Electric 2W sales in India hit one million units annually for the first time

With demand for electric scooters, motorcycles and mopeds maintaining robust double-digit growth right through this year, total retails have now surpassed a million units and counting. The Top 4 OEMs comprising Ola Electric (37% share), TVS (19%), Bajaj Auto (16%) and Ather Energy (11%) together account for 83% of the sales, leaving 17% to 209 other players. Maharashtra is the top state with 182,035 retail sales and 18% share, followed by Uttar Pradesh, Karnataka and Tamil Nadu.

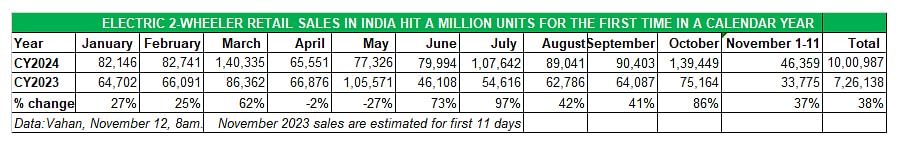

Here’s the latest number-crunching news from the Indian electric two-wheeler industry. Retail sales of electric scooters, motorcycles and mopeds have gone past the 10 lakh or 1 million-units milestone for the first time in a year. As per the latest Vahan data (as of November 12, 2024, 8am), cumulative retail sales between January 1 and November 11 are 10,00,987 units or a little over a million units.

The e2W segment with 10,00,987 units has the largest share of 59.54% of the 1.68 million EVs sold in India across all vehicle segments between January 1 and November 11, 2024,

The e2W segment with 10,00,987 units has the largest share of 59.54% of the 1.68 million EVs sold in India across all vehicle segments between January 1 and November 11, 2024,

At the end of November 2024, India E2W Inc needed just 45,856 units more to achieve the million sales milestone which it has achieved in the first 11 days of November. As of end-of-day November 11, the figure was 46,359 units.

With exactly 50 days to go for CY2024 to come to a close, it can be surmised that given the current sales momentum, India e2W Inc will close this year with record sales in the region of 1.1 million to 1.2 million units. This will constitute a 34% year-on-year increase over CY2023’s 860,410 units. CY2023 itself was a 36% YoY increase over CY2022’s 631,398 units. Considering that in CY2021, a total of 156,325 e-two-wheelers were sold in India, CY2024’s million-plus units (10,00,987 units) already reflects a 540% increase over four years, pointing to the rapid growth of this vehicle segment.

Of the 16,80,947 or 1.68 million EVs sold across India between January and November 11, 2024, the e2W segment with 10,00,987 units has the largest share – 59.54% – followed by electric three-wheelers (587,782 units / 34.96% share). Electric passenger vehicles with 83,076 units is the third largest sub-segment with a 4.94% share. Commercial vehicles (8,951 units) have a 0.53% share of the overall India EV market split into 5,259 light goods carriers, 3,512 electric buses and 180 heavy goods carriers.

Ola, TVS, Bajaj and Ather command 83% of the market

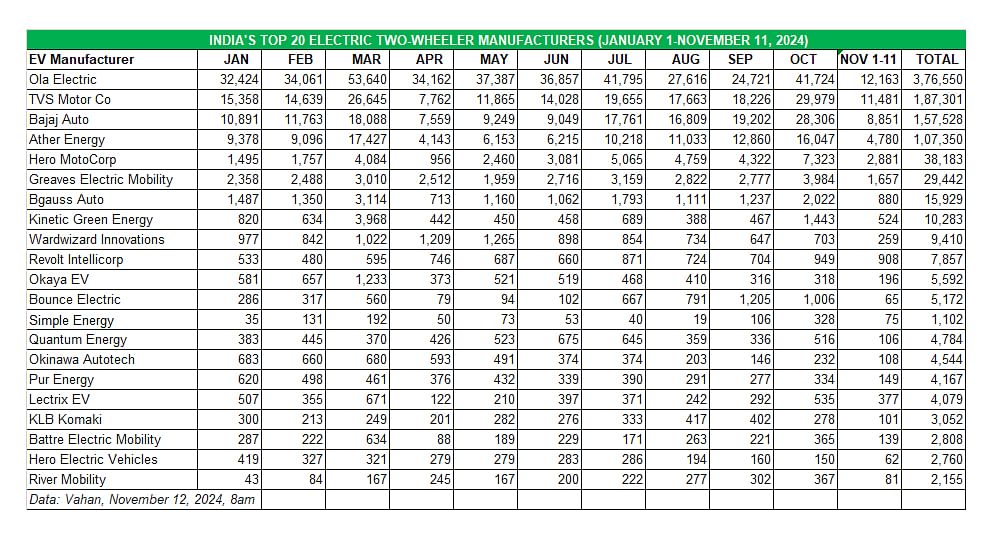

As per the Vahan retail sales data for the January 1-November 11, 2024 period, there are four EV manufacturers which have registered six-figure sales – Ola Electric, TVS Motor Co, Bajaj Auto and Ather Energy.

Market leader Ola Electric with 376,550 units has a 37% share of the million-plus units till date. TVS Motor Co, which has retailed 187,301 iQubes, has a near-19% share while its ICE legacy rival Bajaj Auto, with 157,528 Chetaks, has a near-16% share. Smart e-scooter maker Ather Energy, which has sold 107,350 units till date this year, has a 10.72% share of the market.

Club these four OEMs’ sales and what you get is a commanding 82.79% share of the Indian e2W market, leaving the remaining 17% share to 207 other players in the industry. Maharashtra tops e2W sales with 18% share

Maharashtra tops e2W sales with 18% share

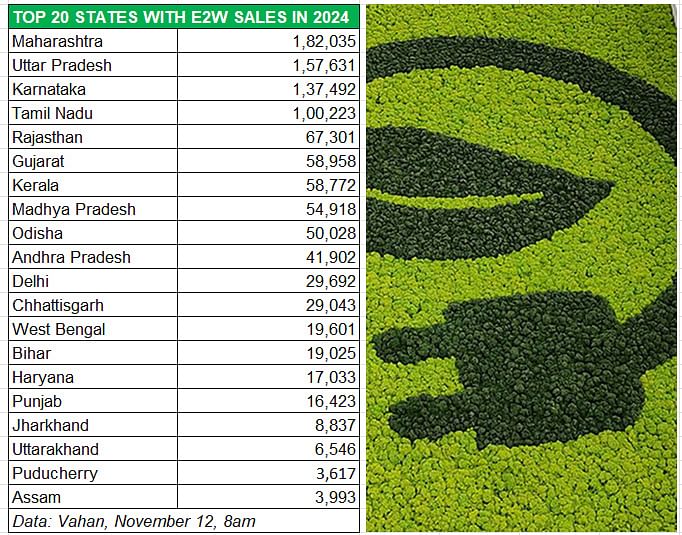

As per the Vahan database, of the total 10,00,987 electric two-wheelers sold in the January 1- November 11, 2024 period, Maharashtra has the bragging rights to being the state with the highest sales in the year to date. At 182,035 units, Maharashtra has an 18.18% share and is ahead of Uttar Pradesh by 24,404 units.

Uttar Pradesh, with 157,631 units, is ranked second in the state-wise EV sales parc for the current year and has a 15.74% share. Karnataka is next with 137,492 units and a 13.73$ share, followed by Tamil Nadu with 1,00,223 e2Ws and a 10% share. Club these four states, each of them with six-figure sales, and their combined total of 577,381 units gives them a 57.68% share of India’s overall e-two-wheeler market.

At No. 5 is Rajasthan with 67,301 units, followed by Gujarat (58,958 units), Kerala (58,772 units), Madhya Pradesh (54,918 units) and Odisha (50,028 units).

Given that the e2W segment is the biggest volume driver for the EV industry, and 1.68 million EVs across all vehicle segments have been sold in the first 315 days of this year, it remains to be seen just how close India EV Inc gets to the 2-million EV retails mark. That in itself will be setting a new record for the industry.

Legacy OEMs TVS, Bajaj, Hero outsell Top 10 two-wheeler EV startups in October

Electric cars and SUVs race to best-ever monthly sales of 10,500 units in festive October

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

12 Nov 2024

12 Nov 2024

16874 Views

16874 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau