Ola sells 29,000 EVs in November, stiff TVS-Bajaj battle continues, Revolt sells 2,000 bikes

Indian electric two-wheeler OEMs register retail sales of nearly 119,000 units and 29% YoY growth in November which takes cumulative 11-month sales to 1.07 million units. While Ola Electric maintains leadership, its market share has fallen to 25%. Separated by just 800 units, the fierce battle between the TVS iQube and Bajaj Chetak continues. Electric motorcycle maker Revolt Motors sees 200% jump in consumer demand for its products. Top 25 e2W OEMs sales numbers revealed.

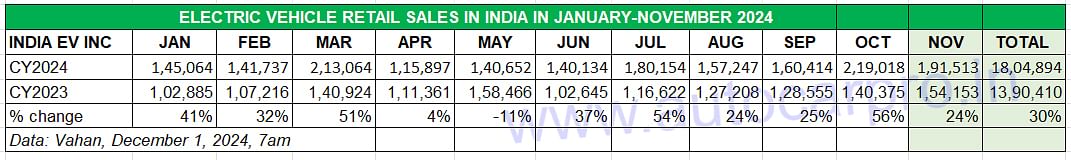

The Indian electric two-wheeler industry, which raced past the 10-lakh or one-million-units milestone for the first time in a calendar year early in November 2024, has seen a good November. Historically, retail sales witness a sizeable drop after a festive month like October but with 191,513 units (up 24% YoY), November 2024 has delivered the third best monthly numbers in the first 11 months of the current year. The festival-laden October 2024 (219,018 units) is the topper, followed by the FAME II subsidy-ending month of March 2024 (141,737 units) and then November 2024 (191,513 units) as detailed in the India EV Inc retail sales data table below.

India EV Inc's November sales of 191,513 units are up 24% YoY and constitute the third-best month after October (219,018 units) and March (213,064 units). e2W retails of 118,924 units (up 29%) account for a 62% share of total EV sales.

India EV Inc's November sales of 191,513 units are up 24% YoY and constitute the third-best month after October (219,018 units) and March (213,064 units). e2W retails of 118,924 units (up 29%) account for a 62% share of total EV sales.

What helped keep the momentum going in November was the fact that the month opened with the Diwali festival and also had ‘Bhai Dooj’ in the first week. As per the latest Vahan retail sales data (as of December 1, 2024, at 7am), the overall Indian EV industry with 191,513 units accounted for 6% of total Indian automobile retails of 32,12,301 or 3.21 million units. From the cumulative first-11-months’ perspective, EVs across all segments at 18,04,894 units or 1.80 million units account for a 7.39% share of total automobile retails of 2,43,96,022 units or 24.39 million units.

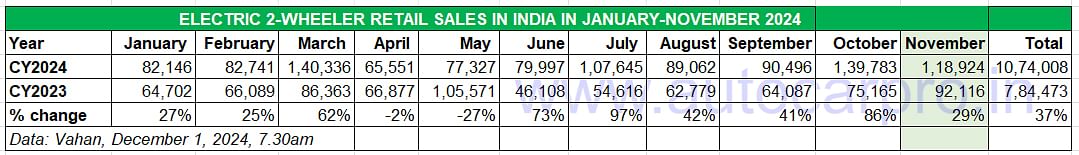

At 118,924 units and 29% YoY growth in November 2024, the electric two-wheeler segment, which is the biggest volume driver of the India EV Inc, accounted for 62% of total India EV Inc's volumes of 191,513 units last month. And, for the January-November 2024 period, cumulative e2W sales of 10,74,008 units (up 37% YoY) make for a 60% share of entire EV industry sales. Clearly, this segment is a mover and shaker, which is reason enough to dig deep into how the key players have fared last month and also in the first 11 months of CY2024.

In November, e2W retails of 118,924 units were up 29% YoY, accounted for 62% of India EV Inc’s volumes of 191,513 units, and helped this segment surpass the million milestone for the first time in a calendar year.

In November, e2W retails of 118,924 units were up 29% YoY, accounted for 62% of India EV Inc’s volumes of 191,513 units, and helped this segment surpass the million milestone for the first time in a calendar year.

As per the latest retail sales data on the Vahan website (December 1, 2024, 7am), cumulative e2W sales from January 1 to November 30 at 10,74,008 units are a robust 37% YoY increase (January-November 2023: 784,473 units).

November 2024 numbers are to be seen in the context of the reduced subsidy offered in the PM E-Drive Scheme, which subsumes the EMPS and opened on October 1. This scheme has an outlay of Rs 10,900 crore over a two-year period with subsidy / demand incentives worth Rs 3,679 crore aimed at supporting 24.79 lakh e-two-wheelers, 316,000 e-three-wheelers, and 14,028 electric buses. Passenger vehicles have been left out of the ambit of the PM E-Drive Scheme which runs from October 1, 2024 through to March 31, 2026. Despite the reduced subsidy, e-two-wheeler buyers continue to be drawn by the prospect of lower cost of ownership compared to petrol-powered machines, enhanced product choice and also availability of customised financing.

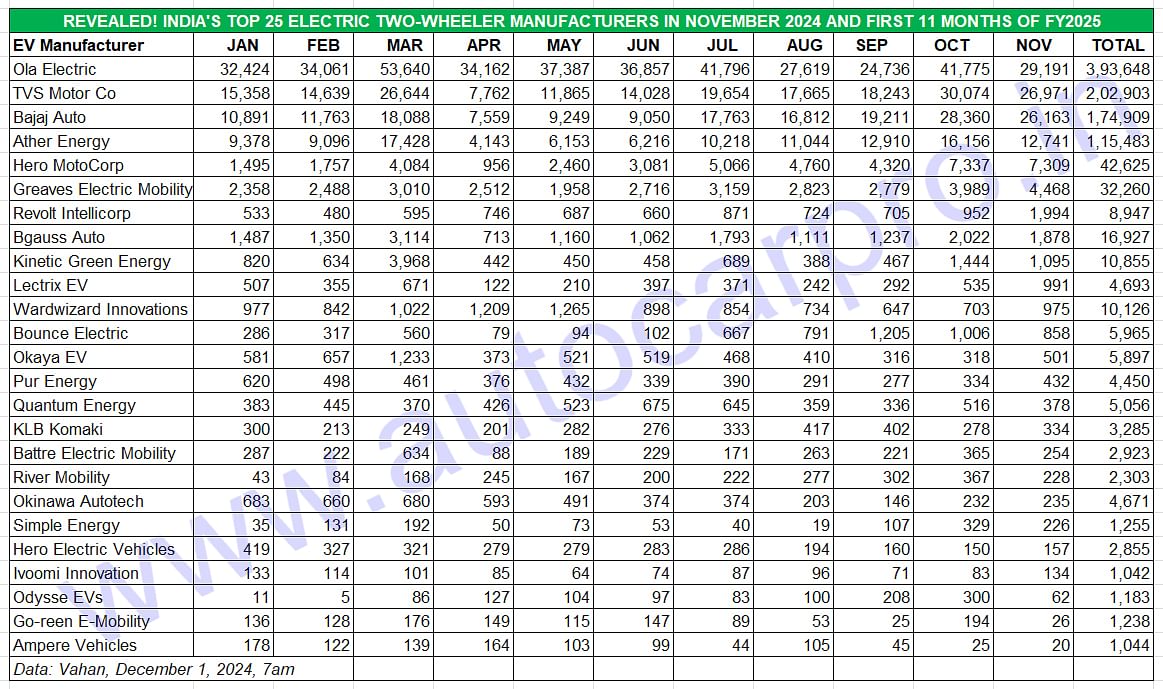

Of the 210-odd players in this sub-segment of the EV industry, the top four – Ola Electric, TVS Motor Co, Bajaj Auto and Ather Energy – have each registered six-figure retails in the first 11 months of this year, resulting in strong market shares. Meanwhile, Hero MotoCorp, Greaves Electric Mobility, Revolt Motors, Bgauss Auto and Kinetic Green are also making their presence felt in the sector. Here’s taking a closer look at the top six OEMs, who are the movers and shakers of the Indian e-two-wheeler industry.

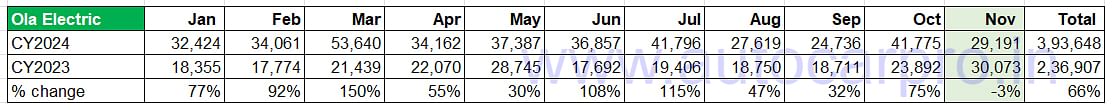

OLA ELECTRIC – November 2024: 29,191 units, down -3% YoY

OLA ELECTRIC – November 2024: 29,191 units, down -3% YoY

Market share: November 2024 – 24.54% / November 2023 market share: 33%

Jan-Oct 2024: 393,648 units, up 66% YoY (Jan-Nov 2023: 236,907 units), CY2023: 267,376 units Ola Electric, which grabbed the headlines in end-November with the launch of two new products – the S1 Z priced at Rs 59,999 and the S1 Z+ which costs Rs 64,999 – as well as the Ola Gig, a dedicated product for the gig economy, priced at an extremely affordable Rs 39,999, registered retail sales of 29,191 units in November, down 3% YoY (November 2023: 30,073 units) and down 30% month on month (October 2024: 41,775 units). Deliveries of the S1 Z, S1 Z+, Gig and Gig1 are slated to begin only next year, around April-May.

Ola Electric, which grabbed the headlines in end-November with the launch of two new products – the S1 Z priced at Rs 59,999 and the S1 Z+ which costs Rs 64,999 – as well as the Ola Gig, a dedicated product for the gig economy, priced at an extremely affordable Rs 39,999, registered retail sales of 29,191 units in November, down 3% YoY (November 2023: 30,073 units) and down 30% month on month (October 2024: 41,775 units). Deliveries of the S1 Z, S1 Z+, Gig and Gig1 are slated to begin only next year, around April-May.

Ola’s November retails take its cumulative 11-month total this year to 393,648 units, up by a strong 66% YoY, and ensures that the company will become the first Indian EV maker to sell 400,000 units in a single calendar year and will achieve this record milestone in the first week of December. In September, Ola became the first Indian EV OEM to surpass 300,000 unit sales in a calendar year.

Ola had opened CY2024 with 32,424 units (up 77%) in January, hit a high of 53,640 units in March (up 150%) and maintained stellar month-on-month growth right from April through to July until the sharp drop in August and September. Ola’s sales decline in August and September were attributed to be related to a large number of customer complaints about service deficiencies. However, following the recently listed company’s assurance that it had addressed 99.1% of the complaints to the satisfaction of its customers through its redressal mechanism, sales saw a strong revival in festive October to 41,775 units (up 75%).

In terms of market share, Ola, which had hit a low of 27% in September – down by 11 percentage points from the 38% it commanded in March 2024 and July 2024 – regained some momentum in October with 30% but has dropped to 24.54% in November. In terms of cumulative sales, Ola remains well ahead of the competition – in fact there a yawning gap. Its January-November 2024 sales (393,648 units, up 6% YoY) give it an overall market share of 37% YTD CY2024, up from 30% in the year-ago period.

Ola Electric’s mass-market S1 X portfolio is available in three battery configurations (2 kWh, 3 kWh, and 4 kWh), and priced at Rs 69,999, Rs 84,999, and Rs 99,999, respectively. The company has also recently revised the prices of its S1 Pro, S1 Air, and S1 X+ to Rs 129,999, Rs 1,04,999, and Rs 89,999, respectively.

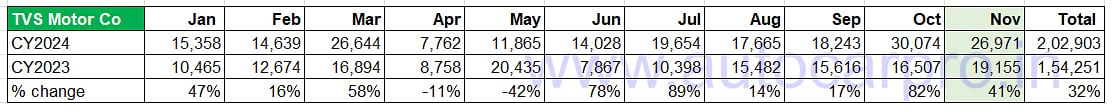

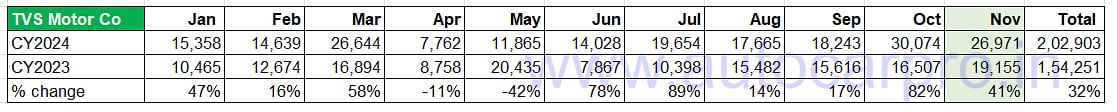

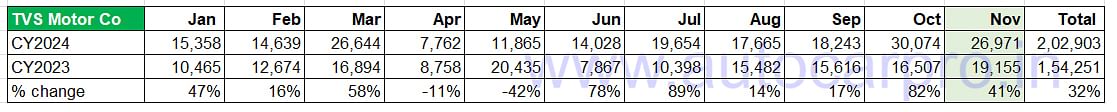

TVS MOTOR CO – November 2024: 26,971 units, up 41% YoY

TVS MOTOR CO – November 2024: 26,971 units, up 41% YoY

Market share: November 2024 – 23% / November 2023 – 21%

Jan-Nov 2024: 202,903 units, up 32% YoY (Jan-Nov 2023: 154,251 units), CY2023: 166,581 units

TVS Motor Co, which had dispatched a record 29,308 iQubes to its dealers in October and 28,564 units in September, to ensure its showrooms were well stocked in the festive month and beyond, sold 26,971 units in November 2024, up 41% YoY. This gives it a market share of 23% for last month and 19% for the January-November 2024 period with cumulative retails of 202,903 units, up 32% YoY.

TVS Motor Co, which had dispatched a record 29,308 iQubes to its dealers in October and 28,564 units in September, to ensure its showrooms were well stocked in the festive month and beyond, sold 26,971 units in November 2024, up 41% YoY. This gives it a market share of 23% for last month and 19% for the January-November 2024 period with cumulative retails of 202,903 units, up 32% YoY.

The iQube’s November sales also mean that TVS has become the second Indian e-two-wheeler OEM, after Ola, to surpass the 200,000-units sales milestone in a single calendar year, with one more month to go in 2024.

The TVS iQube is available with three battery options – 2.2 kWh, 3.4 kWh and 5.1 kWh and according to the company the entire portfolio is getting a good market response. The base variant with a 2.2kWh battery has a 75km real-world range and a charging time of 2 hours, 45 minutes from 0-80% with a 950W charger. This base variant is currently the most affordable iQube at Rs 89,999. This model along with the 3.4 kWh iQube (Rs 126,628 and 100km range) get a 5-inch TFT display with tow and theft alerts and turn-by-turn navigation.

The iQube ST line-up has two variants with 3.4kWh (Rs 155,555) and 5.1kWh (Rs 185,373). While the ST 3.4 variant has a claimed real-world range of 100km, the range-topping ST 5.1 variant has the largest battery capacity of any Indian electric scooter and a real-world range of 150km on a single charge. The iQube ST 5.1 also has a higher 82kph top speed, and the claimed charging time is 4 hours and 18 minutes from 0 to 80 percent.

The company, which has ample manufacturing capacity on hand, is strategically expanding the iQube dealer network. Currently estimated at around 750 touchpoints across India, TVS is increasing the network each month. The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025, plans to roll out a new electric scooter before the end of FY2025.

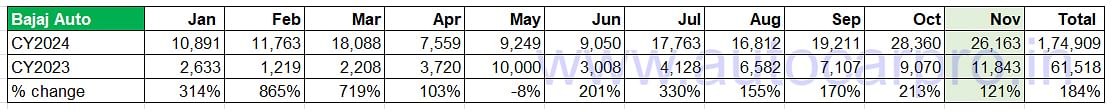

It will be among the moves that TVS, which the longstanding No. 2 OEM in this segment and currently engaged in a fierce battle with Bajaj Auto, to protect its turf. In CY2023, TVS had sold a total of 166,581 iQubes – 94,641 units more than Bajaj Auto’s 71,940 Chetaks. That huge gap is now stands sizeably reduced in the first 11 months of the current calendar year – to 27,994 units. In November 2024, the difference between TVS iQube and Bajaj Chetak sales was only 808 units. BAJAJ AUTO – November 2024: 26,163 units, up 121% YoY

BAJAJ AUTO – November 2024: 26,163 units, up 121% YoY

Market share: November 2024 – 22% / November 2023 – 20%

Jan-Nov 2024: 174,909 units, up 184% YoY (Jan-Nov 2023: 61,518 units), CY2023: 71,940 units Bajaj Auto which, like TVS, entered the e-two-wheeler market in January 2020, is hard on its ICE legacy rival’s heels. Like TVS, Bajaj too also dispatched a record 30,644 Chetaks to its dealers in October, ensuring that customer deliveries were smooth in November. The move seems to have paid off, given that 26,163 Chetaks were retailed last month, up 121% YoY. While November 2024 sales are down 8% month-on-month on festive October’s record 28,352 units, the fact is that since January’s 10,891 units, Bajaj has more than doubled its monthly sales 10 months down the year.

Bajaj Auto which, like TVS, entered the e-two-wheeler market in January 2020, is hard on its ICE legacy rival’s heels. Like TVS, Bajaj too also dispatched a record 30,644 Chetaks to its dealers in October, ensuring that customer deliveries were smooth in November. The move seems to have paid off, given that 26,163 Chetaks were retailed last month, up 121% YoY. While November 2024 sales are down 8% month-on-month on festive October’s record 28,352 units, the fact is that since January’s 10,891 units, Bajaj has more than doubled its monthly sales 10 months down the year.

In November 2024, the Bajaj Chetak had an e2W industry market share of 22% (November 2023: 13%). For the January-November 2024 period, Bajaj Auto has share of 16% – a big jump from the 4% it had in January-November 2023.

Bajaj Auto, whose Chetak has a starting price of Rs 95,998 (ex-showroom Bengaluru) for the Chetak 2903 and rising to Rs 127,244 for the Chetak 3201 and Rs 128,744 for the Chetak 3201 SE, is also upping the ante to achieve even faster sales traction. On September 4, the company launched the Chetak Blue 3202 at Rs 115,000 (ex-showroom, Bengaluru). The Blue 3202 is the renamed Urbane variant with new cells that give it more range while still having the same battery capacity.

In early August, Bajaj Auto launched the Chetak 3201 special edition EV sold only on Amazon, priced at Rs 129,000 (ex-showroom, Bengaluru), with a 136km range which is higher than the top-spec Chetak Premium.

The Chetak 2901, launched in early June at Rs 95,998, is the most affordable of the Chetak line-up and nearly Rs 51,000 cheaper than the top-end variant. The Chetak 2901, which shares its 2.9kWh battery with the mid-spec Chetak Urbane, has successfully taken the battle right into the rivals’ camp – TVS iQube, Ather Rizta S and Ola S1 Air. And the move is playing true with just what Bajaj Auto management planned.

Marketing initiatives like the recent partnership with Kendriya Police Kalyan Bhandar (KPKB) to offer the Chetak 2903 to KPKB beneficiaries (like the Central Armed Police Forces, which includes the BSF, CRPF, CISF, ITBP, SSB and Assam Rifles) across India are helping drive demand.

Bajaj Auto’s cumulative sales of 174,909 units in January-November 2024 are up 184% on year-ago retails of 61,518 units. This means Bajaj Auto has sold an additional 113,331 Chetaks in the past 11 months compared to January-November 2023. In comparison, TVS has sold an additional 48,652 units YoY for the same period. When December 2024 sales are counted, Bajaj Auto will become the third EV OEM to have surpassed the 200,000 sales milestone this year.

Both the TVS iQube and Bajaj Chetak were launched in January 2020. While the TVS iQube has clocked cumulative retails of 422,157 units over the 59 months since launch, the Bajaj Chetak has sold a total of 278,044 units. However, Bajaj Auto’s speedy rate of growth is helping it to close the gap annually with TVS, which is the longstanding No. 2 e2W OEM. This comes about as a result of strong consumer demand for the Chetak, ramped-up production of nearly 20,000 units per month and an expanded Chetak retail sales network. Clearly, the last is not heard on the fierce battle between these two legacy OEMs for e-scooter supremacy.

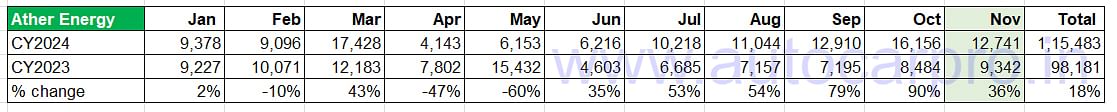

ATHER ENERGY – November 2024: 12,741 units, up 36% YoY

ATHER ENERGY – November 2024: 12,741 units, up 36% YoY

Market share: November 2024 – 11% / November 2023 – 10%

Jan-Nov 2024: 115,483 units, up 18% YoY (Jan-Nov 2023: 98,191 units), CY2023: 104,734 units Smart e-scooter maker Ather Energy, ranked No. 4, completes the quartet of OEMs to sell over 100,000 units in the first 11 months of 2024. In November, the EV startup sold 12,741 units, up 36% YoY. The company, whose best sales this year have come in March (17,428 units), saw demand decline sharp in May and June but has returned to five-figure retails from June onwards (see 11-month retail sales data above). November 2024 retails give the Hosur-based OEM a market share of 11% compared to 10% a year ago.

Smart e-scooter maker Ather Energy, ranked No. 4, completes the quartet of OEMs to sell over 100,000 units in the first 11 months of 2024. In November, the EV startup sold 12,741 units, up 36% YoY. The company, whose best sales this year have come in March (17,428 units), saw demand decline sharp in May and June but has returned to five-figure retails from June onwards (see 11-month retail sales data above). November 2024 retails give the Hosur-based OEM a market share of 11% compared to 10% a year ago.

Cumulative January-November 2024 sales at 115,483 units are up 18% YoY (January-November 2023: 98,181 units), which give it a market share of 11% of e2W Inc’s total retails of 10,74,008 units till end-November.

The Rizta family e-scooter (pictured above) launched in April at a starting price of Rs 109,999 (Rizta S) through to Rs 149,999 (Rizta Z) is witnessing growing customer acceptance. While the S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. The Rizta’s highlights include the largest two-wheeler seat in India and storage space aplenty.

In an effort to rev up demand for its products, Ather is undertaking new customer-friendly initiatives. In October, it launched Ather Care Service plans which offer free periodic maintenance, discounts on wear-and-tear part replacements, and value-added services such as ExpressCare and polishing.

On November 22, Ather Energy introduced ‘Eight70 Warranty’ for its 450 series and Rizta e-scooters, in collaboration with Reliance General Insurance. This addresses customers’ concerns regarding long-term battery health, performance and replacement costs by providing a host of benefits including coverage for up to 8 years or 80,000km, 70% battery health assurance, full coverage against manufacturing defects and failures; no upper limit on claim amounts, and no claim rejection due to deep discharge of battery cells when the scooter is left uncharged or in an idle state over an extended period of time. According to Ather’s Chief Business Officer Ravneet Singh Phokela, “Battery durability is a crucial factor for EV buyers. We often hear about customers' apprehensions regarding the longevity and replacement costs of the batteries of their electric scooters. Understanding this concern, we have introduced our new Eight70 Warranty, which will eliminate any worries and concerns EV buyers may have regarding the long term health of their scooter batteries.”

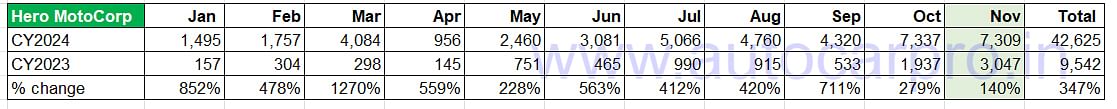

HERO MOTOCORP – November 2024: 7,309 units, up 140% YoY

HERO MOTOCORP – November 2024: 7,309 units, up 140% YoY

Market share: November 2024 – 6% / November 2023 – 3.30%

Jan-Nov 2024: 42,625 units, up 347% YoY (Jan-Nov 2023: 9,542 units), CY2023: 11,141 units Hero MotoCorp, which is set to enter the electric motorcycle segment next year with a jointly developed midsize performance e-motorcycle with Zero Motorcycles of the USA, continues to see sales of its two Vida e-scooters improve month on month. In November, the company registered retail sales of 7,309 units, its second highest monthly numbers in this year thus far. The much-improved performance is reflected in Hero MotoCorp’s growing market share, which has doubled to 6% from 3% in November 2024.

Hero MotoCorp, which is set to enter the electric motorcycle segment next year with a jointly developed midsize performance e-motorcycle with Zero Motorcycles of the USA, continues to see sales of its two Vida e-scooters improve month on month. In November, the company registered retail sales of 7,309 units, its second highest monthly numbers in this year thus far. The much-improved performance is reflected in Hero MotoCorp’s growing market share, which has doubled to 6% from 3% in November 2024.

The Hero Vida brand's cumulative 11-month retails at 42,625 units are a massive 347% YoY jump on a low year-ago base of just 9,542 units. This gives Hero MotoCorp a 4% share for the year to date.

Hero MotoCorp has started scaling up brand presence for Vida and its network now stands at 203 touchpoints comprising 180 dealers across 116 cities. The company, which has the V1 Plus and V1 Pro EVs, plans to expand its portfolio – within the mid- and affordable segment – within FY2025. And it already has around 2,500 charging stations in collaboration with Ather Energy, in which Hero MotoCorp is an early investor.

Like all the leading EV OEMs, Hero MotoCorp too is focusing on reducing product cost. In an earnings conference call in mid-August, Niranjan Gupta, CEO, Hero MotoCorp said: “We are working very aggressively, and on the powertrain side, to bring the costs down by technological improvements, by localization, obviously, by bringing scale. You will see that benefit coming out into our further launches as well. You'll see affordable products coming out later this year.”

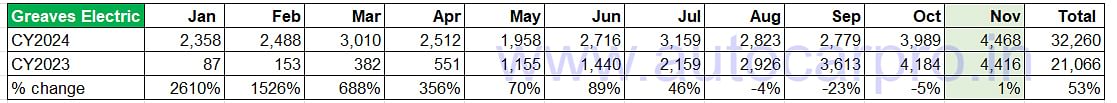

GREAVES ELECTRIC MOBILITY – November 2024: 4,468 units, up 1% YoY

Market share: November 2024 – 4% / November 2023 – 5%

Jan-Nov 2024: 32,260 units, up 53% YoY (Jan-Nov 2023: 21,066 units), CY2023: 16,650 units Greaves Electric Mobility (GEM), which currently has a six-model portfolio of e-scooters comprising the Nexus (pictured above), Primus, Magnus LT/EX (100km+ range), Ampere Magnus Special, entry level Rio Li/La Plus and Zeal EX, has registered its best monthly retails in the year to date in November: 4,468 units, up marginally by 1% YoY.

Greaves Electric Mobility (GEM), which currently has a six-model portfolio of e-scooters comprising the Nexus (pictured above), Primus, Magnus LT/EX (100km+ range), Ampere Magnus Special, entry level Rio Li/La Plus and Zeal EX, has registered its best monthly retails in the year to date in November: 4,468 units, up marginally by 1% YoY.

GEM’s newest product – the Ampere Nexus launched in end-April – seems to be the key driver of this growth, which has been confirmed by the management. In an investor conference call on November 7, 2024, K Vijaya Kumar, Executive Director and CEO, Greaves Cotton said: “We are registering very robust growth month-on-month, quarter-on-quarter primarily based on our new product. The Nexus, which we launched two quarters before is doing very well.”

Targeted at families, the Ampere Nexus has been designed and developed in-house at the Ranipet facility in Tamil Nadu. Equipped with a 3 kWH LFP battery, the Nexus has a claimed top speed of 93kph and a certified range of 136km. Sold in two variants, prices start at Rs 110,000 (ex-showroom) and go up to Rs 120,000.

Greaves Cotton, which has embarked on a strategic growth mission, is seeing GEM, its electric mobility division, deliver impressive results, generating revenues of Rs 175 crore in Q2 FY2025 and Rs 302 crore in H1 FY2025. This growth has been enabled by a focused approach on new product launches and a defined path toward profitability. GEM’s current e-two-wheeler sales and service network across India includes over 400 sales and service points.

GEM’s cumulative 11-month retail sales at 32,260 units are a 53% increase over the 21,066 units sold in January-November 2023. The company’s market share for November 2024 is 4% and that for the first 11 months of CY2024 is 3 percent.

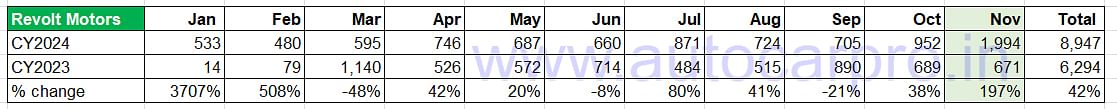

REVOLT MOTORS – November 2024: 1,994 units, up 197% YoY

Market share: November 2024 – 1.67% / November 2023 – 0.72%

Jan-Nov 2024: 8,947 units, up 42% YoY (Jan-Nov 2023: 6,294 units), CY2023: 6,977 units November’s interesting takeaway news comes from Revolt Intellicorp (Revolt Motors), one of the few electric motorcycle manufacturers in India. The company, which earlier had only the 4.1kW RV400 priced at Rs 116,800 (on-road Mumbai) and the RV400 BRZ, has expanded its portfolio with the launch of the RV1 and RV1+ ‘commuter’ electric motorcycles, priced at Rs 84,990 and Rs 99,990 respectively two months ago. The RV1 comes with two battery options – 2.2 kWh battery offering up to 100km range, and a 3.24 kWh battery with 160km range.

November’s interesting takeaway news comes from Revolt Intellicorp (Revolt Motors), one of the few electric motorcycle manufacturers in India. The company, which earlier had only the 4.1kW RV400 priced at Rs 116,800 (on-road Mumbai) and the RV400 BRZ, has expanded its portfolio with the launch of the RV1 and RV1+ ‘commuter’ electric motorcycles, priced at Rs 84,990 and Rs 99,990 respectively two months ago. The RV1 comes with two battery options – 2.2 kWh battery offering up to 100km range, and a 3.24 kWh battery with 160km range.

Revolt Motors has been aggressively expanding its dealership network across India, which now stands at 168 including 14 new ones opened in November in cities such as Hubli (Karnataka), Muzaffarpur (Bihar), Katihar (Bihar), Maheshkhunt (Bihar), Khagaria (Bihar), Nawanshahr (Punjab), Kannauj (UP), Satara (Maharashtra), Sattur (Tamil Nadu), Mayiladuthurai (Tamil Nadu), Bhilwara (Rajasthan), Warangal (Telangana), Balasore (Odhisa), and Bulandshahr (Uttar Pradesh).

The new RV1 and RV1+ along with the expanded network seem to have accelerated sales. Revolt’s November retails at 1,994 units (up 197% YoY) are its third-highest monthly sales yet (after June 2022's 2,424 units and July 2022's 2,318 units) and take its January-November 2024 total to 8,947 units. This means it has already sold 1,970 additional bikes than its entire CY2023’s sales of 6,977 units. What’s more, the company, which was ranked 13th in January 2024 (533 units) has now jumped into No. 6 position units, with its market share rising to 1.67% from 0.72% in November 2023 and 0.82% in January 2024.

INDIA E2W INC TO HIT RECORD 1.15 MILLION UNITS IN 2024, HONDA CHECKS IN

December historically is a slow-moving month for OEMs in India, what with buyers preferring to wait for the new year to dawn to put down their money on a vehicle registered in January. However, this just might be belied given the momentum the e-two-wheeler industry is currently witnessing and the sweet deals that some EV makers are offering.

At 1.07 million units retailed in January-November 2024, India E2W Inc is en route to crack the 1.15 million-units milestone for CY2024. The top six EV makers in this segment continue to shine and each of them has already surpassed their entire CY2023 sales in the current year to date, with December 2024 numbers still to kick in and be counted.

While market leader Ola Electric with 393,648 units has long surpassed its CY2023 sales of 267,376 units, TVS Motor Co has, with 202,903 iQubes sold, beaten its CY2023 retails of 166,581 units. Bajaj Auto has had a stellar year with 174,909 units in January-November, and Ather Energy, with 115,483 units, has also gone past its CY2023 total of 104,734 units. Hero MotoCorp, with 42,625 Vida e-scooters, has also beaten its CY2023 score of 11,141 units. Greaves Electric Mobility, with 32,260 units, has also surpassed its CY2023 tally of 24,043 units. The combined sales of these top six OEMs add up to 106,843 units in November and account for 90% of the e2W industry sales of 118,924 units last month. They have the same ratio for the January-November 2024 period: their combined retails of 961,828 units give them an 89.55% share of the 1.07 million units sold.

Watt lies ahead for the Indian e2W industry? Honda is the latest ICE legacy OEM and the first Japanese two-wheeler major to plug into electric avenue.

Watt lies ahead for the Indian e2W industry? Honda is the latest ICE legacy OEM and the first Japanese two-wheeler major to plug into electric avenue.

These top six players though have brand-new competition coming their way in the form of the Honda Activa e and QC1 revealed on November 27, which mark the Japanese OEM’s entry into the Indian electric two-wheeler market. While Honda has not yet revealed the prices of the two EVs, considering that it has already achieved 99% localisation, one can expect the company to come up with disruptive pricing to unsettle the competition.

All the top six OEMs – Ola (which has launched the S1 Z and Gig), TVS, Bajaj Auto, Ather Energy, Hero MotoCorp and Greaves Electric Mobility – are aggressively working to come with up ‘affordable’ or lower priced EVs, more so in the wake of consistently reducing subsidies. Clearly, there’s plenty of exciting new product action to be expected in CY2025. However, before that we have December still to be counted. So, stay plugged in to Autocar Professional’s sales analyses for in-depth number-crunching.

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

01 Dec 2024

01 Dec 2024

27367 Views

27367 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau