REVEALED: India’s Top 15 States, UTs for electric 2W, 3W, PV and CV sales in CY2024

Uttar Pradesh, with 369,102 units and a 19% share of all-India retail sales of 1.95 million EVs sold last year remains ahead of Maharashtra, which is the No. 1 state for sale of electric two-wheelers, passenger and commercial vehicles. Karnataka, Tamil Nadu, Bihar, Rajasthan and Madhya also registered six-figure sales. We reveal just where the near-2 million EVs were sold in India in CY2024.

India’s electric vehicle (EV) industry wrapped up CY2024 on a strong note with retail sales hitting a record 1.95 million units, increasing by a robust 27% year on year (CY2023: 1.53 million units) and missed the 2-million milestone by a whisker: just 50,000-odd units. The past two years have been particularly good for the sector as OEMs benefit from the growing consumer shift to e-mobility while EV buyers gain from the larger number of EVs across the two- and three-wheeler and passenger vehicle segments.

EV sales in CY2024 at 1.95 million units comprised 7.44% of India Auto Inc’s overall sales of 26.20 million automobiles across all powertrains. While electric two-wheelers (1.14 million units, up 33%) and a 59% share were the largest contributor to India EV Inc, electric three-wheelers (691,340 units, up 18%) accounted for a 35% share. Together, the e2W and e3W segments made up the giant share of 94% of the EV industry’s retails. Also hitting record sales last year was the electric passenger vehicle segment (99,453 units, up 20%) which had a 5% share of total EV sales. The electric commercial vehicle segment, which comprises zero-emission buses, light and heavy goods vehicles, sold 10,051 units, up 100% YoY, and had a 0.5% share of EV sales.

India EV Inc’s strong growth trajectory has its footprint across multiple states and Union territories in terms of EV ownership. With nearly all States and Union Territories wooing EV buyers with EV-ownership friendly policies and measures, finding out how they fare on the EV ownership / user chart is important.

Given the growing market size of the domestic EV industry, it is also interesting to delve into data to find out just how EV ownership / EV population stacks up across India. A deep dive into the retail sales statistics of all the States and Union Territories where the 1.95 million EVs were sold in CY2024, across vehicle segments, reveals plenty of insights.

As per the Vahan-sourced data, of the total 1,950,059 EVs sold in India in CY2024, the top six states – Uttar Pradesh (369,102), Maharashtra (241,941), Karnataka (179,037), Tamil Nadu (131,482), Bihar (112,854), Rajasthan (109,393) and Madhya Pradesh (100,314) – registered six-figure sales. Their cumulative sales of 1,244,123 or 1.24 million EVs account for 64% of total EV sales in India last year. The Top 3 – Uttar Pradesh, Maharashtra and Karnataka – with 790,080 units alone have a 40% share of total EV sales.

7 STATES WITH 6-FIGURE SALES: Uttar Pradesh, Maharashtra, Karnataka, Tamil Nadu, Bihar, Rajasthan, Madhya Pradesh

7 STATES WITH 6-FIGURE SALES: Uttar Pradesh, Maharashtra, Karnataka, Tamil Nadu, Bihar, Rajasthan, Madhya Pradesh

Topping the chart in CY2024 is Uttar Pradesh (UP) with sale of 369,102 units and commanding 19% of the total EV parc in India. This is thanks to UP being the state with the largest number of electric three-wheelers – 266,106 units and an overwhelming 38% of the 6,91,340 e3Ws sold last year. In the other e-sub-segments, Uttar Pradesh ranks down the line – in e-two-wheelers, the state is in fourth place with 95,513 units, ranked fifth in e-passenger vehicles (6,781 units) and e-buses (702 units.

Maharashtra is ranked second overall on the all-India EV ownership scale with 241,941 units and a 12.40% share. However, it has the bragging rights because it is the leader in e-two-wheelers, electric cars and SUVs, and also e-buses. Of the 691,340 e-two-wheelers sold in India in CY2024, Maharashtra with 210,174 units has the largest share of 30 percent. Likewise, in electric car and SUV sales, the state leads with 15,044 units or 15% of the 99,453 ePVs sold. The western state, which is home to the country’s financial capital, is also No. 1 in e-buses with 2,279 units and a 23% market share.

Karnataka, with 179,037 EVs and a 9% share of India EV sales is the overall No. 3 in CY2024 as a result of its second rank in e-two-wheelers (155,454 units / 13.52% share), second rank in e-PVs (14,090 units / 14% share) and fifth rank in e-buses (1,321 units / 13% share). The state is low down the order in e-three-wheelers – it is No. 16 (8,154 units / 1% share) across both passenger and cargo models.

Tamil Nadu, which aims to become the EV hub of the country with its well-established ecosystem of both EV component and vehicle manufacturers, is ranked No. 4 on the all-India EV sales scale for CY2024. The southern state registered retails of 1,31,482 units, which gives it a 7% share of the market. Tamil Nadu, which a year ago bagged Vietnamese EV maker VinFast’s mega investment for setting up an integrated EV plant in Thoothukudi, is the No. 3 in e2Ws (114,762 units / 10% share), No. 4 in ePVs (7,770 units, 8% share) as well as e-CVs (1,014 units / 10% share). It is low on the e3W scale though – the 8,154 units sold put it No. 16 on the all-India e3W table.

Bihar is ranked No. 5 with total EV sales of 112,854 units, which gives it an all-India share of 6%. The bulk of Bihar sales come from e3Ws (89,683 units / 13% share), followed by e2Ws (22,144 units /2% share), ePVs (940 units / 1% share) and eCVs (87 units).

Rajasthan, with 109,393 units and a 5% share, takes fifth position in EV sales for CY2024, and is behind Bihar by just 3,461 units. The bulk of its sales comprise e-two-wheelers (76,821 units / 7% share). While the state witnessed sales of 26,090 e3Ws (4% share), its residents have also bought 6,130 e-PVs (6% share). The northern state saw sale of 348 electric CVs last year.

Madhya Pradesh is the last of the states with six-figure sales in CY2024. With 100,314 units, it has a 5% share of all-India EV sales last year. The bulk of its retails came from e2Ws (65,814 units / 6% share), followed by e3Ws (31,688 units / 4.6% share), electric cars and SUVs (2,508 units / 2.52% share) and 304 electric CVs.

ELECTRIC 2-WHEELERS: Maharashtra, Karnataka and Tamil Nadu shine

ELECTRIC 2-WHEELERS: Maharashtra, Karnataka and Tamil Nadu shine

The electric two-wheeler industry is where plenty of market action and volume lies. If India’s EV industry came within sniffing distance of the record 2 million (20 lakh) retail sales mark in CY2024, then it is because of the big volumes provided by the most affordable sub-segment – electric two-wheelers. Of the total 1.94 million EVs in India in 2024, electric scooters and motorcycles accounted for 1.14 million units or 59% – up from the 56% share of 2023 – recording strong double-digit growth of 33% (CY2023: 860,418 units, up 36% YoY). Three states – Maharashtra, Karnataka and Tamil Nadu – provided the ammo, each with six-figure retails.

Maharashtra, the overall No. 2 state for EV sales, accounted for total EV sales of 241,941 EVs last year. This podium position is the result of being the state with the highest e2W sales – 210,174 units or 87% of its EV sales total and 18% of total e2W retails. Bajaj Auto, which has a stellar run in CY2024, has its Chetak e-scooter factory in Pune.

Karnataka, which is home to smart e-scooter OEM Ather Energy, is the No. 2 state with 155,454 units and a 13.52% share of the 11,49,087 e2Ws sold last year. Tamil Nadu, another Southern state, which is home to the manufacturing plants of market leader Ola Electric, No. 2 OEM TVS Motor Co, and also Greaves Electric Mobility, ranks No. 3 with 114,762 units or a 10% percent share.

Together, these top three states with 480,390 e2Ws account for a 42% share of e2W retails, which OEMs would do well to heed, as also the other 13 that are in this list.

ELECTRIC 3-WHEELERS: Uttar Pradesh commands 38% share of 691,340 units

ELECTRIC 3-WHEELERS: Uttar Pradesh commands 38% share of 691,340 units

The electric three-wheeler industry is the one seeing the fastest transition from IC engine to e-mobility. This segment, with retails of 691,340 zero-emission passenger and cargo vehicles, contributed 35% to total EV sales in CY2024 and 56% of the 1.22 million three-wheelers across all powertrains (diesel, petrol, CNG, LPG and electric) sold in CY2024. The e3W industry, which averaged monthly sales of 57,611 units in CY2024 compared to 48,633 units in CY2023, missed hitting the 700,000 milestone by just 8,660 units.

Uttar Pradesh is the topper here with 266,106 units, accounting for a strong 38% share of total e3W retails. This has also helped the state go ahead of Maharashtra, which is the No. 1 in e2Ws, e-passenger vehicles and e-commercial vehicles but No. 11 for e-3Ws in CY2024.

Bihar, with 89,683 units and a 13% share, is the No. 2 state in this segment, followed by Assam (63,143 units and 9% share).

This e3W segment also has the distinction of having the largest number of players – all of 575 companies as per Vahan data. Like the e-two-wheeler industry, there’s fierce competition, albeit amongst the Top 6 players – Mahindra Last Mile Mobility (MLMM), YC Electric, Bajaj Auto, Saera Electric Auto, Dilli Electric Auto and Piaggio Vehicles. And TVS Motor Co, with its King EV Max, is the latest legacy OEM to have entered the arena.

ELECTRIC PASSENGER VEHICLES: Maharashtra and Karnataka vie for honours

ELECTRIC PASSENGER VEHICLES: Maharashtra and Karnataka vie for honours

The Indian electric passenger vehicle segment, in tandem with the electric two- and three-wheeler segments which notched their best-ever annual sales in CY2024, registered its best-ever calendar year retails of 99,453 units, up 20% YoY (CY2023: 82,563 units). This is also the segment which makes the most news headlines, as they did at the recent Bharat Mobility Global Expo 2025 which saw a flurry of new electric cars, SUVs and MPVs being revealed and some launched.

In CY2024, three states stood out in the e-PV segment – Maharashtra, Karnataka and Kerala – with their combined sales of 40,116 units accounting for 40% of the all-India total of nearly 100,000 units. Maharashtra remained the No. 1 state with 15,044 e-PVs and a 15% share, 954 units ahead of Karnataka (14,090 units), which had a 14% share. Kerala, with 10,982 units and an 11% share is third on the podium.

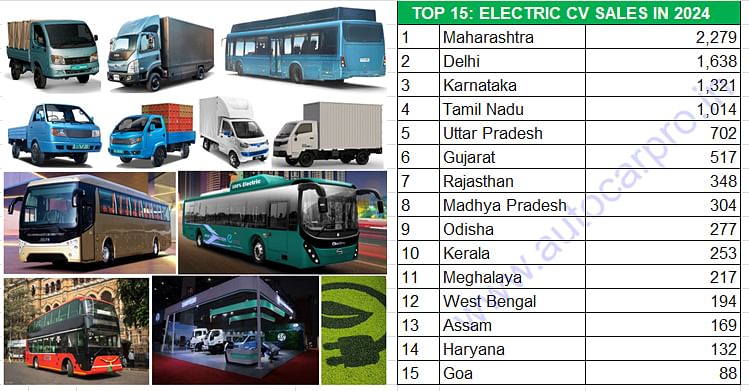

ELECTRIC COMMERCIAL VEHICLES: Maharashtra tops with 22% share of 10,051 units

ELECTRIC COMMERCIAL VEHICLES: Maharashtra tops with 22% share of 10,051 units

The electric CV sector essentially comprises light-, medium- and heavy-duty goods carriers and passenger-transporting buses. As compared to personal electric mobility in the form of e-two-wheelers and passenger vehicles, the CV industry is where electric mobility makes wallet-friendly TCO sense given the much larger number of kilometres driven every day. The sharp rise in demand for zero emission last-mile mobility and logistics operations has led to a marked increase in sale of e-LCVs and SCVs. Demand for electric passenger-transporting buses through STUs is also on the rise.

As per Vahan data for CY2024, Maharashtra tops the list with total retails of 2,279 units and a 22% share of the all-India total of 10,051 e-CVs. It is followed by Delhi (1,638 units and 16% share), Karnataka (1,321 units and 13% share) and Tamil Nadu (1,014 units and 10% share).

INDIA EV INDUSTRY FIRMLY PLUGGED INTO GROWTH MODE

What is helping accelerate EV ownership in India is a combination of factors. While demand for e-mobility was tepid in the initial years of the past decade, the government’s heightened focus towards the EV sector and the overall electric mobility eco-system, along with EV OEMs across vehicle segments expanding their portfolio, and component suppliers either developing in-house or sourcing the latest e-powertrain and parts technologies have all contributed towards the sector’s growth.

Furthermore, growing consumer awareness of the need for eco-friendly mobility amidst the damaging effects of climate change which has also impacted India is helping the cause of EVs. Also, given the high prices of fossil fuels like petrol and diesel, and also CNG, the wallet-friendly nature of EV cost of ownership over the long run is a big catalyst for consumers planning to transition from IC engine motoring to EVs.

Another catalyst is the EV-friendly policies. Most of the states and UTs have notified EV policies which deliver plentiful benefits to EV uses and help accelerate the pace of EV adoption across the country. Given the rapid pace of growth, the Indian EV industry can be expected to notch consistent progress. Some challenges remain like inadequate charging infrastructure and high initial EV prices, which is directly related to the battery cost.

Nevertheless, with both the private and public sectors aggressively investing heavily in expanding the charging network across India, range anxiety for EV users should reduce over the coming years.

There is also the sharpened focus from OEMs and component suppliers on localisation with a view to reduce costs and enhance affordability, and battery prices expected to reduce gradually, industry is optimistic about growth for this eco-friendly form of mobility, both in the near-term and long-term.

With a plethora of initiatives to support localised manufacture of EV batteries, motors and controllers, the domestic EV industry can only benefit as well EV buyers through reduced prices achieved through higher level of localisation. In her comment on the Budget proposals, ACMA president Shradha Suri Marwah said: “The Union Budget 2025-26 is progressive and growth-oriented, reinforcing the government’s commitment to strengthening India’s manufacturing ecosystem and fostering innovation. The focus of MSMEs, clean mobility, exports and supply chain resilience will provide a strong impetus to the auto component industry. Enhanced credit support, rationalised customs duties and incentives for EV and clean tech manufacturing are timely measures that will drive competitiveness and sustainability.”

ALSO READ: Auto retails in CY2024 rise 9% to 26 million, highest-ever sales for cars, 3Ws, tractors

CNG car, SUV sales soar to 715,000 units in CY2024, Maruti Suzuki share at 72%, Tata at 16%

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

04 Feb 2025

04 Feb 2025

31389 Views

31389 Views

Shahkar Abidi

Shahkar Abidi