Ola regains No. 1 e2W title in January, outsells TVS and Bajaj Auto

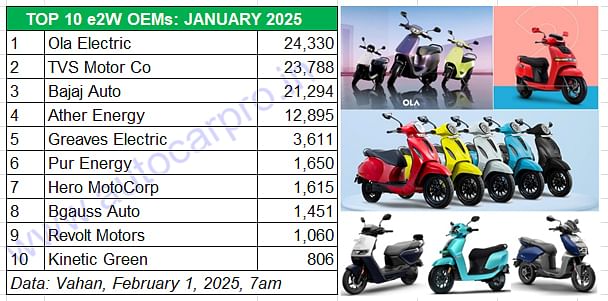

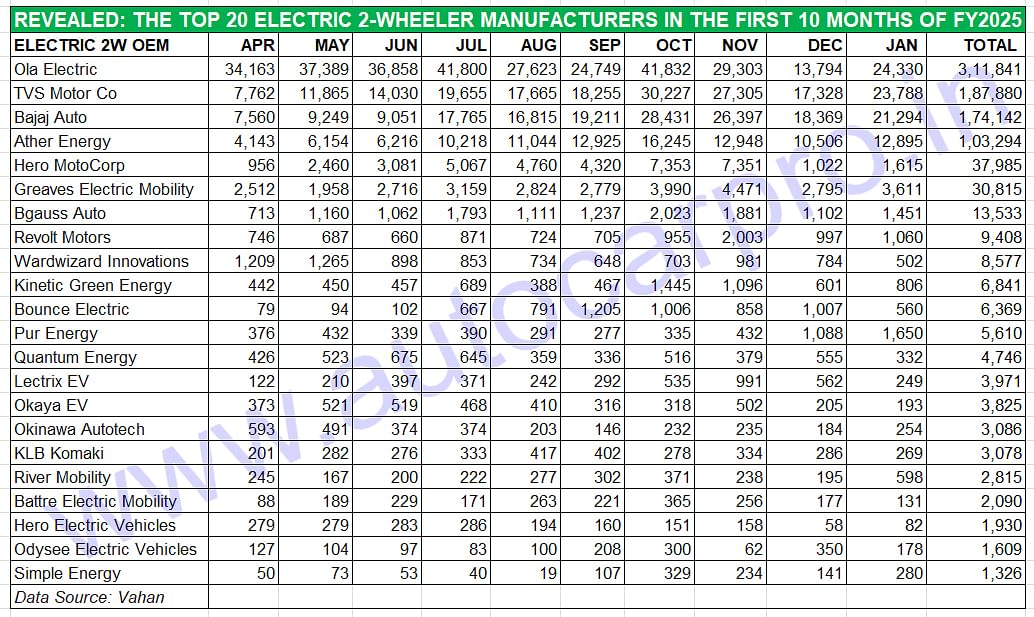

Ola Electric, which had lost its No. 1 rank to Bajaj Auto in December 2024, has bounced back in January. With 24,330 EVs sold, it pipped TVS to the title by 542 units. TVS, which was ahead in each of the first four weeks of the month, sold fewer units compared to Ola in the January 29-31 period. Of the 97,677 e2Ws sold in January, Ola, TVS, Bajaj Auto and Ather Energy command an 84% share.

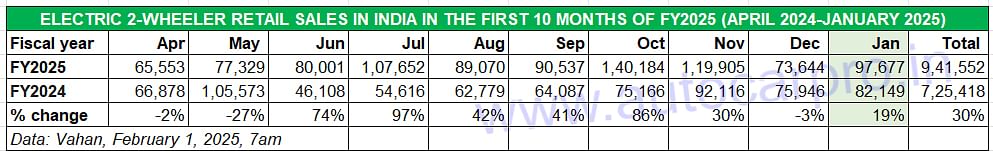

January 2025, which is the first month of the current calendar year and the 10th of the current fiscal year (FY2025) has witnessed retail sales of 97,677 electric two-wheelers, up 19% year on year (January 2024: 82,149 units). This is as per the latest sales data on the Vahan portal (February 1, 2025, 7am). Cumulative sales for the April 2024-January 2025 period at 941,552 units are up 30% YoY (April 2023-January 2024: 725,418 units). The big news though is that Ola Electric is back at the No. 1 position . . . and that’s thanks to strong sales in the last three days of January, helping it pip TVS.

At 945,112 units retailed between April 2024 and January 2025, India e2W Inc is just 3,389 units away from surpassing FY2024’s record sales of 948,501 units.

At 945,112 units retailed between April 2024 and January 2025, India e2W Inc is just 3,389 units away from surpassing FY2024’s record sales of 948,501 units.

January 2025 saw a strong contest between Ola and TVS. Of the 97,677 e2Ws sold in January, Ola, TVS, Bajaj Auto and Ather Energy command an 84% share.

January 2025 saw a strong contest between Ola and TVS. Of the 97,677 e2Ws sold in January, Ola, TVS, Bajaj Auto and Ather Energy command an 84% share.

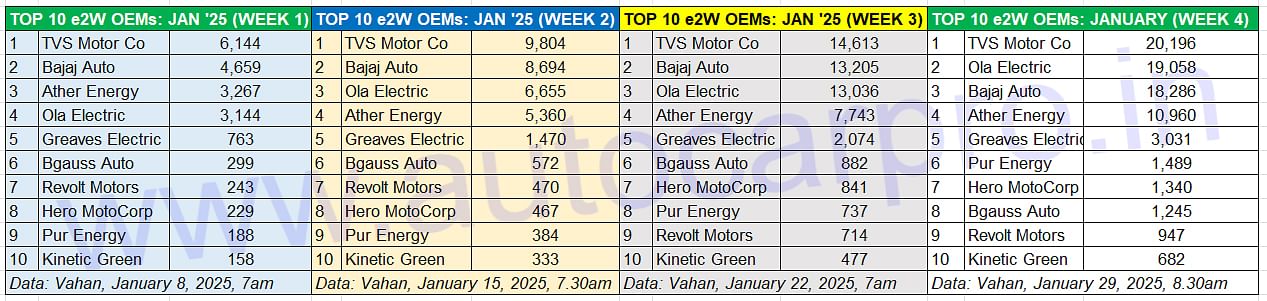

EXCITING WEEKLY BATTLE FOR HONOURS IN JANUARY

It seemed that Ola Electric, which had lost its No. 1 title in December 2024 to Bajaj Auto, was likely to stay No. 2 also in January, given its sales performance in the first four weeks of January 2025. As can be seen in the four-week data tables below, Week 1 saw Ola at No. 4, when it was 3,000 units behind TVS. In Week 2, Ola went past Ather Energy to take No. 3 position and was 3,149 units behind TVS.

Ola Electric was ranked No. 4 in January’s Week 1, No. 3 in Weeks 2 and 3, and No. 2 in Week 4. A late charge in the last 3 days, when it sold an additional 3,598 units, gave it the No. 1 position for the month.

Ola Electric was ranked No. 4 in January’s Week 1, No. 3 in Weeks 2 and 3, and No. 2 in Week 4. A late charge in the last 3 days, when it sold an additional 3,598 units, gave it the No. 1 position for the month.

Week 3 saw it maintain the same rank with the sales gap to TVS at the top being reduced to 1,577 units. Week 4 saw Ola leave Bajaj Auto behind to take second position, 1,138 units behind TVS. Between January 29-31, Ola managed to sell an additional 3,598 units, which helped it go ahead of TVS to take the No. 1 title for the month. TVS, which sold an additional 1,884 iQubes between January 29-31, will have to do better if it is to win the No. 1 tag.

Of the total 97,677 electric scooters, motorcycles and mopeds sold in January, only nine OEMs have registered sales in excess of 1,000 units (see Top 10 data below below). The Top 10 EV OEMs’ combined sales at 92,500 units constitute 94 of total industry sales, with the top four – Ola, TVS, Bajaj and Ather – accounting for 82,307 EVs or 84% of monthly sales. The real battle though is underway with the three podium players — Ola, TVS and Bajaj – each with sales of over 20,000 e-scooters. Let’s take a closer look at the top five EV OEMs in FY2025.

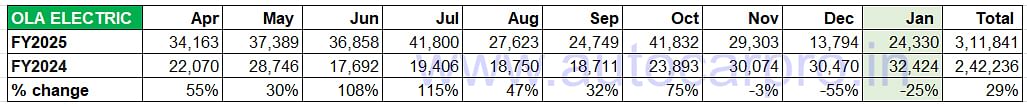

OLA ELECTRIC

OLA ELECTRIC

January 2025: 24,330 units, down 25% YoY / Market share: 25%

FY2025 (first 10 months): 311,841 units, up 29% / Market share: 33% Ola Electric may have regained its No. 1 title for the month but its January retails of 24,330 units are down 25% YoY (January 2024: 32,424 units). Its cumulative 10-month sales of 311,841 units are up 29% YoY but it does not look like Ola will manage to surpass its record CY2024 sales of 407,547 units in the 12 months of FY2025. That’s because quarter on quarter, its numbers have dropped. Compared to Q1 FY2025’s (April-July 2024) 108,410 units, Q2 sales were lower at 94,172 units and Q3 even lower at 84,929 units, dragged down by December’s 13,794 units, down 55% YoY.

Ola Electric may have regained its No. 1 title for the month but its January retails of 24,330 units are down 25% YoY (January 2024: 32,424 units). Its cumulative 10-month sales of 311,841 units are up 29% YoY but it does not look like Ola will manage to surpass its record CY2024 sales of 407,547 units in the 12 months of FY2025. That’s because quarter on quarter, its numbers have dropped. Compared to Q1 FY2025’s (April-July 2024) 108,410 units, Q2 sales were lower at 94,172 units and Q3 even lower at 84,929 units, dragged down by December’s 13,794 units, down 55% YoY.

Ola Electric’s current mass-market S1 X portfolio is available in three battery configurations (2 kWh, 3 kWh, and 4 kWh), and priced at Rs 69,999, Rs 84,999, and Rs 99,999, respectively (ex-showroom Delhi). The company has also recently revised the prices of its S1 Pro, S1 Air, and S1 X+ to Rs 129,999, Rs 1,04,999, and Rs 89,999, respectively.

On January 31, Ola launched its Gen 3 scooters in the form of four models – S1 X, S1 X+, S1 Pro and the new flagship S1 Pro+ – with pricing starting at Rs 79,999 and going up to Rs 170,000. The S1 Air has been discontinued, and the Gen 2 models of the S1 X and S1 Pro will continue to be on sale alongside the Gen 3 scooters at reduced prices.

Expect Ola to up the ante later this year when it starts delivering its new EVs – the S1 Z priced at Rs 59,999 and the S1 Z+ which costs Rs 64,999 and the Ola Gig, a dedicated product for the gig economy, priced at an extremely affordable Rs 39,999, it launched in end-November 2024. Deliveries of the S1 Z, S1 Z+, Gig and Gig1 are slated to begin later this year, around April-May.

Meanwhile, Ola has expanded its network to all of 4,000 stores across India. With 3,200 new stores co-located with service centres, this expansion aims to make Ola’s EVs more accessible across metros, Tier-2, and Tier-3 cities.

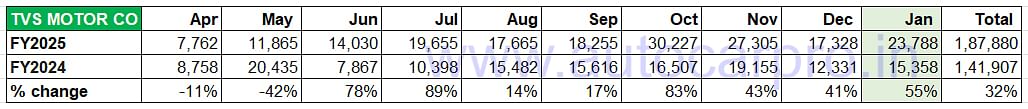

TVS MOTOR CO

TVS MOTOR CO

January 2025: 23,788 units, up 55% YoY / Market share: 24%

FY2025 (first 10 months): 187,880 units, up 32% / Market share: 20% So near, yet so far. This sums up the TVS Motor Co’s near-miss at winning the title of No. 1 electric two-wheeler OEM for January 2025, losing out by just 542 units. With sale of 23,788 units, up 55% YoY (January 2024: 15,358 units), the Chennai-based company, which led the sales chart for the first four weeks from January 1-28, was pipped by Ola only in the last three days of the month.

So near, yet so far. This sums up the TVS Motor Co’s near-miss at winning the title of No. 1 electric two-wheeler OEM for January 2025, losing out by just 542 units. With sale of 23,788 units, up 55% YoY (January 2024: 15,358 units), the Chennai-based company, which led the sales chart for the first four weeks from January 1-28, was pipped by Ola only in the last three days of the month.

Nevertheless, TVS Motor Co is a strong No. 2 in FY2025 with total retails of 187,880 iQubes, up 32% YoY. It will go past the 200,000 sales milestone in February, marking the first time that it has surpassed the 200,000-units sales milestone in a fiscal. In CY2024, TVS sold 220,472 iQubes – will its FY2025 total go beyond this?

With this performance, TVS and the iQube have a market share of 24% in January and 20% for the first 10 months of FY2025. The TVS iQube is available with three battery options – 2.2 kWh, 3.4 kWh and 5.1 kWh. The base variant (2.2kWh), with 75km real-world range and a charging time of 2 hours, 45 minutes from 0-80% with a 950W charger, is the most affordable iQube at Rs 84,999 (ex-showroom Mumbai). This model along with the 3.4 kWh iQube (Rs 119,000 and 100km range) get a 5-inch TFT display with tow and theft alerts and turn-by-turn navigation.

The iQube ST line-up has two variants with 3.4kWh (Rs 138,500) and 5.1kWh (Rs 185,400). While the ST 3.4 variant has a claimed real-world range of 100km, the range-topping ST 5.1 variant has the largest battery capacity of any Indian electric scooter and a real-world range of 150km on a single charge. The iQube ST 5.1 also has a higher 82kph top speed, and the claimed charging time is 4 hours and 18 minutes from 0 to 80 percent.

The company, which has ample manufacturing capacity on hand, is strategically expanding the iQube dealer network. Currently estimated at around 750 touchpoints across India, TVS is increasing the network each month. The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025, plans to roll out a new electric scooter before the end of FY2025.

It will be among the moves that TVS, which the longstanding No. 2 OEM in this segment and currently engaged in a fierce battle with Bajaj Auto, to protect its turf. Bajaj Auto had gone ahead of TVS in two of the past 10 months – September and December.

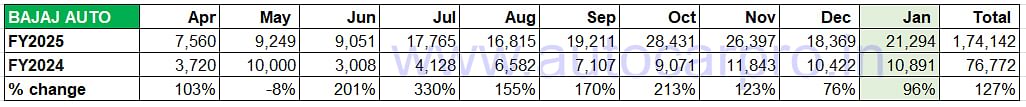

BAJAJ AUTO

BAJAJ AUTO

January 2025: 21,294 units, up 96% YoY / Market share: 22%

FY2025 (first 10 months): 174,142 units, up 127% / Market share: 18.50% Bajaj Auto’s Chetak, which took the No. 1 e2W title in December 2024, is back to No. 3 position in January 2025, what with a resurgent Ola claiming its numero uno rank and TVS also surpassing it. Growth continues to be strong for the Pune-based company and January’s 21,294 units are up 96% on year-ago sales (January 2024: 10,891 units).

Bajaj Auto’s Chetak, which took the No. 1 e2W title in December 2024, is back to No. 3 position in January 2025, what with a resurgent Ola claiming its numero uno rank and TVS also surpassing it. Growth continues to be strong for the Pune-based company and January’s 21,294 units are up 96% on year-ago sales (January 2024: 10,891 units).

This gives the Bajaj Chetak a monthly market share of 22% and, with cumulative 10-month sales of 174,142, the current FY2025 share is 18.50 percent.

In CY2024, Bajaj Auto clocked best-ever annual retail sales of 193,439 Chetaks and 169% YoY growth (CY2023: 71,941 units). Given the current momentum it is witnessing, expect the Chetak to sell another 45,000 to 50,000 units in February and March 2025, which would mean total FY2025 sales in the region of 220,000 units and a new fiscal-year high.

On December 20, Bajaj Auto expanded its Chetak model portfolio with the launch of the new 35 Series which comprises three variants: 3501 (Rs 127,000), 3502 (Rs 120,000) and 3503 and offers a higher range of 153km.

Bajaj Auto’s speedy rate of growth is helping it to close the gap annually with TVS, which is the longstanding No. 2 OEM. This is a result of strong consumer demand for the Chetak, ramped-up production and an expanded Chetak retail sales network.

In CY2025, like Ola which is targeted the gig-worker market with its affordable Gig e-scooter, Bajaj Auto has plans to introduce specially designed EVs for gig workers. "Gig workers don't want a vehicle that shows them as gig workers – they want a family vehicle. We will have Chetak models which will be used for delivery but they will be designed recognising the fact that gig workers need a family vehicle," said Rakesh Sharma, executive director, Bajaj Auto, at a round table in Pune after the unveiling of the Chetak 35 series.

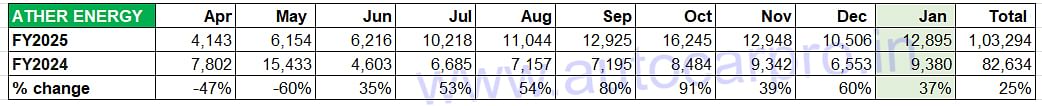

ATHER ENERGY

ATHER ENERGY

January 2025: 12,895 units, up 37% YoY / Market share: 13%

FY2025 (first 10 months): 103,294 units, up 25% / Market share: 11% Smart e-scooter maker Ather Energy, ranked No. 4, completes the quartet of OEMs to sell over 100,000 units in the fiscal to date. Like Ola, TVS and Bajaj, Ather too achieved its best-ever annual sales last year. The company, whose best month was March 2024 (17,429 units), saw sales decline sharply in May and June but returned to five-figure retails from July onwards (see retail sales data above).

Smart e-scooter maker Ather Energy, ranked No. 4, completes the quartet of OEMs to sell over 100,000 units in the fiscal to date. Like Ola, TVS and Bajaj, Ather too achieved its best-ever annual sales last year. The company, whose best month was March 2024 (17,429 units), saw sales decline sharply in May and June but returned to five-figure retails from July onwards (see retail sales data above).

In January, Ather sold 12,895 units, up 37% YoY (January 2024: 9,380 units). Its cumulative 10-month retails at 103,294 units are up 25% YoY and give the company a market share of 11 percent. The Rizta family e-scooter launched in April 2024 at a starting price of Rs 109,999 (Rizta S) through to Rs 149,999 (Rizta Z) is witnessing growing customer acceptance. While the S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. The Rizta’s highlights include the largest two-wheeler seat in India and storage space aplenty. The Ather Rizta recently bagged Autocar India’s Electric Two-Wheeler of the Year 2025 award.

In an effort to rev up demand for its products, Ather is undertaking new customer-friendly initiatives. In October 2024, it launched Ather Care Service plans which offer free periodic maintenance, discounts on wear-and-tear part replacements, and value-added services such as ExpressCare and polishing.

On November 22, Ather Energy introduced ‘Eight70 Warranty’ for its 450 series and Rizta e-scooters, in collaboration with Reliance General Insurance. This addresses customers’ concerns regarding long-term battery health, performance and replacement costs by providing a host of benefits including coverage for up to 8 years or 80,000km, 70% battery health assurance, full coverage against manufacturing defects and failures; no upper limit on claim amounts, and no claim rejection due to deep discharge of battery cells when the scooter is left uncharged or in an idle state over an extended period of time.

Greaves Electric Mobiilty is seeing demand grow for its new Nexus e-scooter.

Greaves Electric Mobiilty is seeing demand grow for its new Nexus e-scooter.

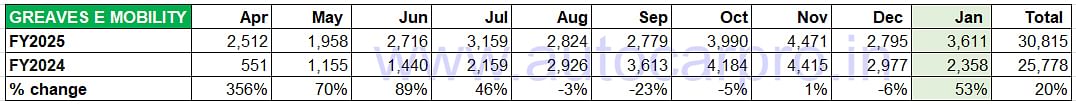

GREAVES ELECTRIC MOBILITY

January 2025: 3,611 units, up 53% YoY / Market share: 3.69%

FY2025 (first 10 months): 30,815 units, up 20% / Market share: 3.27% Greaves Electric Mobility (GEM), which currently has a six-model portfolio of e-scooters comprising the Nexus (pictured above), Primus, Magnus LT/EX (100km+ range), Ampere Magnus Special, entry level Rio Li/La Plus and Zeal EX, sold 3,611 units in January 2025 (up 53% YoY). This performance gives it a market share of 3.69% for the month and fifth rank after Ather. GEM’s cumulative 10-month retails at 30,815 units are up 20% YoY and give it a 3.27% market share.

Greaves Electric Mobility (GEM), which currently has a six-model portfolio of e-scooters comprising the Nexus (pictured above), Primus, Magnus LT/EX (100km+ range), Ampere Magnus Special, entry level Rio Li/La Plus and Zeal EX, sold 3,611 units in January 2025 (up 53% YoY). This performance gives it a market share of 3.69% for the month and fifth rank after Ather. GEM’s cumulative 10-month retails at 30,815 units are up 20% YoY and give it a 3.27% market share.

GEM’s newest product – the Ampere Nexus launched in end-April – seems to be the key driver of this growth, which has been confirmed by the management. In an investor conference call on November 7, 2024, K Vijaya Kumar, Executive Director and CEO, Greaves Cotton said: “We are registering very robust growth month-on-month, quarter-on-quarter primarily based on our new product. The Nexus, which we launched two quarters before is doing very well.”

Targeted at families, the Ampere Nexus has been designed and developed in-house at the Ranipet facility in Tamil Nadu. Equipped with a 3 kWH LFP battery, the Nexus has a claimed top speed of 93kph and a certified range of 136km. Sold in two variants, prices start at Rs 110,000 (ex-showroom) and go up to Rs 120,000.

GEM’s parent company Greaves Cotton, which has embarked on a strategic growth mission, is seeing GEM, its electric mobility division, deliver impressive results, generating revenues of Rs 175 crore in Q2 FY2025 and Rs 302 crore in H1 FY2025. This growth has been enabled by a focused approach on new product launches and a defined path toward profitability. GEM’s current e-two-wheeler sales and service network across India includes over 400 sales and service points.

Greaves Cotton, which also has a presence in the electric three-wheeler market under the Ele, Greaves and Electra brands, is looking to up the ante in the EV world. The company has announced plans to list its EV arm – Greaves Electric Mobility – in CY2025. The aim is to raise Rs 1,000 crore through a fresh issue of shares. Around Rs 83 crore will be invested in setting up an in-house battery pack assembly plant at its Ranipet plant in Tamil Nadu, which went on stream in November 2021.

HERO MOTOCORP

HERO MOTOCORP

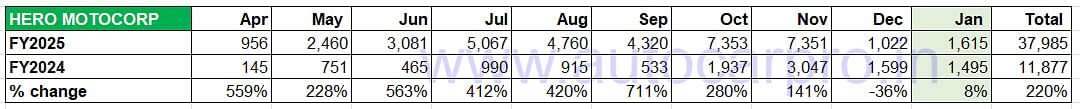

January 2025: 1,615 units, up 8% YoY / Market share: 1.65%

FY2025 (first 10 months): 37,985 units, up 220% / Market share: 4% Hero MotoCorp’s January 2025’s retails at 1,615 Vida e-scooters make for 8% YoY sales growth (January 2024: 1,495 units) and they come on the back of a poor performance in December (1,022 units, down 36%). October (7,353 units) and November (7,351 units) have been the best months for Vida EV retails in the fiscal year to date.

Hero MotoCorp’s January 2025’s retails at 1,615 Vida e-scooters make for 8% YoY sales growth (January 2024: 1,495 units) and they come on the back of a poor performance in December (1,022 units, down 36%). October (7,353 units) and November (7,351 units) have been the best months for Vida EV retails in the fiscal year to date.

In early December Hero MotoCorp expanded its EV portfolio with the launch of the new Vida V2. The Vida 2 is essentially an evolution of the V1 range that the world’s largest ICE two-wheeler began its electric mobility journey in October 2022. The Vida V2 is available in three variants: Lite (Rs 96,000), Plus (Rs 115,000) and Pro (Rs 135,000). The most affordable V2 Lite is an entirely new variant and comes with a small 2.2kWh battery pack that has a claimed 94km IDC range. It also has a lower 69kph top speed compared to the Plus and Pro variants, which have top speeds of 85kph and 90kph, respectively. Only two riding modes are available on the V2 Lite – Ride and Eco – but the rest of the feature-set is very similar to the other two, including the 7-inch touchscreen TFT display.

Hero MotoCorp has started scaling up brand presence for Vida and its network now stands at 203 touchpoints comprising 180 dealers across 116 cities. The company, which has the V1 Plus and V1 Pro EVs, plans to expand its portfolio – within the mid- and affordable segment – within FY2025. And it already has around 2,500 charging stations in collaboration with Ather Energy, in which Hero MotoCorp is an early investor.

GROWTH OUTLOOK FOR FY2025: EXCITING

GROWTH OUTLOOK FOR FY2025: EXCITING

With just two months left for FY2025 to come to a close, the electric two-wheeler industry, which is the biggest sales volume provider for India EV Inc, will cross a million units for the first time in a fiscal soon. At 941,552 units retailed between April 2024 and January 2025, it is just 6,949 units away from surpassing FY2024’s record sales of 948,501 units, which was an increase of 30% YoY (FY2023: 728,215 e2Ws).

There’s plenty for electric two-wheeler buyers to look forward to in CY2025. Not only has the market leader Ola rolled out new models, but the two legacy Japanese OEMs operating in India have also entered the market.

Honda Motorcycle & Scooter India has launched the Activa E (with swappable battery and primarily for personal commute) and QC1 (fixed battery). The Activa e, which has two variants – standard (Rs 117,000) and RoadSync Duo (Rs 152,000) – has a 102km claimed IDC range, go from 0-60kph in 7.3 seconds and has an 80kph top speed. The QC1, Honda’s more budget-friendly EV, is priced at Rs 90,000 and is the most affordable Japanese electric scooter in India. It has a claimed top speed of 50kph, does the 0-40kph in 9.7 seconds and delivers a claimed IDC range of 80km. It’s early days yet for Honda but the Japanese major, which is the scooter market leader, has plans to lead the e2W market and has revealed plans to set up an electric motorcycle plant in India by 2028.

Suzuki Motorcycle India has plugged in with the new e-Access, the electric avatar of the popular Access 125cc petrol scooter. The Suzuki e-Access is powered by a fixed 3.07kWh LFP battery and the company claims a 95km IDC range. This battery pack powers a swingarm-mounted motor making 4.1kW and 15Nm propelling the e-Access to a 71kph claimed top speed.

Clearly, there’s plenty of exciting action in this segment of zero-emission mobility. Stay plugged in as we bring you the latest reports and in-depth number-crunching analyses.

ALSO READ: TVS exports 4,063 BMW CE 02 and 896 iQube electric scooters in April-December

TVS iQube and Bajaj Chetak in India’s Top 10 scooters for April-December

Honda and Suzuki join legacy OEMs TVS, Bajaj, and Hero in electric 2-wheeler race

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

01 Feb 2025

01 Feb 2025

32506 Views

32506 Views

Ajit Dalvi

Ajit Dalvi