TVS Motor: The New King of India's Electric 2-Wheeler Market

January 2026 sees TVS Motor solidify its position with 34,558 units Bajaj struggles to keep pace.

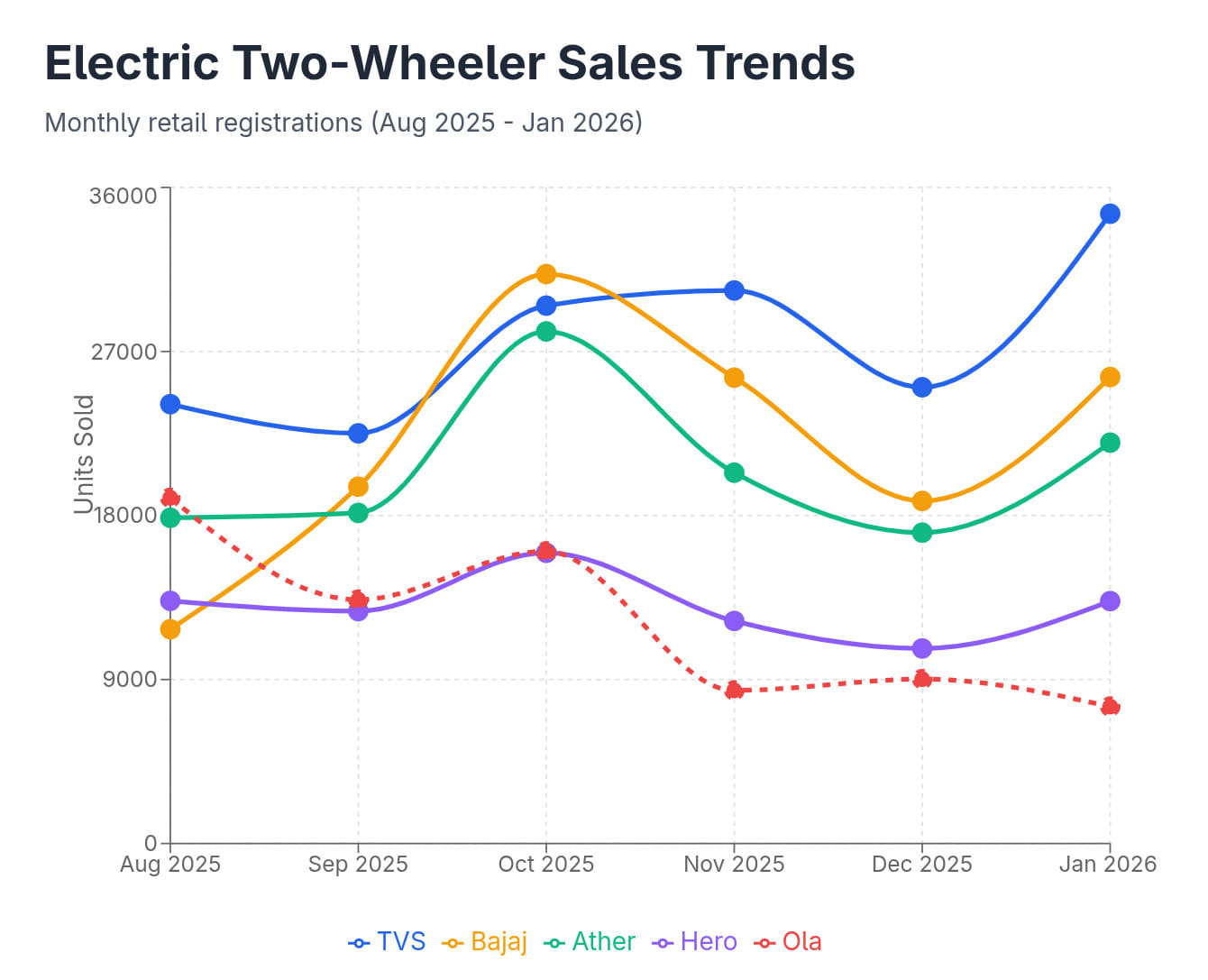

India’s electric two-wheeler market was, at one time, dominated by upstarts Ola and Ather. Then, in late 2024, the picture began to change, as Bajaj Auto—once the undisputed champion of India’s scooter market—emerged as a strong challenger in the high-growth electric two-wheeler market with its reimagined Chetak range. However, a little over a year later, the picture is changing again—this time, it’s the Chennai-based TVS Motor that seems to be clearly pulling ahead of the others, stamping its domination over the fast-growing e2W segment.

January 2026 makes TVS’s leadership unmistakable. With 34,558 units registered, the company now sits nearly 9,000 units ahead of second-place Bajaj Auto and has posted 44% year-on-year growth—more than double Bajaj’s 19% gain. The gap isn’t closing; it’s widening. While Bajaj had its moment as the challenger to startup dominance, TVS has systematically built the scale, consistency, and customer trust that now define market leadership.

But the competitive story extends beyond TVS’s ascent. Ather Energy and Hero MotoCorp are posting explosive growth—68% and 718% year-on-year respectively—driven by product strategies that have unlocked new customer segments. Meanwhile, Ola Electric, which once commanded over a third of the market, has collapsed to just 7,516 units in January, down 69% year-on-year, falling behind even Hero into fifth place.

The overall market continues to expand—1,22,812 units in January represent a 26% month-on-month jump and 25% year-on-year growth—with electric two-wheelers now holding a 6.6% share of India’s total two-wheeler market. But the identity of the winners and losers has fundamentally changed. The startup era that defined the segment’s early years has given way to legacy automotive players with deeper distribution networks, stronger service infrastructure, and the operational muscle to scale sustainably.

TVS Motor: Building on Systematic Execution

TVS Motor’s January performance—34,558 units, up 44% year-on-year and 38% month-on-month—reflects the payoff of methodical strategy. The Chennai-based manufacturer has built its electric two-wheeler business on the fundamentals that matter to India’s mass-market buyer: product reliability, extensive service network, and consistent availability. The iQube range has become the default choice for pragmatic buyers, while the recently launched Orbiter with its 3.1 kWh battery adds a more affordable entry point.

TVS’s competitive edge isn’t flashy technology or aggressive pricing. It’s the 7,000-plus dealer touchpoints that inspire customer confidence and the supply chain stability that kept production running smoothly while competitors dealt with component shortages and service backlogs. By January 2026, TVS had crossed 8 lakh cumulative electric scooter sales—a milestone that underscores the breadth of its customer base and the consistency of its operations.

The gap between TVS and the rest of the field is widening. Where TVS posted 44% year-on-year growth, its nearest traditional competitor Bajaj managed 19%. That differential compounds month after month into market share gains that become self-reinforcing as more dealers stock TVS products and more buyers encounter positive word-of-mouth.

Bajaj Auto: Growth That Feels Like Stagnation

Bajaj Auto’s January numbers—25,598 units, up 36% month-on-month and 19% year-on-year—represent solid absolute growth. But in a market where the leader is growing at 44%, the challenger Ather at 68%, and the dark horse Hero at 718%, Bajaj’s performance looks more like treading water than advancing.

The Chetak has found its audience: buyers attracted by the nostalgic brand heritage, competitive pricing starting at Rs 99,500, and Bajaj’s substantial 4,000-touchpoint retail network. Monthly volumes have stabilized in the 18,000-25,000 range, which is respectable but not transformative. For a company that briefly held the monthly number-one spot in early 2025, the inability to sustain that momentum or match TVS’s acceleration points to challenges in product differentiation or execution.

The next-generation Chetak platform expected in the first half of 2026 could change the trajectory. But until then, Bajaj faces the strategic dilemma of being large enough to matter but not growing fast enough to challenge for leadership.

Ather and Hero: Where the Real Growth Is

Ather Energy: The Rizta Effect

Ather Energy’s 21,999 units in January—a 68% year-on-year increase—demonstrate what happens when product-market fit clicks. The Bengaluru startup’s transformation from niche premium player to volume manufacturer is almost entirely attributable to the Rizta family scooter, which now accounts for over 70% of Ather’s sales.

The Rizta’s design choices—India’s largest two-wheeler seat, a 34-litre boot, 159 km IDC range—directly address the practical needs of family buyers rather than tech enthusiasts. More critically, Ather’s Battery-as-a-Service model brings the Rizta S’s upfront cost down to Rs 76,000, making it price-competitive with mid-tier conventional scooters. By separating battery ownership from the vehicle purchase, Ather has effectively neutralized the primary barrier to electric adoption for cost-conscious buyers.

Ather first crossed 25,000 monthly units in festive October 2025 with 28,101 registrations, and the January performance suggests that wasn’t a one-time spike. With the new cost-optimized EL platform announced at Community Day, Ather is positioning for further expansion into mass-market segments where TVS currently dominates.

Hero MotoCorp: Scale Meets Execution

Hero MotoCorp’s Vida brand delivered 13,302 units in January 2026, up from just 1,626 a year earlier—a 718% year-on-year increase that, while amplified by a small base, reflects genuine momentum. Hero has established itself as a consistent 10,000+ unit monthly player with a 9-11% market share, firmly in fourth place.

The Vida V2 and VX2 leverage what no other electric two-wheeler manufacturer can match: Hero’s unparalleled dealer network and brand recognition in tier-2 and tier-3 cities. The VX2’s Battery-as-a-Service option drops the upfront price to Rs 44,990, making it cheaper than many entry-level petrol scooters and positioning Hero to capture price-sensitive buyers who might otherwise never consider electric.

Hero’s trajectory over the past six months—from 13,315 units in August through consistent 10,000-13,000 monthly volumes—suggests the growth is sustainable rather than promotional. If product quality holds and word-of-mouth stays positive, Hero has the distribution infrastructure to scale significantly further.

Ola Electric: The Unraveling

Ola Electric’s January performance—7,516 units, down 69% year-on-year from 24,413—represents more than cyclical weakness. The company that once held over a third of the market has seen its share collapse to roughly 6% as a combination of service issues, product quality concerns, and strengthened competition has eroded customer trust.

The problems are well-documented: long service wait times, software glitches, delivery delays, and a Central Consumer Protection Authority investigation into over 10,000 complaints. Goa suspended Vahan registrations for Ola scooters over compliance issues. Senior executives including the CTO and CMO have left. The company laid off approximately 25% of its workforce in early 2025 and another 5% in early 2026. Quarterly losses have more than doubled year-on-year, and the stock is down over 60% from its IPO-era peak.

Perhaps more fundamentally, the competitive advantages Ola built—aggressive pricing and a direct-to-consumer model—have been neutralized by legacy OEMs offering comparable features backed by established dealer networks and proven service capabilities. The S1 range, once the benchmark for affordable feature-rich electric scooters, is now one option among many, and not the most trusted.

Ola’s product pipeline includes the Gig delivery scooter, the entry-level S1 Z, and an electric motorcycle. But product launches alone won’t restore the customer confidence that takes years to build and months to destroy. The question now is whether Ola can stabilize at a 6-8% market share or faces further erosion.

The Competitive Realignment

The January 2026 data makes the shifting competitive dynamics clear:

|

OEM |

Jan ’26 |

Jan ’25 |

YoY % |

MoM % |

|

TVS Motor |

34,558 |

24,028 |

+43.8% |

+38.0% |

|

Bajaj Auto |

25,598 |

21,470 |

+19.2% |

+36.2% |

|

Ather Energy |

21,999 |

13,097 |

+68.0% |

+29.0% |

|

Hero MotoCorp |

13,302 |

1,626 |

+718% |

+24.3% |

|

Ola Electric |

7,516 |

24,413 |

−69.2% |

−16.7% |

Source: FADA Research

The divergence in year-on-year growth rates—TVS at 44%, Bajaj at 19%, Ather at 68%, Hero at 718%, Ola at -69%—illustrates how quickly competitive positions can shift in a rapidly evolving market. TVS’s ability to grow at more than double Bajaj’s rate while maintaining market leadership demonstrates execution advantage. Ather and Hero’s triple-digit growth shows where product innovation and distribution scale are creating new volume. And Ola’s collapse underscores how quickly customer trust can erode when service fails.

Looking Ahead

The Indian electric two-wheeler market is entering 2026 with clearer competitive dynamics than at any point in its history. TVS Motor has established leadership through consistent execution. Ather Energy and Hero MotoCorp are scaling rapidly with differentiated strategies. Bajaj Auto faces the challenge of accelerating growth to defend its position. And Ola Electric is fighting to stabilize after a year of decline.

Several near-term developments will shape the market trajectory. Bajaj’s next-generation Chetak platform could reinvigorate its growth. Ather’s new EL platform promises to bring electric scooters to more affordable price points. Hero’s Vida expansion into smaller cities could tap previously underserved markets. And TVS will likely expand its product portfolio to defend against competitors moving upmarket and downmarket simultaneously.

The macro environment remains supportive: petrol prices above Rs 100 per litre in major cities make the running cost advantage of electric scooters compelling. Charging infrastructure, while still incomplete, is expanding in urban centers. Fleet operators are increasingly adopting electric for last-mile delivery. Product quality and range have improved to the point where electric scooters are genuinely competitive with petrol equivalents for city use.

But the GST 2.0 impact persists. The September 2025 tax cut on conventional vehicles narrowed the price differential that had been accelerating electric adoption, and the market share data—6.6% in January versus 8.1% at the pre-GST peak—shows the effect hasn’t fully dissipated. Without renewed policy support through tax incentives, purchase subsidies, or financing programs, the segment may stabilize around current penetration levels rather than accelerating toward double digits.

For now, the market has found a new equilibrium. Whether that equilibrium holds or shifts again will depend on product execution, policy decisions, and the ability of legacy automotive companies to maintain the momentum they’ve built against both each other and any new challengers that emerge.

RELATED ARTICLES

Electric PV Sales Stabilize after GST Hit

Fresh FADA data shows January 2026 registrations surging 55% year-on-year, with Tata, JSW MG, and Mahindra all posting s...

Bajaj Chetak production plunges by 47% in July due to shortage of rare earth magnets

Bajaj Auto manufactured 10,824 Chetaks last month, 9,560 fewer units than the 20,384 Chetaks produced in July 2024. As a...

TVS eyes new markets for iQube e-scooter in rural India

TVS Motor Co, which has topped the electric two-wheeler market for the past four months, looks to expand the predominant...

By Angitha Suresh

By Angitha Suresh

11 Feb 2026

11 Feb 2026

268 Views

268 Views

Arunima Pal

Arunima Pal

Ajit Dalvi

Ajit Dalvi