TVS, Suzuki, Yamaha, Ather and Bajaj increase scooter market share in first-half FY2024

Scooter wholesales at 2.86 million units in April-September 2023 indicate slow recovery; market leader Honda sells 1.28 million units, down 4%; iQube share of TVS dispatches grows to 13%; Suzuki and Yamaha witness sizeable growth.

Among the positives of India Auto Inc’s overall wholesales performance in the first six months of FY2024 is the two-wheeler segment. At 87,39,406 units, cumulative sales of scooters and motorcycles registered 4% YoY growth and accounted for 75% of total automobile sales of 11.61 million units.

Scooters, with 28,65,372 units, saw a YoY increase of 4% (H1 FY2023: 27,64,127) and accounted for 33% of the two-wheeler segment wholesales and 25% of total industry numbers. This total is 55% of FY20203’s 51,90,018 scooters.

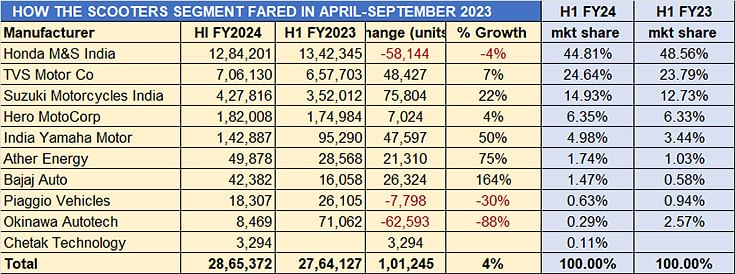

The top five OEMs among the SIAM 10 scooter members in the table below account for 27,43,042 units or an overwhelming 95% of the total scooter sales in the first six months of FY2024. Of this quintet, the top three players – Honda Motorcycle & Scooter India, TVS Motor Co and Suzuki – cumulatively have 24,18,147 units or 84% of the industry numbers. In terms of volume increase amongst these 10 SIAM member companies, five OEMs –TVS, Suzuki, Yamaha, Ather and Bajaj Auto – stand out.

Honda Motorcycle & Scooter India (HMSI) with its Activa brand remains unassailable – in H1 FY2024, the company dispatched 1.28 million units (12,84,201 units), 58,144 units fewer than a year ago and down 4% YoY. This sees HMSI’s scooter market share come down to 44.81%, from the 48.56% it had in April-September 2022.

TVS Motor Co remains the well-entrenched No. 2 player – at 706,130 units, sales were 7% up on year-ago 657,703 units, which helps increase its market share marginally to 24.64% from 23.79% a year ago. While the Jupiter continues to be its best-seller, followed by the NTorq 125, the iQube electric scooter has contributed 96,654 units or 13.68% to total sales. A year ago, the iQube’s share of TVS scooter sales was just 1.63% (10,773 units from 657,703 scooters).

Suzuki Motorcycle India sold 75,804 scooters more in H1 FY2024 to clock 427,816 units, up 22%, which is reflected in its market share growing to 15% from 12.73% in H1 FY2023.

In fourth position is Hero MotoCorp with 182,008 units, up 4% and a market share of 6.35%. Cumulative sales of the Destini 125, Maestro, Pleasure and Xoom were 176,208 units, up 0.69% YoY. The company also sold 5,800 units of its electric scooter, the Vida.

India Yamaha Motor with 142,887 units, saw sales up 50% YoY, a strong performance which sees Yamaha’s scooter share rise to 5%, up from 3.44% a year ago.

Two electric vehicle OEMs – Ather Energy and Bajaj Auto – have witnessed strong sales in April-September 2023. While Ather sold 49,878 e-scooters in the form of the 450S and 450X, up 21,310 units more than it did a year ago to achieve a market share to 1.74%, Bajaj Auto sold 42,382 Chetaks, 26,324 more than in H1 FY2023, for a market share of 1.47%, up on the 0.58% it had 12 months ago.

The electric two-wheeler market leader though is Ola Electric, which retailed 125,219 units in the first six months of FY2024 (as per Vahan retail data) and commands a 30% share. However, with the company not being a member of SIAM, Ola is not represented in this first-half FY2024 wholesales analysis of scooter manufacturers, which is specific to SIAM members only.

WILL THE SCOOTER MARKET SEE BETTER DEMAND IN H2 FY2024?

In FY2023, 5.19 million scooters were sold, up 26% on FY2022’s 41,12,672 units. However, this was well below the pre-Covid FY2020 total of 5.5 million units (55,66,036 units) and way below the record 6.71 million units (67,19,811 units) of FY2018 and 6.70 million units of FY2019.

While there is no doubt that the domestic market scenario is much improved since a year ago, the scooter market in tandem with motorcycles is yet to see fulsome demand come its way. The cost of two-wheeler ownership has increased over the past year and the demand in the critical entry-level segment continues to be impacted. Furthermore, though sales from rural India have picked up marginally, they are yet to deliver sustained growth.

However, given the slight uptick in the past two months and scooter (and bike) makers are optimistic that demand will pick up substantially in the ongoing festive season. Many of the OEMs have introduced new models and variants and are also offering discounts to capture demand.

ALSO READ:

Electric two-wheeler sales near pre-slashed FAME subsidy levels

Diwali comes early: resilient India Auto Inc sells 11 million units in first-half FY2024, up 9%

India Auto Inc well set for a strong FY2024, dispatches 11.61 million units in H1

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

20 Oct 2023

20 Oct 2023

16975 Views

16975 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau