Auto retails see tepid growth in June as demand for cars, CVs and tractors slows down

With passenger vehicle inventory hitting an all-time high of 62-67 days, FADA president urges carmakers to implement prudent inventory control and engage proactively with the market; extreme heat and delayed monsoons have impacted rural market sales adversely and dragged overall numbers down.

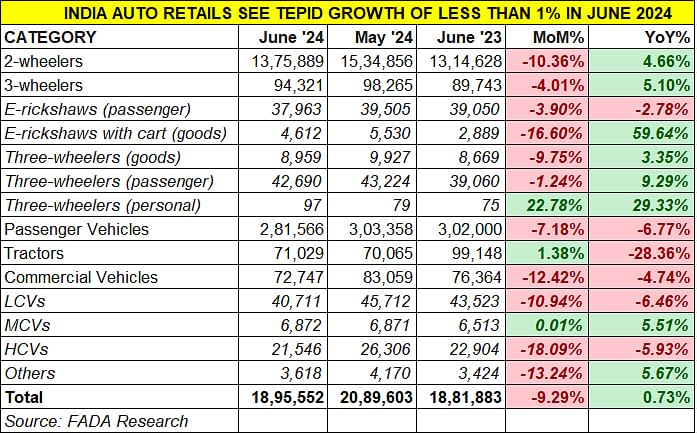

The Federation of Indian Automobile Dealers Association (FADA) has released the retail sales numbers for June 2024. At 1.89 million units combined for the two- and three-wheeler, passenger vehicle, commercial vehicle and tractor segments, total sales last month are just a 0.73% YoY increase (June 2023: 1.88 million units) and a sizeable 9.29% down on May 2024’s 2.08 million units.

FADA president Manish Raj Singhania provided insights on June 2024's auto retail performance, stating: “June is traditionally one of the weakest months for India’s auto retail. This year, while the monsoon progressed normally up to Maharashtra, it lost momentum, delaying rains in West Bengal, Bihar, Uttar Pradesh, Chhattisgarh, and Madhya Pradesh. This exacerbated the effects of a severe heatwave in northwest India, contributing to a prolonged hiatus that not only intensified the heatwave but also delayed the sowing operations of kharif (summer sown) crops in northern and north-western regions, thereby impacting rural sales.”

Two- and three-wheelers sole segments to witness growth

Two- and three-wheelers sole segments to witness growth

The two-wheeler segment – 1.37 million units, up 4.66% – and three-wheelers – 94,321 units, up 5.10% – were the only ones to register YoY growth. Nevertheless, the two-wheeler industry faced significant challenges, with a MoM sales decline of 10.36 percent. Factors such as extreme heat which resulted in 13% less walk-ins, stalled monsoons and election-related market slowdowns particularly affected rural sales, which fell from 59.8% in May to 58.6% in June 2024.

PV OEMs urged to speedily reduce extremely high inventory levels

The passenger vehicle segment, which has seen its inventory build up substantially, saw retails of 281,566 units, down 6.77% YoY (June 2023: 302,000 units) and a month-on-month decline of 7.18% on May 2024’s 303,358 units.

The FADA president has flagged his concern about the car and SUV inventory levels, which have reached an all-time high – ranging from 62 to 67 days. He said, “Despite improved product availability and substantial discounts aimed at stimulating demand, market sentiment remains subdued due to extreme heat resulting in 15% less walk-ins and delayed monsoons. Dealer feedback highlights challenges such as low customer inquiries and postponed purchase decisions. With the festive season still some time away, it is crucial for passenger vehicle OEMs to exercise caution. Effective inventory management strategies are essential to mitigate financial strain from high interest costs. FADA strongly urges PV OEMs to implement prudent inventory control and engage proactively with the market.

CV sector adversely impacted by multiple factors

CV sector adversely impacted by multiple factors

The commercial vehicle category also experienced a downturn, with sales decreasing by 4.74% YoY to 72,747 units (Hune 2023: 76,364 units) and 12.42% MoM (May 2024: 83,059 units). Commenting on the CV sector’s performance, FADA president Manish Raj Singhania said: “June presented various challenges, including delayed monsoons, poor market sentiment and postponed purchases due to low demand and funding delays. The industry continues to face de-growth, impacted by high temperatures affecting the agricultural sector and infrastructural project slowdowns.”

Near-term outlook: Cautiously optimistic

In his near-term industry commentary, the FADA president said that the southwest monsoon has covered the entire country ahead of schedule, boosting prospects for kharif sowing. The newly elected government’s increase in minimum support prices (MSPs) for kharif crops is expected to improve disposable incomes in rural India, potentially enhancing auto retail performance. However, dealer feedback across the two-wheeler, passenger vehicle and commercial vehicle segments presents a cautious picture. While dealers anticipate better sales due to improved supply and new product launches, they express concerns over low customer inquiries and market sentiment dampened by heavy rains.

For two-wheelers, the arrival of the monsoon is expected to provide a boost, although challenges such as agricultural cash flow constraints and regional market variations remain. In the passenger vehicle segment, high inventory levels and ongoing low market sentiment necessitate cautious management. Meanwhile, the commercial vehicle sector looks forward to potential growth driven by renewed infrastructure projects and seasonal demands, despite current slowdowns.

Based on current market conditions, the overall rating for July auto retail performance is cautiously optimistic with a moderate outlook. While some segments may see improved activity, overall growth is likely to be tempered by persistent challenges.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

05 Jul 2024

05 Jul 2024

4876 Views

4876 Views

Autocar Professional Bureau

Autocar Professional Bureau