Mahindra races past 300,000 SUV sales in first-half CY2025

M&M, which is riding a wave of surging demand for its SUVs, registers strong 22% growth in April-June 2025 which is its best-ever quarter yet, and also achieves a 20% increase in first-half CY2025 sales. This performance sets the stage for the SUV manufacturer to drive past the 600,000 milestone for the first time in both the current calendar year as well as FY2026.

Mahindra & Mahindra, which achieved the 500,000 annual sales milestone for the first time in CY2024, and went to improve upon that score in FY2025 with 551,487 SUVs, is driving towards another record calendar year and fiscal. The company announced its June 2025 wholesales at 47,306 units, up 18% YoY (June 2024: 40,022 units), which takes its cumulative April-June 2025 and first-quarter FY2026 sales to 152,067 units, up 22% YoY (Q1 FY2025: 124,248 units). The Q1 FY2026 numbers constitute the company’s best-ever quarter sales.

Nevertheless, reflecting the somewhat tepid market movement in June 2025, last month’s sales (47,306 units), despite a strong 22% YoY increase, are the lowest for M&M in the first quarter of FY2026 and constitute the second month in the current calendar year that monthly sales have slipped below the 50,000-unit mark for M&M (see data table below).

As of Q1 FY2026, Mahindra & Mahindra with 152,067 units is ranked No. 2 on the PV OEM scale, behind market leader Maruti Suzuki India (393,572 units, down 6% YoY) and has driven past longstanding second-ranked Hyundai Motor India (132,259 units, down 12% YoY), which is now in third position. Tata Motors (123,839 units, down 10% YoY) is ranked fourth amongst the 16 players in the PV market.

Halfway into CY2025, M&M has clocked sales of 301,194 SUVs, up 20% YoY (H1 CY2024: 250,348 units). This total is already 57% of the company's record CY2024 sales of 528,460 SUVs. And, Q1 FY2026 with 152,067 units has turned out to be its best quarter yet.

Halfway into CY2025, M&M has clocked sales of 301,194 units and 57% of its record CY2024 score of 528,460 SUVs. And, Q1 FY2026 with 152,067 units has turned out to be its best quarter yet.

Halfway into CY2025, M&M has clocked sales of 301,194 units and 57% of its record CY2024 score of 528,460 SUVs. And, Q1 FY2026 with 152,067 units has turned out to be its best quarter yet.

The company, which has been riding a wave of surging demand for its SUVs, clocked 50,000 monthly sales for the first time in September 2024 (51,062 units, up 24%) and followed it up best-ever 54,504 units in the festival-laden October 2024 (up 25%).

With the dynamic and strong consumer buying shift from hatchbacks and sedans to SUVs over the past two years, M&M with its portfolio of 12 SUVs (Bolero, Bolero Neo, Bolero Neo+, Scorpio N, Scorpio Classic, Thar, Thar Roxx, XUV3XO, XUV700, XUV400, BE 6 and XEV 9e) has benefitted handsomely.

While the model-wise sales split for the Mahindra SUV portfolio for June 2025 is not yet available, the wholesales numbers for the first two months of FY2026 give a good indication of the key growth drivers. Of the total 104,761 SUVs the company sold in April-May 2025, the Scorpio N and Classic leads with 29,935 units and a 28% share of sales. The No. 2 best-selling model is the Thar Roxx and Thar combine (21,092 units and 20% share), followed by the indefatigable Bolero (17,322 units and 16% share). The XUV 3XO compact SUV (15,520 units and 15% share) is fourth and the flagship XUV700 (13,246 units and 13% share) is fifth. The two electric origin SUVs – BE 6 and XEV 9e – with 7,012 units account for a 6.69% share of M&M’s wholesales in April-May 2025.

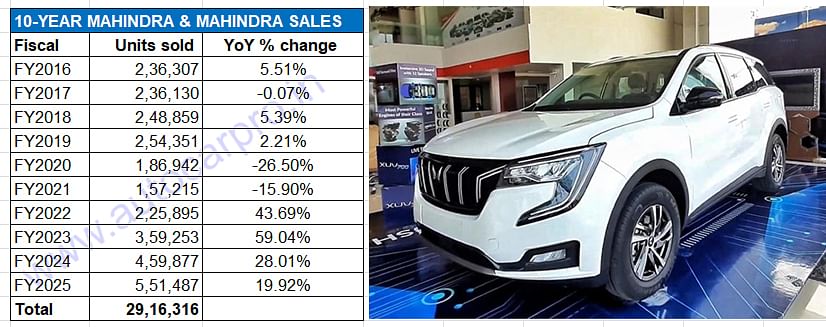

Decadal data reveals that M&M has more than doubled its sales: from FY2016's 236,307 units to best-ever 551,487 units in FY2025.

Decadal data reveals that M&M has more than doubled its sales: from FY2016's 236,307 units to best-ever 551,487 units in FY2025.

MAHINDRA WITNESSES ACCELERATED GROWTH SINCE FY2023

A look at M&M’s decadal wholesales numbers reveals the SUV manufacturer has more than doubled its 2016 sales of 236,307 units 10 years later to 551,487 units. Between FY2016 and FY2019, the company averaged annual sales of 243,911 units and then, as a result of the Covid-19 pandemic, hit lows of 186,942 units in FY2020 and 157,215 units in FY2021.

However, since then, M&M's rise and market performance has been stratospheric. FY2022’s 225,895 units were a 44% YoY increase and were followed by 359,253 units in FY2023, up 59% YoY. FY2024 saw M&M hit a new high of 459,877 units, up 28% YoY. FY2025 with 551,487 units set a new benchmark, with the company having surpassed the 500,000 or half-a-million units wholesales milestone for the first time in a fiscal.

Is 600,000 SUVs and beyond for the asking for the company this year and in FY2026? In a market that remains hungry for SUVs, and following ts stellar performance in Q1 FY2026 and H1 CY2025, Mahindra & Mahindra is extremely well placed to achieve new sales milestones both for the current calendar year and fiscal year.

ALSO READ:

Mahindra XEV 9e, BE 6 production and sales hit highest level in May

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

02 Jul 2025

02 Jul 2025

7124 Views

7124 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal