Diwali comes early: resilient India Auto Inc sells 11 million units in first-half FY2024, up 9%

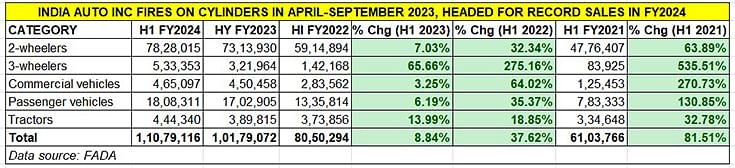

With all vehicle segments – 2-wheelers (up 7%), 3-wheelers (up 66%), PVs (up 6%), CVs (up 3%) and tractors (up 14%) – registering growth in April-September 2023 just before Navratri and Diwali, India Auto Inc is driving towards record sales in FY2024.

With cumulative retail sales of automobiles across five segments – two- and three-wheelers, passenger vehicles, commercial vehicles and tractors – registering strong 20% year-on-year growth in September 2023 at 1.18 million units (18,82,071 units), India Auto Inc has closed the first six months of FY2024 on a strong note.

Total sales of 1,10,79,116 units or 11.07 million units in the April-September 2023 period are 900,044 units more – or 9% higher – than the 1,01,79,072 units sold in H1 FY2023, clearly indicating the resilient nature of the industry in the face of some challenging conditions.

FADA president Manish Raj Singhania said: “The narrative of H1 FY2024 is one of resilience and recovery, with the total auto retail registering a 9% growth year on year. All categories also showed YoY growth with two-wheelers, three-wheelers, CVs, PVs and tractors growing by 7%, 66%, 3%, 6% and 14% respectively”. (See the H1 FY2024 retail sales data table below).

Two-wheelers: 7.82 million units, up 7% YoY

Two-wheelers, with 7,828,015 units, accounted for 70% of the overall market and saw 7% YoY growth, thanks to demand returning from rural India in the form of green shoots of recovery. Motorcycle and scooter numbers would have been more but for the tepid sales in the first four months of the ongoing fiscal year. Nevertheless, the fact remains that the two-wheeler segment remains under stress and still far from its H1 FY2019 peak of 97,27,200 units.

Three-wheelers: 533,353 units, up 66% YoY

The star showing in H1 FY2024 has come from the three-wheeler segment – sale of a record-breaking 533,353 units constitutes a handsome 66% YoY increase (H1 FY2023: 321,964 units). Three-wheeler retails contributed 4.81% to overall industry sales in H1 FY2024 and are benefitting from the transition to electric mobility. Of the total 533,353 three-wheelers retailed in H1 FY2024, 298,683 units comprised electric passenger and cargo carrying three-wheelers, which translates into a 56% share of the segment. This also means that every second three-wheeler currently sold in India is an electric model. Good news for EV OEMs.

FADA president Singhania commented: “The three-wheeler segment was the undisputed star, with a remarkable 66% YoY growth, consistently registering unparalleled sales figures month after month. Notably, the first half of FY2024 saw the segment significantly outperforming the H1 FY2019 figures of 358,187 units. This extraordinary performance underscores the sector's vigorous recovery.”

Passenger Vehicles: 1.80 million units, up 6% YoY

Second in volume terms is the passenger vehicle segment – 18,08,311 units, up 6.19% YoY and accounting for 16.32% of the total market. Between April-September 2023, the PV OEMs have sold 105,406 units more than they did a year ago and that can be attributed to the sustained demand for SUVs and MPVs.

In his comments on the PV segment, Singhania said: “The PV segment, while having its set of challenges, also showcased a narrative of steady resurgence and growth. It not only grew by 6% YoY but also witnessed record retails, with H1 FY2024 seeing an all-time high in PV retails at 18,08,311 units, surpassing the previous record set in H1 FY2023 (17,02,905 units). This continued growth trajectory for two consecutive fiscal years is a testament to the resilient demand and the market's positive response to the diverse and dynamic offerings in the segment.”

Commercial vehicles: 465,097 units, up 3.25% YoY

Commercial vehicles, the barometer of the economy, saw retail sales of 465,097 units, up 3.25% YoY but 64% better than FY2022. This is the CV industry’s second-best retail sales performance for the first-half of any fiscal, and just 7,395 units less than the best yet – 472,492 units in H1 FY2019.

The CV sector sees cyclical growth in a four-year pattern and from the look of it, the first year of upward movement has begun, thanks to big-ticket investment in infrastructure building from both the Central and State governments, as well as the private sector. What’s also helping CV sales is the boom in the e-commerce industry and the demand for last-mile deliveries across the country.

Tractors: 444,340 units, up 20% YoY

Despite a slowdown in September, tractor sales have not been left behind. The first half of FY2024 witnessed record-breaking retails of 444,340 units, reflecting substantial 20% YoY growth. This performance not only indicates a strong market demand but also surpasses the sales figures of H1 FY2023, which stood at 389,815 units.

Commenting on H1 FY’24 Auto Retails, FADA President, Mr. Manish Raj Singhania said, "As Fiscal Year 2024 unfolded, the auto retail sector in India embarked on a journey of cautious optimism and resilience amidst a mix of obstacles and victories across various vehicle categories. The initial modest 4% decline in April's overall vehicle retails was not only a reflection of the dynamic nature of the automotive market but also a precursor to a story of gradual recovery and growth that would unfold over the subsequent months, culminating in a robust 20% YoY growth in September.

Brimming with hope and optimism, India Auto Inc has stocked its dealers with strong inventory of popular models of all vehicle classes ahead of the 42-day festive season period which begins on October 14 with Navratri and continues with Diwali in mid-November.

Improving growth indicators in the form of an abundant monsoon, a buoyant stock market and sustained increase across key sectors have seen the Federation of Automobile Dealers Associations (FADA) upgrade its outlook for the automobile sector from cautious optimism to a hopeful and positive outlook for the market. Yes, it looks like Diwali has come early for India Auto Inc.

ALSO READ:

EV sales in H1 FY2024 jump 51% to 738,000 units, fiscal headed for record 1.5 million

Electric two-wheeler sales near pre-slashed FAME subsidy levels

CNG vehicle sales rise 32% to 666,000 units in January-September, CNG price cut to Rs 76 per kg

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

12 Oct 2023

12 Oct 2023

7612 Views

7612 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau