Hyundai India sells 132,259 vehicles in Q1 FY2026, SUV share at 68%

Demand for Hyundai passenger vehicles was tepid in April-June 2025 with sales down 12% YoY. SUVs, led by the Creta, continue to buffer the decline in the hatchback and sedan sales and the estimated 90,515 units sold in the first quarter of FY2025 accounted for 68% of total domestic market sales for the Korean vehicle manufacturer.

Hyundai Motor India, the longstanding second-ranked passenger vehicle manufacturer after Maruti Suzuki, has had a tepid first-quarter in FY2026. June 2025 with 44,024 units (down 12% YoY) was the eighth month in a row of sales decline. Cumulative April-June 2025 wholesales of 132,259 units are also down 12% YoY (Q1 FY2025: 149,455 units).

As a result, Mahindra & Mahindra with 152,067 units and strong 22% YoY growth in Q1 FY2026 has wrested second spot, behind market leader Maruti Suzuki India (393,572 units, down 6% YoY. Tata Motors (123,839 units, down 10% YoY) is ranked fourth amongst the 16 players in the PV market.

Halfway into CY2025, HMIL’s 285,809 units are 47% of its record CY2024 sales of 605,429 units. Both Q1 FY2026 and H1 CY2025 wholesales are down YoY.

Halfway into CY2025, HMIL’s 285,809 units are 47% of its record CY2024 sales of 605,429 units. Both Q1 FY2026 and H1 CY2025 wholesales are down YoY.

As in FY2025, when Hyundai clocked sales of 598,666 PVs (down 3%), the rapid consumer shift towards SUVs have impacted demand for its clutch of hatchbacks and sedans as it has for market leader Maruti Suzuki.

Commenting on the domestic market sales, Tarun Garg, whole-time director and Chief Operating Officer, Hyundai Motor India said, “In the domestic market, the geopolitical situation continued to affect the market sentiment with domestic sales registering 44,024 units in June 2025. As we come closer to the beginning of production at the Talegaon plant, we remain cautiously optimistic about a gradual recovery of demand, supported by reduction in repo rates and improving liquidity on account of cut in CRR. We are closely watching the global geopolitical scenario and are committed to delivering value and innovation to our customers across both domestic and export markets.”

SUVs continue to provide the bulk of the sales for Hyundai Motor India which retails 10 models in India — two hatchbacks (Grand i10 Nios, i20), two sedans (Aura, Verna) and seven SUVs (Creta, Creta Electric, Venue, Alcazar, Exter, and Tucson along with the all-electric Ioniq 5).

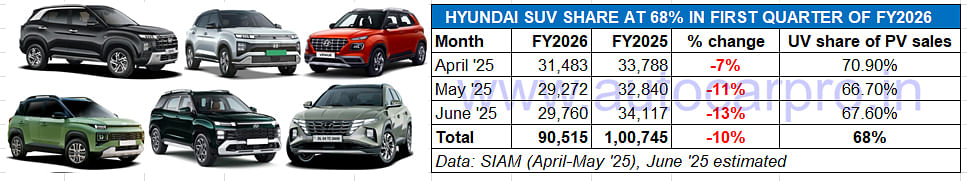

Hyundai sells 90,515 SUVs in Q1 FY2026

In the first three months of FY2026, the Korean car and SUV maker has dispatched a total of 90,515 SUVs to its dealers across the country. This total is down 10% YoY (Q1 FY2025: 100,745 SUVs). The Q1 FY2026 SUV sales have contributed 68.43% to Hyundai Motor India’s total passenger vehicle wholesales of 132,259 units. This is slightly higher than the 67.40% in Q1 FY2025. April 2025 (31,483 SUVs) has the highest monthly share of 71 percent (see data table below).

April 2025 (31,483 SUVs) saw the SUV contribution of 71% to Hyundai India’s monthly sales of passenger vehicles.

April 2025 (31,483 SUVs) saw the SUV contribution of 71% to Hyundai India’s monthly sales of passenger vehicles.

While the model-wise SUV splits are not yet available for June 2025, the April-May wholesales data reflects the top models in demand. The Creta, which is India’s best-selling midsize SUV which has recently received an all-electric sibling, and the Venue and Exter compact SUVs continue to be the growth drivers.

In April-May, the Creta and Creta Electric together accounted for 33,876 units and a 37% share of total SUV sales. The Venue (15,473 units and 17% share) and Exter (11,315 units and 12.50% share) are the second- and third-highest contributors to SUV sales. The flagship Alcazar midsize SUV (1,939 units and 2% share) is fourth on the company’s SUV sales scale.

As of Q1 FY2026, Hyundai is currently the No. 3 PV OEM. If has to regain its No. 2 position in the Indian PV market in FY2026, it will have to consistently register a higher level of monthly sales in the coming months.

The company, which is the longstanding No. 2 made-in-India vehicle exporter, has been constrained for maufacturing capacity at its Chennai plants. Once the refurbished Talegaon facility goes on stream in the next few months, expect Hyundai to up the ante.

ALSO READ:

Hyundai Alcazar closes in on 100,000 units four years after launch

Hyundai India test over 4.25 million engines using cold bed engine tech

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

02 Jul 2025

02 Jul 2025

6511 Views

6511 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal