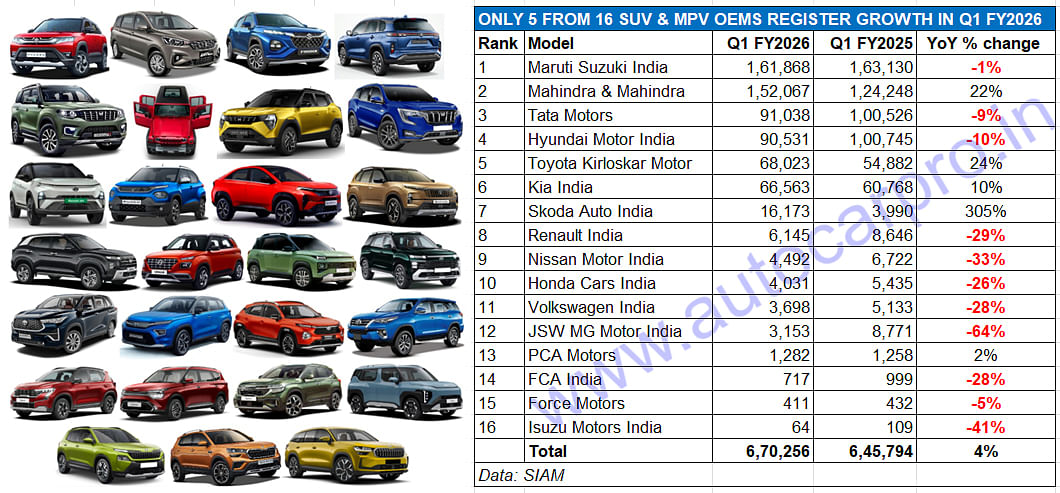

UV makers sell 670,256 units in Q1 FY2026, Maruti and Mahindra separated by 9,801 units

The SUV and MPV industry registered tepid 3.8% YoY growth in April-June 2025 with 11 of the 16 UV OEMs including Maruti Suzuki posting sales declines. Mahindra & Mahindra, up 22%, sees its market share rise to 23% and just behind Maruti Suzuki’s 24 percent. While Toyota continues its strong run, Kia has benefited from demand for the new Carens Clavis, and Skoda India’s Kylaq has given it a new charge.

With apex industry body SIAM releasing the automobile wholesales (factory dispatches) data for the first quarter of FY2026, it is amply clear that demand has been muted in the overall passenger vehicle industry at 1.02 million units (up 3%). Of this, utility vehicle (UV) manufacturers contributed 670,256 units – this total is up just 3.8% YoY (Q1 FY2025: 645,794 UVs) which compares poorly with the 18% growth a year ago in April-June 2025 (Q1 FY2024: 547,194 UVs).

This scenario is reflected in the sales of the 16 UV manufacturers, of which 11 including market leader Maruti Suzuki, have registered YoY sales declines. Only five OEMs – Mahindra & Mahindra, Toyota Kirloskar Motor, Kia India, Skoda Auto India and PCA Motors – have registered YoY growth (see UV Q1 FY2026 data table at the end of this Q1 FY2026 sales analysis).

Let’s take a closer look at the top seven UV manufacturers' performance.

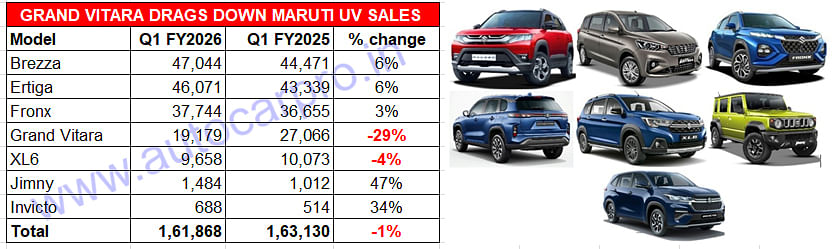

No. 1 – MARUTI SUZUKI INDIA: 161,868 UVs, down 1% YoY

No. 1 – MARUTI SUZUKI INDIA: 161,868 UVs, down 1% YoY

Q1 FY2026 UV market share: 24%

Q1 FY2025 UV market share: 25%

Utility vehicle market leader Maruti Suzuki India, which has seven models comprising the Brezza, Fronx and Jimny compact SUVs, Grand Vitara midsize SUV and the Ertiga and Invicto MPVs, has clocked factory dispatches of 161,868 units in April-June 2025. This is 1,262 fewer UVs than a year ago (Q1 FY2025: 163,130 units) and sees its market share drop to 24% from 25 percent.

The Maruti Brezza, currently India’s best-selling compact SUV, tops the model-wise chart with 47,044 units, up 6%, and 29% share of Maruti Suzuki sales in the first quarter. The Ertiga, the No. 1 MPV in the country, sold 46,071 units and is followed by the Fronx compact SUV (37,744 units).

Maruti Suzuki’s UV total has been adversely impacted by the poor sales of the Grand Vitara midsize SUV. At 19,179 units, YoY demand was down sharply by 29% YoY (Q1 FY2025: 27,066 units). It is understood that there is a three-row Grand Vitara in the pipeline but it won’t be available till end-2025.

The XL6 MPV’s sales too were down by 4% to 9,658 units but demand rose strongly for the Jimny and Invicto MPV. However, the net result of Maruti’s tepid UV sales in Q1 FY2026 is that its arch rival Mahindra & Mahindra is hard on its heels. At the end of Q1 FY2026, the difference is just 9,801 units.

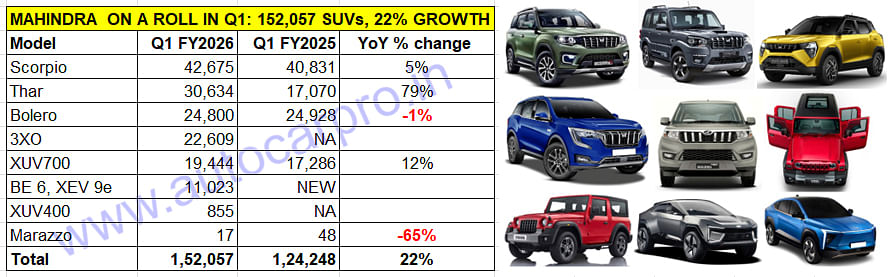

No. 2 – MAHINDRA & MAHINDRA: 152,057 UVs, up 22% YoY

No. 2 – MAHINDRA & MAHINDRA: 152,057 UVs, up 22% YoY

Q1 FY2026 UV market share: 23%

Q1 FY2025 UV market share: 19%

Mahindra & Mahindra, with its armada of SUVs, is on a roll. The Mumbai-based auto major has dispatched 152,057 SUVs in the first three months of FY2026, which marks robust 22% YoY growth (Q1 FY2025: 124,248 units).

Importantly, this strong performance puts it very close behind the market leader – the gap at the end of the April-June 2025 quarter is only 9,801 units, far lesser than the lead of 38,882 units that Maruti Suzuki had a year ago.

Barring three models (Bolero, XUV400, Marazzo MPV), all of M&M’s SUVs are commanding strong demand. They are led by the Scorpio (42,675 units, up 5%), Thar (30,634 units, up 79%) as a result of the five-door Thar Roxx, 3X0 (22,609 units) XUV700 (19,444 units, up 12%) and also the two new electric SUVs, the BE 6 and XEV 9e (11,023 units).

M&M’s Q1 performance this fiscal gives it a UV market share of 23%, considerably higher than the 19% it had in Q1 FY2025.

With 9 months or three-quarters left in the current fiscal year, which will see Maruti Suzuki roll out its first EV, it will be interesting to see how the current market leader protects its UV turf. Or will the unstoppable Mahindra march into the lead and wrest the UV title for FY2026.

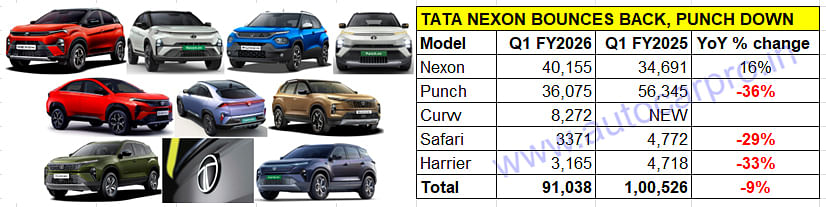

No. 3 – TATA MOTORS: 91,038 UVs, down 9% YoY

No. 3 – TATA MOTORS: 91,038 UVs, down 9% YoY

Q1 FY2026 UV market share: 14%

Q1 FY2025 UV market share: 15%

Tata Motors, with its pack of five SUVs, has sold a total of 91,038 units in Q1 FY2026, down 9% YoY and 9,488 fewer units than a year ago (Q1 FY2025: 100,526 units). The Nexon, which is witnessing a resurgence of demand, and the new Curvv coupe-SUV are the only ones to register growth.

With three-month sales of 40,155 units, the Nexon’s factory dispatches are up 16% YoY (Q1 FY2026: 40,831 units).

In comparison, the Punch, India’s best-selling SUV in FY2025 (196,567 units), is witnessing a surprisingly poor start to FY2026. Q1 FY2026 sales at 36,075 units are down sharply by 36% YoY (Q1 FY2025: 56,345 units). This translates into 20,270 fewer units YoY. The estimated 10,446 units sold in June 2025 are the lowest monthly sales for the Punch since July 2023 (12,019 units).

While the Curvv, which is in its first year of sales, has sold 8,272 units, both the Safari and Harrier are down by 29% and 33% YoY, respectively.

Of the five SUVs, Tata Motors has an electric variant for four of them barring the Safari which gives it a wider target audience than its rivals.

No. 4 – HYUNDAI MOTOR INDIA: 90,531 UVs, down 10% YOY

No. 4 – HYUNDAI MOTOR INDIA: 90,531 UVs, down 10% YOY

Q1 FY2026 UV market share: 13.50%

Q1 FY2025 UV market share: 15.60%

When four of six models see YoY sales declines, it can only have a detrimental impact on total sales as well as market share. Hyundai Motor India, which has been feeling the heat from an aggressive M&M, sold 90,531 UVs in April-June 2025. This translates into 10,214 fewer UVs sold and a 10% YoY sales decline. As a result, Hyundai’s UV market share has reduced to 13.50% from 15.60% a year ago and also allowed Tata Motors to take third rank.

The Creta, which now has an electric sibling, remains Hyundai’s best-selling model as well as India’s No. 1 midsize SUV. The 47,662 units were a 3% YoY increase and accounted for 53% of Hyundai’s Q1 UV dispatches. The two compact SUVs – Venue (22,331 units, down 21%) and Exter (17,188 units, down 23%) – have dragged Hyundai numbers down in the first quarter of FY2026. The flagship Alcazar midsize SUV though bucked the trend with 3,113 units and marginal 2% growth.

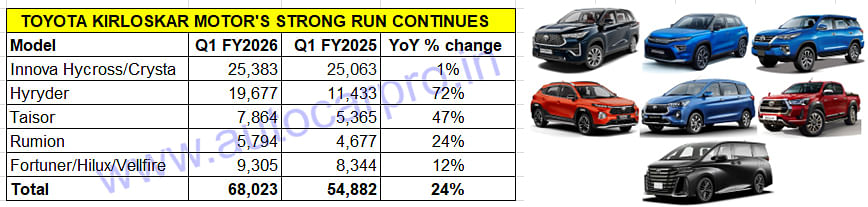

No. 5 – TOYOTA KIRLOSKAR MOTOR: 68,023 UVs, up 24% YoY

No. 5 – TOYOTA KIRLOSKAR MOTOR: 68,023 UVs, up 24% YoY

Q1 FY2026 UV market share: 10%

Q1 FY2025 UV market share: 8.49%

Toyota, like M&M, is also surfing the wave of demand for its UVs, both SUVs and MPVs. The Innova MPV, its best-selling product, the sold 25,383 units, up 1% YoY (Q1 FY2025: 25,063 units). Compared to the Crysta, the Innova Hycross commands the bulk of the sales.

Along with its own products, TKM’s resurgence in the UV market is being driven by the Maruti-rebadged models led by the Urban Cruiser Hyryder midsize SUV and Taisor compact SUV. While the Hyryder has sold 19,677 units, which marks stellar 72% YoY growth (Q1 FY2025: 11,433 units), the Taisor has clocked 7,864 units, up 37% YoY. The Rumon MPV too has achieved high double-digit growth while the Fortuner-Hilux-Venture together have sold 9,305 units, up 12% YoY.

TKM’s strong showing in the first quarter is reflected in its improved UV market share of 10% versus 8.49% a year ago.

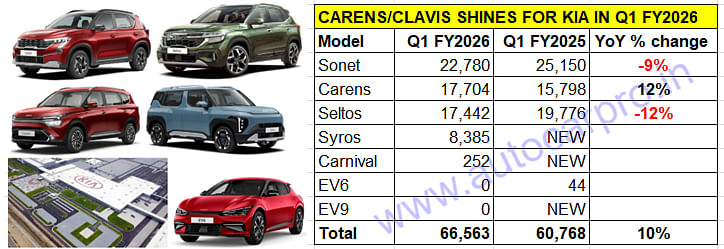

No. 6 – KIA INDIA: 66,653 UVs, up 9.53% YoY

No. 6 – KIA INDIA: 66,653 UVs, up 9.53% YoY

Q1 FY2026 UV market share: 10%

Q1 FY2025 UV market share: 9%

Kia India, which is the fourth ranked UV OEM, has clocked sales of 66,653 units in Q1 FY2026, up 10% YoY (Q1 FY2025: 645,794 units). The company currently has seven models on sale, of which three – the Syros compact SUV, Carnival MPV and EV9 – have been recently launched and are in their first year of sale.

While the Sonet with 22,780 units (down 9%) remains its best-seller, the Carens MPV, which has been joined by the upmarket Clarens Clavis in May, is the only long-serving model to register growth. With 17,704 units (up 123%), the Carens-Clavis combine has posted 12% YoY growth (Q1 FY2025: 15,798 units) and also gone past the Seltos, which is now in third place with 17,442 units (down 12%).

The Syros, which is part of the ultra-competitive compact SUV market, has sold 8,385 units while the new Carnival Limousine has sold 252 units.

No. 7 – SKODA AUTO INDIA: 16,713 UVs, up 305% YoY

No. 7 – SKODA AUTO INDIA: 16,713 UVs, up 305% YoY

Q1 FY2026 UV market share: 2.49%

Q1 FY2025 UV market share: 0.61%

The Kylaq, Skoda India’s vehicle of entry into the booming compact SUV market, has received a massively strong customer response. The Kylaq has energised Skoda Auto and how. In the first three months of FY2026, it has sold 13,509 units, commanding 83% of the Czech manufacturer’s total UV sales of 16,173 units.

Sales of the other two models – the Kushaq and Kodiaq midsize SUVs – are both down YoY, by 37% and 7% respectively. From February 2025 onwards, the Kylaq has become the company’s best-selling locally produced vehicle, ahead of the Kushaq and also the Slavia sedan.

Of the 11 UV manufacturers, only five – Mahindra & Mahindra, Toyota Kirloskar Motor, Kia India, Skoda Auto India and PCA Motors – registered YoY growth in the first quarter of FY2026.

Of the 11 UV manufacturers, only five – Mahindra & Mahindra, Toyota Kirloskar Motor, Kia India, Skoda Auto India and PCA Motors – registered YoY growth in the first quarter of FY2026.

UTILITY VEHICLE SHARE OF PV SALES RISES TO 66% FROM 65% IN FY2025

he UV industry’s performance in Q1 FY2026 maintains the same trend as in FY2025, when 2.79 million UVs accounted for 65% of the 4.30 million passenger vehicle wholesales and acted as a buffer to the sharp decline of passenger car and sedan sales.

The 670,256 UVs dispatched in April-June 2025 are 66% of the 10,11,882 million passenger vehicles sold. Of this, the share of passenger cars is 30%, down from the 33% it had in Q1 FY2025. It is worth noting that a decade ago in FY2016, the passenger car share of the overall PV segment was 72% and that of UVs was 21 percent.

ALSO READ:

Hyundai Creta to Skoda Kylaq: Top 20 utility vehicles in Q1 FY2026

Top 10 MPVs in Q1 FY2026: Maruti Ertiga, Toyota Innova, Kia Carens sell 89,000 units

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

16 Jul 2025

16 Jul 2025

5599 Views

5599 Views

Shahkar Abidi

Shahkar Abidi