India Auto Inc sales tumble 3 quarters in a row

Indian automobile industry sees sales decline for the ninth straight month and in the absence of a growth catalyst from the government, growth seems far away.

What started with a dip in passenger vehicle (PV) sales in June 2018 now threatens to hit the overall industry. The unprecedented sales slowdown has engulfed all vehicle segments in the Indian automobile industry, leading to a pandemic which is impacting survival of businesses at the ground level.

Announcing another round of performance results on July 10, SIAM communicated the industry’s distressed situation and also released the wholesales numbers for June 2019 which paint a continuous red streak across all segments.

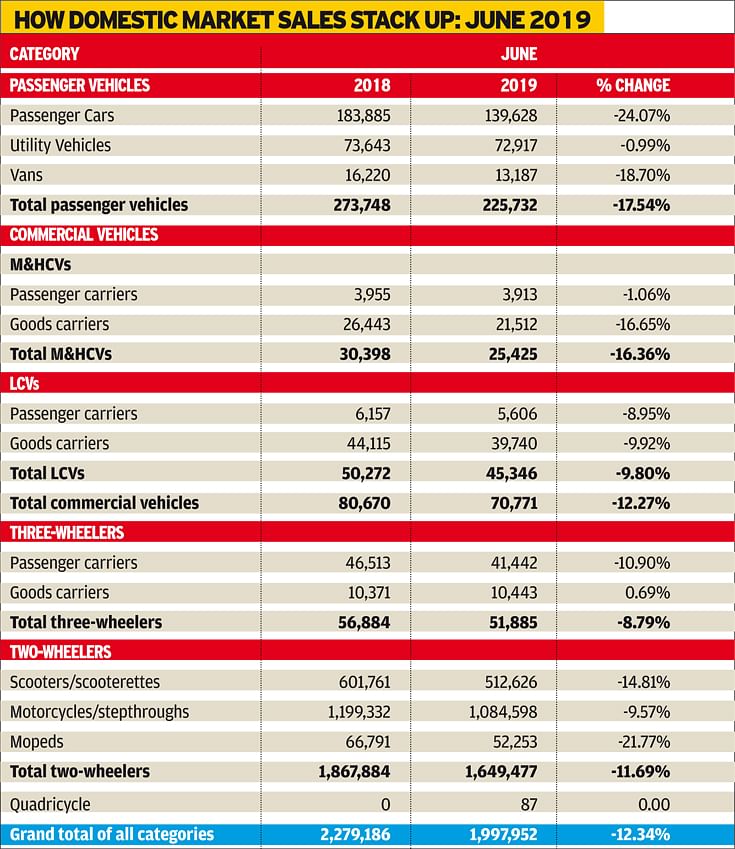

Overall sales in the month stood at 1,997,952 units (June 2018: 2,279,186 / -12.34%) with PVs declining 17.54 percent to 225,732 units (June 2018: 273,748). In the CV segment, M&HCVs at 25,425 units (30,398 / -16.36%) and LCVs closing at 45,346 units (50,272 / -9.80%) made the entire segment register a 12.27 percent decline with overall sales of 70,771 units in the month (June 2018: 80,670).

Three-wheelers at 51,885 units (56,884 / -8.79%) and two-wheelers at 1,649,477 units (1,867,884 / -11.69%) were part of the same zone as well, which painted the entire industry red in a single brush stroke.

A slowing economy with GDP growth coming down from 7.2 percent in FY2018 to 6.8 percent in FY2019 and estimated to hover between 6 and 6.5 percent in H1 of FY2020 is what SIAM assesses as the root cause of this deep slowdown.

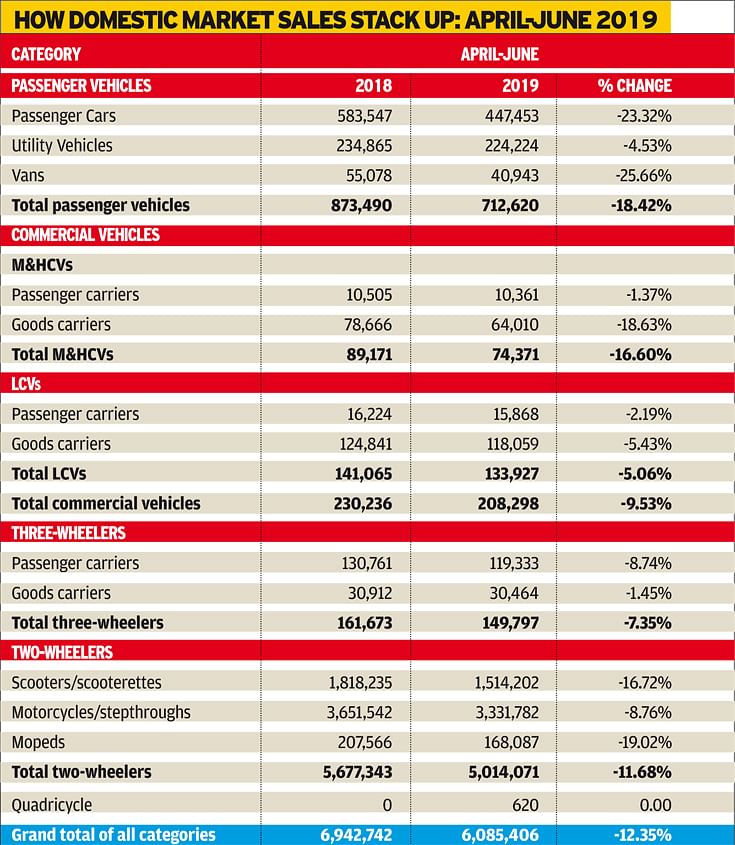

April-June 2019: 12.35 percent down YoY

In terms of the performance review in the first quarter of FY2020, de-growth numbers for each category were similar to that in June, clearly hinting at the continued downturn the industry has been witnessing over the past few months.

PVs dipped 18.42 percent between April and June 2019 with net factory wholesales of 712,620 units (April-June 2018: 873,490). Within this category, passenger cars declined 23.32 percent to 447,453 units (583,547), UVs 4.53 percent with 224,224 units (234,865) and vans too slumped 25.66 percent to 40,943 units (55,078).

Poor consumer sentiment, low finance availability, drop in rural demand and increase in insurance cost are the key factors identified by SIAM for this dismal performance by the PV segment, wherein OEMs have been on an inventory correction spree starting March this year.

Interestingly, the retail sales numbers as pulled out from the Vahan unified central server show that the situation has marginally improved on the ground with 783,409 PVs going in the hands of customers in the three-month period (April-June 2018: 798,823), observing a downturn of a substantially lower 1.93 percent in comparison. "It is a resultant of inventory correction methodologies that OEMs have been adopting over the past few months and now we need to arrest the de-growth," said Vishnu Mathur, director general, SIAM.

Out of the 208,298 units (April-June 2018: 230,236) and 9.53 percent drop in the complete CV segment, M&HCVs dropped 16.60 percent to 74,371 units (89,171) and LCVs declined to 133,927 units (141,065 / -5.06%). Passenger carriers fell 1.37 percent to 10,361 units (10,505) and by 2.19 percent to 15,868 units (16,224) in the M&HCV and the LCV segments, respectively. Goods carriers, on the other hand, dropped 18.63 percent and 5.43 percent to 64,010 units (78,666) and 118,059 units (124,841) in the M&HCV and LCV segments, respectively.

While revised axle load norms with an increased freight carrying capacity of trucks resulted in decreased demand in the 16T and above category, sales in public carriers was impacted due to a slowdown in the procurement of buses by STUs and private operators.

On the other hand, while growth in e-commerce business and warehouse consolidation led to demand for ICVs in the 3.5-7.5T and 7.5-16T categories, SCV and pick-up sales up to the 3.5T category were impacted due to a drop in consumer durable sales and crop production.

Overall three-wheeler numbers declined 7.35 percent to 149,797 units (161,673) and two-wheelers slumped 11.68 percent to 5,014,071 units (5,677,343). While scooters registered a 16.72 percent drop to 1,514,202 units (1,818,235), motorcycles closed at 3,331,782 units (3,651,542 / -8.76%). Low consumer sentiment in rural markets and hefty increment in on-road price of two-wheelers due to price increase in insurance premiums and an increased vehicle price in lieu of ABS and CBS implementation led to lowered demand.

Budget 2019: a missed opportunity for revival

While an environment of political stability with the re-elected government and a slew of road and infrastructure projects lined up in the coming years give some positive hope to the industry, the proposals in the Union Budget 2019 were a missed opportunity to revive an ailing sector.

According to Rajan Wadhera, president, SIAM, "The PV segment has been de-growing for almost 12 months now and we don't see any signs of improvement as it is linked to the GDP performance of the country."

"The rural demand is going down more than the rate of de-growth in urban areas. We have seen this happen over the last two quarters. In motorcycles, three-wheelers and CVs up to 2-tonne capacity, the rural share is as high as 50 percent.

"We had anticipated a reduction in GST base rates in the Budget allocation, which unfortunately didn't happen as it would have immediately helped revive demand in the market," Wadhera added.

Going by past precedence of receiving a tax cut by the government in the trying times of 2009 and 2011, industry was hopeful of an intervention this time as well.

"While we were hopeful that growth will come back and when it doesn't happen, we have to conserve our resources. There could be job losses and a lot of it has already begun at the dealer level," Wadhera updated on the current situation. There were no talks of a concrete scrappage policy either in the Budget to push demand.

The automobile sector contributed a substantial Rs 120,000 crore in GST collection in FY2019 – over 10 percent of the total Rs 1,100,000 crore revenue generated by the government.

"This downturn is directly impacting the GST recovery by the government. We are in the midst of a de-growth challenge and this is a very difficult phase. If we need to become a US$ 3 trillion economy, we will need to accelerate the automotive sector," he added.

While SIAM had proposed a reduction in GST as an immediate step to resurrect demand, the government went ahead and hit the industry harder by increasing cess on petrol and diesel fuel by Rs 2 each per litre in its attempt to push e-mobility. Various sops including a reduced GST from 12 to 5 percent for electric vehicles was proposed in the Budget, with conventional technology left to bleed through.

"Yes, we support the government's vision of a greener and cleaner tomorrow, but in order to meet that, we cannot kill the present. As SIAM, we all have been together in our demand for GST cut on PVs. Corporate tax reduction for companies having turnover up to Rs 400 crore is a step in the right direction and will aid demand from MSMEs," said Wadhera said.

"We, as an industry, do have a responsibility towards emission reduction, energy conservation and bringing futuristic products to the market, but the ramp down of conventional technology and gradual ramp up of EV technology has to go hand in hand."

"We need time to bring well researched, engineered and well-tested EV products to the market. The techno-commercial feasibility has to be there and it's unimaginable how the industry will manage such amounts of funds to now freshly infuse into EV development, before even realising profits from BS VI investments," he added.

Need BS VI fuel by mid-February 2020

While the industry is anticipating a major pre-buying of BS IV vehicles, especially CVs, in Q4 of the ongoing fiscal, it also needs to trigger a cut-off for BS VI production in order to streamline BS VI availability as on April 1, 2020.

"We are trying to synchronise rollout of BS VI with the government and OMCs. We have requested both parties to ensure BS VI fuel availability all across India by February 15, in order to ensure a smooth transition for CVs," concluded Wadhera.

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

10 Jul 2019

10 Jul 2019

12098 Views

12098 Views

Shahkar Abidi

Shahkar Abidi