Auto retails in CY2024 rise 9% to 26 million, highest-ever sales for cars, 3Ws, tractors

Despite a number of growth-impacting factors, CY2024 was a proof of India Auto Inc’s resilience. While passenger vehicle sales hit a record 4 million units, three-wheelers as well as tractors notched their best-ever annual sales. Two-wheeler sales at 18.9 million units, narrowly missed their CY2018 peak as did commercial vehicle sales, which surpassed the million mark for the second year in a row.

India Auto Inc has done well in CY2024 and proof of that is in the retail sales numbers released by the Federation of Automobile Dealers Association (FADA) today. Retail sales, which constitute the real-world customer deliveries across the country, present a more accurate scenario than the wholesales data which essentially are vehicle dispatches to OEM dealers.

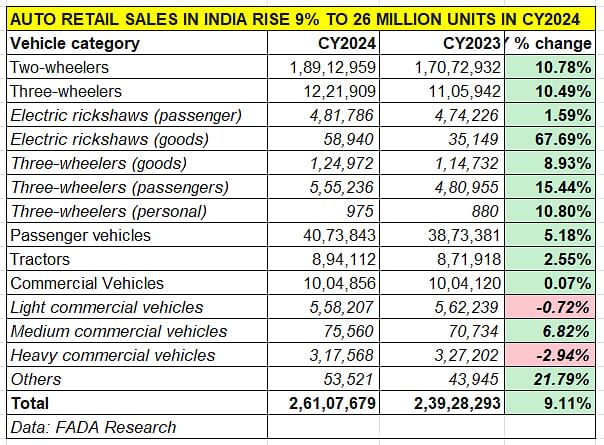

In CY2024, a total of 26 million vehicles (2,61,07,679 units) were sold to customers across five segments, which makes for 9.11% year-on-year growth (CY2023: 2,39,28,293 units).

In CY2024, a total of 26 million vehicles (2,61,07,679 units) were sold to customers across five segments, which makes for 9.11% year-on-year growth (CY2023: 2,39,28,293 units).

As the detailed vehicle segment-wise data table below reveals, all segments other than the two CV sub-segments of light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs) have done well. This strong performance comes despite a number of growth-impacting factors. According to FADA president C S Vigneshwar, “Despite multiple headwinds in CY2024 including heatwaves, elections at both Central and State levels and uneven monsoons, the auto retail industry remained resilient, closing the year with a 9% YoY growth.”

Two-wheelers, the largest volume category, registered sales of 1,89,12,959 units, up by 10.78% YoY, and accounted for the giant share of 72.44% of the total 26 million automobiles sold in CY2024, up from the 71% share it had in CY2023. According to FADA, 2024 2W retails narrowly missed out surpassig the previous highest of CY2018.

The passenger vehicle segment, which has been powered by unabating demand for SUVs since the past three years, clocked retail sales of 4 million units (40,73,843 units), up 5.18% YoY (CY2023: 3.78 million units). The PV share of total India Auto Inc retails in CY2024 was 15.60% vs 16.18% in CY2023.

The next highest contribution to annual sales comes from the three-wheeler segment, which is seeing the fastest transition to electric mobility. At 12,21,909 units sold in CY2024, YoY growth was 10.49% (CY2023: 11,05,942 units. The 3W share of total auto retails in CY2024 was 4.68% compared to 4.62% in CY2023.

The commercial vehicle segment crossed the one-million milestone in CY2024 for the second year in a row with total sales of 10,04,856 units, albeit flat sales (0.07% YoY) versus 10.04,120 units in CY2023. Medium CVs was the sole sub-segment to register growth – 75,560 units, up 6.82% YoY. LCV sales at 558,207 units were down 0.72% and MCV retails were also down – by 2.94% to 317,568 units.

Meanwhile, tractors makers registered their best-ever calendar year retails. At 894,112 units, the YoY growth was 2.55% (CY2023: 871,918 units).

FADA’s near- and long-term growth outlook

According to the apex dealer association, dealer sentiment for January 2025 remains cautiously optimistic, with nearly half (48.09%) of surveyed dealers anticipating growth, 41.22% expecting stable demand and only 10.69% foreseeing a decline.

In the critical two-wheeler segment, improved MSP and rural fund inflows could bolster sales albeit financing challenges remain. The rise of EVs – which jumped 33% YoY to 1.14 million units and accounted for 59% of India EV market in CY2024 – will also begin to impact the entry-level two-wheeler market share.

For the passenger vehicle segment, a host of upcoming new model launches, the ongoing wedding-season demand as well as CY2025 promotions should drive footfalls, though potential price hikes could moderate gains, states FADA. PV OEMs must carefully manage their supplies in line with market demand, points out the dealer body.

The commercial vehicle segment is likely to witness a mild uptick — Q4 is traditionally stronger — but progress will hinge on the pace of infrastructure projects and easier credit approvals.

Overall, despite certain headwinds, auto dealers remain hopeful that steady product availability, strategic marketing and supportive government measures will sustain momentum in the near term.

As regards the outlook for the entire year (CY2025), the automotive retail sector appears poised for a significant rebound. According to FADA’s study, 66.41% of dealers are anticipating growth, 26.72% expecting stability and only 6.87% foreseeing a slowdown this year. Dealers across categories sense a resurgence in market confidence, fuelled by improved rural liquidity, evolving government policies and a wave of new product launches across multiple powertrain. Despite financing headwinds and heightened competition, many retailers believe that focused marketing strategies, robust supply chains and better alignment with customer preferences will create a foundation for sustained expansion.

PV dealers anticipate strong consumer pull from new SUV launches, feature-rich EVs and its maturing EV ecosystem, though price-sensitive buyers and interest rate fluctuations remain watchpoints.

In two-wheelers, rising rural incomes, fresh model introductions and an eventual plateau in EV disruption could revitalise growth after years of sluggish demand. The CV sector is looking for momentum from infrastructure investments, stable credit availability and government incentives—factors that could spark a healthy uptick in fleet renewals and expansions.

Overall, FADA remains optimistic that market recovery, coupled with strategic OEM support and policy-level clarity, will enable the automotive retail industry to end CY’25 on a robust note.

RELATED ARTICLES

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

07 Jan 2025

07 Jan 2025

11941 Views

11941 Views

Ajit Dalvi

Ajit Dalvi