Bajaj Chetak outsells Ola and TVS to become India’s No. 1 e2W OEM in December

With retail sales of 18,276 units and a market share of 25% in December 2024, the Bajaj Chetak has topped India’s e-two-wheeler rankings for the first time since its launch. The TVS iQube with 17,212 units and a 23% share maintains its No. 2 position while Ola, with 13,769 units and a 19% share, is third, followed by Ather Energy and Greaves Electric Mobility.

Five years after it was launched in January 2020, the Bajaj Chetak has taken the No. 1 electric two-wheeler title for the first time, for a single month, in December 2024. The Chetak’s total retails of 18,276 units translate into a market share of 25% specific to the 73,316 e-two-wheelers sold in India in the last month of CY204. In the process, Bajaj Auto clocked cumulative sales of 193,439 units, up 169% YoY in CY2024, missing the 200,000 milestone by 6,561 units.

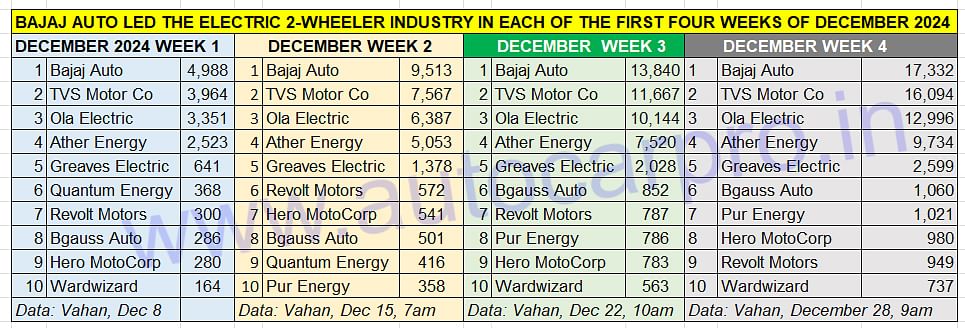

The Bajaj Chetak held onto its lead in each of the four weeks of December 2024 and the last three days of the month to clock sales of18,276 units.

The Bajaj Chetak held onto its lead in each of the four weeks of December 2024 and the last three days of the month to clock sales of18,276 units.

As can be gleaned from the retail sales data for the first four weeks of December (depicted above), Bajaj Auto, which launched the new Chetak with enhanced 153km range on December 19, led the field throughout the month. As the comparative four-week data table (shown above) reveals, the Chetak has topped for three straight weeks – Week 1 (4,988 units, 28% share), Week 2 (9,513 units, 27% share), Week 3 (13,840 units, 26% share) and Week 4 (17,332 units, 25% share). And the lead continued in the last three days of December.

However, when it comes to cumulative 12-month sales, Bajaj Auto with 193,439 units stays put at No. 3 position. Ola Electric, being the first Indian EV maker to surpass 400,000 sales in a calendar year, is way ahead with 407,547 units and TVS Motor Co, which sold 220,472 iQubes, is also ahead of the Pune-based ICE and EV maker albeit the sales gap between the iQube and Chetak has reduced substantially from 94,639 units in CY2023 to 27,033 units in CY2024. The intense battle between the two OEMs will continue in CY2025.

TVS Motor Co, which sold 17,212 units in December for a market share of 23%, maintains its No. 2 position for the month, ahead of Ola by 3,443 units. The iQube’s best sales month ever since its launch in January 2020 has been October 2024 (30,180 units). Total sales in CY2024 were 220,472, units up 32% YoY (CY2023: 166,580 units).

Ola Electric, which has been the No. 3 e2W OEM for all of December, clocked total retails of 13,769 units between December 1-31 (down 55% YoY), which gives it a 19% market share for last month. Ola had opened CY2024 with 32,424 units (up 77%) in January, hit a high of 53,643 units in March (up 150%) and maintained stellar month-on-month growth right from April through to July until the sharp drop in August (27,623 units) and September (24,748 units). It bounced back in October (41,817 units) but sales fell 30% month on month in November (29,252 units). Ola, nevertheless, remains the No. 1 e2W OEM in India for CY2024 with total sales of 407,547 units, up 52% YoY, and a yawning distance away from its nest two rivals – TVS and Bajaj Auto.

Expect Ola Electric, which launched two new products in November – the S1 Z priced at Rs 59,999 and the S1 Z+ which costs Rs 64,999 – as well as the Ola Gig, a dedicated product for the gig economy, priced at an extremely affordable Rs 39,999, to see a strong 2025. Deliveries of the S1 Z, S1 Z+, Gig and Gig1 are slated to begin only next year, around April-May.

Ather Energy, whose EV portfolio comprises the Rizta, 450S and 450 Apex e-scooters, maintained its No. 4 rank in December with a total of 10,421 units which gives it a 14% market share for the month. Cumulative retails from January till December are 126,165 units. The Rizta family e-scooter, launched in April and the winner of Autocar India’s Electric Two-Wheeler of 2025 Award, is witnessing growing demand. While the S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. The Rizta’s highlights include the largest two-wheeler seat in India and storage space aplenty.

Greaves Electric Mobility, which is seeing growing traction for its Nexus e-scooter, is ranked fifth with 2,795 units, which gives the company a 3.81% market share. While the rankings from No. 1 to No.5 remain unchanged, the next five rankings have changed in the past three weeks.

Bgauss Auto, which was ranked eighth in December Week 1 and Week 2, has moved up to No. 6 in with 1,100 units.

Pur Energy, which was not in the Top 10 OEMs in Week 1, was 10th in Week 2 and No. 8 in Week 3, has wrapped up December as the No. 7 with 1,087 units.

Bounce Electric, which was not in the Top 10 OEM chart for the first three weeks of December, has bounced into the final Top 10 with a strong showing late in the month. The company sold a total of 1,007 units which gives it eighth rank.

Electric motorcycle maker Revolt Motors (994 units) which was No. 7 in Week 1, No. 6 in Week 2, and No. 7 position in Week 3, dropped two ranks to be No. 9. Revolt is seeing strong demand coming its way, particularly after the launch of the RV1 and RV1+ and clocked 2,000 sales (up 197% YoY) in November. Revolt Motors, which sold a total of 9,951 units in CY2024, is currently the best-selling e-motorcycle OEM in India

Wardwizard Innovations wraps up the Top 10s for December 2024 with 784 units.

The Indian electric two-wheeler industry has had a good year in 2024. Of the total 1.94 million EVs sold across vehicle segments in India in CY2024 (up 27% YoY), electric scooters and motorcycles accounted for 1.14 million units (11,48,415) or a 59% share – up from the 56% share it had in CY2023 – registering strong double-digit growth of 33% (CY2023: 860,418 units, up 36% YoY).

With each of the Top 5 OEMs – Ola Electric, TVS Motor Co, Bajaj Auto, Ather Energy and Greaves Electric Mobility – comfortably surpassing their CY2023 sales, this was only expected.

ALSO READ: E2W sales jump 33% to 1.14 million units and 59% of India EV market in CY2024

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

01 Jan 2025

01 Jan 2025

27141 Views

27141 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau