Suzuki and TVS win scooter market share, Honda and Hero share dips in April-July '19

While scooter sales of Honda 2Wheelers (-21%) and Hero MotoCorp's (-36%) are down in the first 4 months of FY2020, Suzuki (+26%) and TVS (-1.5%) notch smart market share gains.

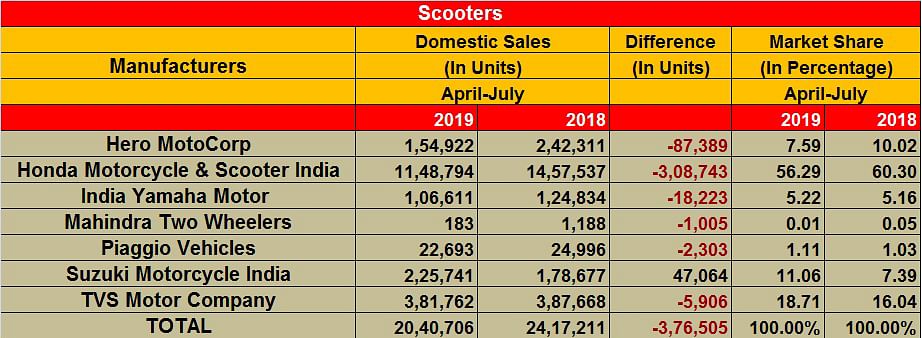

The scooter market, not too long ago the darling of the two-wheeler industry, has not been spared the trials and tribulations of a sales slowdown. In July 2019, the segment saw total despatches of 526,504 units (-12.10%) and in the April-July 2019 period, a total of 2,040,706 units (-15.58%). Its overall share of the two-wheeler market remains a good 31 percent though.

Honda Motorcycle & Scooter India (HMSI) remains the unassailable scooter market leader due to the powerful brand presence of the Activa but the fact of the matter is that its sales are slowing sharply. In the first four months of FY2020, HMSI sold a total of 1,148,794 units, down 21.18 percent (April-July 2018: 1,457,537). In the process, its scooter market share has reduced by 4 percentage points to 56.29 percent from 60.30 percent in April-July 2018.

In the opening month of FY2020, Honda's best-seller sold 210,961 units, a far cry from the year-ago sales (April 2018: 339,878) and down 38 percent YoY. In May 2019, it saw 218,734 units go out to showrooms, down 19.7 percent (May 2018: 272,475) and in June 2019, a total of 218,734 scooters, down 19.72 percent (June 2018: 272,475). Clearly, the ball is in the Honda's court to do something quickly to arrest the fall in the Activa's sales. The Japanese major, which is readying for the BS VI era, unveiled its first -- and India's -- BS VI-compliant product, not surprisingly, the Activa.

But HMSI is aggressively working on new growth strategies, and is targeting semi-urban and rural India to drive up sales. Earlier this year, it has tied up with Cholamandalam Investment & Finance Co for offering retail finance. What will help is Cholamandalam’s strong nationwide presence with over 1,000 branches, most of them rural and semi-urban areas, and a base of a million consumers.

Another sizeable market share drop is with Hero MotoCorp, which sees its share drop to 7.59 percent from 10.02 percent a year ago. The company sold a total of 154,922 units in April-July 2019, which marks a sharp YoY decline of 36 percent.

Hero MotoCorp is looking to cash in on the growing demand for 125cc scooters. In May this year, the company launched the Maestro Edge 125 offering it in three variants – a carburettor drum brake variant priced at Rs 58,500, a carburettor disc brake variant at Rs 60,000 and a fuel-injected variant at Rs 62,700 (prices ex-showroom, Delhi). Hero’s second offering in the 125cc segment, after the Destini 125, faces competition from other similarly conceptualised scooters like the TVS NTorq (Rs 59,900) and the Honda Grazia, for which prices start from Rs 60,723.

The two other scooter makers which are benefiting from the slowing sales of HMSI and Hero are TVS Motor Co and Suzuki Motorcycle India. TVS Motor Co sold a total of 381,762 units in April-July 2019, down a marginal 1.52 percent YoY which can be put down to the poor consumer sentiment stress in the market. However, the company saw its market share grow by 2.67 percentage basis points to 18.71 percent from 16.04 percent a year ago.

On June 7, TVS launched two variants of the Jupiter ZX – drum and disc. While the drum-brake model has been priced at Rs 56,093, the front disc brake-equipped version costs Rs 58,645 (both prices, ex-showroom, Delhi). Both come equipped with TVS’ version of combined brakes, called SBT, as standard. The ZX variant now gets many new features, including an LED headlight and a digi-analogue instrument cluster.

With the Jupiter and NTorq 125 maintaining good sales traction in the market, the company would be looking forward to the festive season to notch higher numbers.

The biggest market share gainer though is Suzuki Motorcycle India with a sterling performance in April-July 2019. With 225,741 scooters sold, it is the sole scooter maker to post positive numbers and notches robust 26.34 percent growth YoY. This performance sees the company make the highest gains of 3.67 percentage basis points in the April-July period to take 11.06 percent market share, compared to 7.39 percent a year ago.

The Access 125 has turned out to be a game-changer for the company. This popular buy and Suzuki's best-selling scooter seems to be closing the gap with the Jupiter and is a consistent No. 3, after the Activa and Jupiter. On July 16, Suzuki launched a refreshed version, the Access 125 Special Edition (SE) equipped with a disc brake variant. It is powered by the same all-aluminium, four-stroke, single-cylinder 124cc engine which develops 8.7ps at 7000rpm and 10.2 Nm of torque at 5000rpm.

TVS Motor and Suzuki were the two OEMs which, due to their Jupiter and Access scooters respectively, made smart gains in scooter market share in what was a tough FY2019. Bajaj Auto though, despite not being in the scooter market, was the biggest market share gainer last fiscal. Will they continue to maintain that growth trajectory in FY2020 or will Honda and Hero spring some surprises to rev up their sales? Stay tuned.

Read more: Motorcycle OEMs market share in April-July '19

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

17 Aug 2019

17 Aug 2019

16088 Views

16088 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau