Why Did GST Cuts Not Transform Compact UV Space?

The compact SUV segment gained from the GST cut, but its mid-year weakness was only partly about pricing. The structural challenges remain.

Earlier this year, a noticeable weakness had developed in the UVC (Utility Vehicle Compact) segment — the sub-4m SUV category that includes models like Maruti Brezza, Hyundai Venue, Tata Nexon, and Mahindra XUV 3XO. Between June and September 2025, wholesale volumes had dropped into the 71,000–79,000 range, well below the 86,000–88,000 recorded in April and May. The question at the time was whether this was a temporary lull or a sign of deeper trouble.

The GST cut, effective September 22, provided a partial answer. UVC wholesales surged to 1,09,144 units in October (boosted by the festive season and pent-up demand from the late-September tax change), then settled to 98,036 in November, 1,04,217 in December, and 97,684 in January. The post-GST average of 1,02,270 represents a 29.6 per cent increase over the pre-GST average of 78,942.

Three Phases of UVC in 2025-26

The data divides neatly into three distinct phases.

- April and May formed the pre-weakness baseline, averaging 87,134 units.

- From June through September, the segment weakened to an average of 74,721 units, a decline of 14 per cent from the opening months.

- Then, from October onwards, the segment recovered to an average of 1,02,270 — above both the weakness phase and the pre-weakness baseline.

This trajectory suggests that the GST cut did more than simply reverse the mid-year decline. It lifted the segment to a level it had not sustained earlier in the financial year. However, the nature of the recovery — a 17 per cent gain over the April–May baseline rather than the 29.6 per cent headline figure calculated against the full pre-GST period — suggests that the mid-year weakness was partly self-inflicted through inventory management ahead of the anticipated GST change.

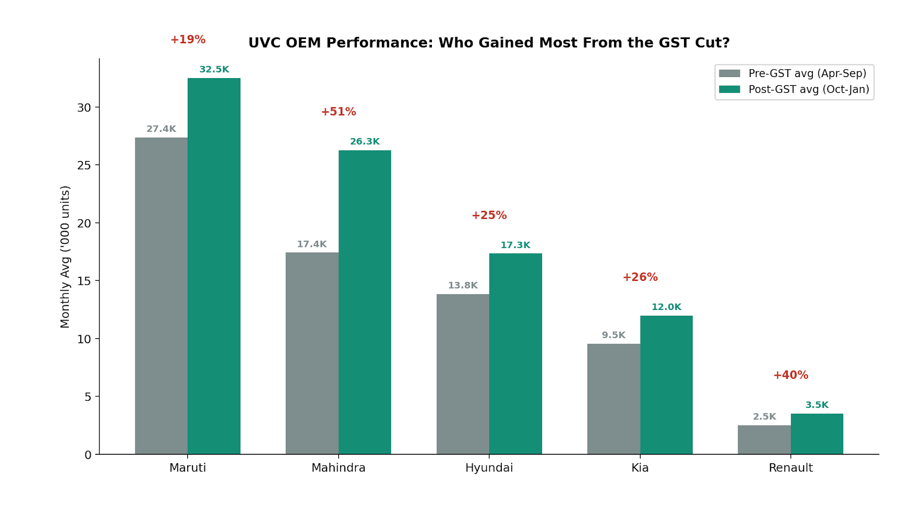

Mahindra’s Stand-Out Performance

All this is not to say the recovery was uniform across manufacturers. Mahindra’s UVC portfolio (XUV 3XO, Bolero, Thar) recorded the largest absolute and percentage gain, moving from an average of 17,418 units pre-GST to 26,267 post-GST — a 50.8 per cent increase. The XUV 3XO in particular surged, moving from the 15,000–19,000 band into the 24,000–31,000 range, indicating that the model had significant latent demand that the price reduction unlocked.

Hyundai (Venue, Exter) and Kia (Sonet, Syros) showed similar-magnitude gains of 25–26 per cent, suggesting these Korean OEMs benefited proportionally from the tax change. Maruti, despite being the volume leader, recorded a more modest 18.8 per cent gain — likely because Brezza and Fronx were already well-established at their price points and had less room for demand expansion.

Hyundai (Venue, Exter) and Kia (Sonet, Syros) showed similar-magnitude gains of 25–26 per cent, suggesting these Korean OEMs benefited proportionally from the tax change. Maruti, despite being the volume leader, recorded a more modest 18.8 per cent gain — likely because Brezza and Fronx were already well-established at their price points and had less room for demand expansion.

Renault’s UVC business (Kiger, Triber) grew 40.4 per cent, though from a much smaller base. Skoda’s Kylaq, which had been averaging around 3,600–4,000 units per month throughout the year, showed no particular GST-driven acceleration, suggesting its buyer profile is less price-sensitive.

The Structural Question Persists

The fact that UVC’s post-GST performance (averaging 1,02,270) represents only a 17 per cent premium over its April–May levels (87,134) suggests that price was not the only factor behind the mid-year weakness. Part of the problem appears to be competitive: UV1 models like the Hyundai Creta, Maruti Grand Vitara, and, more recently, the Maruti e Vitara and Victoris are offering increasingly compelling alternatives at a modest price premium. Buyers who might previously have defaulted to a sub-4m SUV now have reason to consider stepping up.

Additionally, the compact car segment’s own recovery to around 100,000 units — with models like the Swift and Baleno offering strong value — may be pulling some buyers who previously would have moved from a hatchback to a small SUV. The UVC sits between these two forces: pressure from above (UV1 upgradation) and from the side (Compact segment strength). The GST cut alleviated the pricing pressure but did not eliminate the competitive one.

RELATED ARTICLES

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

By Shruti Shiraguppi

By Shruti Shiraguppi

18 Feb 2026

18 Feb 2026

65 Views

65 Views

Arunima Pal

Arunima Pal