2026. The orders span across TACL's entire product portfolio, including gaskets, heat shields, forging components, hoses, anti-vibration parts, and chassis components.

Varroc Engineering Secures Contract for AC Bi-Directional Wall Chargers

ZF and BMW Agree on Drive Technology Partnership

ZF Friedrichshafen AG and BMW Group have entered into a contract for the supply of drive components intended for electric and hybrid vehicle platforms. The agreement covers production and development work scheduled to begin in the coming years.

ZF Friedrichshafen AG and BMW Group have entered into a contract for the supply of drive components intended for electric and hybrid vehicle platforms. The agreement covers production and development work scheduled to begin in the coming years.

The partnership will focus on components for battery electric vehicles and plug-in hybrid systems. ZF will supply transmission systems and related drive technology parts to BMW manufacturing facilities. The contract includes provisions for collaborative development of future drivetrain solutions.

JS Auto Cast Secures Rs 300 Crore Investment from Premji Invest

JS Auto Cast Foundry India Private Limited has completed a Rs 300 crore primary equity raise from Premji Invest, marking a significant capital infusion for the ferrous castings manufacturer.

JS Auto Cast Foundry India Private Limited has completed a Rs 300 crore primary equity raise from Premji Invest, marking a significant capital infusion for the ferrous castings manufacturer.

The investment gives Premji Invest a 23% stake on a fully diluted basis in JS Auto Cast, which operates as a wholly-owned stepdown subsidiary of Bharat Forge Limited. The company specializes in critical ferrous castings for industrial and automotive applications.

Video Playlist

Can Small Cars Survive CAFE 3 Norms?

India is about to rewrite the rules for how clean your next car has to be. From 2027 to 2032, the government’s draft CAFE-3 norms (Corporate Average Fuel Efficiency – Phase III) will sharply tighten fuel consumption and CO₂ targets for every carmaker operating in India. The impact? Higher prices, new model strategies, more hybrids and EVs — and a serious question mark over the future of small cars.

India is about to rewrite the rules for how clean your next car has to be. From 2027 to 2032, the government’s draft CAFE-3 norms (Corporate Average Fuel Efficiency – Phase III) will sharply tighten fuel consumption and CO₂ targets for every carmaker operating in India. The impact? Higher prices, new model strategies, more hybrids and EVs — and a serious question mark over the future of small cars.

In this episode of Autocar Professional POV, we break down what CAFE-3 really means, why the industry is split down the middle, and how this policy could reshape India’s passenger vehicle market.

Ashok Leyland Says Electronics are Redefining BS6 Heavy Trucks

BS6 has fundamentally altered the role electronics play in commercial vehicles, shifting the focus from mechanical robustness alone to uptime, diagnostics and operational efficiency, Sanjeev Kumar, President, M&HCV at Ashok Leyland, told Autocar Professional.

BS6 has fundamentally altered the role electronics play in commercial vehicles, shifting the focus from mechanical robustness alone to uptime, diagnostics and operational efficiency, Sanjeev Kumar, President, M&HCV at Ashok Leyland, told Autocar Professional.

Earlier-generation trucks, largely mechanical in nature, depended heavily on operator intervention. In contrast, BS6 platforms are built on a connected electronic architecture that allows OEMs to monitor vehicle health in real time. Kumar said Ashok Leyland now tracks BS6 trucks through its uptime solution centre in Chennai, staffed by nearly 100 engineers, enabling predictive diagnostics and early fault detection.

Electronics Will Become Part of the Auto Aftermarket Over Time, Says ACMA President

Electronics will inevitably become part of the automotive aftermarket, but the transition will be gradual rather than disruptive, shaped by India’s large existing vehicle parc and legacy vehicles on the road.

Electronics will inevitably become part of the automotive aftermarket, but the transition will be gradual rather than disruptive, shaped by India’s large existing vehicle parc and legacy vehicles on the road.

Speaking on the sidelines of Automechanika 2026, Vikrampati Singhania, President of the Automotive Component Manufacturers Association of India, said that while new vehicles are increasingly electronics- and software-driven, the aftermarket will continue to service conventional mechanical parts for several years.

Rural India Powers the Aftermarket: ACMA’s Sriram Viji

India’s automotive aftermarket is undergoing a quiet but decisive shift, with rural India emerging as its next growth engine, even as vehicles become more electronics-driven and complex to service.

India’s automotive aftermarket is undergoing a quiet but decisive shift, with rural India emerging as its next growth engine, even as vehicles become more electronics-driven and complex to service.

Speaking to Autocar Professional on the sidelines of ACMA Automechanika 2026, Sriram Viji, President-Designate of the Automotive Component Manufacturers Association of India (ACMA) and Managing Director of Brakes India, said rising electronic content in vehicles is reshaping replacement economics rather than slowing aftermarket demand.

According to Viji, electronics integration across braking, safety and vehicle control systems is pushing up the value of replacement parts. What were once largely mechanical components are now embedded with sensors, controllers and software, making replacements more expensive and technically demanding. This, he noted, is changing the aftermarket’s value profile while raising the bar on skills and diagnostics.

January Sales

Nexon Tops Sales Charts in January; PV Market Clocks Record 4.5 Lakh Units Led By SUVs

India’s passenger vehicle (PV) market opened calendar year 2026 on a strong footing, with January wholesales estimated at around 4.5 lakh units, marking the highest-ever January performance and the second-highest monthly tally on record. The month’s sales data underline the structural shift toward utility vehicles, with six SUVs featuring among the top 10 selling models.

India’s passenger vehicle (PV) market opened calendar year 2026 on a strong footing, with January wholesales estimated at around 4.5 lakh units, marking the highest-ever January performance and the second-highest monthly tally on record. The month’s sales data underline the structural shift toward utility vehicles, with six SUVs featuring among the top 10 selling models.

Leading the charts in January was Tata Nexon, with sales of 23,365 units, reinforcing its position as one of the most consistent performers in the market. It was followed by the Maruti Suzuki’s Dzire (19,629 units) and the Tata Punch (19,257 units).

Skoda India Reports Strong January Performance, Unveils 2026 Strategy

Maruti Suzuki Reports Record Monthly Sales of 236,963 Units in January 2026

Maruti Suzuki India Limited announced its highest-ever monthly sales volume for January 2026, with total sales reaching 236,963 units. The milestone represents significant growth compared to the 212,251 units sold in January 2025.

Maruti Suzuki India Limited announced its highest-ever monthly sales volume for January 2026, with total sales reaching 236,963 units. The milestone represents significant growth compared to the 212,251 units sold in January 2025.

The sales breakdown shows domestic sales of 178,300 units, sales to other original equipment manufacturers (OEM) of 7,643 units, and exports of 51,020 units. Notably, the company achieved an all-time monthly high in exports, marking a substantial increase from the 27,100 units exported in January 2025.

Maruti Suzuki Says Capacity Constraints Limiting Small Car Sales

Honda Motorcycle & Scooter India Sales Rise 29% YoY in January 2026

Honda Motorcycle & Scooter India (HMSI) reported strong sales momentum in January 2026, clocking total sales of 5,74,411 units, marking a 29% year-on-year increase compared with the same month last year.

Honda Motorcycle & Scooter India (HMSI) reported strong sales momentum in January 2026, clocking total sales of 5,74,411 units, marking a 29% year-on-year increase compared with the same month last year.

Of the total volumes, domestic sales accounted for 5,19,579 units, while exports stood at 54,832 units, underscoring steady demand for HMSI’s two-wheeler portfolio across both Indian and overseas markets.

Bajaj Auto Reports 25% Sales Growth in January 2026

Suzuki Motorcycle India Reports 15% Sales Growth in January

Mahindra Trucks & Buses Records 40% Sales Growth in January

Mahindra & Mahindra Ltd. has reported a 40% year-on-year growth in its Trucks and Buses business for January 2026, with total sales reaching 3,065 vehicles including exports.

Mahindra & Mahindra Ltd. has reported a 40% year-on-year growth in its Trucks and Buses business for January 2026, with total sales reaching 3,065 vehicles including exports.

The commercial vehicle segment, covering vehicles above 3.5 tonnes, comprises the company's Mahindra Trucks & Buses division and SML Mahindra Limited. The performance marks a significant uptick in the company's heavy commercial vehicle operations.

Escorts Kubota Reports 46.9% Growth in Tractor Sales for January 2026

Escorts Kubota Limited announced its sales volumes for January 2026, reporting significant growth in its tractor business while construction equipment sales remained relatively flat.

Escorts Kubota Limited announced its sales volumes for January 2026, reporting significant growth in its tractor business while construction equipment sales remained relatively flat.

The company's Agri Machinery Business Division sold 9,799 tractors in January 2026, marking a 46.9% increase compared to 6,669 tractors sold in the same month last year. The growth was primarily driven by strong domestic demand, with domestic tractor sales reaching 9,137 units, up 50.8% from 6,058 units in January 2025.

Q3 Earnings Report Card

Tata Motors PV Reports ₹3,483 Crore Q3 Loss as JLR Cyber Impact Lingers

Tata Motors Passenger Vehicles Limited (TMPVL) posted a consolidated net loss of ₹3,483 crore for the quarter ended December 31, 2025, weighed down by the continued fallout from the cyber incident at its Jaguar Land Rover (JLR) subsidiary.

Tata Motors Passenger Vehicles Limited (TMPVL) posted a consolidated net loss of ₹3,483 crore for the quarter ended December 31, 2025, weighed down by the continued fallout from the cyber incident at its Jaguar Land Rover (JLR) subsidiary.

The company's consolidated revenue from operations stood at ₹70,108 crore in Q3 FY26, marking a sharp 3.1% decline from ₹72,349 crore in the previous quarter and a 25.8% drop from ₹94,472 crore in the year-ago period.

Hyundai Motor India Revenue Grows 8% YoY, Led by SUV Momentum and Exports

Hero MotoCorp Fires on All Cylinders in Q3 FY26 on Strong Festive Demand

Hero MotoCorp reported strong growth in key earnings parameters for the December quarter, driven by robust festive demand, an improved product mix, and growth across scooters, exports and electric vehicles.

Hero MotoCorp reported strong growth in key earnings parameters for the December quarter, driven by robust festive demand, an improved product mix, and growth across scooters, exports and electric vehicles.

The company posted revenue from operations of ₹12,328 crore in Q3 FY26, registering a growth of 21% year-on-year. The parts, accessories and merchandising business recorded its highest-ever quarterly revenue at ₹1,673 crore.

Normalised profit after tax, before considering the one-time impact of an exceptional item, rose 20% to ₹1,439 crore. Reported profit after tax stood at ₹1,349 crore, up 12% year-on-year, after accounting for a one-time charge of ₹119 crore related to the implementation of new labour codes.

Ather Energy Reports 50% Revenue Growth But Losses Widen in Q3 FY26

Electric two-wheeler manufacturer, Ather Energy Limited announced its unaudited financial results for the quarter and nine months ended December 31, 2025, showing strong revenue momentum even as losses deepened due to increased operational expenses and supply chain challenges.

Electric two-wheeler manufacturer, Ather Energy Limited announced its unaudited financial results for the quarter and nine months ended December 31, 2025, showing strong revenue momentum even as losses deepened due to increased operational expenses and supply chain challenges.

For the quarter ended December 31, 2025, Ather Energy posted revenue from operations of ₹9,536 crores, representing a robust 50.2% year-on-year increase from ₹6,349 crores in Q3 FY25 (December 31, 2024).

Software Contributes 14% to Ather’s Q3 Revenue; Tarun Mehta Says there's More Room

Kinetic Engineering Reports 33% Revenue Growth in Q3

JK Tyre Reports 3.7-Fold Surge in Q3 Profit Amid Strong Demand and Margin Expansion

JK Tyre & Industries Limited reported a sharp 3.7-fold increase in net profit for the third quarter ended December 31, 2025, reaching Rs 209 crore compared to Rs 57 crore in the corresponding period last year, reflecting strong operational performance across business segments.

JK Tyre & Industries Limited reported a sharp 3.7-fold increase in net profit for the third quarter ended December 31, 2025, reaching Rs 209 crore compared to Rs 57 crore in the corresponding period last year, reflecting strong operational performance across business segments.

The company's consolidated total revenues stood at Rs 4,235 crore for the quarter, with EBITDA climbing to Rs 583 crore, translating to a margin of 13.8% – a substantial expansion of 470 basis points year-on-year.

Olectra Greentech Q3 FY26 Revenue Rises 29%; Profit Largely Flat

Minda Corporation Reports Record Quarterly Revenue of Rs 1,560 Crore in Q3 FY2026

Minda Corporation Ltd, the flagship company of Spark Minda, announced its financial results for the quarter ended December 31, 2025, reporting its highest-ever quarterly consolidated revenue of Rs 1,560 crore, marking a year-on-year growth of 24.6% and a sequential growth of 1.6% over the previous quarter.

Minda Corporation Ltd, the flagship company of Spark Minda, announced its financial results for the quarter ended December 31, 2025, reporting its highest-ever quarterly consolidated revenue of Rs 1,560 crore, marking a year-on-year growth of 24.6% and a sequential growth of 1.6% over the previous quarter.

The auto component manufacturer's operating profit (EBITDA) reached Rs 184 crore with an operating margin of 11.8%, representing a 30 basis points year-on-year improvement and a 3.2% sequential growth over Q2 FY2026. The company's profit before tax stood at Rs 97 crore (6.2% margin), up 6.8% year-on-year and 4.0% quarter-on-quarter. Reported profit after tax was Rs 84 crore (5.4% margin), up 30.1% year-on-year, though marginally down 0.4% sequentially.

Belrise Industries Q3 FY26 Revenue Rises 8%

Castrol India Posts Highest-Ever Revenue in FY25; Volumes Rise 8%

Castrol India Limited on Tuesday reported its highest-ever annual revenue for FY25, supported by sustained volume growth for the eighth consecutive quarter, expansion of its industrial business and deeper penetration into rural markets.

Castrol India Limited on Tuesday reported its highest-ever annual revenue for FY25, supported by sustained volume growth for the eighth consecutive quarter, expansion of its industrial business and deeper penetration into rural markets.

The lubricant maker’s revenue from operations rose 7% year-on-year to ₹5,722 crore in the calendar year ended December 31, 2025, while EBITDA increased 5% to ₹1,348 crore. Volumes grew 8% during the year, led by the core automotive lubricants business, continued scale-up of industrial products and an expanded distribution network.

Entry & Exit

Toyota CEO Sato to Step Down, CFO Kon Named Successor

Toyota Motor Corporation announced Friday that Chief Executive Koji Sato will step down from his position and be replaced by the company's Chief Financial Officer, Kenta Kon.

Toyota Motor Corporation announced Friday that Chief Executive Koji Sato will step down from his position and be replaced by the company's Chief Financial Officer, Kenta Kon.

Sato will transition to the role of vice chairman and chief industry officer. The leadership change comes as the automotive industry faces significant disruption. In their new roles, Kon will concentrate on internal company management while Sato will focus on broader industry matters, the company said in a statement.

Spark Minda Elevates Ajay Agarwal to Group Chief Financial Officer

Spark Minda, Minda Corporation Limited has appointed Ajay Agarwal as Group Chief Financial Officer and Key Managerial Personnel, effective February 5, 2026. The move represents a leadership enhancement for the automotive component manufacturer as it pursues its next phase of growth.

Spark Minda, Minda Corporation Limited has appointed Ajay Agarwal as Group Chief Financial Officer and Key Managerial Personnel, effective February 5, 2026. The move represents a leadership enhancement for the automotive component manufacturer as it pursues its next phase of growth.

Agarwal will maintain his existing responsibilities while assuming the additional GCFO role. His portfolio includes oversight of financial strategy and governance, alongside leadership of cross-functional initiatives in strategic growth, digital transformation, and investor relations.

TVS Motor Company Appoints Madhu Manral Srivastava as President, Group Head of Human Resources

TVS Motor Company announced on February 6, 2026, the appointment of Madhu Manral Srivastava as President and Group Head of Human Resources, effective immediately. She will be based in Bengaluru and brings cross-industry experience spanning natural resources, oil and gas, financial services, telecom, and manufacturing.

TVS Motor Company announced on February 6, 2026, the appointment of Madhu Manral Srivastava as President and Group Head of Human Resources, effective immediately. She will be based in Bengaluru and brings cross-industry experience spanning natural resources, oil and gas, financial services, telecom, and manufacturing.

Prior to joining TVS Motor Company, Srivastava served as the Global Chief Human Resources Officer of Vedanta Resources, a USD 25 billion multinational with a 100,000-strong workforce. She led enterprise-wide people strategy and major HR integrations, including the acquisition of Cairn India and other businesses. She played a role in building leadership depth, strengthening organization capability, driving culture transformation, and anchoring people strategy through periods of growth and change.

Olectra Greentech Appoints K. N. M. Rao as Vice President for Product Development

Olectra Greentech Limited announced the appointment of Kallepalli Nagamalleshwar Rao as Vice President - Product Development for its e-Bus Division, effective February 5, 2026.

Olectra Greentech Limited announced the appointment of Kallepalli Nagamalleshwar Rao as Vice President - Product Development for its e-Bus Division, effective February 5, 2026.

Rao brings more than 30 years of experience in product and platform development across electric and conventional automotive vehicles. He has held senior leadership positions at SWITCH Mobility, Ashok Leyland, Mahindra & Mahindra, and Tata Motors, where he contributed to vehicle platform development and mobility solutions.

Olectra Greentech Appoints Suhas Athma as VP-Human Resources

Bonfiglioli Transmissions Appoints New Chairperson and Independent Directors

RELATED ARTICLES

Jaguar Registrations Collapse 99% as Land Rover Shows Growth in UK Market

Jaguar registered just six vehicles in January as brand restructuring takes effect, while sister brand Land Rover posted...

TVS Motor Launches Two New Models in Egyptian Market

The Indian two-wheeler manufacturer introduces the Ronin Top motorcycle and Ntorq Race Edition scooter through its distr...

India-US Trade Deal Slashes Tariffs on Luxury Cars, Excludes Tesla

India and the United States are finalizing an interim agreement that reduces duties on high-end American automobiles but...

08 Feb 2026

08 Feb 2026

391 Views

391 Views

Angitha Suresh

Angitha Suresh

Autocar Professional Bureau

Autocar Professional Bureau