Hyundai Venue and Mahindra XUV300 drive UV market share gains in tough Q1

The two compact SUVs have given a new charge to Hyundai and Mahindra & Mahindra and brought an uptick in their UV market share in the first quarter of FY2020.

Utility vehicles (UVs) continue to be the favourite of the passenger vehicle world, globally and in India too. While OEMs are fast-forwarding SUV development plans and also crunching time-to-market schedules, in India the ongoing downturn has led to an even more pitched battle for the elusive customer. And Hyundai Motor India and Mahindra & Mahindra (M&M) are succeeding where others are slip sliding their way in a market which has lost its grip. Of the 15 UV makers in the fray, these two, along with Nissan (very marginal rise) are the only ones to have increased market share.

Typically, over the years, SUVs accounted for a fourth or 25 percent of the total PV market. Now with passenger car sales down by a substantial 24 percent both in June 2019 and in Q1 FY2020 (April-June 2019), UVs currently account for a robust 32 percent of total PV sales in June and in Q1. Reason enough to bring a smile or two to knackered OEMs, who not only have to contend with the emission technology upgrade to BS VI but also keep an eagle eye on the latest missive on electrification.

Maruti Suzuki cedes share

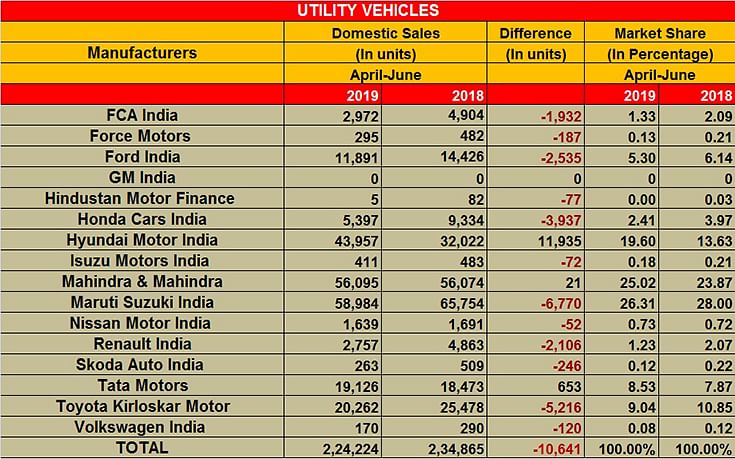

UV sales in June were down 1 percent with total volumes of 72,917 units (June 2018: 73,643) and down 4.53 percent in Q1 FY2020 at 224,224 units (234,865). With UV market leader Maruti Suzuki India's sales down 7.9 percent to 17,797 units in June and down 10.3 percent to 65,794 units in Q1, it's a no-brainer that the UV segment would be under pressure to stay in positive territory.

Not surprisingly, Maruti's performance is reflected in its market share which in Q1 FY2020 has fallen to 26.31 percent from 28 percent in Q1 FY2019 (see detailed market share table below). Its quartet of the Gypsy, Vitara Brezza, Ertiga and the S-Cross registered a fall of 10.29 percent to 58,984 units. With the consumer shift from diesel to petrol taking firm hold in buying patterns, the Vitara Brezza’s diesel-only powertrain is not helping the company. In contrast, the Ertiga MPV, available in both petrol and diesel, is fairing reasonably well.

Hyundai Venues in

No. 2 UV player Hyundai Motor India is seeing the gains of launching its Venue sub-compact SUV with multiple powertrain and drivetrain choices, including a brand-new 1.0-litre turbocharged petrol mated to a 7-speed DCT.

The Venue, which received an overwhelming 2,000 bookings on day one, has, along with elder sibling Creta, given a new charge to Hyundai’s UV sales, which stand at 43,957 units at the end of Q1 – a solid 37.27 percent growth (Q1, FY2019: 32,022). As a result, Hyundai’s UV market share has seen smart growth, from 13.63 percent in Q1 FY2019 to 19.60 percent now.

Sustained demand for the Venue has also had an impact on the well-performing Tata Nexon, which, along with its sibling Tata Sumo, saw a substantial dip of 15 percent in the first quarter with sales touching 12,652 (Q1 Fy2019: 14,873).

XUV300 keeps Mahindra flag flying high

UV major Mahindra & Mahindra, which bucked the overall industry trend of negative growth in June, and has the lowest rate of sales decline (-1.88%) in April-June 2019 where 14 others have recorded double-digit declines and one in single digits, has the SsangYong Tivoli-based XUV300 to thank for its improved sales traction. Although volumes remained almost flat at 56,074 in Q1 FY2020 (Q1 FY2019: 56,095), the company saw its UV market share grow 1.14 basis points to 25.02 percent, compared to 23.87 percent a year ago.

While Honda Cars India at 2.41 percent and Toyota Kirloskar Motor with an overall hold of 9.04 percent saw a reduction in their respective UV market shares, Tata Motors registered an increment of 0.66 basis points to 8.53 percent with net volumes ranging 19,126 units (18,473 / +7.87%). The Harrier in the midsize SUV segment is doing well with cumulative numbers between the Harrier, Safari and the Sumo Grande culminating at 5,632 units (1,211), a near four-fold growth in volumes. The SUV based on a Land Rover platform might feel the heat with the aggressively priced MG Hector and the upcoming Kia Seltos.

With the Union Budget not offering any growth catalyst for the IC-engine industry, the ongoing liquidity crunch (albeit the severity is far less now) and potential buyers preferring to adopt a wait-and-watch policy, the coming months will be a testing time for UV makers as well as entire industry. And in a segment where being compact makes big news, the message is clear and distinct: it's the SUV-ival of the fittest.

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

15 Jul 2019

15 Jul 2019

17184 Views

17184 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau