Electric 3W industry scales new high in CY2024: 691,000 units, Mahindra and Bajaj Auto shine

The electric three-wheeler segment, which is the one with the highest level of transition to e-mobility, clocked its best-ever annual sales of over 691,000 units and accounted for 56% of the 1.22 million three-wheelers sold in CY2024. While Mahindra Last Mile Mobility maintains its leadership with a 10% market share, Bajaj Auto has rapidly moved up the ranks to be at No. 3 with a 6% share.

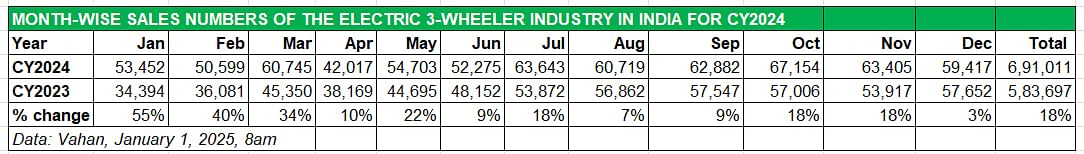

CY2024 has come and gone and the electric three-wheeler industry, the second largest in volumes after e-two-wheelers, has displayed the strongest growth trajectory. At 691,011 units retail sales, year-on-year growth was 18% (CY2023: 583,597 units) and accounted for a commanding 56% share of the total 12,20,925 three-wheelers sold in India last year. This segment is also the one which has, for the past three years, witnessed the highest level of transition from ICE to e-mobility.

The e3W industry, which averaged monthly sales of 57,584 units in CY2024 compared to 48,633 units in CY2023, missed hitting the 700,000 milestone by just 8,989 units.

The e3W industry, which averaged monthly sales of 57,584 units in CY2024 compared to 48,633 units in CY2023, missed hitting the 700,000 milestone by just 8,989 units.

While the 650,000 milestone was achieved in the first fortnight of December itself, the 700,000 milestone was missed by a whisker – 8,989 units. The sustained growth in e3W retails is a result of many factors including lower cost of ownership (compared to IC engine, CNG and LPG options), improved financing options, the FAME-EMPS and now the PM E-Drive purchase incentive scheme, increased product choice and as well as growing demand from fleet and last-mile logistics operators.

Demand for electric three-wheelers soared under the FAME II subsidy scheme, when it kept registering strong double-digit growth. Under the four-month EMPS, which ended on September 30, 2024 and had a reduced subsidy compared to FAME II, monthly sales growth has been more muted and in single digits. Now with the new PM E-Drive scheme – which offers the same subsidy as in the EMPS for the first year and half of that in the second – and effective for a two-year period, it remains to be seen if the same momentum is maintained in the second year.

The PM E-Drive scheme incentivises purchase of 316,000 e-three-wheelers. E-three-wheelers including e-rickshaws, get a subsidy of Rs 25,000 in the first year and Rs 12,500 in the second year. For the L5 category (cargo e-three-wheelers), the incentive is Rs 50,000 per unit in the first year and Rs 25,000 in the second.

Every second 3W sold in India is a zero-emission model

Of all vehicle segments, it is the e-three-wheeler industry which is witnessing the fastest transition to electric mobility. Of the total 1.22 million three-wheelers (across petrol, diesel, CNG, LPG and electric powertrains) sold in CY2024, across, electric three-wheelers – 691,011 units – account for 56% of the sales, effectively translating into every second three-wheeler sold in India being an EV. CNG-powered three-wheelers, at 348,885 units, are the next highest and have a 28% share of the overall market, and are followed by diesel (137,768 units, 11% share), LPG (32,603 units, 3% share) and petrol (11,426 units, 1% share).

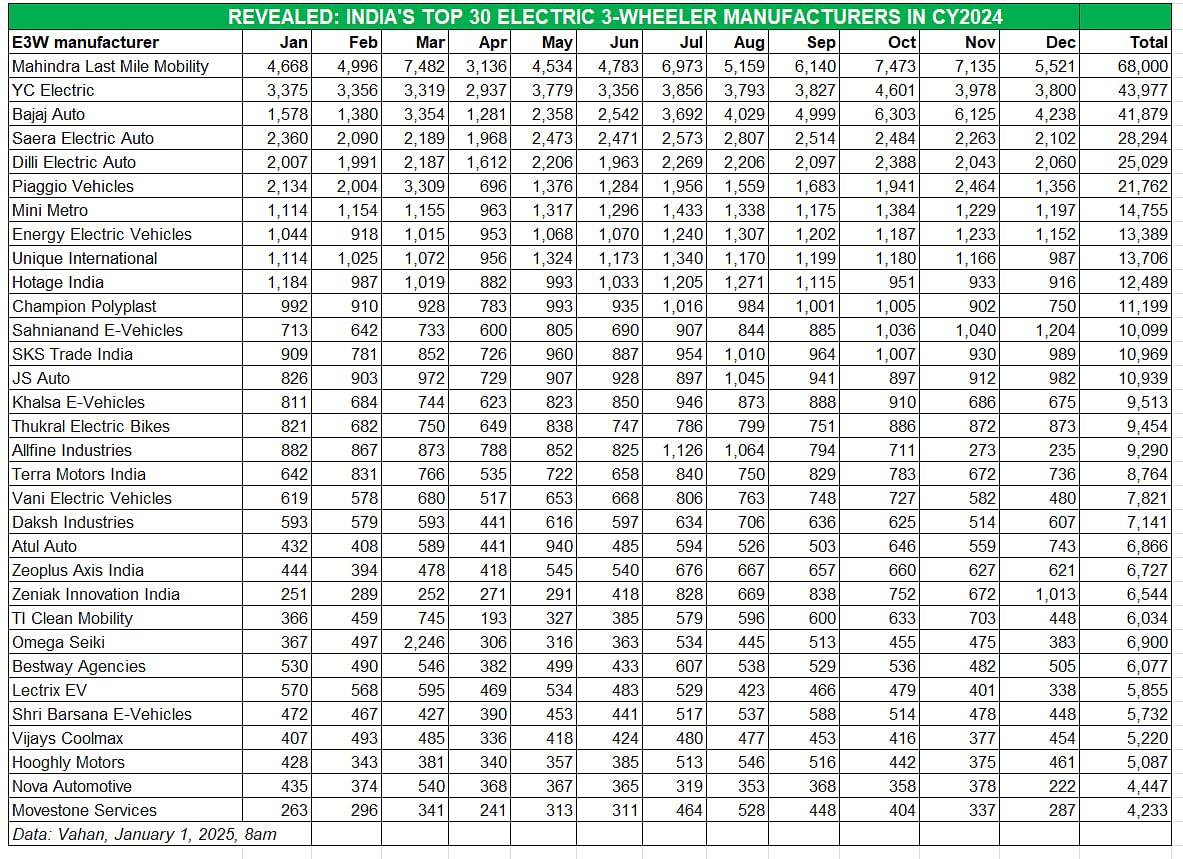

Like the e-two-wheeler industry, there’s fierce competition too in this segment, albeit amongst the Top 6 players – Mahindra Last Mile Mobility (MLMM), YC Electric, Bajaj Auto, Saera Electric Auto, Dilli Electric Auto and Piaggio Vehicles. They are part of an industry which, at last count as per Vahan, has all of 575 players!

Throughout CY2024, this segment has been dominated by seven to eight players – Mahindra Last Mile Mobility (MLMM), Bajaj Auto, YC Electric, Saera Electric Auto, Piaggio Vehicles, Dilli Electric Auto and Energ EV. However, the real battle was fought at the podium level between Mahindra Last Mile Mobility, Bajaj Auto and YC Electric.  MAHINDRA LAST MILE MOBILITY

MAHINDRA LAST MILE MOBILITY

CY2024: 68,000 units, up 25% YoY, 10% market share

CY2023: 54,594 units, 9% market share Mahindra Last Mile Mobility (MLMM), the market leader in the e3W segment, has had a good year and registered strong double-digit growth. At 68,000 units, up 37% YoY, this is its best annual sales performance. The company, whose EV portfolio comprises the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo which cater to multiple mobility operations in the passenger and cargo domains. MLMM saw two straight months of over 7,000 sales in October (7,473 units) and November (7,135 units).

Mahindra Last Mile Mobility (MLMM), the market leader in the e3W segment, has had a good year and registered strong double-digit growth. At 68,000 units, up 37% YoY, this is its best annual sales performance. The company, whose EV portfolio comprises the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo which cater to multiple mobility operations in the passenger and cargo domains. MLMM saw two straight months of over 7,000 sales in October (7,473 units) and November (7,135 units).

MLMM’s best-ever monthly numbers in October saw it surpass its CY2023 retails of 54,594 units, which means it has sold an additional 13,406 units in CY2024.

To ensure sustained supplies to meet growing demand, MLMM has tripled its production capacity, leveraging its manufacturing plants in Bengaluru, Haridwar, and Zaheerabad. In July, MLMM signed an MoU with Ecofy to offer ease of finance for 10,000 units through leasing and subscription schemes. This move seems to have paid off given the enhanced volumes in the past few months.

Suman Mishra, MD and CEO of Mahindra Last Mile Mobility, is strongly bullish on the growth of the sector. In a recent interview with Autocar Professional, she said: "The fundamental value proposition of EVs will only improve with scale. Range and efficiency will increase, and customers will earn more through lower operational costs. This category has seen consistent growth while other sectors have slowed. The demand is organic, and as financing improves and infrastructure develops, the future of electric three-wheelers is brighter than ever.”

She added, "The fundamental value proposition of electric three-wheelers will only get better as the scale increases, and with the right policy and infrastructure support, the growth will continue.” Mishra remains confident about the long-term viability of the Indian electric three-wheeler market, even without subsidies (which is slated after FY2026). "Today, customers are willing to pay a premium of Rs 50,000 to Rs 60,000 for an EV over an ICE vehicle. This reflects the cost-efficiency of EVs.” YC ELECTRIC

YC ELECTRIC

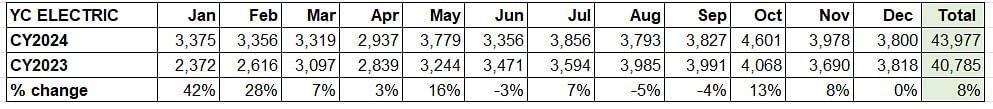

CY2024: 43,977 units, up 8% YoY, 6.36% market share

CY2023: 40,785 units, 7% market share

YC Electric, the longstanding No. 2 e-three-wheeler OEM, just about managed to retain its CY2023 rank by dint of its sales in the first seven months of CY2024. From August onwards, the company lost out to Bajaj Auto in each month right till December. At 43,977 units, up 8% YoY (CY2023: 40,785 units)., YC Electric was just 2,098 units ahead of the Pune-based rival.

This performance gives the company, which has five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations – a market share of 6.36%, below MLMM’s 10% and a whisker above Bajaj Auto’s 6.06 percent.

BAJAJ AUTO

BAJAJ AUTO

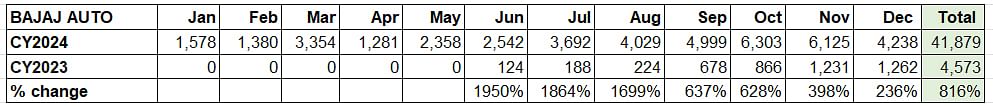

CY2024: 41,879 units, up 816% YoY, 6% market share

CY2023: 4,574 units, 0.78% market share

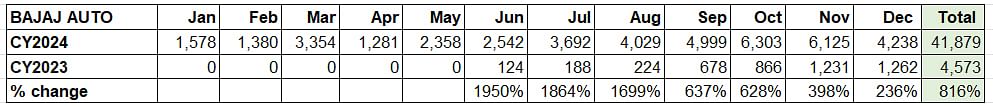

Like the e-two-wheeler market where Bajaj Auto is now challenging No. 2 OEM TVS Motor Co, the company has also achieved strong traction in the e-three-wheeler industry where it is a relatively young entrant. Having entered this market only in June 2023, Bajaj Auto has rapidly climbed the rankings to be the No. 2 OEM, just behind Mahindra Last Mile Mobility.

Like the e-two-wheeler market where Bajaj Auto is now challenging No. 2 OEM TVS Motor Co, the company has also achieved strong traction in the e-three-wheeler industry where it is a relatively young entrant. Having entered this market only in June 2023, Bajaj Auto has rapidly climbed the rankings to be the No. 2 OEM, just behind Mahindra Last Mile Mobility.

In CY2024, the Pune-based OEM, which is India’s largest three-wheeler manufacturer as well as exporter, sold a total of 41,879 units, which marks 816% YoY growth albeit on a low year-ago base of 4,573 units. In CY2023 (six months since its market entry), Bajaj Auto was ranked 28th in the field with 2,428 units. From a less-than-one-percent e3W market share in CY2023, Bajaj Auto has taken a 6% share in CY2024 and its ranking has jumped to No. 3.

From January’s 1,578 units to averaging monthly sales of 6,211 units in October-November, Bajaj is witnessing strong growth. This performance is reflected in its growing market share – from the 3% it had in January 2024, Bajaj Auto’s e3W share has risen to 9.65% in November. On the cumulative sales front, CY2024’s 2024’s 41,879 units give it a 6% market share. From market entry in June 2023 to December 2024, Bajaj Auto has clocked total sales of 46,452 units and risen to podium position in a field of nearly 580 players. What has helped the company is sustained demand for both its products, ramped-up production and an expanded EV sales network.

Bajaj Auto has two products – the RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 in the fray. The Maxima XL Cargo E-Tec 12.0, which develops 5.5 kW power and 36 Nm, has a bigger battery and higher range of 183km per charge than the RE E-Tec 9.0 passenger model. SAERA ELECTRIC AUTO

SAERA ELECTRIC AUTO

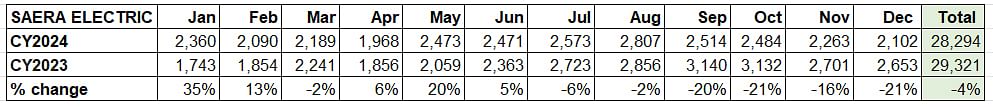

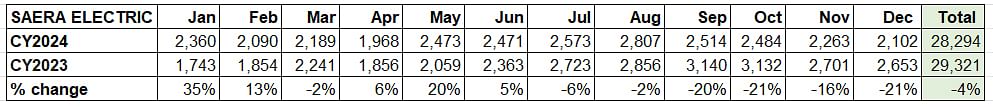

CY2024: 28,294 units, down 4% YoY, 4% market share

CY2023: 29,321 units, 5% market share

Saera Electric Auto, which manufactures the Mayuri brand of e-rickshaws and e-karts, is ranked fourth in the e3W industry. December with 2,102 units (down 21%) was the sixth month in a row that the company saw its sales decline. Total CY2024 retails at 28,294 units are down 4% YoY (CY2023: 29,321 units) and its market share has reduced to 4% from 5% a year ago. In end-October, the company announced a collaboration with Porter, an on-demand logistics platform to deliver L3 and L5 e-carts. The pilot project will be facilitated in Delhi and Bangalore with the initial projection of delivering 500 vehicles per month in respective cities. The company will be hopeful the strategic partnership gives a fillip to its retails in the months ahead.

Saera Electric Auto, which manufactures the Mayuri brand of e-rickshaws and e-karts, is ranked fourth in the e3W industry. December with 2,102 units (down 21%) was the sixth month in a row that the company saw its sales decline. Total CY2024 retails at 28,294 units are down 4% YoY (CY2023: 29,321 units) and its market share has reduced to 4% from 5% a year ago. In end-October, the company announced a collaboration with Porter, an on-demand logistics platform to deliver L3 and L5 e-carts. The pilot project will be facilitated in Delhi and Bangalore with the initial projection of delivering 500 vehicles per month in respective cities. The company will be hopeful the strategic partnership gives a fillip to its retails in the months ahead.

PIAGGIO VEHICLES

PIAGGIO VEHICLES

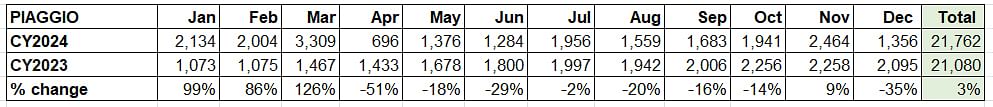

CY2024: 21,762 units, up 3% YoY, 3% market share

CY2023: 21,080 units, 3.61% market share November 2024 saw Italian major Piaggio Vehicles register its best-ever monthly retails this year – 2,464 units, up 9% YoY. December numbers though were down 35% YoY, which took its entire CY2024 retails to 21,762 units, up 3% YoY (CY2023: 21,080 units) which is just 682 units more than a year ago. The company’s CY2024 market share was 3%, slightly lesser than the 3.61% in CY2023.

November 2024 saw Italian major Piaggio Vehicles register its best-ever monthly retails this year – 2,464 units, up 9% YoY. December numbers though were down 35% YoY, which took its entire CY2024 retails to 21,762 units, up 3% YoY (CY2023: 21,080 units) which is just 682 units more than a year ago. The company’s CY2024 market share was 3%, slightly lesser than the 3.61% in CY2023.

Piaggio’s Apé E-City FX Max passenger model (with 145km range) and Apé E-Xtra FX Max cargo carrier (115km range) are fully assembled by an all-women team at its Baramati factory in Maharashtra. In an effort to simplify e3W ownership and eliminate upfront battery costs, Piaggio has launched a battery subscription model for its Apé Elektrik earlier tyhis year in key markets across India.

Fourteen companies have registered annual sales of over 10,000 units. Other than the OEMs detailed above, the others include Dilli Electric Auto (25,029 units), Mini Metro (14,755 units), Energy Electric Vehicles (13,389 units), Unique International (13,706 units), Hotage India (12,489 units), Champion Polyplast (11,199 units), Sahnianand E-Vehicles (10,099 units) and SKS Trade India (10,099 units).

Meanwhile, in a manner akin to Bajaj Auto’s speedy growth in the e3W industry, Murugappa Group company TI Green Mobility (Montra Electric), which has recently forayed into this sector, is fast climbing up the ranks. The company, which had entered the e3W market in July 2023, clocked annual sales of 6,034 units in CY2024 to be positioned at No. 24. This gives it a market share of 1%, creditable considering that this sub-segment of the EV industry has the highest number of players – 575 companies – all vying for a slice of the zero-emission action on three wheels only.

ALSO READ: Hyundai Motor India plots entry into e-3-wheeler market, may partner TVS

ALSO READ: Hyundai Motor India plots entry into e-3-wheeler market, may partner TVS

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

01 Jan 2025

01 Jan 2025

29544 Views

29544 Views

Ajit Dalvi

Ajit Dalvi