Revolt Motors sells nearly 10,000 electric motorcycles in CY2024

New Delhi-based electric motorcycle maker sees resurgence in demand after the launch of two new models – the RV1 and RV1+ ‘commuter’ EVs – which are aimed at drawing buyers from the volume-driven, fuel-sipping, price-sensitive, entry level petrol-engine commuter motorcycle segment.

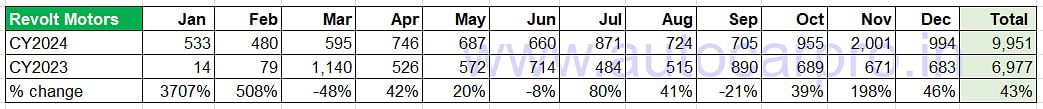

If electric scooters accounted for the bulk of the 1.14 million electric two-wheelers sold in India in CY2024, then the share of New Delhi-based electric motorcycle manufacturer Revolt Motors (9,951 units, up 43% YoY) seems minuscule at 0.86 percent. But when Revolt Motors’ performance is viewed from the perspective of a pure electric motorcycle OEM, then the perception changes.

As per Vahan data (January 1, 2025, 7am), Revolt has sold a total of 9,951 zero-emission motorcycles, making it the OEM with the highest sales in this sub-segment of the e-two-wheeler industry. The TVS Motor-backed Ultraviolette, which markets the F77 Mach 2 performance e-motorcycle, is the No. 2 e-motorcycle OEM in India with sales of 405 units in CY2024.

After the launch of the RV1 and RV1+ ‘commuter’ EVs in end-September, sales have risen sharply for Revolt. November 2,001 units are its best monthly sales yet.

After the launch of the RV1 and RV1+ ‘commuter’ EVs in end-September, sales have risen sharply for Revolt. November 2,001 units are its best monthly sales yet.

Revolt can be counted as one of the success stories of CY2024 and a revival of sorts for the company, which is one of the few electric motorcycle manufacturers in India. The company, which earlier had only the 4.1kW RV400 priced at Rs 116,800 (on-road Mumbai) and the RV400 BRZ, expanded its portfolio with the launch of the RV1 and RV1+ ‘commuter’ electric motorcycles, priced at Rs 84,990 and Rs 99,990 respectively in September. The RV1 comes with two battery options – 2.2 kWh battery offering up to 100km range, and a 3.24 kWh battery with 160km range.

With rising petrol prices (currently at Rs 103.49 a litre in Mumbai), and a growing transition to electric two-wheelers in India, Revolt Motors believes the RV1 and RV1+ have the potential to disrupt the commuter-motorcycle segment with the promise of lower TCO (total cost of ownership), modern technology, and the convenience of a stress-free, gearless commute.

The Revolt RV1 and RV1+ feature a host of modern features, including LED headlight and tail-lights, a 6-inch digital backlit LCD display, as well as a built-in under-seat storage for the charger. While the RV1 offers a range of 100km with its 2.2kWh battery, the RV1+ gets a claimed range of 160km with a bigger 3.24kWh battery pack. While the RV1 takes 2 hours and 15 minutes to recharge from 0-80%, the RV1+ requires 3.5 hours and supports fast-charging as well with a 0-80% recharge time of only 80 minutes. Revolt Motors offers a 5-year, 75,000km warranty on the detachable battery and 2-year warranty on the standard charger supplied with the motorcycles.

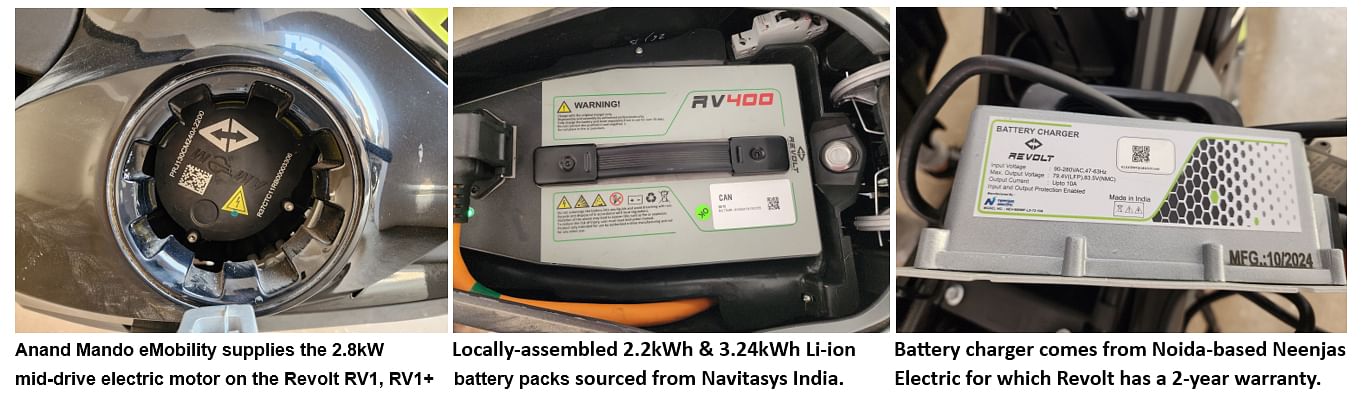

What has helped Revolt’s pricing strategy is the higher level of localisation, a mantra which most EV makers have adopted in their quest for increased affordability. Most components, including the switchgear, chassis, tyres, and lights are localised on the Revolt RV1 and RV1+.

Furthermore, even the electric drivetrain components are localised, thereby enabling the company to achieve a competitive price tag. While the 2.8kW mid-drive electric motor is being locally manufactured and supplied by Anand Group’s EV drivetrain joint venture – Anand Mando eMobility, the lithium-ion battery pack and BMS are locally assembled by Navitasys India at Bawal, Haryana. And the battery charger on the Revolt RV1 and RV1+ is manufactured by the Noida-headquartered Neenjas Electric.

Strategic move to target entry level ICE bikes pays dividends

The strategy to pit the RV1 and RV1+ against the volume-driven, fuel-sipping, price-sensitive, entry level petrol-engine commuter motorcycle segment seems to have succeeded. The company received over 16,000 bookings for the two new zero-emission bikes in the first weeks of bookings. And, as the CY2024 retail sales data table above shows, monthly sales have taken off since October.

Revolt Motors has been aggressively expanding its dealership network across India and aims to improve accessibility to its products in urban and semi-urban areas. The company’s dealer network currently stands at 168 including 14 new ones in cities such as Hubli (Karnataka), Muzaffarpur (Bihar), Katihar (Bihar), Maheshkhunt (Bihar), Khagaria (Bihar), Nawanshahr (Punjab), Kannauj (UP), Satara (Maharashtra), Sattur (Tamil Nadu), Mayiladuthurai (Tamil Nadu), Bhilwara (Rajasthan), Warangal (Telangana), Balasore (Odhisa), and Bulandshahr (Uttar Pradesh).

Revolt's OEM ranking improves to No. 10 from 14 in CY2023

Revolt’s CY2024 retails at 9,951 units are a strong 43% YoY increase (CY2023: 6,977 units) which translates into an additional 2,974 bikes sold last year. This performance, which gives it a 0.86% share of the overall e2W market, has ensured that the company has moved up in the e2W OEM rankings to No. 10 from No. 14 in CY2023.

However, CY2024’s retails are not its best annual sales numbers. Revolt’s best annual sales came in CY2022 when it had sold 14,910 units and had a 2.36% market share of the 631,397 electric two-wheelers sold that year.

In CY2025, Revolt will face new competition from both Hero MotoCorp as well as Ola, which have confirmed plans to enter this sub-segment. Hero MotoCorp and its partner Zero Motorcycles will launch their middleweight electric bike albeit it is a premium model. The collaboration essentially combines the expertise of Zero Motorcycles in developing powertrains and electric motorcycles with the scale of manufacturing, sourcing and marketing prowess of Hero MotoCorp. The Hero-Zero EV platform will spawn four products – two high-performance motorcycles and two mid- to high-performance.

E-two-wheeler market leader Ola will also enter this segment with its first electric motorcycle. Last year, the company had showcased four concepts.

(With inputs from Mayank Dhingra)

ALSO READ:

E2W sales jump 33% to 1.14 million units and 59% of India EV market in CY2024

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

01 Jan 2025

01 Jan 2025

13011 Views

13011 Views

Shahkar Abidi

Shahkar Abidi