CNG car, SUV sales soar to 715,000 units in CY2024, Maruti Suzuki share at 72%, Tata at 16%

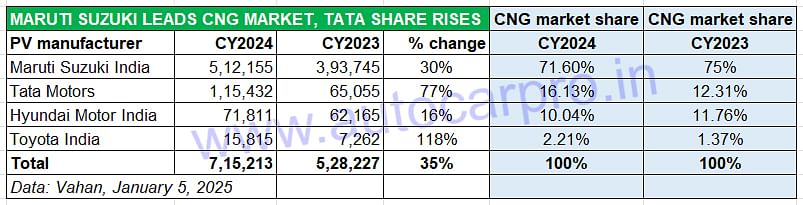

Strong 35% retail sales growth for CNG-powered passenger vehicles reflective of the fuel’s compelling value proposition. While Maruti Suzuki, with its 15-model portfolio, sold over 500,000 units for the first time annually to maintain its firm grip with a 72% share, Tata Motors, with 115,432 units, increased its CNG share to 16 percent. Hyundai sold 71,811 units and Toyota 15,815 CNG cars and SUVs.

Even as sales of electric passenger vehicles rose 20% YoY to their highest level of over 99,000 units in CY2024, consumer demand for environment-friendly cars, SUVs and MPVs fuelled by CNG also hit their best-ever calendar year sales of over 7,15,000 units in CY2024. As per retail sales data sourced from the Vahan portal, a total of 7,15,213 CNG-powered passenger vehicles were sold last year by the four key OEMs in this segment, up strongly by 35% YoY (CY2023: 528,227 units).

In CY2024, the CNG PV industry hit its highest monthly sales yet in festive October 2024 – 101,852 units, up 69% YoY – followed by January (67,276 units), July (60,224 units) and November (60,144 units). Other than September and November, the segment registered high double-digit growth for 10 months last year.

Let’s take a closer look at each of the four mainstream PV OEMs in the CNG market – Maruti Suzuki India, Tata Motors, Hyundai Motor India and Toyota Kirloskar Motor – who altogether sold an additional 186,986 units in CY2024 compared to CY2023, enabling the CNG PV industry to register strong 35% YoY growth.

MARUTI SUZUKI SELLS OVER HALF-A-MILLION CNG CARS AND SUVs

MARUTI SUZUKI SELLS OVER HALF-A-MILLION CNG CARS AND SUVs

CY2024: 512,157 units / CNG market share: 71.60% / Share of PV retail sales: 31%

CY2023: 393,745 units / CNG market share: 75% / Share of PV retail sales: 25%

Passenger vehicle market leader Maruti Suzuki, the pioneer in the factory-fitted CNG PV segment in India since 2010, has the largest portfolio of 15 CNG models including the Alto K10, Baleno, Brezza, Celerio, Dzire, Eeco, Ertiga, Grand Vitara, S-Presso, Wagon R, XL6, Fronx and more recently the Swift. Understandably, with such a wide model spread and strong demand for most of them, the company has a vice-like grip on the market.

Maruti Suzuki, which completely pulled out of the diesel car market in April 2020, has seen the vacuum being filled by the consumer demand for its CNG models. As per Vahan data, Maruti Suzuki India sold a total of 16,44,507 units (1.64 million units) of which the 512,157 CNG PVs (up 30% YoY) account for a 31% share, up from the 25% it had in CY2023. This gives it a commanding market share of 71.60%, albeit down on CY2023’s 75%, likely due to Tata Motors’ advance in this vehicle segment.

The company continues to have a strong order book for its CNG models, with the most popular ones being the Ertiga MPV, Brezza compact SUV and the Dzire sedan. On the fiscal year front, Maruti Suzuki has outlined an ambitious sales target over 600,000 CNG PVs in FY2025, which translates into 38% YoY growth over its FY2024’s 434,122 units. Between April 1, 2024 and January 5, 2025, the car and SUV maker has sold 430,876 CNG PVs, which means it is just 3,246 units shy of its FY2024 total.

The Nexon is the latest Tata Motors’ model to go CNG. The Altroz, Tiago, Punch, Tigor and Nexon all have the innovative twin-CNG-cylinder technology pioneered by the company.

The Nexon is the latest Tata Motors’ model to go CNG. The Altroz, Tiago, Punch, Tigor and Nexon all have the innovative twin-CNG-cylinder technology pioneered by the company.

TATA MOTORS CNG PV SALES JUMP 71% AND MARKET SHARE TO 16%

CY2024: 115,434 units / CNG market share: 16% / Share of PV retail sales: 22%

CY2023: 65,055 units / CNG market share: 12% / Share of PV retail sales: 12%

Tata Motors, the No. 3 PV OEM in overall sales after Maruti Suzuki and Hyundai Motor India, is ranked No. 2 in CNG-powered car and SUV sales. The company, which had first introduced its innovative twin-CNG-cylinder technology in the Tata Altroz hatchback, has now standardised the technology in its entire CNG line-up which comprises the Tiago CNG, Punch CNG, Altroz CNG, Tigor CNG and most recently, the Nexon CNG launched in September 2024.

One of the Tata CNG models’ USPs is the seamless shift between CNG and petrol mode as a result of a single ECU while maintaining higher fuel efficiency. What’s more, they enable vehicle start directly in the CNG mode.

In early February 2024, Tata Motors launched the Tiago and Tigor CNG AMT which has added more ‘ammo’ to the CNG portfolio. The company has seen robust demand for its CNG PVs in CY2024 – at 115,432 units, the YoY increase is 77 percent, which translates into a 16% CNG market share, up from 12% in CY2023. This is the first time that Tata Motors has recorded over 100,000 CNG PV sales in a calendar year. What’s more, the share of CNG PVs to Tata Motors’ overall PV sales has risen to 22% (115,434 CNG units: 525,162 PVs) compared to 12% in CY2023 (65,055 CNG units: 515,969 PVs).

That’s not all. Tata Motors could also be looking to introduce a CNG variant of the recently launched Curvv SUV-coupe, adding to the petrol, diesel and electric powertrains. Speaking to Autocar India at the launch of the electric Curvv on August 7, Shailesh Chandra, Managing Director, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, said that a CNG version is under active consideration. “While designing the car, we have ensured that the design is protected for CNG and while it’s premature to confirm a launch I can say it’s under active consideration,” affirmed Chandra.

This strong growth of its CNG model range has, to some extent, compensated for the marginal 2% YoY growth of Tata Motors’ EV retail sales (61,435 EVs) in CY2024.

The Exter compact SUV is the first Hyundai CNG model to get dual-cylinder technology. The Aura CNG and Grand i10 Nios CNG now have a similar layout.

The Exter compact SUV is the first Hyundai CNG model to get dual-cylinder technology. The Aura CNG and Grand i10 Nios CNG now have a similar layout.

HYUNDAI MOTOR INDIA CNG SALES UP 16% BUT RETAIL SHARE FALLS TO 10%

CY2024: 71,811 units / CNG market share: 10% / Share of PV retail sales: 13%

CY2023: 62,165 units / CNG market share: 12% / Share of PV retail sales: 11%

Hyundai Motor India is ranked third in the CNG PV OEM listing for CY2024 with 71,811 units, an increase of 16% YoY and an additional 9,646 units YoY (CY2023: 62,165 units). However, despite this performance, the expanding market and the marked growth of Tata Motors (which sold an additional 50,379 units) mean that Hyundai’s CNG market share has fallen to 10% from 11.76% in CY2023.

On the wholesales front though, as per the company, its CNG contribution to overall domestic market PV sales of 605,429 PVs in CY2024 rose to 13.1% from 10.4% in 2023. Hyundai Motor India, which currently has three CNG models straddling all segments – the Aura sedan, Grand i10 Nios hatchback and Exter SUV. All three models are beneficiaries of the company’s Hy-CNG Duo technology, introduced in 2024. In July 2024, Hyundai became the second PV manufacturer in India, after Tata Motors, to offer a dual-cylinder setup for its CNG cars. This involves the use of two smaller CNG cylinders instead of one large unit that occupies a majority of the boot space, thereby opening up more boot space and further improving the practicality of CNG cars and SUVs.

Toyota, which entered the CNG market in November 2022, sold 15,817 units in CY2024 to have a market share of 2.21 percent.

Toyota, which entered the CNG market in November 2022, sold 15,817 units in CY2024 to have a market share of 2.21 percent.

TOYOTA INDIA: MOVE TO DIVERSIFY INTO CNG PAYS DIVIDENDS

CY2024: 15,817 units / CNG market share: 2.21% / Share of PV retail sales: 6%

CY2023: 7,262 units / CNG market share: 1.37% / Share of PV retail sales: 4%

Toyota Kirloskar Motor, which is currently witnessing strong demand for its range of cars, SUVs and MPVs and registered best-ever calendar year retails of 260,336 units, up 33% YoY, and wholesales of 300,159 units in CY2024, is seeing its expansion into CNG territory pay dividends. TKM entered the CNG market in November 2022.

The company, which has recently expanded its CNG passenger vehicle portfolio to four models with the Taisor joining the Glanza hatchback, Urban Cruiser Hyryder and the Rumion MPV, sold 15,817 CNG-powered PVs in CY2024, up 118% YoY (CY2023: 7,262 units). This makes for a CNG penetration level of 6% versus 4% in CY2024.

CNG AS A WALLET-FRIENDLY FUEL

In cost-conscious India, the growing demand for CNG vehicles is understandable. At an estimated running cost of Rs 1 per kilometre for a CNG car or SUV compared to Rs 2.25 per kilometre for its petrol-engined sibling makes wallet sense. Speaking to Autocar Professional (in the interview published in the December 15, 2024 print edition), Shailesh Chandra, President, SIAM and Managing Director of Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, said: “The CNG segment has been a clear success this year (CY2024). CNG offers a compelling value proposition for cost-conscious consumers and its growth highlights significant demand for economical alternatives, especially in price-sensitive segments.

The CNG filling infrastructure across the country is being expanded and there were over 5,500 CNG filling stations with plans to meet the 8,000 mark by 2026, with increasing availability in Tier 1 and II cities as well. By 2030, according to an ICRA report, the government’s long-term plan aims to set up 17,700 CNG stations across India by 2030.

The price of CNG in Mumbai (as of January 6, 2025) is Rs 77 per kg, up from the Rs 73.50 per kg in June 2024. CNG prices are likely to rise this year because CNG suppliers, to manage the shortfall in domestic gas allocation, have to source additional market-priced natural gas (LNG) which results in higher cost of gas. This would lead to an erosion in the value proposition of CNG as a motoring fuel, particularly compared to EVs.

ALSO READ:

Maruti, Hyundai, Tata, Toyota: CNG strategies explained

RELATED ARTICLES

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

07 Jan 2025

07 Jan 2025

15545 Views

15545 Views

Arunima Pal

Arunima Pal

Shruti Shiraguppi

Shruti Shiraguppi