Top 10 UVs’ sales in first 10 months of FY2023 surpass a million units

Surging pace of demand for these popular SUVs and MPVs sees their cumulative sales zip past a million units in the April 2022-January 2023 period. UV segment sales to scale record high for third straight year.

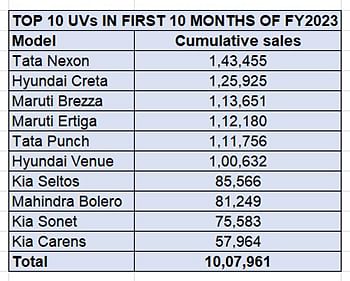

The pace of sales of utility vehicles (UVs) in India continues to surprise. Sustained growth in high double-digits means new highs are being set on a regular basis. Cumulative sales in the April 2022 to January 2023 period are a case in point – total numbers of the Top 10 or best-selling UVs add up to 10,07,961 units or over a million units.

What's more, the race to a million units is getting shorter every fiscal. The million-units sales milestone in the UV segment was crossed for the first time in FY2021 when 10,60,750 units were sold. FY2022 numbers went up 40% on that to record 1,489,178 units. In FY2023, the million milestone took a scant seven months (April-October 2022) compared to the nine months it took in FY2022 and 12 months in all of FY2021.

Here's looking at the best-selling UVs in the first 10 months of the ongoing fiscal.

Top 10 SUVs and MPVs have seen sustained demand in the April 2022 to January 2023 period in a competitive marketplace.

Tata Nexon: 143,455 units

The compact Tata Nexon SUV, India’s No. 1 UV, is top of the pack with 143,455 units and accounts for 14.23% of total Top 10 UV sales in the first 10 months of FY2023. Its best monthly sales this fiscal came in January 2023 with 15,567 units.

Tata Motors’ high-on-style compact SUV that’s big on content too and sold in petrol, diesel and electric avatars continues to score big in the competitive Indian marketplace and has driving past the 450,000 sales mark in 65 months since launch. Sold in as over 80 variants – 67 petrol and diesel, and 14 electric – this is one SUV where buyers are really spoilt for choice.

On-road Delhi pricing for the Nexon range across petrol, diesel and EV powertrains starts at Rs 859,000 for the 1.2 Revotron XE petrol through to Rs 13.93 lakh for the 1.2 Revotron XZA+(P) Jet. The 31-diesel variant range opens at Rs Rs 11.28 lakh for the 1.5 Revotprq XM through to Rs 14.08 lakh for the 1.5 Revotron XZA+(P) Jet. The 14-variant Nexon EV's pricing starts at Rs 14.99 lakh for the base XM variant and tops out with the Rs 19.50 lakh Max XZ+Lux 7.3kW Jet.

Hyundai Creta: 125,925 units

What the Nexon is to Tata Motors, the Creta midsize SUV is to Hyundai, which also recorded its best-ever annual sales in CY2022 – 552,511 units, up 9% YoY. The Creta is estimated to have sold 140,895 units, contributing 25.50% to Hyundai’s total sales of 552,511 units last year. In the first 10 months of the ongoing fiscal, the Creta has gone home to a total of 125,925 buyers.

The Creta, which crossed the 800,000 sales milestone in November 2022, also clocked its best monthly sales this fiscal in January 2023 – 15,037 units.

Available in 20 variants – 12 petrol and 8 diesel – the Hyundai Creta’s on-road pricing (Delhi) starts at Rs 13.19 lakh for 1.5 MPi E petrol and tops out at Rs 22.77 lakh for the 1.5 CRDi SX(O) Knight Ed AT.

Maruti Brezza: 113,651 units

The Maruti Suzuki Brezza has driven past its sibling, the Ertiga MPV, to take third rank with 113,651 units. The Ertiga has been a consistent No. 3 in the UV charts and like the MPV, the Brezza too has crossed the 800,000-units mark in cumulative sales in India.

Following the launch of the second-generation new Brezza compact SUV, on June 30 at Rs 799,000, demand for this model has surged and the company recorded its best monthly wholesales of 15,445 units in festive September 2022. In fact, this was the best monthly figure for any UV in all of CY2022, which has been bettered by the Tata Nexon last month with 15,567 units in January 2023.

Available in seven variants, with prices ranging from Rs 934,000 for the 1.5 LXi through to the Rs 16.27 lakh 1.5 ZXI+ AT (on-road Delhi), this practical and spacious SUV ticks all the boxes that matter.

Maruti Ertiga: 112,180 units

At No. 4 is the popular family car and the ace of space, the Maruti Ertiga with 112,180 units. In a market teeming with compact SUVs and more recently midsize SUVs, the Ertiga continues to maintain a strong presence, delivering the goods consistently.

Like the Hyundai Creta and its sibling Brezza, the Ertiga has also crossed the cumulative sales milestone of 800,000 units, doing so in 10 years and five months since launch in September 2022. Sold in nine variants, pricing for the Ertiga ranges from Rs 979,000 for the base LXi petrol to Rs 15.06 for the top-end ZXI+ A/T petrol (on-road, Delhi). The CNG range starts at Rs 12.44 lakh for the VXi and tops out at Rs 13.70 lakh for the ZXi CNG.

In mid-April 2022, Maruti Suzuki launched the updated Ertiga, with a restyled front end and interior changes, powered by an upgraded 1.5-litre petrol engine with DualJet technology, and start-stop technology. It also introduced a CNG option to the new line-up, using the same 1.5 DualJet engine.

The vehicle Tour M variant gets a CNG option as well which is clearly targeted at the taxi segment as well as economy-minded buyers who want to keep their ownership costs in check.

Tata Punch: 111,156 units

For a model which is just 15 months old, the petrol-only Tata Punch compact SUV continues to punch above its weight and takes fifth position, the same as it did in India’s Top 25 UVs for CY2022. Over the past year, the Punch has quickly moved into becoming Tata Motors’ second-best-selling model after the Nexon.

Pricing for the 26-variant Punch range starts at Rs 658,000 for the Pure variant and goes up to Rs 10.57 lakh for the Creative (O) AT KZR (on-road Delhi). At Auto Expo 2023 last month, Tata Motors unveiled the Punch CNG , which is slated for launch later this year.

Hyundai Venue: 100,632 units

The Venue, Hyundai’s first-ever compact SUV, is the sixth best-seller in the April 2022-January 2023 period with 100,632 units. Hyundai has 13 variants on offer comprising 10 petrol and three diesel, with On-road Delhi pricing ranging from Rs 906,000 for the 1.2 E petrol through to Rs 15.30 lakh for the 1,5 CRDi SX(O).

In September 2022, to expand the product’s allure, the company launched the Venue N Line at Rs 12.16 lakh. The Venue N Line comes with a single powertrain – a 120hp, 172Nm, 1.0-litre turbo-petrol engine paired to the 7-speed DCT with paddle shifters, with the cosmetic changes the talking point of the variant.

Kia Seltos: 85,566 units

At No. 7 in the Top 10 rankings is the Kia Seltos, with 85,566 units. Kia India’s best-selling product right from its market entry in August 2019 remains its biggest contributor to overall sales and is ahead of its siblings, the Sonet compact SUV and the Carens MPV.

Mahindra Bolero: 81,249 units

Mahindra & Mahindra is represented in the Top 10 UVs listing by its hardy Bolero, which has sold 81,249 units in the first 10 months of FY2023. Very creditable considering that the Bolero is averaging over 8,000 units a month amidst much more vaunted competition. Both models, the Bolero and the Bolero Neo, continue to see robust demand which speaks volumes for the longstanding brand.

Kia Sonet: 75,583 units

Kia India’s compact SUV with 75,583 units remains a popular buy and along with the Seltos and, more recently, the Carens, has enabled the Korean carmaker to increase its market share. Kia India recorded its highest-ever domestic monthly sales of 28,634 units in January 2023, which is a 48% YoY increase over January 2022 numbers. The company’s previous monthly best was 25,857 units in September 2022.

Kia Carens: 57,964 units

Kia India has a new growth accelerator in the Carens MPV. The Carens, which has registered its best-ever monthly sales of 7,900 units in January 2023, bettering the previous best of 7,895 units in June 2022, has cumulatively sold 70,656 units in India since its launch a year ago and 57,964 units in the first 10 months of FY2023. The Carens’ role in Kia’s recent growth trajectory assumes even more importance when seen in the company’s overall sales in the Indian market till now. Last month, Kia India surpassed the cumulative sales milestone of 650,000 units in January in less than four years since its market entry in August 2019.

UV sales to scale new record in FY2023

Given the rapid pace of sales, UV sales will notch a new record this fiscal for the third year in a row. Having crossed a million sales for the first time in FY2021 (10,36,006 units), and then surpassed it again in FY2022 (14,89,178 units), FY2023 will see overall segment sales close in on the two-million mark. At the end of December 2022, cumulative nine-month sales (April-December 2022) were 14,69,594 units, just 19,584 units shy of the FY2022 total. This would have been crossed in the first week of January 2023 itself which will be known once industry body SIAM announces the official UV wholesales numbers for January 2023 later this week.

ALSO READ:

India’s Top 6 carmakers start 2023 with strong sales in January

Indian EV industry opens CY2023 with retail sales of over 100,000 units

India Auto Inc retails up 14% in January, all segments other than tractors log double-digit growth

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

12 Feb 2023

12 Feb 2023

10063 Views

10063 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi