Honda scooter market share drops to 39%, TVS’ rises to 29% in Q1 FY2026

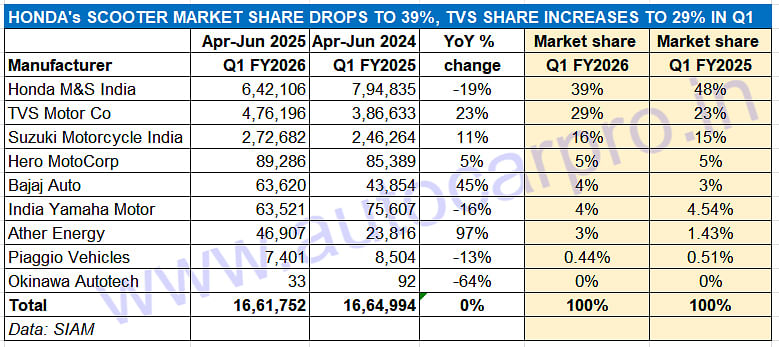

The April-June 2025 quarter saw flat scooter wholesales at 1.66 million units albeit its share of the overall 2W market rose to 35.54% from 33.39% a year ago. Market leader Honda’s factory dispatches at 642,106 units were down 19% while TVS Motor Co’s 476,196 units were up 23 percent. While Suzuki continues to make steady gains with its Access, Hero MotoCorp, Bajaj Auto and Ather Energy benefit from demand for their electric scooters.

After achieving strong 9% growth in FY2025, the Indian two-wheeler industry has had a tepid start to FY2026. The April-June 2025 quarter has seen factory dispatches of 4.67 million units, which is a sales decline of 6.2%. According to SIAM, this is due to some inventory correction. Nevertheless, of the three sub-segments, the scooter segment with 1.66 million units saw the lowest rate of decline (-0.2%) compared to motorcycles (2.90 million units, -9.2%) and mopeds (109,361 units, -11%).

Three months into FY2026, the Indian scooter industry has achieved 24% of its record 68,53,214 wholesales in FY2025.

Three months into FY2026, the Indian scooter industry has achieved 24% of its record 68,53,214 wholesales in FY2025.

Scooter makers had wrapped up FY2025 with record wholesales of 6.85 million units, up 17% YoY, and the best-ever fiscal for the segment. This could also mean the industry had a good level of scooter inventory left in its showrooms across India. Nevertheless, a pointer to the growth of the scooter segment is that its share of the overall two-wheeler market has increased in Q1 FY2026 by 2.15% to 35.54% from 33.39 percent.

Longstanding scooter market leader Honda Motorcycle & Scooter India has registered factory dispatches of 642,106 units in Q1 FY2026. This translates into 152,729 fewer scooters compared to Q1 FY2025 (794,835 units) and results in its market share reducing to 39% from 48% a year ago. In FY2025, Honda, which sells the Activa 110/125 and the Dio 110/125 scooters along with the electric Activa E and QC 1, had a market share of 41.50 percent.

TVS Motor Co, which has the Jupiter, NTorq, Zest and electric iQube in its scooter stable, sold 476,196 units in April-June 2025. This is an additional 89,563 units over the 386,633 units in Q1 FY2025, which results in TVS’ scooter market share rising substantially to 29% from 23% a year ago.

While the three petrol-engined scooters have sold 406,706 units, up 20% YoY, the TVS iQube electric scooter with 69,490 units has clocked 41% YoY growth (Q1 FY2025: 49,164 iQubes). This gives TVS a 15% EV penetration level in its scooter sales.

Suzuki Motorcycle India has maintained the same growth trajectory it displayed in FY2025, even increasing its market share to 16% from 15% a year ago. The Indian two-wheeler arm of the Japanese auto major dispatched 272,682 scooters in the first quarter, up 11% YoY. While the Access 125 remains its best-selling product, what helps Suzuki is that its two other scooters – Avenis and Burgman Street – are also powered by the same 125cc engine and are benefiting from the consumer upgrade to the 125cc segment.

Suzuki has recently announced its foray into the electric scooter market with its e-Access, the electric avatar of its best-selling model. While it has produced 488 units in Q1, wholesales have yet to commence.

Hero MotoCorp, with factory dispatches of 89,286 units in Q1 FY2026, has posted 5% YoY growth (Q1 FY2025: 85,389 units). Hero’s scooter range comprises the 110cc Pleasure and Xoom, 125cc Destini/Destini Prime and the 156cc Xoom 160. These together have sold 66,631 units, down 11% YoY (Q1 FY2025: 74,830 units).

What has brought the overall scooters into positive territory is the strong factory dispatches of the Hero Vida 2 and recently launched V2X electric scooters. The 22,655 EVs dispatched in April-June 2025 are a 115% increase YoY on the year-ago 10,559 Vida 1s.

This performance sees the world’s largest two-wheeler maker maintain its 5% scooter market share.

Bajaj Auto, just like TVS, Hero MotoCorp and Ather Energy, has benefited from the growing demand for its electric scooters. The Pune-based company sold a total of 63,620 units in Q1 FY2026, comprising 62,620 Chetaks and 1,000 Yulu Ver 3.0x units. This total makes for 45% YoY growth (Q1 FY2025: 43,854 units) and a marginal 1% increase in market share to 4 percent.

Just 99 scooters behind Bajaj Auto is India Yamaha Motor with 63,521 units. This is a sizeable 16% YoY decline (Q1 FY2025: 75,607 units) as a result of which its market share stands reduced to 4% from 4.54% a year ago. The 125cc-engined Alpha, Fascino and Ray ZR have together sold 58,534 units, down 17% YoY. The 155cc Aerox scooter, with 4,987 units, has registered a sales decline of 3.6% (Q1 FY2025: 5,166 Aerox).

Ather Energy, which is witnessing strong sales traction for its Rizta family e-scooter, has dispatched 46,907 of its electric scooters which include the Ather 450 and 450 Apex in the past three months, up 97% YoY. This strong performance sees Ather double its market share to 3% from 1.43% in Q1 FY2025.

Three months into FY2026, the Indian scooter industry has achieved 24% of its record 68,53,214 wholesales in FY2025. It will have to perform better over the next three quarters if it is both improve upon that total and also go on breach the seven-million-units milestone.

ALSO READ: Bajaj Auto ahead of TVS in e-2W sales in first-half July

Legacy e-2W OEMs keep startups at bay, capture 58% share in first-half CY2025

RELATED ARTICLES

TVS iQube Rides Past 800,000 Sales, 100,000 Units Sold in 3 Months

Launched in January 2020, the TVS iQube takes six years to hit the 800,000 sales milestone. While the first 300,000 unit...

Thar Roxx Races Past 100,000 Sales In 16 Months

Launched on September 25, 2024, the five-door Thar Roxx has been a huge success and helped propel the Thar brand into Ma...

India’s Top 30 SUVs, MPVs In CY2025 – Hyundai Creta Pips Tata Nexon To Top Spot

Of the 2.95 million utility vehicles sold in CY2025, the Top 30 models accounted for 2.82 million units (95% share). Mar...

17 Jul 2025

17 Jul 2025

16338 Views

16338 Views

Ajit Dalvi

Ajit Dalvi