Honda and Suzuki join legacy OEMs TVS, Bajaj, and Hero in electric 2-wheeler race

With two legacy Japanese manufacturers entering the electric two-wheeler market, the existing trio of TVS Motor Co, Bajaj Auto and Hero MotoCorp get new ammo in the battle of old versus new, where the startup brigade is led by Ola Electric, Ather Energy and Greaves Electric Mobility. And the legacy OEMs have outsold the Top 3 startups in Q4 CY2024 and first three weeks of January 2025.

The Indian two-wheeler market has always been an exciting one, both in terms of mega volumes and the sheer number of models on sale. Over the past four-odd years, electric mobility has provided a new verve to this segment which clocked record retail sales of 1.14 million units in CY2024, up 33% YoY. And the 2W segment has just turned a lot more exciting what with two Japanese majors – Honda and Suzuki – entering the EV market on two wheels.

The electric two-wheeler market which has, for quite some years, been populated by startups led by Ola Electric and Ather Energy and accompanied by a host of smaller players, is now seeing the legacy ICE players, who have now diversified into EVs on two wheels, become serious competitors in the zero-emission game. Arch rivals Bajaj Auto and TVS Motor Co were the first to bite the EV bullet, both having launched their products – the Bajaj Chetak and TVS iQube – in January 2020. Since then, both TVS (439,943 units) and Bajaj (296,698 units) have taken giant strides with their two-wheeled EVs and are currently ranked second and third in cumulative retails after Ola Electric (784,625 units), which entered the market in December 2021.

Hero MotoCorp, the world’s largest two-wheeler OEM, entered the fray rather belatedly with its Vida brand in early 2022 albeit it had invested in Bengaluru-based smart e-scooter startup Ather Energy in 2016, starting with a 30% equity stake. Till end-December 2024, Hero MotoCorp has sold a total of 55,025 Vida e-scooters with the bulk of the retails coming in CY2024 (43,702 units).

HONDA CHECKS IN WITH ACTIVA E: AND QC1

HONDA CHECKS IN WITH ACTIVA E: AND QC1

One of the much-awaited launches at the Bharat Mobility Global Expo was that of the Honda e-scooters, which are produced at its Narasapura plant in Karnataka. First revealed on November 27, 2024, the Honda Activa E (with swappable battery and primarily for personal commute) and QC1 (fixed battery) have been officially launched.

The Activa e, which has two variants – standard (Rs 117,000) and RoadSync Duo (Rs 152,000) –has a 102km claimed IDC range, go from 0-60kph in 7.3 seconds and has an 80kph top speed.

The Activa e: will be sold through existing Red Wing dealers, with a ‘shop-in-shop’ concept as part of a phased rollout with Concept Stores opening in some cities soon. There are 83 Honda Power Pack e: battery-swapping stations in Bengaluru, and they are being introduced in Delhi and Mumbai.

Honda plans to have over 250 stations in Bengaluru by 2026, aiming to have stations within every 5km in the city. Customers will have to pay per swap, and Honda will also sell the Activa e: with a Battery-as-a-Service option.

In the first phase, the Activa e will be sold in three cities starting in Bengaluru from February, and from April in Mumbai and Delhi.

The QC1, Honda’s more budget-friendly EV, is priced at Rs 90,000 and is the most affordable Japanese electric scooter in India. It has a claimed top speed of 50kph, does the 0-40kph in 9.7 seconds and delivers a claimed IDC range of 80km.

The QC1 will initially be available in six cities, including Delhi, Mumbai, Pune, Bengaluru, Hyderabad, and Chandigarh. Bookings for the QC1 and the Activa e: are currently open with a token amount of Rs 1,000. It’s early days yet for the Honda EVs and the market response to the Activa e and QC1 remains to be seen.

SUZUKI PLUGS IN WITH THE ELECTRIC ACCESS SCOOTER

Suzuki Motorcycle India, the two-wheeler arm of the Japanese automaker in India, has also frayed into EVs with the new e-Access, the electric avatar of the popular Access 125cc petrol scooter. The

Suzuki e-Access is powered by a fixed 3.07kWh LFP battery and the company claims a 95km IDC range. This battery pack powers a swingarm-mounted motor making 4.1kW and 15Nm propelling the e-Access to a 71kph claimed top speed.

Suzuki India claims the 240W charger supplied with the e-Access can top up the battery from 0-80 percent in 4 hours 30 minutes, while a full charge from flat will take 6 hours and 42 minutes. These numbers drop to 1 hour and 12 minutes and 2 hours and 12 minutes, respectively, when the e-Access is charged via the fast charger.

The zero-emission Access looks rather different from its ICE sibling and sports an LED headlight and tail-lamps. At 122kg, the e-Access is 18-19kg heavier than the petrol scooter. While the pricing has not been announced, the company’s strategy is to also export the made-in-India e-Access to overseas markets.

It is likely that some percentage of buyers for the Honda and Suzuki EVs will migrate from their ICE siblings albeit that percentage would be small in the first half of the year. Nevertheless, the fact that two more legacy OEMs have entered the e2W arena gives the existing trio of TVS, Bajaj and Hero MotoCorp more firepower in the old-versus-new battle with the startup world.

TOP 3 LEGACY OEMS OUTSELL TOP 3 STARTUPS IN OCT-DEC 2024 & JANUARY 1-20, 2025

TOP 3 LEGACY OEMS OUTSELL TOP 3 STARTUPS IN OCT-DEC 2024 & JANUARY 1-20, 2025

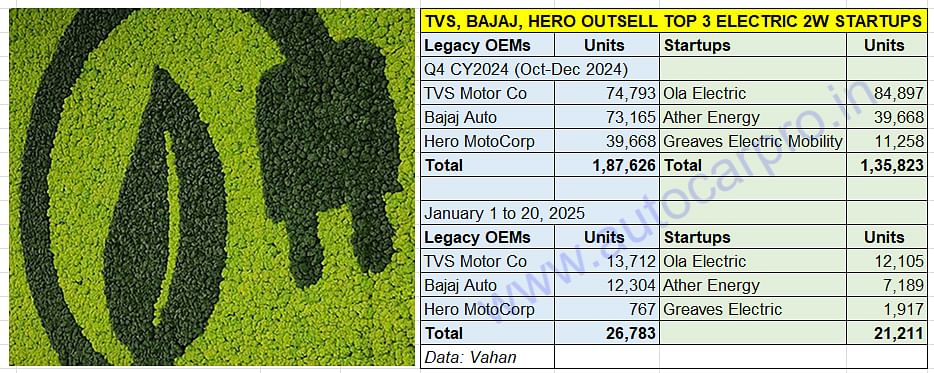

A quick look at Vahan-sourced retail sales data for the last quarter of CY2024 (October-December 2024) as well as the first 20 days of January 2025 reveals that legacy OEMs TVS Motor Co, Bajaj Auto and Hero MotoCorp have outsold the top three all-electric vehicle 2W startups Ola Electric, Ather Energy and Greaves Electric Mobility (which acquired the Ampere Vehicle startup).

As the data table above indicates, the TVS-Bajaj-Hero combine together sold 187,626 e-scooters as compared to the Ola-Ather-Greaves triumvirate’s 135,823 units. The sizeable gap of 51,803 units is also due to CY2024 market leader Ola’s retails falling sharply in November (29,289 units) and December (13,781 units). Now, in the first 20 days of CY2025, Ola Electric seems to be back in action.

As the data table above indicates, the TVS-Bajaj-Hero combine together sold 187,626 e-scooters as compared to the Ola-Ather-Greaves triumvirate’s 135,823 units. The sizeable gap of 51,803 units is also due to CY2024 market leader Ola’s retails falling sharply in November (29,289 units) and December (13,781 units). Now, in the first 20 days of CY2025, Ola Electric seems to be back in action.

Between January 1 and 20, 2025, the three legacy OEMs have sold 26,783 units while the Ola-Ather-Greaves combine has sold 21,211 units, with the retail sales gap currently at 5,572 units.

Not very long ago, it was felt that EV startups on two wheels, with their perceived absence of legacy issues, IT technology prowess, venture capital investments and the ability to burn cash to get a foothold in the market, would stamp their dominance on this segment of zero-emission mobility.

However, TVS, Bajaj Auto and Hero MotoCorp, the three legacy ICE OEMs which have diversified and plugged into e-mobility, are proving to be a resilient lot and are giving the two-wheeler startup world a run for their money and more.

These three companies, which have a strong R&D setup and component supplier base, are clearly benefiting from their growing localisation levels, introduction of new variants, brand power and the marketing strength that comes from a large dealer network spread across the country. They are now joined by Japanese majors Honda and Suzuki, which also stand to gain from their well-established manufacturing as well as sales and service footprint in the country.

ALSO READ: TVS tops e2W chart for third week in a row in January, Ola bounces back

E2W sales jump 33% to 1.14 million units and 59% of India EV market in CY2024

Bajaj Chetak and TVS iQube sell 850,000 units since launch five years ago

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

22 Jan 2025

22 Jan 2025

7516 Views

7516 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau