Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-level ICE bike segment, registers new sales milestone. Will GST 2.0, which has increased the price differential between ICE 2Ws and EVs, result in slower demand this year?

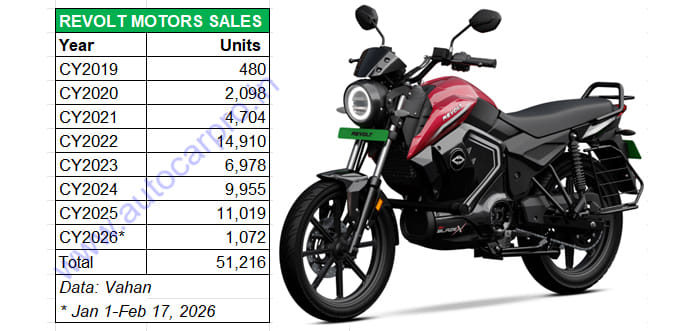

Revolt Motors, which was the first of the electric 2-wheeler OEM in India to launch a zero-emission motorcycle in August 2019, has surpassed 50,000 customer deliveries. As per retail sales numbers on the Vahan portal, from October 2019 till February 17, 2026, the company has delivered a total of 51,216 units. The retail milestone comes six months after the company rolled out its 50,000th e-motorcycle from its manufacturing plant in Manesar, Haryana on June 20, 2025.

Revolt Motors’ customer deliveries in CY2025 (11,019 units) were its second-highest annual sales after CY2022 (14,910 units) when this e-motorcycle OEM had a 2.36% market share of the 631,397 electric two-wheelers sold that year. Demand dropped sharply by 53% in CY2023 (6,978 units) but rose by 43% in CY2024 (9,955 units). In CY2025, Revolt was ranked 11th amongst over 250 e-2W makers in India, which is a noteworthy achievement for company which manufactures only electric motorcycles.

The launch of the RV BlazeX in February 2025 helped Revolt Motors cross the 10,000-unit annual sales mark for the second time since it entered the electric 2W market in August 2019.

The launch of the RV BlazeX in February 2025 helped Revolt Motors cross the 10,000-unit annual sales mark for the second time since it entered the electric 2W market in August 2019.

RV BlazeX helped increase sales in CY2025

In CY2025, motorcycles commanded 61% of India’s 20-million-strong two-wheeler (CY2025) market, leaving the rest to scooters (37%) and a minuscule 2% to the humble moped. In the pre-GST 2.0 market, Revolt Motors’ strategy to pit the RV1 and RV1+ against the volume-driven, fuel-sipping, price-sensitive, entry level petrol-engine commuter motorcycle segment did click.

Enthused by the growing demand for the RV1 and RV1+, Revolt Motors strategically priced and positioned the new RV BlazeX, launched in February 2025, above the RV1 and RV1+ and below the higher-priced RV400 and RV400 BRZ siblings.

The RV BlazeX, which expanded Revolt Motors’ portfolio to five models, helped energise sales after two continuous years of a demand slowdown. Priced at Rs 119,990 (ex-showroom India), the high-on-connectivity, 113kg RV BlazeX is powered by a 3.24 kWh lithium-ion battery pack along with a 4.1 kW mid-drive electric motor that empower a top speed of 85kph and a claimed 150km range on a single charge (claimed IDC range in Eco mode). The company offers a product and battery warranty of 5 years / 75,000km.

Keeping the RV BlazeX company in the Revolt stable are the RV1 (Rs 99,990, 2.2 kWh battery, 100km range), RV1+ (Rs 104,990, 3.24 kWh battery, 160km range), the RV400 BRZ (Rs 129,950, 3.24 kWh battery, 150km range) and the RV400 (Rs 149,950, 3.24 kWh battery, 150km range). While the RV1 and RV1+ were launched in September 2024, the RV400 BRZ was introduced in the nascent electric motorcycle market in January 2024. The RV400, along with the now-discontinued RV300, were the first products from the company (called Revolt Intellicorp at the time) and launched in August 2019. These bikes were based on Chinese Super Soco models.

Demand slowdown after GST 2.0

In the current calendar year (CY2026), Revolt Motors has clocked retail sales of 1,072 units between January 1 and February 17. In January 2026, it sold 666 units, down 37% YoY (January 2025: 1,061 units) and delivered 406 units in the first 17 days of February 2026. After clocking four-figure retails in October (1,349 units) and November 2025 (1,045 units), monthly sales have fallen to three figures since December. This can be attributed to the marked price cuts in ICE motorcycles as a result of GST 2.0 from October last year which substantially increased the price gap between the ICE and electric cousins.

Until GST 2.0 checked in, the RV BlazeX’s pricing (Rs 119,990) undercut the starting price for a number of the base variants in the premium 150-200cc IC engine commuter motorcycle segment. In fact, this ICE segment (150-200cc) saw sales down by 9% YoY to 10,99,816 units in FY2025. FY2026 is proving to be very different – the 12,39,606 units in the first 10 months are a robust 33% YoY increase (April 2024-January 2025: 932,332 units). Clearly, even fence-sitting motorcycle buyers, who would have been considering purchase of an electric bike, are now putting their money down on petrol-engined performance bikes with vengeance.

Will the first-mover advantage continue?

Revolt Motors benefits from a first-mover advantage in the fledgling electric motorcycle market, having been around for over six years. Compared to the large number of e-scooter OEMs including legacy players like Bajaj Auto, TVS Motor Co and Hero MotoCorp and startups like Ola Electric and Ather Energy, there are only a handful of e-motorcycle OEMs – Ultraviolette, Ola, Oben EV, KLB Komaki, Matter Motor Works, Okaya EV and Wardwizard Innovations.

In November 2022, the TVS Motor-backed Ultraviolette, which launched its F77 performance e-motorcycle, then the F77 Mach 2 (Rs 299,000) in April 2024, and the X47 (Rs 249,000) in September 2025, remains at the top-end of the price spectrum. Two years ago, in February 2024, Ola Electric diversified into the electric motorcycle market with its Roadster X series.

That’s not the only competition Revolt will have to contend with in the future. ICE motorcycle majors Hero MotoCorp and TVS Motor Co, which showcased e-motorcycles at EICMA 2025, will be looking to introduce their products. Bajaj Auto too is pushing the e-motorcycle envelope with a very vigorous R&D effort, and Honda has announced plans to set up an electric motorcycle plant in India in 2028.

(With inputs from Rishaad Mody, Autocar India)

RELATED ARTICLES

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

By Ajit Dalvi

By Ajit Dalvi

19 Feb 2026

19 Feb 2026

1 Views

1 Views

Arunima Pal

Arunima Pal

Shruti Shiraguppi

Shruti Shiraguppi