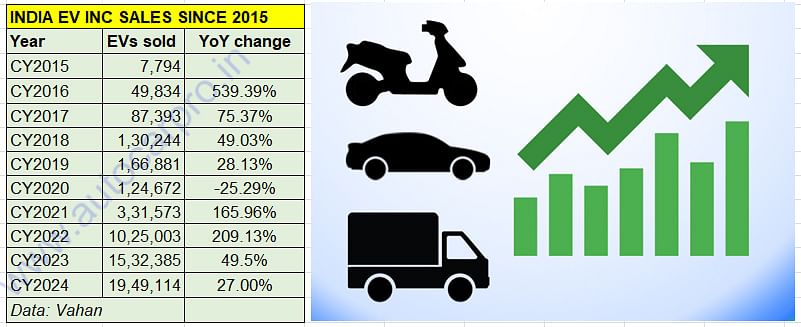

EV sales in CY2024 jump 27% but miss 2-million mark by 50,886 units

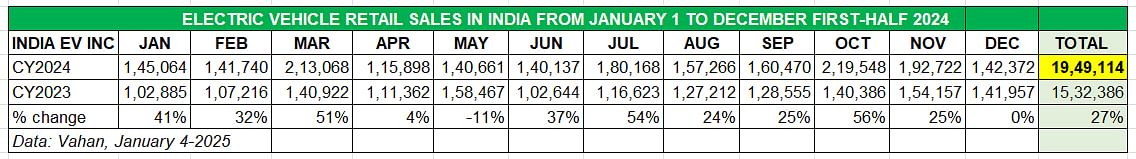

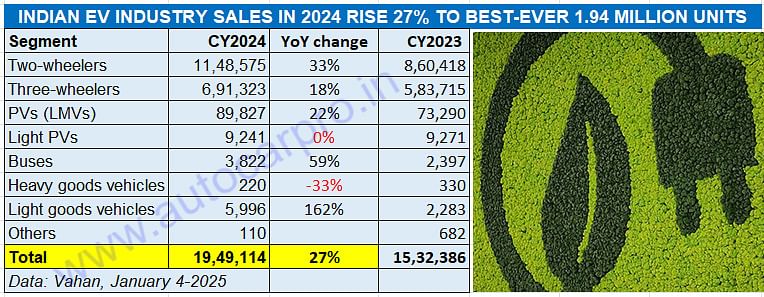

Strong double-digit growth in all segments, other than heavy goods vehicles, meant that the Indian electric vehicle industry registered its best-ever annual retail sales of 19,49,114 units in CY2024. With daily sales of 5,325 EVs, OEMs came tantalisingly close to achieving the 2-million milestone but narrowly missed out due to the flat sales in December, when buyers prefer to defer purchase decisions to the new year.

So near yet so far, but nevertheless a stupendous performance. This effectively summarises the stellar performance of India Electric Vehicle Inc in CY2024. At 19,49,114 EVs sold, overall EV sales last year leapt by 27% YoY (CY2023: 15,32,386 units). That’s 5,325 EVs, across all segments, sold every day of CY2024 which was a leap year. And an additional 416,728 EVs sold in CY2024 over CY2023.

With this stellar performance, the EV industry in India came tantalisingly close to achieving the 2-million milestone but narrowly missed out due to the flat sales in December, when buyers prefer to defer purchase decisions to the new year. The difference was a minuscule 50,886 EVs.

Importantly, the zero-emission mobility sector’s performance was driven by double-digit growth in all but one sub-segment (heavy goods vehicles). The two- and three-wheeler segments along with electric passenger vehicles registered robust doubled-digit growth.

The festival-laden October 2024 turned out to be India EV Inc’s best-ever month – 219,548 units, up 56% YoY.

The festival-laden October 2024 turned out to be India EV Inc’s best-ever month – 219,548 units, up 56% YoY.

Electric 2Ws (59% share) and 3Ws (35% share) were the key volume and growth drivers. While the e-PV share was 5%, e-CVs contributed to 0.51% of the total 1.94 million EVs sold in India in 2024.

Electric 2Ws (59% share) and 3Ws (35% share) were the key volume and growth drivers. While the e-PV share was 5%, e-CVs contributed to 0.51% of the total 1.94 million EVs sold in India in 2024.

In CY2024, which opened with January’s 145,064 units, three months stood out – the festival-laden October for being India EV Inc’s best-ever month (219,548 units, up 56%), the FAME II subsidy-ending month of March (213,068 units, up 51%) and November (192,722 units, up 25%). Other than April (115,898 units, up 4%), May (140,661 units, down 11%) and December (142,372 units, zero growth) there was strong double-digit YoY growth all through the year as the Vahan-sourced retail sales data reveals.

ELECTRIC 2W SALES IN CY2024: 11,48,575 units, up 33%

E2W SHARE India EV SALES IN CY2024: 59%

If India’s EV industry came within sniffing distance of the record 2 million (20 lakh) retail sales mark in CY2024, then it is because of the big volumes provided by the most affordable sub-segment – electric two-wheelers. Of the total 1.94 million EVs in India in 2024, electric scooters and motorcycles accounted for 1.14 million units (11,48,575) or 59% – up from the 56% share of 2023 – recording strong double-digit growth of 33% (CY2023: 860,418 units, up 36% YoY).

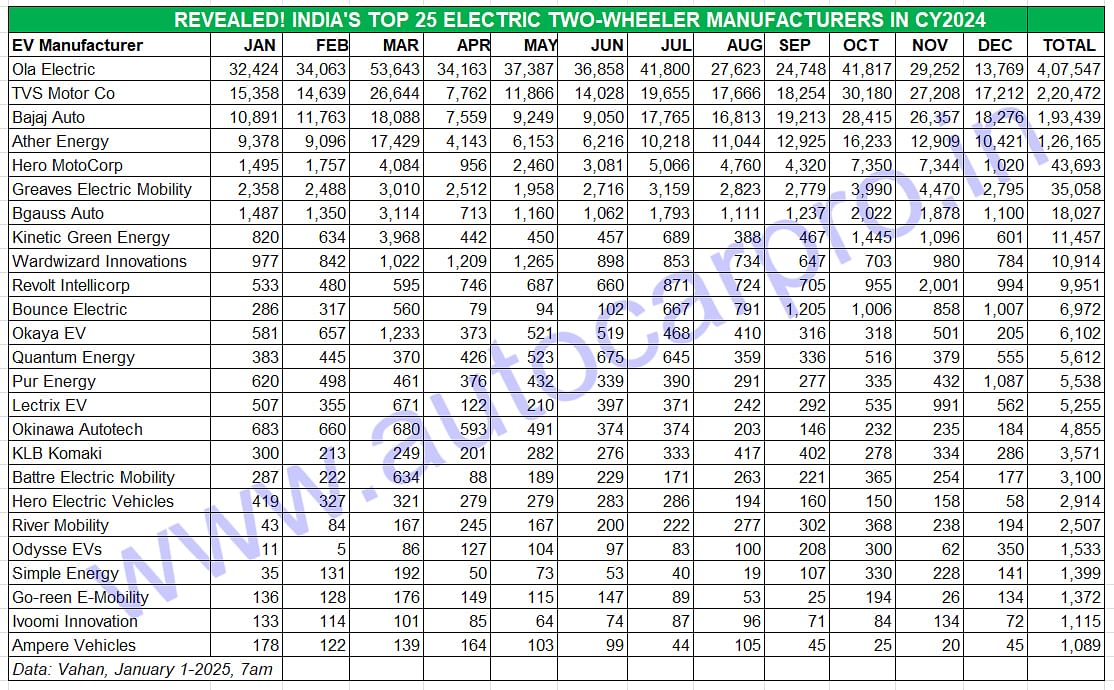

This segment, which has all of 210 players, has surpassed million-unit sales for the first time – on November 12, 2024 – and went on to set a new benchmark. In a field comprising 220 players – up from 180 in CY2023 – there are four OEMs had the giant’s share of the market in 2024. Ola Electric, TVS Motor Co, Bajaj Auto and Ather Energy all registered six-figure sales and also their own individual best-ever annual performances.

The combined sales of this quartet add up to 947,623 units, which constitutes 82% of India’s total e-two-wheeler sales. Interestingly, other than Bajaj Auto – which Autocar Professional correctly forecast a year ago that it was the dark horse for all 2024 – all three OEMs have their manufacturing plants in Tamil Nadu. Meanwhile, Hero MotoCorp, Greaves Electric Mobility, Revolt Motors, Bgauss Auto and Kinetic Green are also making their presence felt in the sector.

For a comprehensive analysis of the e2W segment’s CY2024 performance and sales statistics of the Top 25 OEMs, CLICK HERE.

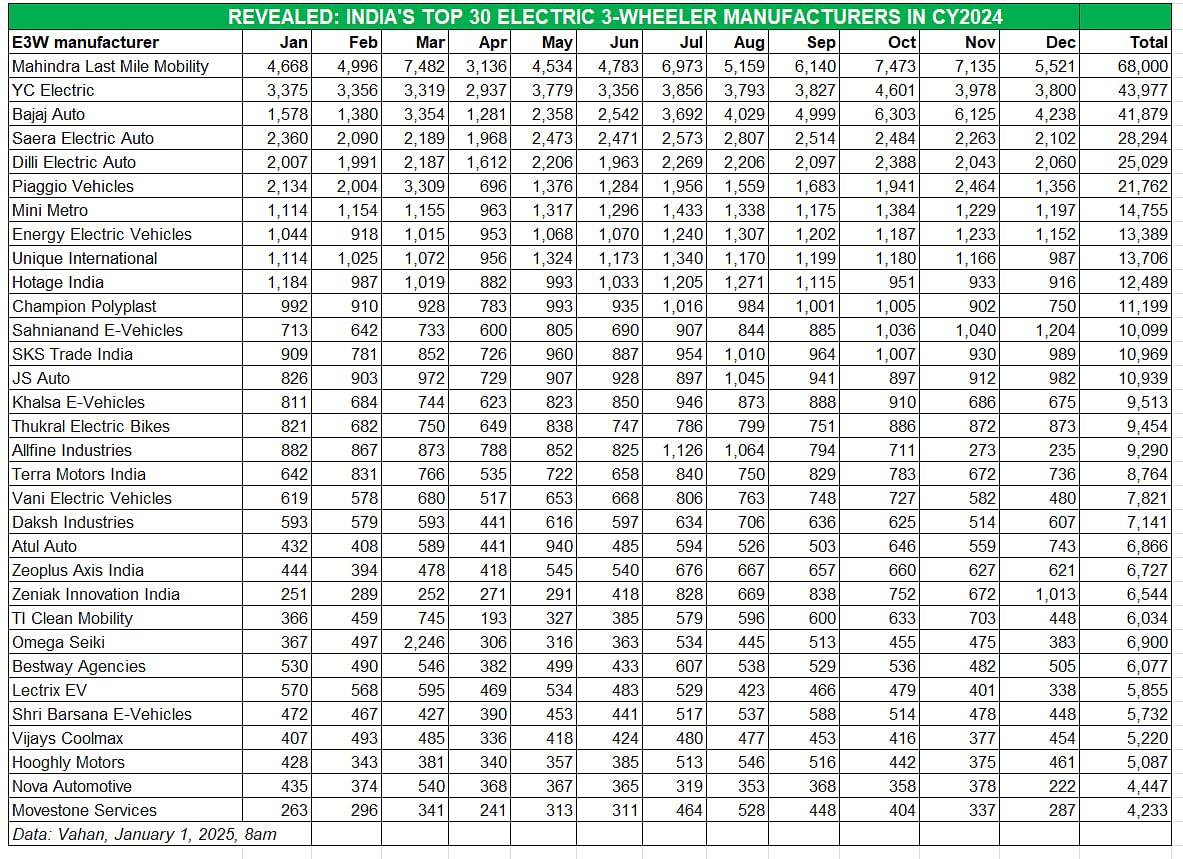

ELECTRIC 3-WHEELER SALES IN CY2024: 691,323 units, up 18%

ELECTRIC 3-WHEELER SALES IN CY2024: 691,323 units, up 18%

E3W SHARE OF INDIA EV SALES IN CY2024: 35%

The electric three-wheeler industry, the second largest in volumes after e-two-wheelers, displayed the strongest growth trajectory. At 691,323 units sold, year-on-year growth was 18% (CY2023: 583,597 units).

Of the total 1.22 million three-wheelers (across petrol, diesel, CNG, LPG and electric powertrains) sold in CY2024, across, electric three-wheelers – 691,323 units – account for 56% of the sales, effectively translating into every second three-wheeler sold in India being an EV. CNG-powered three-wheelers, at 348,885 units, are the next highest and have a 28% share of the overall market, and are followed by diesel (137,768 units, 11% share), LPG (32,603 units, 3% share) and petrol (11,426 units, 1% share).

Like the e-two-wheeler industry, there’s fierce competition too in this segment, albeit amongst the Top 6 players – Mahindra Last Mile Mobility (MLMM), YC Electric, Bajaj Auto, Saera Electric Auto, Dilli Electric Auto and Piaggio Vehicles. They are part of an industry which, at last count as per Vahan, has all of 575 players!

Throughout CY2024, this segment has been dominated by seven to eight players – Mahindra Last Mile Mobility (MLMM), Bajaj Auto, YC Electric, Saera Electric Auto, Piaggio Vehicles, Dilli Electric Auto and Energy EV. However, the real battle was fought at the podium level between Mahindra Last Mile Mobility, Bajaj Auto and YC Electric. For a deep dive into the e3W segment’s performance, CLICK HERE.

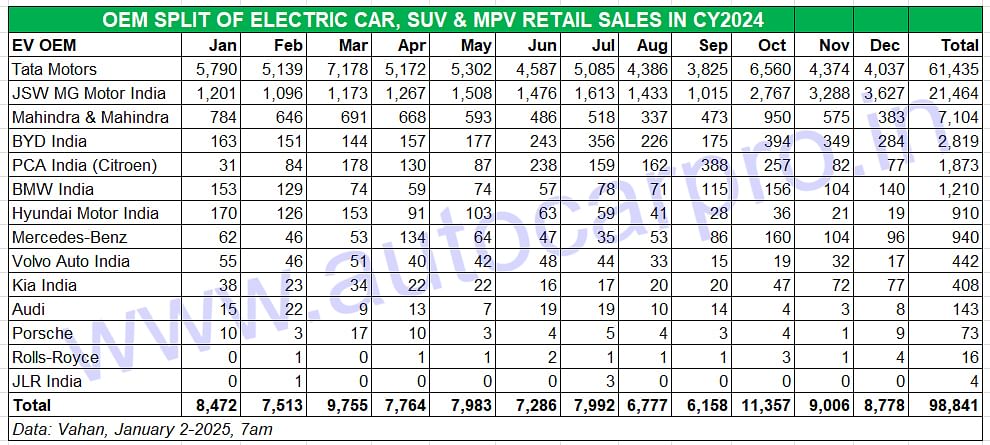

ELECTRIC PASSENGER VEHICLE SALES IN CY2024: 99,068 units, up 20%

ELECTRIC PASSENGER VEHICLE SALES IN CY2024: 99,068 units, up 20%

E-CAR & SUV SHARE OF INDIA EV SALES IN CY2024: 5%

The Indian electric passenger vehicle segment, in tandem with the electric two- and three-wheeler segments which notched their best-ever annual sales in CY2024, registered its best-ever calendar year retails. At 99,068 units, the year-on-year increase is 20% (CY2023: 82,563 units).

The growing shift to e-mobility in the passenger vehicle segment is being seen on our roads in the form of green-number-plated SUVs, sedans and hatchbacks as an increasing number of PV buyers prefer to put their money on a wallet-friendly EV, despite the higher initial price compared to their petrol or diesel brethren. Between 2015 and 2024, nearly 250,000 electric PVs have been sold in India.

As per the Vahan-sourced retail sales data for CY2024, which saw sales decline in three of the 12 months, reveals that the festival-laden October (11,361 units, up 49%) was the best-ever month for the e-PV industry. While the industry has sold an additional 16,505 units in 2024, the growing competition for a bigger slice of the market has eaten into market leader Tata Motors’ share which now is at its lowest in the past three years. For a detailed look at the movers and shakers in the year that was, CLICK HERE.

ELECTRIC COMMERCIAL VEHICLE SALES IN CY2024: 10,038 units, up 100%

ELECTRIC COMMERCIAL VEHICLE SALES IN CY2024: 10,038 units, up 100%

CV SHARE OF INDIA EV SALES IN CY2024: 0.51%

The electric commercial vehicle segment too witnessed demand rise albeit on a much lower scale compared to the other three segments. A total of 10,038 e-CVs were retailed between January-December, up 100% YoY (CY2023: 5,010 units). And the growth is there for two of the three sub-segments – buses: 3,822 units, up 59% YoY, light goods vehicles (5,996 units, up 162%) – while heavy goods vehicles saw a decline (220 units, down 33%).

EV PENETRATION RISES TO 7.47% IN CY2024 FROM 6.38% IN CY2023

There is little doubt that EV penetration levels have increased albeit it could have been higher but for some growth-impeding challenges that are being addressed by both the government and the private sector.

All put together, the 19,49,114 EVs sold in CY2024 account for 7.40% of the total 26 million (2,60,88,406 units, up 8.65% YoY) vehicles sold across all segments and petrol, diesel, CNG, LPG and electric-powered vehicles in India. This is an increase over the 6.38% EV penetration level in all of 2023 – 15,32,386 EVs of overall 24 million vehicles sold (2,40,10,663 units).

At 18,39,898 or 1.83 million units, the combined retail sales of electric two-wheelers (59% share) and three-wheelers (35% share) together account for an overwhelming 94% of total EV sales in India in. Electric cars and SUVs, with 99,068 units, account for a 5% share, and electric buses, heavy and light goods carriers at 10,038 units account for a 0.51% share.

Between 2015 to 2024, 5.40 million EVs have been sold in India. Of this 4.5 million or 83% were bought in the past three years.

Between 2015 to 2024, 5.40 million EVs have been sold in India. Of this 4.5 million or 83% were bought in the past three years.

INDIA'S EV GROWTH STORY PICKS UP PACE: 4.5 MILLION EVs SOLD IN 3 YEARS

A deep dive into retail sales numbers for the past 10 years reveals just how demand has grown for EVs in India, particularly in the past three years. Between 2015 to 2024, a total of 5.40 million zero-emission vehicles have been bought in the country. Of this, four-and-a-million EVs or 83 percent have been delivered to customers only in the past three years, reflecting the accelerated growth in the domestic EV industry.

The government has outlined a strategic shift to e-mobility, and has targeted EVs to account for 30% of its mobility requirements by 2030. Growing consumer awareness about the need to use eco-friendly transport and the wallet-friendly nature of EV cost of ownership over the long run is proving to be a big catalyst to adoption of electric mobility. What’s more, there’s fast-paced demand coming in from the e-commerce industry and logistics players for EVs on two and three wheels, and from taxi fleet operators for electric passenger vehicles.

Meanwhile, recognising the huge business potential, auto component manufacturers are also upping the ante on localising EV parts, either through full ground-up development or through technology licences. This is leading to enhanced optimisation of production costs and in turn EV affordability, which is the overriding growth mantra.

WILL THE TWO-MILLION EV MILESTONE BE ACHIEVED IN FY2025?

While the two-million EV sales milestone may have been narrowly missed in CY2024, can it be achieved in the current fiscal year. As per Vahan retail sales data for the first nine months of FY2025 (April-December 2024), a total of 14,49,242 EVs or 1.49 million units have been sold. This leaves a gap of 550,758 units to be bridged by March 31, 2025.

January 2025 will see a fair deal of excitement in the EV industry, particularly at the Bharat Mobility Global Expo (January 17-22) in New Delhi where a number of EV makers will display as well as launch their new zero-emission products.

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

05 Jan 2025

05 Jan 2025

64189 Views

64189 Views

Shahkar Abidi

Shahkar Abidi