The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolution has been brewing in the 200cc segment.

India’s motorcycle market is typically discussed in terms of two segments: the massive 110cc commuter category, dominated by Hero MotoCorp, and the premium 350cc space, where Royal Enfield operates virtually alone. Together, these two segments account for the bulk of the narrative. But between them, the 200cc segment or B5 segment has been recording a sustained expansion that makes it one of the more interesting motorcycle growth stories of 2025–26.

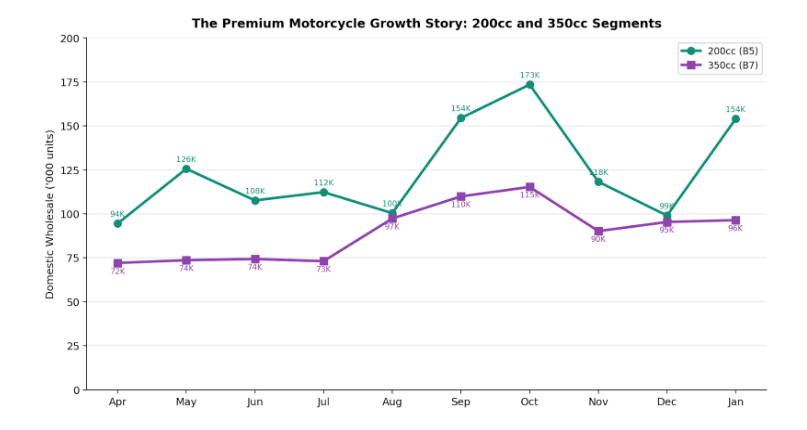

The segment recorded 94,489 units in domestic wholesales in April 2025. By September, it hit 1.54 lakh — a 63 per cent jump driven in part by the festive build-up. October followed with 1.73 lakh, the year’s highest monthly figure. After a seasonal dip in November (1.18 lakh) and December (99,001), January 2026 bounced back to 1.54 units. The pre-festive average (April through August) was approximately 1.08 lakh units per month. The September-through-January average is approximately 1.40 lakh — a 30 per cent increase.

The Growth Drivers

TVS Motor’s Apache series has been the segment’s growth engine. Apache’s monthly wholesales have moved from approximately 34,000 units in the early months of the year to a consistent 45,000–51,000 range from September onwards. This makes TVS the largest contributor to the 200cc segment’s expansion, and the Apache’s positioning as a performance-oriented commuter with sporting pretensions appears to be resonating with a growing pool of buyers willing to spend more than the 125cc ceiling but not ready for the 350cc commitment.

Bajaj Auto’s Pulsar range and KTM portfolio have also contributed, moving from approximately 20,000 units per month in the early part of the year to the 30,000–34,000 range. Honda’s entry into this space with the SP160 and Hornet has diversified the segment further, adding a new competitor that brings Honda’s distribution and brand strength to a category it had previously underserved.

The 200cc Context

The 200cc Context

To understand why the 200cc segment matters, one has to consider its position relative to the rest of the motorcycle market. The 110cc segment (B2) remains far larger in absolute terms, with monthly volumes ranging from 3.22-6.52 lakh units—but its growth is largely cyclical, tied to rural demand and the monsoon and festive seasons. The 125cc segment (B3), which has been the arena for Honda and Hero’s most direct competition, operates in the 2.30–3.77 lakh range. Both segments are mature, with limited structural growth potential.

The 200cc segment, at 94,000–1,73,000, is smaller, but its growth rate is more notable. It represents the beginning of what might be called the “premiumisation belt” of the Indian motorcycle market — the zone where buyers move from pure-commuter purchases to aspirational or lifestyle-oriented ones.

The 350cc segment (B7), dominated by Royal Enfield, has shown a similar trajectory, rising from 72,000 in April to above 95,000 in most months from August onwards. Together, the 200cc and 350cc segments illustrate a gradual but measurable shift in the Indian motorcycle buyer’s willingness to spend more.

Implications for OEMs

For TVS, the Apache’s strength in the 200cc segment validates its strategy of positioning the brand as a performance-oriented alternative to Hero and Honda’s commuter-focused portfolios. The Apache is now TVS’s single most important domestic motorcycle franchise, and its volumes are approaching territory where it anchors the company’s motorcycle margins.

For Bajaj, the 200cc space is familiar ground, with the Pulsar having created the segment two decades ago. The continued growth suggests the Pulsar franchise, supplemented by the KTM lineup, retains relevance even as new competitors enter. For Honda, the entry into 200cc with dedicated products is a strategic acknowledgment that the segment is too large and too fast-growing to leave to competitors.

The 200cc segment’s trajectory is worth monitoring not because it will rival the 110cc market in volume any time soon, but because it signals where the Indian motorcycle market is headed. As incomes rise and buyers’ expectations evolve, the gravitational centre of the two-wheeler market is gradually shifting upward. The 200cc space is where that shift is most visible today.

RELATED ARTICLES

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

Why Did GST Cuts Not Transform Compact UV Space?

The compact SUV segment gained from the GST cut, but its mid-year weakness was only partly about pricing. The structural...

By Arunima Pal

By Arunima Pal

18 Feb 2026

18 Feb 2026

125 Views

125 Views

Shruti Shiraguppi

Shruti Shiraguppi