TVS Motor is No. 1 electric 2W OEM for three months in a row and Q1 FY2026

TVS sells 25,274 iQube e-scooters in the Indian e2W industry's best-ever June and nearly 70,000 units in April-June 2025 to stay ahead of its archrivals for the third straight month. While Bajaj Auto and its Chetak remain close behind TVS, Ola Electric continues to see a YoY decline in sales. Ather Energy and its Rizta witness strong demand and Hero MotoCorp is set to up the ante with the launch of a brand-new Vida e-scooter today.

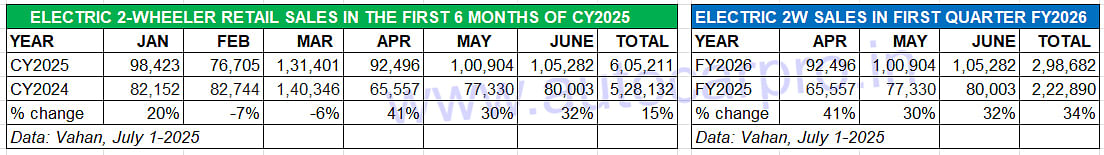

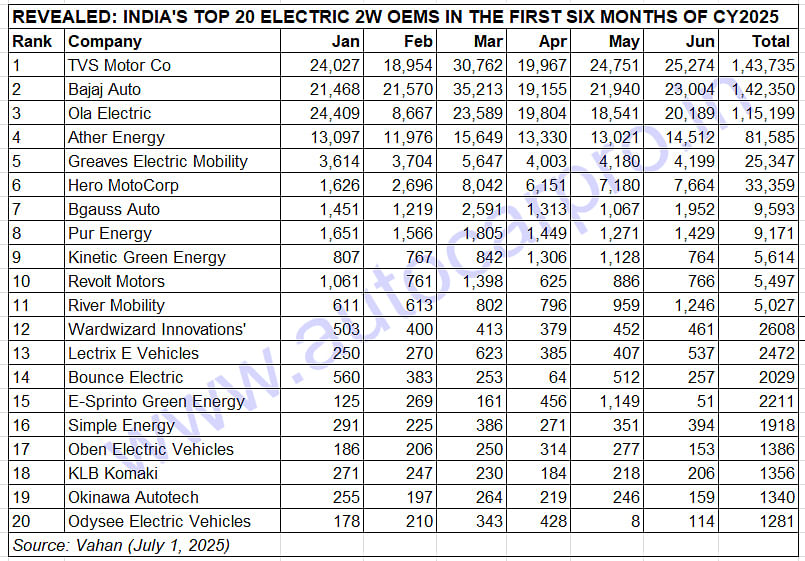

The good news continues to flow from the Indian electric two-wheeler industry. After registering record monthly sales of 92,492 units and 45% YoY growth in April 2025, May also turned out to be high-sales driver with 100,904 units and 30% growth. Now, June 2025, with 105,282 e-2Ws sold and 32% YoY growth (June 2024: 80,003 units) has turned out to be the best-ever June for Indian e-2W OEMs, breezing past the previous best in June 2024. The quick takeaway though is TVS Motor Co maintaining its No. 1 e-2W OEM status for the third month in a row and, as a result, for the first quarter of FY2026. This is as per the latest retail sales numbers on the Vahan portal (July 1-2025, 7am).

In first-half CY2025, the 605,211 e-2Ws sold are a 15% YoY increase and 53% of CY2024’s record e-2W sales of 1.14 million units. Q1 FY2026 retails at 298,682 units are a 34% YoY increase.

In first-half CY2025, the 605,211 e-2Ws sold are a 15% YoY increase and 53% of CY2024’s record e-2W sales of 1.14 million units. Q1 FY2026 retails at 298,682 units are a 34% YoY increase.

In fact, this segment of the EV industry is well set to set multiple new benchmarks. For Q1 FY2026, cumulative sales at 298,682 e-2Ws are up 34% (Q1 FY2025: 222,890 units). For the first-half of the current calendar year, the total of 605,211 e-2Ws are a 15% increase (January-June 2024: 528,132 units). This is 53% of CY2024’s record e-2W sales of 1.14 million units (11,49,374 units), and creates a firm foundation for India e-2W Inc to build on for the remaining six months of CY2025.

With electric 2Ws being the largest volume segment, it can be surmised that the overall Indian EV industry too is well placed to finally surpass the 2-million sales milestone, both for CY2025 and FY2026, having narrowly missed the milestone in CY2024 and FY2025.

The Top 10 e-2W OEMs from the field of 201 players accounted for 100,235 units or 95% of total sales in June 2025. Of them, the Top 4 (TVS, Bajaj, Ola and Ather) – each with five-figure sales – sold a combined 82,979 units or 79 percent. Let’s take a closer look at each of the top six players in detail and how they fared last month and for the first quarter (April-June 2025) of FY2026.

Of the 105,282 e-2Ws sold in June, the Top 10 OEMs accounted for 100,235 units and 93%, with the Top 4 having a commanding 79% share. TVS and Bajaj are engaged in an intense battle for leadership.

Of the 105,282 e-2Ws sold in June, the Top 10 OEMs accounted for 100,235 units and 93%, with the Top 4 having a commanding 79% share. TVS and Bajaj are engaged in an intense battle for leadership.

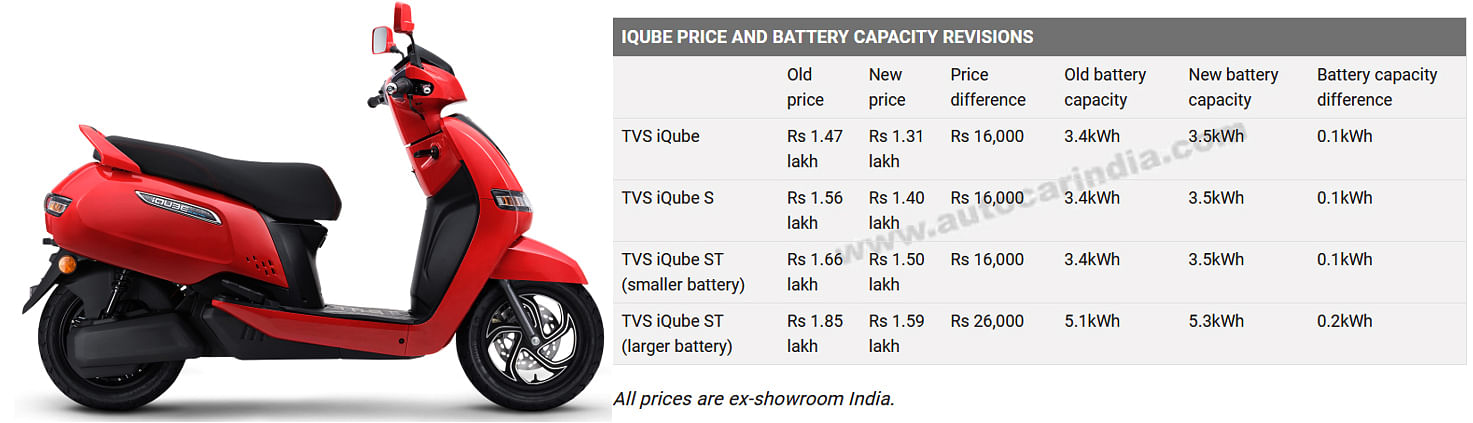

With 69,992 units sold in April-June 2025, the TVS iQube is the best-selling e-2W for three straight months. In May 2025, the company had slashed prices by up to Rs 26,000 as well as increased battery capacity marginally.

With 69,992 units sold in April-June 2025, the TVS iQube is the best-selling e-2W for three straight months. In May 2025, the company had slashed prices by up to Rs 26,000 as well as increased battery capacity marginally.

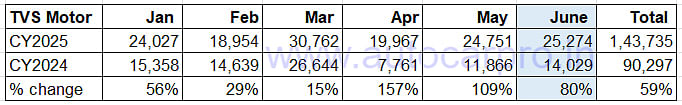

TVS MOTOR CO

June 2025: 25,274 units, up 80% YoY / Market share: 24%

June 2024: 14,029 units / Market share: 17%

April-June 2025: 69,992 units, up 108% (Q1 FY2025: 33,656 units)

Q1 FY2026 market share: 23%

TVS Motor Co is on a roll in FY2026. Having topped monthly e-2W retail sales for the very first time in April 2025, it held onto the crown in May 2025 and now also in June. With 25,274 units, up 80% YoY (June 2024: 14,029 units), the iQube has found more buyers than its key rivals to be India’s No. 1 e-2W OEM for the third month in a row. This performance gives TVS and the iQube a monthly market-leading share of 24 percent.

TVS Motor Co is on a roll in FY2026. Having topped monthly e-2W retail sales for the very first time in April 2025, it held onto the crown in May 2025 and now also in June. With 25,274 units, up 80% YoY (June 2024: 14,029 units), the iQube has found more buyers than its key rivals to be India’s No. 1 e-2W OEM for the third month in a row. This performance gives TVS and the iQube a monthly market-leading share of 24 percent.

As a result of being the No. 1 e-2W OEM for three months in a row, the TVS and the iQube have also topped the charts for Q1 FY2026. With 69,992 units sold in April-June 2025 and strong 108% YoY growth (Q1 FY2025: 33,656 units), TVS has a market-leading share of 23% in Q1 FY2026.

On the six-month or half-yearly scale, TVS has clocked cumulative sales of 143,735 units, up 59% (January-June 2024: 90,297 units), which is already 65% of its record annual sales of 220,813 units in CY2024.

What would have given iQube sales a boost is TVS Motor Co slashing prices by up to Rs 26,000 and also increased the battery capacities of some variants. The battery capacity of the base variant of the iQube, iQube S and iQube ST has been increased by 0.1 kWh and now has a claimed riding range of 145km per charge. The iQube S and iQube ST come with a fast 950W charger, which means a 0-80% top-up takes just three hours. While the S variant (Rs 140,000) receives a 0.1 kWh bump up to 3.5 kWh, the lower version of the higher-spec ST iQube also gets the same 3.5 kWh battery pack upgrade. The higher ST variant now houses a 5.3 kWh battery, up 0.2kWh, and is priced at Rs 159,000 (ex-showroom). Design upgrades include beige-coloured inner panels, dual-tone seat, and a pillion back-rest. The enhanced features list now includes a touchscreen display, turn-by-turn navigation and tyre pressure monitoring.

The Chennai-based two-wheeler major is looking to further up the ante. Speaking after the company’s Q4 FY2025 results, K N Radhakrishnan, director and CEO of TVS Motor Co, said that a number of new EVs are in the final developmental stage and are slated to be launched in the coming quarters. This includes a new entry-level model.

TVS’ entry level e-scooter is likely to be called the Orbiter and positioned below the flagship iQube, when it is launched later this year priced at around or lower than Rs 100,000. At present, the iQube’s pricing starts at just above Rs 100,000 and goes up to Rs 159,000 for the top-end ST 5.1 kWh variant.

Of the 4 variants in the Chetak 35 Series, the 3503, priced at Rs 110,000 is the most affordable Bajaj EV on two wheels.

Of the 4 variants in the Chetak 35 Series, the 3503, priced at Rs 110,000 is the most affordable Bajaj EV on two wheels.

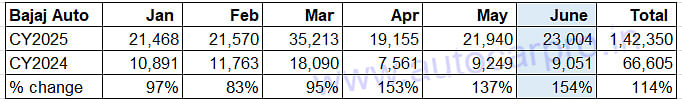

BAJAJ AUTO

June 2025: 23,004 units, up 154% YoY / Market share: 22%

June 2024: 9,051 units / Market share: 11%

April-June 2025: 64,099 units, up 148% (Q1 FY2025: 25,861 units)

Q1 FY2026 market share: 21%

Compared to its market-topping performances in February (21,563 units) and March (35,160 units), Bajaj Auto finds itself in the No. 2 slot since April, mainly due to the faster traction for the TVS iQube. In June, 23,004 Chetaks were sold, up 154% (June 2024: 9,051 units), which takes its Q1 FY2026 total to 64,099, 38,238 units more than a year ago (Q1 FY2025: 25,861 units) and a much-improved Q1 market share of 21 percent.

Compared to its market-topping performances in February (21,563 units) and March (35,160 units), Bajaj Auto finds itself in the No. 2 slot since April, mainly due to the faster traction for the TVS iQube. In June, 23,004 Chetaks were sold, up 154% (June 2024: 9,051 units), which takes its Q1 FY2026 total to 64,099, 38,238 units more than a year ago (Q1 FY2025: 25,861 units) and a much-improved Q1 market share of 21 percent.

For the January-June 2025 period, the 142,350 Chetaks sold are a 114% YoY increase (H1 CY2025: 66,605 units) and constitute 73% of Bajaj Auto’s record sales of 193,651 units in CY2024.

On June 17, Bajaj Auto launched the Chetak 3001, which is the new entry-level variant priced at Rs 99,990 (ex-showroom Bengaluru). The 3001 replaces the erstwhile Chetak 2903. With this move, all Chetaks are now born of the new chassis platform that debuted last with the launch of the Chetak 35. Like its nomenclature – the 3001 and the 35 series – the four-variant Chetak model range comprises two battery configurations. The 3001, the smallest with 3 kWh and a 127km range, will replace the Chetak 2903 variant.

While the base 3001 variant costs Rs 99,990, the top-end Chetak 3501 has a price sticker of Rs 135,000. The 3001, the most affordable Chetak, slots between the TVS iQube 2.2 kWh and iQube 3.5 kWh at the lower end, and the premium Ather Rizta S at the higher end.

The larger 3.5 kWh battery pack is available on the 3501, 3502 and 3503. While the 3501 and 3502 deliver a claimed range of 153km, the 3503 travels 151km on a single charge. Speed on the 3503 is limited to 63kph; the other two variants have a top speed of 73kph.

The Chetak retail sales network is now spread to over 300 Chetak experience centres and 4,000 touch-points across the country.

While the S1 range of e-scooters forms the bulk of Ola’s sales, deliveries of the Ola Roadster X electric motorcycle have begun across the country.

While the S1 range of e-scooters forms the bulk of Ola’s sales, deliveries of the Ola Roadster X electric motorcycle have begun across the country.

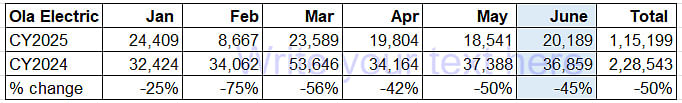

OLA ELECTRIC

June 2025: 20,189 units, down 45% YoY / Market share: 19%

June 2024: 36,859 units / Market share: 46%

April-June 2025: 58,534 units, down 46% (Q1 FY2025: 108,411 units)

Q1 FY2026 market share: 20%

Ola Electric, which was the longstanding market leader not very long ago, continues to feel the heat of the competition. The company had last topped the monthly sales chart in January 2025 but lost that spot to Bajaj Auto in February and March 2025, and to TVS in April, May and June 2025.

Ola Electric, which was the longstanding market leader not very long ago, continues to feel the heat of the competition. The company had last topped the monthly sales chart in January 2025 but lost that spot to Bajaj Auto in February and March 2025, and to TVS in April, May and June 2025.

In June, the company, which now sells both e-scooters and motorcycles, registered retail sales of 20,189 units, down sharply by 45% on year-ago numbers (June 2024: 38,859 units). As a result, its market share for June 2025 at 19% has more than halved on June 2024’s 46 percent.

In Q1 FY2026, Ola Electric has sold a total of 58,534 units, down 46% on its April-June 2024 retails of 108,411 units.

For the calendar year to date, Ola’s last six months’ sales add up to 115,199 units, down 50% YoY (January-June 2024: 228,543 units). This is only 28% of the company’s record annual sales of 407,690 units in CY2024. Ola remains the sole e-2W OEM to have surpassed 300,000 and 400,000 retail sales.

The bulk of Ola’s sales come from the 14-variant S1 e-scooter, which straddles multiple price-points starting from entry level mass mobility through to premium (Rs 65,000 to Rs 170,000). The S1 Pro, equipped with a 4kWh battery, has a claimed 142km range on a single charge and has an ex-showroom price of Rs 154,999.

In May this year, Ola began customer deliveries of its Roadster X electric motorcycle. The company is targeting strong growth with the X, what the ICE motorcycle market being much bigger than scooters. The Ola Roadster X, which develops peak power of 11 kW, top speed of 125kph and has a range of 501km, is claimed to offer “15X lower running cost than comparable ICE models”. Roadster X first-in-segment features include ABS, cruise control, advanced regen, reverse mode, and advanced safety tech including geo and time fencing, theft detection, and ‘Find Your Vehicle’.

A couple of months ago, Ola had stated that it is “delaying the S1 Z, Gig/Gig+ and some other future products and will sequentially launch these products such that each product receives the right customer mindshare.”

Demand for Ather e-scooters soared by 133% to 14,512 units in June. The Rizta family scooter, which accounts for the bulk of demand, has surpassed 100,000 sales since its launch last year.

Demand for Ather e-scooters soared by 133% to 14,512 units in June. The Rizta family scooter, which accounts for the bulk of demand, has surpassed 100,000 sales since its launch last year.

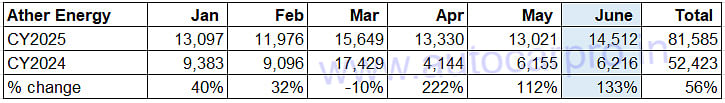

ATHER ENERGY

June 2025: 14,512 units, up 133% YoY / Market share: 14%

June 2024: 6,216 units / Market share: 8%

April-June 2025: 40,863 units, up 147% (Q1 FY2025: 16,515 units)

Q1 FY2026 market share: 14%

Ather Energy, whose flagship e-scooter the Rizta surpassed 100,000 sales within two years since launch, clocked sales of 14,512 units in June 2025, up 133% YoY (June 2024: 6,216 units). This gives it a 14% share for the month and takes its cumulative Q1 FY2026 total to 81,585 units, up 56% (Q1 FY2024: 16,515 units). This gives it the fourth rank, both for last month and for the first quarter of the current fiscal year. Ather’s market share for June as well as Q1 FY2026 is 14 percent, which is strong increase of the 8% a year ago.

Ather Energy, whose flagship e-scooter the Rizta surpassed 100,000 sales within two years since launch, clocked sales of 14,512 units in June 2025, up 133% YoY (June 2024: 6,216 units). This gives it a 14% share for the month and takes its cumulative Q1 FY2026 total to 81,585 units, up 56% (Q1 FY2024: 16,515 units). This gives it the fourth rank, both for last month and for the first quarter of the current fiscal year. Ather’s market share for June as well as Q1 FY2026 is 14 percent, which is strong increase of the 8% a year ago.

For the first six months of CY2025, Ather sales at 81,585 units are a 56% YoY increase (H1 CY2024: 52,423 units). This constitutes 64% of its record 126,355 units sold in CY2024, with six month left in CY2025.

Ather’s main growth driver remains the Rizta family e-scooter, which alone now contributes to nearly 60% of the startup’s total sales. This is creditable given that the three-variant flagship scooter is a premium product priced from Rs 104,999 (Rizta S) to Rs 122,000 (Rizta Z 2.9) and to Rs 142,000 (Rizta Z 3.7).

While the Rizta S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. The Rizta’s highlights include the largest two-wheeler seat in India and storage space aplenty. The Ather Rizta was the winner of Autocar India’s Electric Two-Wheeler of the Year 2025 award.

In an effort to achieve speedier sales and also expand the consumer buying option, Ather Energy plans to introduce Battery as a Service (BaaS) for its model line-up. The BaaS model of sales, which separates EV ownership from that of the battery, was first introduced by JSW MG Motor India for its Windsor EV and has proved to be a successful move for the carmaker.

Interestingly, Hero MotoCorp, an early investor in Ather and currently having the largest equity stake, is also introducing the BaaS optio to reduce the upfront EV ownership cost (see details in the Hero MotoCorp analysis below).

Meanwhile, in August this year, Ather will reveal its new scooter platform – EL – and concept vehicles at its Community Day 2025. The new EL platform, engineered to be versatile and cost-efficient, will enable Ather to expand its product lineup to cater to a wider range of customer needs. This year’s event will also see the launch of Ather’s next-generation fast chargers, and an upgraded version of its software stack, Ather Stack 7.0.

While the Vida 2 has given a new charge to Hero's e-2W sales, the company is to unveil a subscription-based Battery-as-a-Service (BaaS) model on July 1 along with a new Vida model, the V2X.

While the Vida 2 has given a new charge to Hero's e-2W sales, the company is to unveil a subscription-based Battery-as-a-Service (BaaS) model on July 1 along with a new Vida model, the V2X.

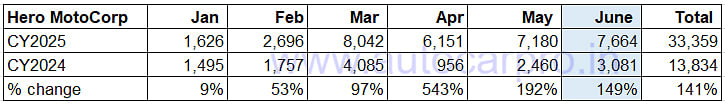

HERO MOTOCORP

June 2025: 7,664 units, up 149% YoY / Market share: 7%

June 2024: 3,081 units / Market share: 4%

April-June 2025: 20,995 units, up 223% (Q1 FY2025: 6,497 units)

Q1 FY2026 market share: 7%

The manufacturer of the Vida brand of e-scooters sold 7,664 units in June, improving upon its April (6,151 units) and May (7,180 units) performance. This takes Hero MotoCorp’s cumulative three-month sales to 20,995 units, up 223% YoY (April-June 2024: 6,497 units). Total sales for the first half of CY2025 at 33,359 Vida scooters are up 141% (H1 CY2025: 13,834 units).

The manufacturer of the Vida brand of e-scooters sold 7,664 units in June, improving upon its April (6,151 units) and May (7,180 units) performance. This takes Hero MotoCorp’s cumulative three-month sales to 20,995 units, up 223% YoY (April-June 2024: 6,497 units). Total sales for the first half of CY2025 at 33,359 Vida scooters are up 141% (H1 CY2025: 13,834 units).

The company is benefiting from expansion of its EV portfolio with the launch of the new Vida V2 in December 2024. The Vida 2 is essentially an evolution of the V1 range that the world’s largest ICE two-wheeler OEM began its electric mobility journey in October 2022. The Vida V2 is available in three variants: Lite (Rs 96,000), Plus (Rs 115,000) and Pro (Rs 135,000). The most affordable of the lot, the V2 Lite comes with a small 2.2kWh battery pack that has a claimed 94km IDC range.

Just like Ather has done last month, Hero MotoCorp will introduce a subscription-based Battery-as-a-Service (BaaS) model today (July 1, 2025), which will also see the company roll out a brand-new ‘affordable’ model, the Vida VX2.

Along with a flexible ‘pay-as-you-go’ ownership model, the BaaS subscription solution will significantly reduce the upfront ownership cost, making electric mobility more affordable and accessible to a wider customer base. Vida EV buyers will be able to choose from flexible subscription plans tailored to their daily or monthly budget and usage along with access to Vida’s growing all-India ecosystem which already includes over 3,600 fast-charging stations and 500-plus service points across over 100 cities.

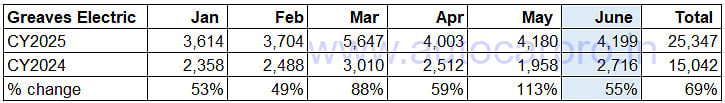

GREAVES ELECTRIC MOBILITY

GREAVES ELECTRIC MOBILITY

June 2025: 4,199 units, up 55% YoY / Market share: 4%

June 2024: 2,716 units / Market share: 3%

April-June 2025: 12,382 units, up 73% (Q1 FY2025: 7,186 units)

Q1 FY2026 market share: 4%

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton, has clocked retail sales of 4,199 e-scooters in June 2025. This sees the company increase its market share to 4 percent.

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton, has clocked retail sales of 4,199 e-scooters in June 2025. This sees the company increase its market share to 4 percent.

The company has a six-model portfolio of e-scooters comprising the Nexus (pictured above), Primus, Magnus LT/EX (100km+ range), Ampere Magnus Special, entry level Rio Li/La Plus and Zeal EX.

GEM’s sales in the first three months of FY2026 at 12,382 units are up 73% *Q1 FY2025: 7,186 units) and it currently has a 4% market share in the current fiscal.

The Ampere Nexus, GEM’s e-scooter launched a year ago in April 2024, is a key growth driver. Targeted at families, the Ampere Nexus has been designed and developed in-house at the Ranipet facility in Tamil Nadu. Equipped with a 3 kWH LFP battery, the Nexus has a claimed top speed of 93kph and a certified range of 136km. Sold in two variants, prices start at Rs 110,000 (ex-showroom) and go up to Rs 120,000.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

01 Jul 2025

01 Jul 2025

14780 Views

14780 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal