Electric two-wheeler sales hit highest level in FY2024: 944,000 units

FY2024 is a record-breaking fiscal for India EV Inc with the volume-driving e-two-wheeler segment setting a new sales benchmark. Ola sells over 326,000 units for a 35% market share and TVS Motor Co 182,000 units for a 19% share, Ather Energy and Bajaj Auto battled for fourth place with over 105,000 units each. India's Top 25 e2W OEMs revealed.

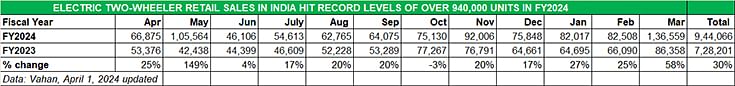

Even as the ongoing IPL 2024 cricket tournament is turning out to be a season of batsmen hitting mega sixes, FY2024 has also turned out to be a mega fiscal for the Indian electric vehicle industry. Leading the charge is the electric two-wheeler industry. As accurately forecast last month to go beyond the 900,000-unit milestone, retail sales of electric scooters and motorcycles in FY2024 have hit a record 944,000-plus units, as a result of best-ever monthly sales of 136,559 units in March 2024, up 58% year on year. FY2024’s record retails constitute handsome 30% year-on-year growth (FY2023: 728,201 units) on a high year-ago base.

This number-crunching exercise was first published early morning March 31, the last day of FY2024, as per Vahan retail sales information. The numbers were marginally revised with the updated retail sales for March 2024 released on April 1. March 2024 is the only the second instance of monthly sales surpassing 100,000 units (and that too by a fair margin), the previous one being May 2023 (105,564 units), when buyers advanced their purchases ahead of the sharp reduction of the FAME II subsidy scheme from June 1, 2023.

With EV prices likely to be raised from April 1 as a result of reduced subsidy, March 2024 with 136,559 units was the best-ever month for e-2W OEMs.

With EV prices likely to be raised from April 1 as a result of reduced subsidy, March 2024 with 136,559 units was the best-ever month for e-2W OEMs.

Mega March hits monthly sales for a six: 136,559 units, UP 58%

March 2024 with its record sales of 136,559 units, up 58% YoY, was akin to the last over of a T20 match, wherein most OEMs have notched their best-ever monthly numbers. And that’s thanks to e-scooter and bike buyers making a beeline to showrooms to pick their favourite eco-friendly steeds before the new Electric Mobility Promotion Scheme 2024 (EMPS), unveiled on March 13 to continue subsidies for electric two- and three-wheelers, kicks in from April 1 for a four-month period. It has a total outlay of Rs 500 crore and is valid for four months from April 1 to July 31, 2024.

Under EMPS which has a total outlay of Rs 333.39 crore for a four-month period, electric two-wheelers are eligible for a subsidy of Rs 5,000 per kilowatt-hour (kWH) with a maximum limit of Rs 10,000 per unit. This would mean that, similar to the market scenario on June 1, 2023, electric two-wheeler prices will rise as most OEMs would typically pass on the load to the consumer.

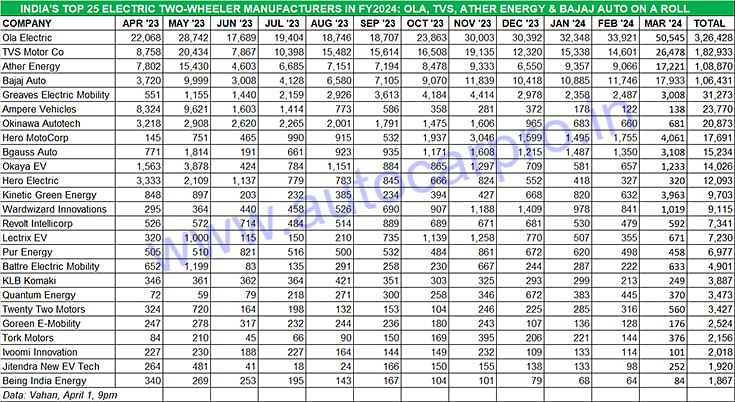

Cognisant of this, most of the leading e-two-wheeler OEMs had rolled out special offers in March, looking to capture demand as it came their way. And the proof of their success lies in the March numbers. A close look at the company-wise data table below will reveal that 22 of the Top 25 OEMs have registered their best-ever monthly sales in March 2024.

Of the nearly 175-odd players in the fray, four OEMs in the form of two start-ups and two legacy players – Ola Electric, TVS Motor Co, Ather Energy and Bajaj Auto – stand out. Not only are the only ones to register six-figure sales but their combined sales of 724,662 units account for 77% of the total 944,066 retails in FY2024. Interestingly, other than Bajaj Auto, the other three have their EV manufacturing plants in Tamil Nadu.

A strategic move to sharply drop prices of its S1 range saw Ola Electric register best-ever monthly sales of 50,545 units in March 2024.

A strategic move to sharply drop prices of its S1 range saw Ola Electric register best-ever monthly sales of 50,545 units in March 2024.

OLA ELECTRIC – First OEM in India to sell over 325,000 units in a year

FY2024 sales: 326,428 units, up 88% (FY2023: 172,791 units)

Market share: 35%

Ola Electric has hit a huge ‘six’ with retail sales of 326,428 units in FY2024, up 88% YoY (FY2023: 172,791 units). A strategic move to substantially reduce prices and offering buyers FAME subsidies up to Rs 46,780 for its popular S1 range of e-scooters (S1 Pro, S1 Air and S1 X+) in February and March 2024 have powered numbers at the end of the fiscal. The resultant surge of demand meant that Ola registered sales 33,921 units in February and 50,545 units in March, the latter its best-ever monthly sales as well as for a single OEM in India to date.

With this Ola has become the first Indian EV maker to sell over 300,000 units in a fiscal and has a stranglehold on the segment with a massive lead over its rivals. In FY2024, the company’s market share has increased to 35% from 24% in FY2023, clearly establishing its supremacy in the expanding market. In CY2023, Ola had sold 265,634 units, registering 143% YoY growth.

Ola Electric is well placed to continue capturing domestic market demand. The company, which has a one-million-units capacity plant at Krishnagiri in Tamil Nadu, is upping the ante on localisation. While it produces the electric motor and battery pack indigenously, manufacturing of BMS and digital instrument clusters is outsourced to players like Foxconn.

Last month, Ola received its second Production Linked Incentive (PLI) certificate, this time for the Gen-2 Ola S1 Pro for meeting the government’s PLI norms of achieving a minimum of 50% domestic value addition (DVA). The S1 Air was the first Ola product to get PLI certification.

Ola, which has an integrated direct-to-customer distribution channel, currently has a total of 935 experience centres and 414 service facilities (to be expanded to 600 by April 2024).

Strong demand for the iQube has given TVS Motor Co an EV market share of 19.37% in FY2024, up from the 11.27% share it had in FY2023.

Strong demand for the iQube has given TVS Motor Co an EV market share of 19.37% in FY2024, up from the 11.27% share it had in FY2023.

TVS MOTOR CO – iQube scooter packs a punch and more

FY2024 sales: 182,933 units, up 125% (FY2023: 82,108 units)

Market share: 19.37%

TVS Motor Co has had a great run in FY2024 with its iQube e-scooter, more than doubling its FY2023 sales. With retails of 182,933 units in FY2024, the company recorded sterling 125% YoY growth (FY2023: 82,108 units). This gives it a market share of 19.37%, up from the 11.27% share it had in FY2023.

Like Ola, Ather and Bajaj Auto, TVS clocked its best-ever monthly sales in March 2024 – 26,478 units – going ahead of its previous best of 19,135 units in November 2023.

In CY2023, TVS had dispatched a total of 166,190 iQubes to its showrooms across India, recording 252% YoY growth. From January 2020, when it was launched, through to end-February 2024, cumulative wholesales of the TVS iQube are 299,370 units. This level of sustained strong growth has helped increase the EV penetration level for the company.

The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025, is targeting a big jump in the contribution of EV sales to its overall volumes over the next two years. TVS, which has expanded its EV sales programme to Nepal and to Europe, is understood to be plotting a series of new EVs targeted at different customer segments with a complete portfolio offering between 5 to 25 kilowatts.

In January, Ather Energy launched the Apex 450 which has a 157km range.

In January, Ather Energy launched the Apex 450 which has a 157km range.

ATHER ENERGY: Keeps a hard-charging Bajaj Auto at bay

FY2024 sales: 108,870 units, up 41.50% (FY2023: 76,939 units)

Market share: 11.53%

Bengaluru-based Ather Energy has retained its No. 3 ranking with retails of 108,870 units in FY2024, up 41.50% (FY2023: 76,939 units), keeping a hard-charging Bajaj Auto at bay. This performance has given it a 12% market share, a marginal increase on the 10.56% share it had in FY2023.

Ather ended FY2024 with a flourish: 17,221 units in March 2024, its best-ever monthly sales. While it remained ahead of fourth-placed Bajaj Auto in the first six months of the fiscal, Bajaj went ahead of Ather in the next six months including the last month of FY2024.

The company made a series of moves to protect its turf. Not only did it slash the price of the 450S e-scooter by Rs 20,000 to Rs 109,000 but it also launched the new Apex 450 in early January 2024. Priced at Rs 189,000, the Apex 450 uses the same 3.7kWh battery pack as the 450X but claimed IDC range has gone up to 157km, due to the new regenerative braking system. The company recently received a shot in the arm with early investor Hero MotoCorp set to increase its stake to 39.7% in January 2024.

Ather now plans to roll out its family scooter named Rizta on Ather Community Day – April 6, 2024. Expected to be priced between Rs 110,000 and under Rs 130,000, Ather will expand its market reach with the Rizta which will compete with the high-selling TVS iQube, Bajaj Chetak and Vida V1 Pro in the below-Rs 130,000 price category, which benefits from FAME 2 subsidies.

On the network front, Ather at present has over 175 experience centres across India and plans to add another 75 outlets to achieve a 250-showroom network by end March 2024. While it will refrain from going into deep rural areas, Ather Energy is confident that its upcoming products will strengthen its potential in Tier-2, Tier-3, and Tier-4 markets.

Just 2,439 units behind Ather, Bajaj Auto has seen demand surge for its Chetak. Its market share in FY2024 has jumped to 11% from 4% in FY2023.

Just 2,439 units behind Ather, Bajaj Auto has seen demand surge for its Chetak. Its market share in FY2024 has jumped to 11% from 4% in FY2023.

BAJAJ AUTO: Chetak sales just 2,439 units behind Ather in FY2024

FY2024 sales: 106,431 units, up 273% (FY2023: 28,537 units)

Market share: 11.27%

Pune-based Bajaj Auto, which entered the EV market in January 2020 (just like TVS), has sold a total of 106,431 Chetak e-scooters in FY2024, an increase of 273% YoY (FY2023: 28,537 units), albeit on a low year-ago base. March 2024’s 17,933 units, its best-ever monthly numbers yet, capped off a strong fiscal for the Pune-based company in March. This performance gives Bajaj Auto a market share of 11.27%, nearly tripling its 4% share in FY2023.

The company witnessed strong demand, particularly in the second half of the fiscal. What is creditable is that it has narrowed the sales gap with No. 3 player Ather Energy. At the end of FY2024, the difference was only 2,439 units. In fact, from October 2023 to March 2024, Bajaj outsold Ather for six straight months.

What has helped accelerate sales is ramped-up production and an expanded Bajaj Chetak network, currently in 141 cities across India, which is to be expanded to 250 cities by March 2024.

On December 1, 2023, Bajaj Auto launched the Chetak Urbane, which costs Rs 115,000 in its standard form, and Rs 121,000 for an additional ‘Tecpac’, which unlocks more features and performance. The company website lists the Chetak Urbane as having slightly higher range (113km) than the current Chetak (108km). However, for the Urbane, this is the IDC-certified range, while for the current Chetak Premium, 108km is its claimed real-world range (its IDC rating is 126km). The new Chetak Urbane gets the same 2.9kWh battery capacity as the current model. The Chetak Urbane utilises the same colour LCD display as the Premium variant. In standard form, the Urbane offers a 63kph top speed, and comes with only one riding mode – Eco. With the ‘Tecpac’ installed, top speed rises to 73kph and the user gets a Sport riding mode as well.

The fifth position amongst the Top 25 OEMs goes to the Greaves Electric Mobility-Ampere Vehicles combine with 55,043 units, giving it a 6% market share. Okinawa Autotech, which not too long ago was a major player, is at No. 6 with 20,873 units. Having begun FY2024 with four-figure sales, the last four months of the fiscal saw its numbers slide into three figures.

Hero MotoCorp is ranked seventh (17,691 units), followed by Bgauss Auto (15,234 units), Okaya EV (14,026 units), and Hero Electric (12,093 units). Kinetic Green jumps into 12th position with 9,703 units, thanks to the 3,963 units sold in March 2024, the acceleration coming from the recent launch of the E-Luna. Wardwizard Innovations, which has been in the news lately for a flurry of products, is No. 13 with 9,115 units.

Combined sales of 724,662 units from the Top 4 OEMs (Ola, TVS, Ather and Bajaj Auto) account for 77% of the total 944,066 retails in FY2024.

Combined sales of 724,662 units from the Top 4 OEMs (Ola, TVS, Ather and Bajaj Auto) account for 77% of the total 944,066 retails in FY2024.

GROWTH OUTLOOK FOR ELECTRIC 2-WHEELER OEMS IN FY2025

When the FAME II subsidy was slashed from 40% to 15% in June 2023, the Cassandras of the auto industry were quick to write off the EV industry. But by October 2023, e-two-wheeler sales had bounced back to pre-slashed FAME subsidy levels, thanks to the promise of wallet-friendly transport. Between June 2023 and March 2024, nearly 771,627 units – or 82% of FY2024’s record sales – have been bought at higher prices.

It’s likely the new Electric Mobility Promotion Scheme (EMPS) will have the same effect down the line, given the wallet-friendly proposition of an e-two-wheeler compared to its petrol-engined sibling. While the initial cost of an electric two-wheeler remains higher, a growing number of consumers are making the transition to e-mobility because of high petrol prices, which had remained unchanged from May 2022 until early March 2024. This is a key EV industry growth factor, which has proven to be an enabler for the transition to e-mobility, both personal and commercial.

Two-wheeled EV manufacturers are also benefiting from sustained demand for last-mile deliveries from urban India as well as town and country, which is acting as a sales catalyst for e-two-wheelers used for e-commerce and food deliveries. This is thanks to the key advantage stemming from TCO (Total Cost of Ownership), particularly for fleet operators who clock plenty of kilometres each day. Like the aircraft industry, e-vehicles used for fleet operations make money the more they are on the road. It’s a plug-in-plug-out seamless operation for them – while 50% of the fleet would be out on the job, the other half is getting charged, ready to replace their parched brethren when they come in for their ‘juice’ of electricity.

Meanwhile, with EV OEMs pursuing higher levels of localisation, it is likely there will be new product cost rationalisation. What is also helping their cause is Indian Tier 1 suppliers achieving strong progress in indigenous manufacture of EV components. A recent example is Sona Comstar, which has become the first supplier in India to receive automotive PLI certification for its hub wheel drive motor for electric two-wheelers.

Having recorded 944,000-plus sales in FY2024 and strong 30% YoY growth, the e-two-wheeler industry will see slower growth on this high base but with a wider array of scooters and motorcycles, surging demand from last-mile mobility operators and the continuing consumer shift from petrol to electric power, FY2025 could see sales in the region of 1.2 to 1.3 million units.

ALSO READ: EV sales in India jump 42% to 1.67 million in FY2024, 2- and 3Ws, cars and SUVs scale new highs

Electric car and SUV sales jump 90% to 90,000 units in FY2024

Electric 3-wheeler sales surge 57% in FY2024, hit record levels of 632,500 units

RELATED ARTICLES

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

31 Mar 2024

31 Mar 2024

84025 Views

84025 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal