TVS NTorq 125 surpasses two million sales, NTorq 150 coming soon

Launched in February 2018, TVS Motor Co’s vehicle of entry into the 125cc scooter market registers new sales milestone in the domestic market. While the first million units took a little over 4 years, the last million units have been sold in 36 months, making it the NTorq 125 the company’s second best-selling scooter after the flagship Jupiter. And, there’s a 150cc avatar slated for launch this festive season.

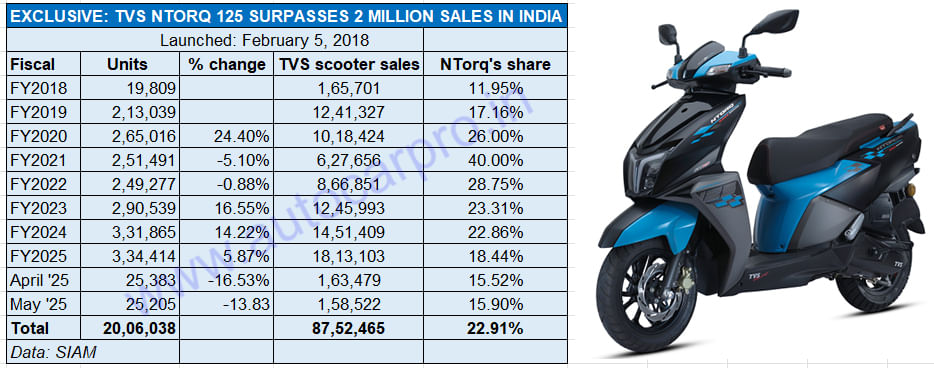

TVS Motor Co, which sold a record 1.81 million scooters and 3.51 million two-wheelers in FY2025, continues to do well in the new fiscal year. TVS’s scooter sales in the first two months of FY2026 at 322,001 units are up 23% YoY (April-May 2024: 262,721 units). The key drivers of this growth are the flagship Jupiter, the NTorq 125 and the all-electric iQube scooter. The NTorq, having sold 19,55,450 units till end-FY2025, needed another 44,550 units to hit the 2-million sales milestone. With April-May 2025 wholesales at 50,588 units, the NTorq 125 has achieved that (see data table below).

The TVS NTorq 125 crossed the 2-million domestic market sales milestone in May 2025. 308,252 NTorqs have been sold in overseas markets till end-FY2025.

The TVS NTorq 125 crossed the 2-million domestic market sales milestone in May 2025. 308,252 NTorqs have been sold in overseas markets till end-FY2025.

While the first million units were sold in 51 months after launch, the run from 10,00,000 to two million units has taken 36 months or three years.

Since launch till end-May 2025, the NTorq 125 has sold a total of 20,06,038 units (2 million units) and contributed 23% to the 8.75 million scooters TVS has sold in India since February 2018. As per the wholesales data table above, the NTorq’s best 12-month sales were in FY2025 when it sold 334,414 units, up 6% YoY (FY2024: 331,865 units) and accounted for 18% of TVS’ record scooter sales of 1.81 million units.

This share, however, is considerably down from the 29% share the NTorq had in FY2022, which indicates its contribution has slowed down over the past three years in comparison to the Jupiter (whose share grew to 61% in FY2025) and the iQube (15% share).

In FY2025, the NTorq held onto its position as India’s fourth best-selling scooter, behind the Honda Activa (2.52 million units), sibling Jupiter (1.10 million units), and Suzuki Access (727,458 units) and just 13,194 units ahead of the Honda Dio (321,220 units). The NTorq was also the fourth most-exported scooter in FY2025 (64,988 units).

The NTorq’s importance in TVS’ scooter portfolio stems from the fact that after the Jupiter 110 and 125, it remains TVS’ second-best-selling scooter. In fact, the success of the NTorq, which won Autocar India’s Scooter of the Year 2019 award, was the inspiration behind TVS rolling out its second 125cc scooter, the Jupiter 125 in October 2021.

The NTorq is also the No. 1 exported scooter for TVS. Since its launch in February 2018 till end-FY2025, 308,252 NTorqs have been sold in overseas markets compared to 122,866 Jupiters in the same period.

TARGETED AT YOUNG INDIA

TVS introduced the NTorq in early 2018, when the scooter buyer preference for 125cc models was just about taking shape in India. Over the past few years, the company has, at regular intervals, introduced new variants to retain model freshness and also to rev up sales.

The NTorq’s snazzy looks notwithstanding, what stands out for the product is the many segment-first features including the TVS SmartXonnect, which offers Bluetooth connectivity with the rider’s mobile phone (via a mobile app) in the form of navigation assist, location assist, call / SMS alerts, rider stats and more. The snazzy scooter set the pace in its segment by offering a fully digital console with over 50 features.

The NTorq 125 remains a popular buy as a result of its youthful styling and impressive set of features. Autocar India’s commentary on the scooter states that “it packs good performance along with a sporty exhaust sound. The scooter is spacious, comfortable and stable. Fuel efficiency is on the lower side in the segment, but the NTorq makes up for it with its style, features and fun factor.”

The NTorq is available in a total of five variants – NTorq (drum/disc), Race Edition, Super Squad Edition, Race XP and XT, with pricing starting from Rs 84,600 to Rs 104,600 (ex-showroom Mumbai). While the Race XP and Race XT gets a slightly more powerful engine at 10.2hp and 10.8Nm, the rest aren't too far behind at 9.4hp and 10.5 Nm of torque. The differences between the Disc, Race Edition and Super Squad Edition are purely cosmetic.

While the Jupiter, sold in 110 and 125cc avatars, remains TVS' best-selling scooter, the NTorq 125 has contributed 23% to TVS' scooter sales since its launch.

While the Jupiter, sold in 110 and 125cc avatars, remains TVS' best-selling scooter, the NTorq 125 has contributed 23% to TVS' scooter sales since its launch.

JUPITER AND NTORQ HELP TVS INCREASE SCOOTER MARKET SHARE TO 26%

While the TVS Jupiter, which hit 7 million sales in January 2025, remains the biggest contributor to TVS’ scooter sales with a 62% share since its launch in September 2013, the NTorq is the strong No. 2 with a 23% share since its launch. The other scooters in TVS’ stable are the Zest, Pep+ and the electric iQube.

The NTorq’s strong showing is creditable considering it is part of a very competitive sub-segment which also has the Honda Activa, sibling Jupiter, Suzuki Access, Hero Destini and Maestro, Yamaha Ray ZR and Fascino, Aprilia SR 125 and the Vespa 125

The NTorq’s strong showing in the competitive Indian scooter marketplace, along with the Jupiter’s sustained growth, has helped TVS increase its market share. From FY2018 through to FY2025, TVS Motor has increased its scooter market share from 16.35% to 26.45%, enabling it to take No. 2 position after Honda (41.50% scooter market share, down from 56.86% in FY2018). Third-placed Suzuki had a 14.95% scooter market share in FY2025.

TVS READIES NTORQ 150 FOR FESTIVE-SEASON LAUNCH

Meanwhile, it is learnt that the NTorq 150 will among the new models that TVS Motor Co is planning to launch later this year. As scooter buyers look to upgrade to higher-power steeds, TVS expects an option of a 150cc sibling to the NTorq 125 will prove beneficial to the brand to take on the Yamaha Aerox 155 (which sold 22,928 units in FY2025, up 24%), Aprilia 160cc scooters and the Hero Xoom 160.

According to Autocar India, by virtue of its displacement, the NTorq 150 will have at least single-channel ABS as a result of government regulations. Expect TVS to play to its usual strengths of a comprehensive feature list and high levels of build quality with its largest ICE scooter to date. TVS will carry forward the smaller NTorq’s sporty styling to the bigger 150cc model, which is likely to get 14-inch wheels at both ends, like the rival offerings from Hero MotoCorp, Yamaha and Aprilia.

Like TVS’ upcoming entry level electric scooter, the new NTorq 150 is likely to be launched in or around the festive season this year. Pricing will be in the s 150,000 range, in sync with those of its 150cc rivals. Will the NTorq 150 be the talk of the town just as the NTorq 125 was when it was launched? We have to wait a few months to find out.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

22 Jun 2025

22 Jun 2025

8893 Views

8893 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal