July sales see carmakers firing on all cylinders

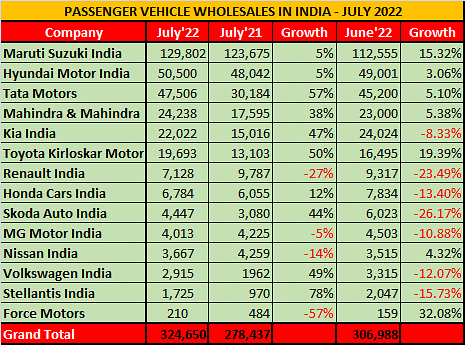

Key carmakers in India registered robust volumes and growth last month with easing off of chip pressures and continued demand for new cars.

Leading carmakers in India’s passenger vehicle (PV) market announced their sales performance for July, with most OEMs being able to ramp up production.

While chip supplies are improving, it's still not green signal for India Auto Inc. The fact, however, is that companies are in a much better state as compared to a year ago and are going all out to reduce delivery lead times for some popular models in the fray, as they face the risk of losing customers in a highly competitive market.

Maruti Suzuki India: 142,850 / +6.81%

For India’s largest carmaker, Maruti Suzuki India (MSIL), overall despatches to its dealers stood at 142,850 units last month, registering a 7 percent year-on-year (YoY) increase compared to July 2021’s 133,732 units shipped to its retail partners across the country. The company, however, said in a media statement that there was a minor impact of the semiconductor shortage on its production, particularly on its domestic models being manufactured for sale in India.

MSIL's utility vehicle sales coming from the Brezza, Ertiga, S-Cross and XL6, declined 28 percent to 23,272 units, compared to 32,272 units sold a year ago. The company had recently introduced the new Brezza compact SUV on June 30, and this could be a temporary blip as it transitions to the new model and ramps up production.

Hyundai Motor India: 50,500 / +5.1%

While MSIL continued to lead the tally, Korean rival Hyundai Motor India (HMIL), secured second position as it despatched 50,500 units to its dealers, registering a 5.1 percent YoY uptick (July 2021: 48,042). HMIL’s director for Sales, Marketing and Service operations, Tarun Garg, said, “With improvement in the semiconductor situation, the PV segment is showing positive trends, riding on the green shoots of pent-up demand and customer desire for personal mobility.”

Hyundai’s midsize Creta SUV is currently high on demand, and commands the lion’s share of the company’s 130,000 pending orders as on July 13. The SUV has soaring waiting periods of up to nine months in some cities, depending upon its trim and fuel option.

Tata Motors: 47,505 / +57%

At No. 3, Tata Motors sprung a new surprise by belting out its highest-ever dealer despatches at 47,505 units, a significant 57 percent YoY uptick over July 2021’s 30,185 cars and SUVs. Tata Motors has historically been outdoing its industry peers in terms of navigating through the chip crisis, and the July performance is a testament to the company’s leverage of its sourcing strengths.

While conventional IC-engine-powered models went home to 43,483 buyers (July 2021: 29,581 / +46%), the EV portfolio comprising the Nexon EV, Tigor EV as well as the fleet-only Xpres-T EV, recorded volumes of 4,022 units, multiplying more than six times the 604 units clocked in July 2021.

While SUV sales constituted more than 64 percent of the company’s total July 2022 numbers, the micro-SUV – Tata Punch – was the best-seller at 11,007 units. The company’s sales of its two CNG models – Tiago i-CNG and Tigor i-CNG – too was highest so far at 5,293 units.

Mahindra & Mahindra: 24,238 / +38%

At 24,238 units, Mahindra & Mahindra (M&M) too is firing on all cylinders with July despatches being 38 percent higher than volumes of 17,595 units in July 2021. The company is straddling through a problem of plenty with over 143,000 pending orders until July 1, with the much-revered XUV700 having over 80,000 open bookings, and a wait period of close to two years in some cities. What will be a challenge is the record-breaking orders received for its Scorpio-N – at over 100,000 bookings in under 30 minutes on July 30.

Kia India: 22,022 / +47%

Kia India’s 22,022 units registered a 47 percent YoY uptick (July 2021: 15,016), with the Seltos and Sonet going home to 8,451 and 7,215 buyers, respectively. The seven-seat MPV Carens too clocked robust numbers and recorded sales of 5,978 units in July 2022. According to Harpreet Singh Brar, SVP and head of Sales and Marketing, Kia India, “ The gradual improvement in the supply chain is adding momentum to Kia India’s growth. So far, we are outpacing the industry with cumulative growth of 28.4 percent over 2021, which is much higher than the industry average of 16 percent. With the upcoming festive season, we shall strive to improve supplies to give faster deliveries to our customers.”

Toyota Kirloskar Motor: 19,693 / +50%

The Japanese carmaker registered a 50 percent YoY increase in July volumes, which culminated at 19,693 units (July 2021: 13,103). The July numbers are the highest-ever for the company, since its inception in India in 1999. “This significant milestone also reinforces the popularity enjoyed by our segment-leading models like the Innova Crysta, Fortuner and Legender. The new Glanza premium hatchback, as well as the Urban Cruiser continue to gather momentum and bring us encouraging bookings,” said Atul Sood, AVP, Sales and Strategic Marketing, TKM.

Renault India: 7,128 / -27%

French carmaker Renault reported a drop in July numbers by as much as 27 percent on a year-on-year basis. The company despatched 7,128 units last month, compared to 9,787 units clocked in July 2021.

What could possibly be not working in Renault's favour is the lack of a CNG fuel option in its affordable category of cars as customers look for lowest cost of mobility amidst rising fuel prices, as well as the increase in the number of options for customers, for instance, the Tata Punch giving a strong fight to the Renault Triber and Kiger.

On the other hand, July also brought a new milestone for Renault India when its value-for-money Triber MPV accomplished the 100,000-unit sales mark within 30 months of coming to the market. The company also introduced the refreshed Kiger last month with few cosmetic and feature updates.

Honda Cars India: 6,784 / +12%

Honda Cars India (HCIL) clocked cumulative volumes of 6,784 units in July, registering a YoY growth of 12 percent (July 2021: 6,055). The Japanese carmaker has cited the chip shortage to be continuing to impact its supplies and said it is diligently aligning production to meet the demand in quickest time.

Yuichi Murata, director, Marketing and Sales, said, “As we approach the festive season, we hope that the demand will continue to stay strong, and bring in the much-needed festive cheer for the industry after the challenging situation last year.”

Skoda Auto India: 4,447 / +44%

What has been a true revival story, the new duo of the Slavia and Kushaq midsize sedan and SUV models, respectively, have turned tables around for the Czech carmaker. Skoda Auto India clocked 4,447 units last month, recording a 44 percent growth over July 2021’s 3,080 units, when the Kushaq had made its market debut.

The company says that despite July being a slow month where new purchases are kept on hold on account of the monsoons, and pushed to the nearing festive season, the robust demand for its India product portfolio saw it garner strong numbers. “We are on-track to achieve our best-ever annual sales in the two-decade history of the brand Skoda in India,” said Zac Hollis, brand director.

MG Motor India: 4,013 / -5%

MG Motor India clocked sales of 4,013 units in July, registering a 5 percent YoY decline (July 2021: 4,225). The company said in a statement that it is working towards augmenting its supplies and meeting customer demand persistently. The carmaker is gearing up to roll out the updated 2022 version of its best-seller Hector SUV.

While July numbers are a mixed bag for OEMs, depending upon their strategy to navigate through the chip shortage, the macro-level situation looks a lot less grim compared to a few months ago. Semiconductor supplies are consistently improving, and with a robust order book, most OEMS are looking at a record FY23 that could surpass the previous best of 3.3 million units, albeit with fears of inflation, recession, as well as geopolitical implications.

Also read

CV sales in uptick mode in July' 22

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

02 Aug 2022

02 Aug 2022

7113 Views

7113 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau