EV sales in India race past a million units in first-half CY2025

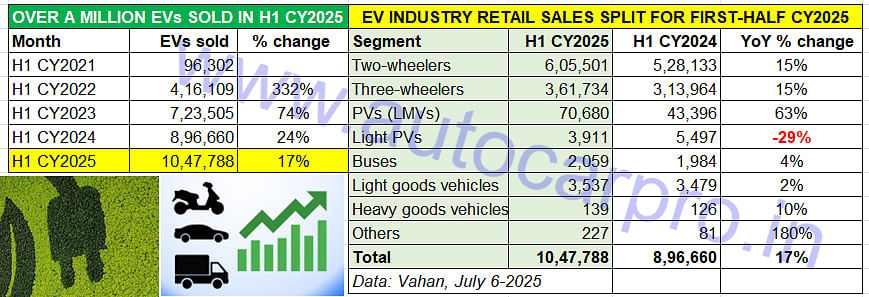

Riding on strong double-digit growth in the 2-, 3-wheeler and passenger vehicle segments, India EV Inc sells 10,47,788 vehicles to register 17% growth. This is the highest-ever retail sales between January-June and puts the industry in line to achieve 2-million annual sales for the first time. What could be a sales spoilsport is the likelihood of EV production impacted by disrupted supplies of rare earth magnets from China.

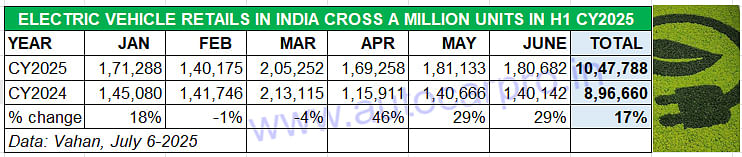

India’s Electric Vehicle industry is on a roll this year, with all EV categories witnessing strong double-digit growth in the first six months. As per retail sales numbers on the Vahan portal, between January and June 2025, a total of 1.04 million EVs (10,47,788 units) across the two- and three-wheeler, passenger and commercial vehicle categories have been delivered to customers. This marks 17% year-on-year growth (H1 CY2024: 896,660 EVs) and also the first time that EV OEMs have surpassed the million-units milestone in the first six months of a year.

Other than February and March, monthly sales of EVs registered strong double-digit growth in the first half of the current calendar year.

Other than February and March, monthly sales of EVs registered strong double-digit growth in the first half of the current calendar year.

Halfway into CY2025, India EV Inc is well placed to hit the 2-million sales milestone for the first time in a calendar year. Disrupted production due to slowed-down supplies of rare earth magnets could prove to be spoiler though.

Halfway into CY2025, India EV Inc is well placed to hit the 2-million sales milestone for the first time in a calendar year. Disrupted production due to slowed-down supplies of rare earth magnets could prove to be spoiler though.

Of the past six months, the highest sales came in FY2025-ending March (205,252 units) albeit they were down 4% on March 2024’s 213,115 units, which remains the second best-ever month for EV sales in India to date, after October 2024 (219,713 units).

The cumulative January-June 2025 retail sales of 10,47,788 units already 54% of CY2024’s 1.95 million units (19,50,635 units) with six months still to be counted in this year. What is helping drive demand for EVs is the favourable market sentiment, a positive monsoon outlook by the IMD and, importantly, a good number of new product launches across the two-wheeler and passenger vehicle segments.

Despite geopolitical tensions along with global trade uncertainties that the automotive as well as other industries are grappling with, India’s GDP rose by 7.4% in FY2025’s fourth quarter, helping the country maintain its status as the world’s fastest-growing economy and is on track to transform into the world’s fourth largest economy by the end of the current fiscal (FY2026).

While there seems to be a level of softness of new vehicle purchases from urban India in the past few months, an upbeat rural market benefiting from the abundant monsoon could act as a buffer and provide the ammo for the rest of the year and beyond. However, a growth spoiler looms ahead in the form of disruption of critical rare earth magnets critical rare earth magnets which are used in a plethora of operations including EV motors, power steering systems, generator magnets, dashboard displays, and LED lighting systems, among other relevant components in the EV ecosystem.

ELECTRIC TWO-WHEELERS: 605,501 units, up 15% YoY

ELECTRIC TWO-WHEELERS: 605,501 units, up 15% YoY

Share of EV industry: 58%

CY2025 looks set to be yet another record-setting year for the Indian electric two-wheeler industry. Between January 1 and June 30, 2025, a total of 605,501 e-2Ws have been sold across India. This constitutes 15% YoY growth (H1 CY2024: 528,133 units) and is 53% of CY2024’s record sales of 1.14 million e-2Ws.

The Indian e-2W industry, which is the mover and shaker of the overall EV industry volume-wise, accounts for 58% of the total 10,47,788 EVs retailed across segments in the first half of CY2025. Of the 200-odd players in the fray, a small bunch of legacy two-wheeler manufacturers have kept their startup rivals at bay.

TVS Motor, Bajaj Auto, Hero MotoCorp, Greaves Electric, Kinetic Green and Honda have sold 351,717 e-2Ws in January-June 2025, well ahead of the Top 20 startups led by Ola Electric and Ather Energy, which with 242,112 units have a 40% market share in the first half of the current calendar year which looks well set to surpass CY2024's record sales of 1.14 million units. CLICK HERE for e-2W H1 CY2025 sales analysis and the best-selling companies.

ELECTRIC 3-WHEELERS: 361,734 units, up 15% YoY

ELECTRIC 3-WHEELERS: 361,734 units, up 15% YoY

Share of EV industry: 34%

Like the two-wheeler industry, the electric three-wheeler industry too is poised to set a new sales benchmark this year. Between January 1 and June 30, a total of 361,734 units were sold. This marks 15% year-on-year growth (January-June 2024: 313,964 units) and is 52% of CY2024’s record sales of 691,302 units.

If e-3W OEMs maintain the same level of growth displayed in the past six months, or exceed that considering the festival season comes up later this year, then it can be surmised that India e-3W Inc will go on to surpass the 700,000-units retail sales milestone for the first time in CY2025.

Of the total 605,493 three-wheelers (across all powertrains) sold in India in H1 CY2025, electric three-wheelers account for the bulk of them – 60% – clearly establishing their stranglehold over this vehicle segment. Furthermore, it is also the one to register the highest YoY growth amongst all fuels (electric, CNG, LPG, petrol and diesel). The 15% YoY increase in sales has given it an additional 5% market share, growing from the 55% it had in H1 CY2024 and thereby has taken away sales from the CNG market.

Like the e-2W industry, a shakeout is also underway between the legacy OEMs and a host of startups in this segment. The Top 15 e-3W OEMs list for H1 CY2025 has four legacy players – Mahindra & Mahindra, Bajaj Auto, Piaggio Vehicles and recent entrant TVS Motor Co – which between them have sold 84,754 units which makes for a 23% market share. Electric 3W market leader Mahindra Last Mile Mobility (38,262 units, 10.57% share) is followed by Bajaj Auto (33,521 units, 9.26% share), Piaggio Vehicles (ranked No. 6 with 7,357 units, 2% share) and TVS Motor Co (ranked 11th with 1.55% share).

The remaining 276,970 units sold in H1 FY2025 are split between 569 others players, which reflects the intense competition is this segment of the EV industry. CLICK HERE for the e-3W H1 CY2025 sales analysis and Top 30 OEMs list.

ELECTRIC PASSENGER VEHICLES: 74,591 units, up 53% YoY

ELECTRIC PASSENGER VEHICLES: 74,591 units, up 53% YoY

Share of EV industry: 7%

Like the e-2W and e-3W segments, the electric passenger vehicle (e-PV) segment too is charging towards setting its very own sales record this year. As per Vahan data, total retail sales of electric cars, SUVs and MPVs at 74,591 units are up by 53% YoY. This total is already 75% of the e-PV industry's entire CY2024 sales of 99,597 units. Unless production in the second half of this year is hampered by delayed supplies of rare earth magnets, the e-PV industry should go on to hit a record 150,000-plus units in CY2025.

H1 FY2025 has seen four straight months of 13,000-plus sales and the best-ever monthly retails of 13,397 units in June. While market leader Tata Motors’ share has dropped sharply to 38% from 68% in H1 2024, JSW MG Motor India has doubled its share to 32% as has Mahindra & Mahindra to 17 percent.

If the mass-market electric PV manufacturers are making the most of the demand for EVs, can luxury EV OEMs, which push the R&D, technology, comfort and excellence envelope, be behind? This sub-segment too, led by BMW India and Mercedes-Benz India, has joined the e-PV party.

Combined retail sales of the seven OEMs at 2,178 units are up 59% on year-ago sales of 1,373 units. This total gives the luxury e-PV OEMs a three percent share of overall e-PV sales in the first half of this year. CLICK HERE for the H1 2025 sales analysis and detailed stats of 14 e-PV OEMs.

ELECTRIC COMMERCIAL VEHICLES: 5,735 units, up 7% YoY

ELECTRIC COMMERCIAL VEHICLES: 5,735 units, up 7% YoY

Share of EV industry: 0.54%

Compared to the other three sub-segments, cumulative six-month sales and YoY growth in the electric commercial vehicle segment is tepid. At 5,735 units, the YoY increase is 2.61% (H1 CY2024: 5,589 units).

Sales of zero-emission passenger buses rose 4% to 2,059 units (H1 CY2024: 1,984 units). Most of these electric buses, which cost between Rs 1 crore to 2 crore, are bought state or city road transport corporations.

The bulk of the e-CV sales belonged to electric light goods vehicles – at 3,537 units, sales were up 2% YoY – and accounted for 62% of the segment’s retails in first-half CY2025. Most of the demand for these vehicles comes from last-mile mobility and logistics operators from across India.

Stay tuned in regularly as we bring you the very latest on the Indian EV industry's sales story.

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

08 Jul 2025

08 Jul 2025

13741 Views

13741 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi