Winners and losers in India's bike and scooter market in first-half FY2024

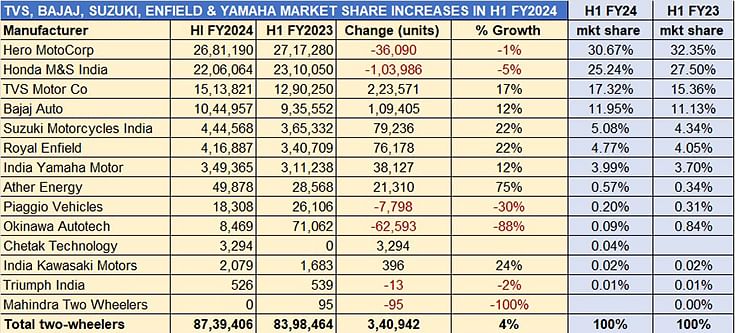

A total of 8.73 million two-wheelers were dispatched in April-September 2023, marking 4% YoY growth. Of the 14 OEMs, eight improved upon their year-ago wholesales and increased their market share in a highly competitive scenario. Here’s a detailed look at who sold what as per the latest SIAM wholesales data.

After what seems to be quite a long period of tepid sales in the Indian two-wheeler market, the buzz is back. Scooter and motorcycle manufacturers, many of whom have launched new products in the past three months, have dispatched a total 8.73 million units in the first six months of the ongoing fiscal year, up 4% year on year (April-September 2022/ H1 FY2023: 83,98,464 units).

At 87,39,406 units, cumulative sales of scooters, motorcycles and mopeds in April-September 2023 accounted for 75% of India Auto Inc's total automobile sales of 11.61 million units, which comprised two- and three-wheelers, passenger vehicles and commercial vehicles.

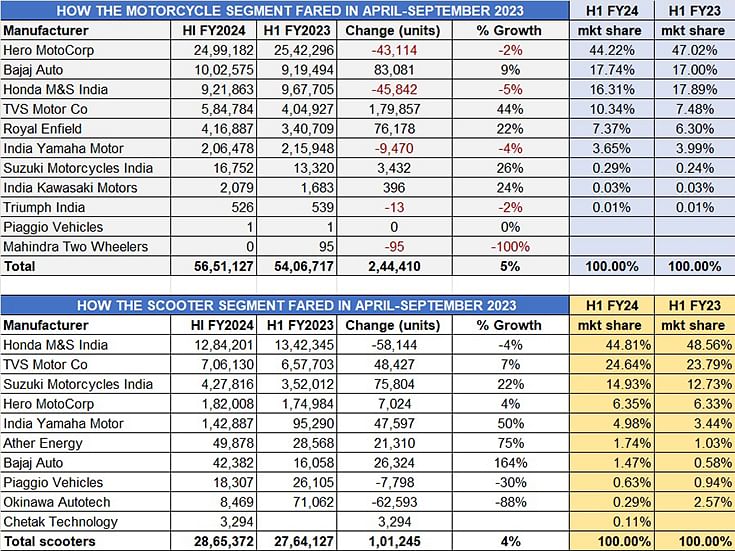

Importantly for industry, the growth is democratised across the two key sub-segments. While scooter dispatches at 28,65,372 units are up 4% (H1 FY2023: 27,64,127), motorcycle numbers are up 5% at 56,51,127 units (H1 FY2023: 54,06,717).

What has helped drive numbers is a combination of factors including the growth in the country’s GDP, green shoots of recovery in the rural market and a number of new product launches. Of the 14 OEMs in the fray, six manufacturers, including the top two OEMs (Hero MotoCorp and Honda Motorcycle & Scooter India), have seen their sales decline albeit marginally.

A look at the wholesale numbers of all the OEMs, who are SIAM members, reveals that five companies –TVS Motor Co, Bajaj Auto, Suzuki Motorcycles India, India Yamaha Motor and Royal Enfield – are the ones to have increased their market share, indicating their growing level of competitiveness and in turn profitability (see data table below).

Let’s take a closer look at how the top eight two-wheeler manufacturers have performed in April-September 2023 and the resultant impact on their market share. While the data for overall wholesales is depicted above, the company-wise split for motorcycles and scooters appears at the bottom of this analysis.

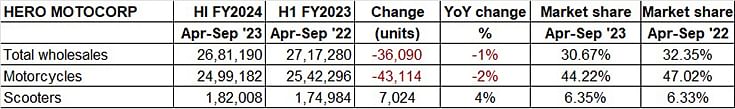

HERO MOTOCORP: 26,81,190 units, down 1% YoY

Market share: 30.67% in H1 FY24, down from 32.35% in April-Sep 2022

India’s two-wheeler market leader and also bike market leader Hero MotoCorp with sales of over 2.68 million units saw a 1% dip in YoY sales and its market share has reduced to 30.67% from 32.35% in H1 FY2023. Quarter on quarter too, numbers are down because in Q1 FY2024, Hero’s market share was 31.81%. One can pin that down on tepid sales of commuter bikes in the first four-five months of FY2024 albeit demand has begun returning since last month and the company could see much better momentum in the coming months.

Hero MotoCorp sold nearly 2.5 million motorcycles in H1 FY2024, which is 43,114 units less than in the year-ago period. The entry level trio of the 97.2cc HF Deluxe, Passion and Splendor mass-market commuter bikes have seen sales rise marginally by 0.33% to 21,47,948 units from 21,40,783 units a year ago, accounting for 80% of total sales for the company.

Demand for the 125cc Glamour and Splendor bikes slipped by 10.45% to 317,131 units (H1 FY2023: 354,159). It was a similar sales story for the 163cc Xtreme 160R and the XPulse 200 sports bikes – their combined sales of 33,972 units were down 28% on year-ago sales of 47,167 units.

In scooters, Hero remains in fourth position with 182,008 units, up 4% and a market share of 6.35%. Cumulative sales of the Destini 125, Maestro, Pleasure and Xoom were 176,208 units, up 0.69% YoY. The company also sold 5,800 units of its electric scooter, the Vida. All said and done, Hero MotoCorp is still considerably well placed for HMSI to challenge its numero uno rank. The company is going all out this festive season with customer-friendly offers, which should see it garner strong sales in October and November.

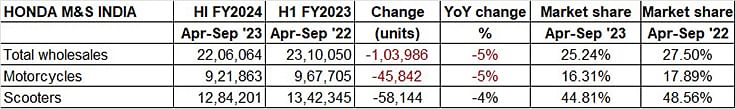

HONDA MOTORCYCLE & SCOOTER INDIA: 22,06,064 units, down 5% YoY

Market share: 25.24% in H1 FY24, down from 27.50% in April-Sep 2022

With cumulative six-month sales of 2.20 million two-wheelers, Honda Motorcycle & Scooter India's (HMSI) H1 FY2024 numbers are a 5% decline YoY (April-September 2022: 23,10,050 units). The data table above indicates that the company sold 103,986 fewer units than it did in H1 FY2023.

While HMSI’s No. 1 position is scooters remains unassailable, thanks to the Activa brand – in H1 FY2024, the company dispatched 1.28 million Activas (109.5cc and 124cc), 58,144 units fewer than a year ago and down 4% YoY. This sees HMSI’s scooter market share come down to 44.81%, from the 48.56% it had in April-September 2022.

HMSI was among the first OEMs in India to become OBD-II emission compliant ahead of the April 1, 2023 deadline – in January 2023 with the 110cc Activa, India’s best-selling scooter, and the 125cc Activa in March. The user- and urban-friendly Activa is sold in seven variants – four 110cc and three 125cc – and is Honda’s trump card in the competitive Indian two-wheeler market. And HMSI has on July 13 expanded its 125cc portfolio with a sibling to the 109cc Dio – the Dio 125 priced at Rs 83,400.

In the motorcycle segment, HMSI sold a total of 9,21,863 units, down 5% like scooters. However, akin to Hero MotoCorp, demand has returned to its entry level bikes – the 109cc Livo and Shine, whose combined sales of 156,762 units are up 40% on year-ago 112,208 units.

In the 125cc category, the CB Shine and SP125 together clocked 605,472 units, down 17% (H1 FY2023: 731,120 units).

In the 150cc-200cc category, Honda bike sales were up 33% to 138,264 units (H1 FY2024: 103,950) Reflecting the growing demand for midsize bikes, the CBR300 and the H’Ness 350 together have sold 21,365 units, up 5.5% (H1 FY2024: 20,241) but with the bulk of bike sales being impacted adversely, they have dragged overall.

Like arch rival Hero MotoCorp, HMSI is going all out in the festive season and over the past couple of months, it has launched no less than 10 motorcycles. These includes the the SP125 Sports Edition, CB200X, CB300F, Hornet 2.0, MY2023 110cc Livo commuter bike, CD110 Dream Deluxe, and the SP160. Clearly, the Japanese two-wheeler major is upping the ante on the motorcycle front and looking to capture fresh demand emanating out of the festive season.

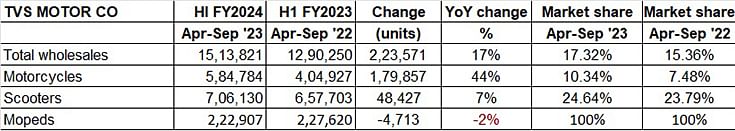

TVS MOTOR CO: 15,13,821 units, up 17% YoY

Market share: 17.32% in H1 FY24, up from 15.36% in April-Sep 2022

Of the four OEMs with million-plus wholesales in April-September 2023, TVS Motor Co has registered the best growth – 17% – while fourth-placed Bajaj Auto is next with 12 percent. TVS, as a result of sustained demand for both its scooters and motorcycles, has delivered a strong performance. The company also dispatched 222,907 mopeds.

Combined scooter, bike and moped wholesales at 15,13,821 units in H1 FY2024 are up 17% over H1 FY2023’s 12,90,250 units.

While scooters (706,130 units) account for 47% of TVS two-wheeler sales, motorcycles (584,784 units) have a 38% share and mopeds 15%. A year ago, the ratio was scooters 51%, motorcycles 31% and mopeds 18%, clearly indicating that demand for TVS bikes has risen sharply compared to scooters or mopeds.

TVS has recorded strong double-digit growth in its motorcycle sales – 44% – the Raider 125 commuter bike is coming into a league of its own – sales in the first six months of ongoing FY2024, at 228,268 units, are already 95% of the Raider’s entire FY2023 sales of 239,388 units. The Raider, which has clocked over 500,000-unit sales in 25 months since launch in India, has quickly become the best-selling bike for TVS, ahead of the popular Apache series. The Apache bikes sold 176,302 units, up 11% on the 1,58,819 units sold in H1 FY2023.

The trio of entry-level bikes – the 110cc Radeon, Sport and 100cc Star City – clocked sales of 172,573 units, up 1.33% YoY. TVS also sold 1,864 units of the RR 310.

On the scooter front, TVS Motor Co remains the well-entrenched No. 2 player – at 706,130 units, sales were 7% up on the year-ago 657,703 units, which helps increase its market share marginally to 24.64% from 23.79% a year ago. While the Jupiter continues to be its best-seller, followed by the NTorq 125, the iQube electric scooter has contributed 96,654 units or 13.68% to total sales. A year ago, the iQube’s share of TVS scooter sales was just 1.63% (10,773 units from 657,703 scooters).

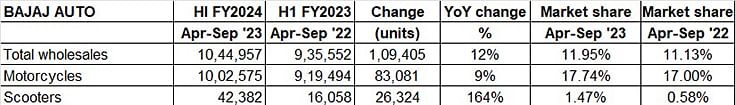

BAJAJ AUTO: 10,44,957 units, up 12% YoY

Market share: 11.95% in H1 FY24, up from 11.13% in April-Sep 2022

After TVS, Bajaj Auto is the other ‘millionnaire’ which continues to record strong numbers. The predominantly motorcycle player, which has only recently ventured into e-scooters, sees its market share rise 12%, mainly as a result of its 9% growth in motorcycle sales.

The Pune-based OEM sold a total of 10,44,957 units, comprising 10,02,575 bikes (up 9% YoY) and 42.382 electric Chetak scooters (up 164% YoY).

A look at the SIAM data reveals that Bajaj Auto has recorded strong growth in each of the 6 segments it is engaged in, with particularly smart growth in the premium bike categories.

In the entry level 100-110cc segment, the Platina 100 and CT100X have sold 2,79,659 units, down 20% (H1 FY2023: 350,261). The 110-125cc segment, which has the CT125X, Platina 110, Pulsar 125 and KTM 125 Duke and RC125, delivered sales of 4,17,629 units up 21% YoY (April-September 2022: 344,789). Then, in the 125-150cc category, the Pulsar 150 clocked sales of 1,13,268 units, up 3% (H1 FY2023: 109,978).

In the 150-200cc segment, the Pulsar N160, NS200 and RS200, along with the KTM 200 Duke and RC200 brought in sales of 1,33,199 units, rising 47% (H1 FY2023: 90,314 units). A segment above, in the 200-250cc category (Pulsar 22F, N250, F250, Dominar 250, KTM 250 Duke and Husqvarna Vitpilen and Svartpilen 250s), the growth story is even better – 40,044 units versus 16,667 units, which constitutes 140% YoY growth. And in the 350-500cc segment (Dominar 400, KTM RC390 and 390 Adventure) Bajaj sold 18,776 units, up 151% YoY.

Clearly, Bajaj is well set to accelerate growth in FY2024. Like Hero MotoCorp, Bajaj Auto too has challenged Royal Enfield’s midsize bike market dominance with the launch of the Triumph Speed 400, priced at Rs 223,000, which is rolling out of the Chakan factory, along with the Scrambler 400X, which was launched on October 11 at Rs 263,000.

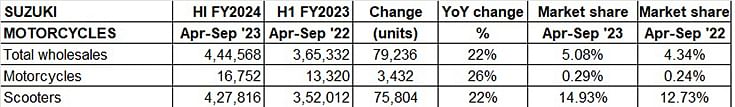

SUZUKI MOTORCYCLE INDIA: 444,568 units, up 22% YoY

Market share: 5.08% in H1 FY24, up from 4.34% in April-Sep 2022

Suzuki Motor Corp’s two-wheeler arm and Indian operation dispatched 444,568 units in H1 FY2024, which marks 22% YoY growth (H1 FY2023: 365,332 units). This performance gives Suzuki Motorcycle India a slight boost in market share to a little over 5 percent.

The company’s 124cc-engined scooters (Access, Avenis and Burgman Street) cumulatively sold 427,816 units, up 21.5% and accounted for an overwhelming 96% of total sales. Expect the bulk of these sales to have come from the popular Access.

Among the Suzuki bikes, the 155cc Gixxer sold 12,660 units, up 41% (H1 FY2023: 8,942). In the 200-250cc category, the combined sales of the Gixxer 250 and V-Strom SX fell 5% to 3,974 units (H1 FY2023: 4,185). In the big-bike segment, the 1340cc Hayabusa sold 118 units in April-September 2023.

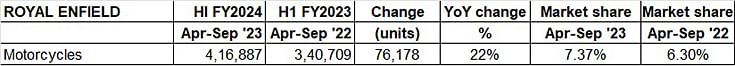

ROYAL ENFIELD: 416,887 units, up 22% YoY

Market share: 7.37% in H1 FY24, up from 6.30% in April-June 2022

The Chennai-based motorcycle manufacturer reported total wholesales of 416,887 units, up 22% on its year-ago sales of 340,709 units. This has helped the company increase its bike market share to 7.37% from 6.30% a year ago.

The bulk of its sales (91%), as usual, came in the 250-350cc category where the Bullet 350, Hunter 350, Classic 350 and Meteor 350 reside – 381,293 units, which marks 23% YoY growth. The 411 Himalayan adventure bike clocked sales of 21,085 units, 79 units more than it did a year ago. In the 500-800cc segment (Continental GT650, Interceptor 650, Super Meteor 650) Royal Enfield saw sales rise by 54% to 14,509 units, compared to the 9,433 units sold in H1 FY2023.

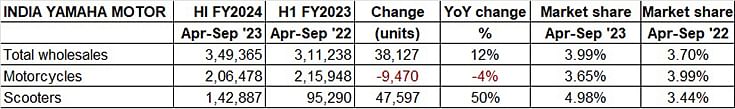

INDIA YAMAHA MOTOR: 349,365 units, up 12% YoY

Market share: 3.99% in H1 FY24, up from 3.70% in April-Sep 2022

India Yamaha Motor, which is seventh in the OEM rankings with 349,365 units, recorded 12% YoY growth. The smart rise in demand for its scooters saved the blushes for the Japanese OEM.

The sales are split 59% between motorcycles (206,478 units, down 4%) and 41% scooters (142,887 units, up 50%). In Q1 FY2024, the motorcycle share was 65%, which means scooter share has increased. The Ray and Fascino scooters together sold 138,350 units, up 45% YoY (H1 FY2023: 95,290). While the 149cc FZ series of bikes sold 98,930 units, down 10%, the 155cc MT 15 and R15s sold 1,07,548 units, up 5 percent.

Like Suzuki, Yamaha has also seen a marginal uptick in market share to 3.99%, up from 3.70% a year ago.

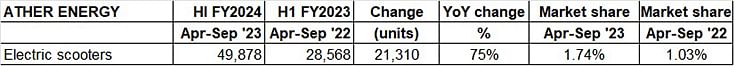

ATHER ENERGY: 49,878 units, up 75% YoY

Market share: 1.74% in H1 FY2024, up from 1.03% in April-Sep 2023

Bengaluru-based Ather Energy, which is the No. 3 best-selling electric scooter OEM after Ola Electric and TVS Motor Co, retailed 49,878 units in the April-September 2023 period, which is a solid 75% YoY increase (H1 FY2023: 28,568 units). This has helped the Bengaluru-based EV OEM to increase its share in the overall two-wheeler market to 1.74% from 1.03% in April-June 2022.

WILL THE IMPROVING SALES MOMENTUM SUSTAIN IN H2 FY2024?

FY2023 saw a little over 15.8 million two-wheelers (1,58,62,087 units) being sold, recording 17% growth. While was better than FY2022’s 13.5 million units, it was less than FY2021’s 15.1 million units, FY2020’s 17.4 million units and considerably less than the best-yet number of 21.1 million units in FY2019.

At halfway stage in FY2024, India Two-Wheeler Inc at 87,39,406 units has achieved 55% of FY2023’s total. The industry will have to log in a much higher rate of growth if it is get closer to FY2020’s 17 million-plus sales.

The on-ground retail market scenario has signalled healthy recovering and the beginning of a turnaround in rural markets, which are the key buyers of mass-market commuter bikes that are the volume providers. However, while the rate of growth in this entry-level segment may be slow, the executive and premium segments are seeing strong double-digit growth as easy finance availability has consumers flocking to buy new, peppier models.

With Navratri underway, Dussehra and Diwali coming up, scooter and motorcycle manufacturers have in the past month ramped up their production and supplies to their dealers across the country, ensuring that popular models are easily available. What’s more, a number of OEMs have rolled out a good number of new products and variants, while also offering attractive festive-season deals. While October and November 2023 will surely bring in better numbers, what will be critical is the sales momentum sustaining in December and through the last three months of FY2024.

ALSO READ:

TVS, Suzuki, Yamaha, Ather and Bajaj increase scooter market share in H1 FY2024

Electric two-wheeler sales near pre-slashed FAME subsidy levels

Diwali comes early: resilient India Auto Inc sells 11m units in H1 FY2024, up 9%

Tata, Toyota and VW buck industry decline in car and sedan sales in H1 FY2024

SUVs capture 57% of India's PV market: Maruti leads with 26% market share, M&M at 18% in H1 FY2024

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

21 Oct 2023

21 Oct 2023

37119 Views

37119 Views

Shahkar Abidi

Shahkar Abidi