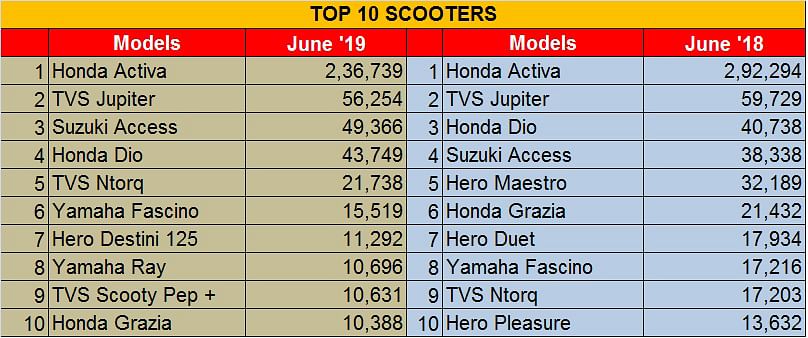

India's Top 10 Scooters – June 2019 | Activa sales improve, Jupiter and NTorq stay strong, Access revs up, Destini is down

Despite the downturn, the contribution of scooters to the overall two-wheeler market remains a robust 32 percent. OEMs are hopeful of numbers improving in the coming months.

The Indian two-wheeler industry's report card for June, as it was for all the other segments, was a bad one. Overall sales at 1,649,477 units were down 11.69 percent compared to year-ago sales, and scooters were down 14.81 percent at 512,628 units. But the decline notwithstanding, what's important is that the contribution of scooters to the overall two-wheeler market has not dropped hugely. In July 2018, scooters contributed 32 percent to the overall 2W industry sales of 1,867,884 units; in July 2019, despite a lower industry total, their contribution is 31 percent.

Honda and its Activa are to the scooter market what Maruti is to the passenger vehicle segment: a mover and shaker. While the Activa remains the unassailable scooter market leader with the massive lead over the far-paced second player, its slowing sales are an opportunity for new and niftier rivals to make gains. And that's what underway in the domestic market. Let's take a closer look.

Compared to May 2019, when the Honda Activa sold 218,734 units, its performance in June is better with 236,739 units albeit considerably below year-ago sales of 292,294 units. This is the best yet in Q1 FY2020 considering Honda despatched 210,961 units in April 2019. In end-May, the company launched the Activa 5G Limited Edition, with prices starting at Rs 55,032 (for the Activa 5G Limited Edition STD) and going up to Rs 56,897 for the Activa 5G Limited Edition DLX).

The Japanese major, which is readying for the BS VI era, recently unveiled its first BS VI-compliant product, not surprisingly, the Activa.

The TVS Jupiter remains the firm No. 2 and sold 56,254 units in June, similar to its May 2019 sales of 56,797 units. While the company must be happy that the numbers have not fallen in the depressed market, the Jupiter is not gaining speedier traction, remaining in the 50,000-60,000 unit monthly sales bracket.

On June 7, TVS launched two variants of the Jupiter ZX – drum and disc. While the drum-brake model has been priced at Rs 56,093, the front disc brake-equipped version costs Rs 58,645 (both prices, ex-showroom, Delhi). Both come equipped with TVS’ version of combined brakes, called SBT, as standard. The ZX variant now gets many new features, including an LED headlight and a digi-analogue instrument cluster.

With the new version, TVS appears to be directly targeting the 110cc Activa 5G that also features an LED headlight and digi-analogue gauge. The Activa 5G, however, is slightly cheaper at Rs 54,632 (drum) and Rs 56,497 (disc).

The past few months have seen TVS, along with Suzuki Motorcycle India, expand their two-wheeler market share thanks to their scooters' peppy sales.

At No. 3 is the Suzuki Access 125, which is fast becoming a popular buy and Suzuki's best-selling scooter. The Access seems to be closing the gap with the Jupiter and is at No. 3. In May 2019, with sales of 51,414 units, it was just 5,383 units behind the Jupiter. The gap, however, widened in June with the Access 125 at 49,366 units.

On July 16, Suzuki launched a refreshed version, the Access 125 Special Edition (SE) equipped with a disc brake variant. It is powered by the same all-aluminium, four-stroke, single-cylinder 124cc engine which develops 8.7ps at 7000rpm and 10.2 Nm of torque at 5000rpm.

At No. 4 is the Honda Dio, which saw despatches of 43,749 units, 3,091 units less than the 46,840 units in May and 2,752 units fewer than the 46,501 units in April. The Dio has strong brand equity among young college-going buyers, with Jharkhand, Karnataka and Maharashtra being strong markets.

Now, in a bid to rev up sales, Honda Motorcycle & Scooter India (HMSI), which is targeting semi-urban and rural India to drive up sales, has tied up with Cholamandalam Investment & Finance Co for offering retail finance. What will help is Cholamandalam’s strong nationwide presence with over 1,000 branches, most of them rural and semi-urban areas, and a base of a million.

The dark horse among the scooters is the TVS NTorq. Compared to a year ago, the 125cc scooter has jumped four ranks to be at No. 5 spot with 21,738 unuts. The snazzy-looking scooter has a lot going for it including its youthful appeal. Monthly volumes for the latest TVS 125cc scooter have stabilised at around 15,000 to 17,000 units . The scooter is riding the growing wave of demand for 125cc scooters, so expect better numbers to come its way later in the year.

At the sixth position is the Yamaha Fascino with 15,519 units, better than the 15,479 units in May and 14,873 units in April 2019. It is one of the few scooters which are currently seeing an uptick in. However, Yamaha needs to do more if the current sales momentum is to be maintained, especially when you consider that it now has a direct rival from Hero in form of the new 110cc Pleasure Plus.

The Hero Destini 125, which was at No. 5 position in May, has dropped to No. 6 in June with 11,292 units, a good 5,460 units less than the 16,752 units of May. In April 2019, the Destini 125 had 16,301 units to its name. The aggressive pricing (sub-Rs 55,000 ex-showroom) seems to have worked for a while for the family scooter but consumer preferences are clearly changing. The Maestro, the other Hero scooter, which was in the Top 10 in May, has dropped out of the June 2019 list of best-selling scooters

At No. 8 is the Yamaha Ray with 10,696 units, maintaining its composure in a dithering market, This scooter recently made the news when it got updated with a combined braking system and got a new blacked-out colour scheme.

The TVS Scooty Pep + with 10,631 units brings up the rear end of the Top 10 list with the final member being the Honda Grazia, with 10,388 units. Much was expected of the Grazia when it was launched but clearly the big numbers have yet to come.

Finally, it can be said that scooters are to the overall two-wheeler market what SUVs are to the PV segment. Gearless scooters have, over the past decade, brought new life to the mobility scenario in the country and have, among other things, enabled women to commute on their own.

The past few months have shown that the rate of sales decline for SUVs is slowing, which is good news for Indian OEMs. Will the scooter market replicate this scenario? Watch this space.

Read more: Top 5 Utility Vehicles in June 2019

Top 10 Passenger Vehicles in June 2019

Top 10 Two-Wheelers in June 2019

Bajaj Auto, TVS and Suzuki snatch Q1 2W market share

India Auto Inc sales tumble 3 quarters in a row

Hyundai records PV market share gains in a red-inked Q1

Hyundai Venue and Mahindra XUV300 drive UV market share gains in tough Q1

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

20 Jul 2019

20 Jul 2019

48405 Views

48405 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi