Electric car and SUV sales up 14% in November to 8,600 units, Tata share falls to 50%, JSW MG rises to 36%

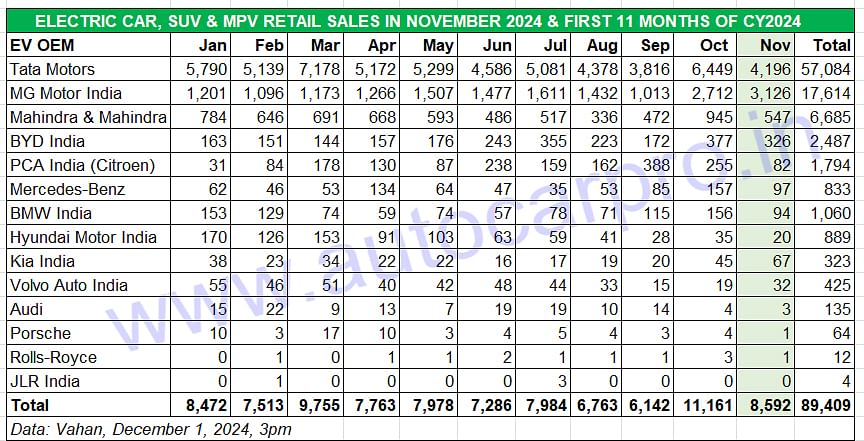

After notching best-ever monthly retails in festival-laden October, demand for electric PVs slowed down albeit November was the third best-selling month this year even as January-November (89,557 units) sales have surpassed CY2023 numbers. While market leader Tata Motors is feeling the heat of the competition, JSW MG Motor India is benefiting from the Windsor EV and its new BaaS sales strategy. Luxury EV sales fell sharply last month but cumulative 11-month retails are up 12% year on year.

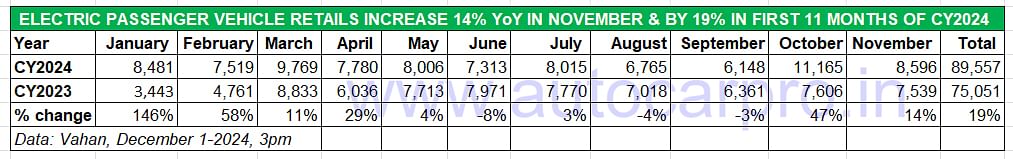

After a heady and festive month of October 2024, when the electric passenger vehicle industry achieved record monthly retail sales of 11,165 units (up 47% YoY), November 2024 sales at 8,596 units (up 14% YoY) appear rather tepid in comparison. Nevertheless, they are 40% better than the 17-month low of 6,148 units in September 2024 and have helped India ePV Inc to surpass its entire CY2023’s retails of 82,558 units. As per Vahan retail sales data (December 1, 2024, 3pm), total January-November 2024 sales of electric cars, SUVs and MPVs at 89,557 units are a 19% YoY increase over the year-ago sales of 75,051 units.

Cumulative sales of 89,557 electric passenger vehicles in the first 11 months of CY2024 have surpassed CY2023's record retails of 82,558 units.

Cumulative sales of 89,557 electric passenger vehicles in the first 11 months of CY2024 have surpassed CY2023's record retails of 82,558 units.

CY2024 has been somewhat of a roller-coaster in terms of monthly sales. It opened with strong sales of 8,481 units (up 146% YoY), dropped 11% month on month to 7,519 units in February, hit 9,769 EVs in the FY2024-ending month of March, dropped sharply to 6,148 units in September, and then hit its best-ever monthly numbers in October (11,165 units). Let’s take a detailed look at the movers and shakers in this segment of the Indian EV industry.

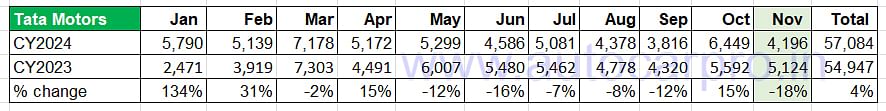

TATA MOTORS – November 2024: 4,196 units, down -18% YoY

TATA MOTORS – November 2024: 4,196 units, down -18% YoY

Market share: November 2024 – 49% / November 2023 market share: 68%

Jan-Nov 2024: 57,084 units, up 4% YoY (Jan-Nov 2023: 54,947 units), CY2023: 60,004 units

Tata Motors is clearly feeling the heat of the growing competition. As per Vahan data (December 1, 3pm), the longstanding electric car and SUV market leader sold 4,196 EVs in November 2024, down 18% YoY (November 2023: 5,124 units). This performance translates into its market share dropping sharply to 49% from 68% in November 2023 (5,124 units) as well as in January 2024 (5,790 EVs out of India ePV Inc’s 8,481 units). In October 2024, Tata Motors had sold 6,449 units (up 15% YoY) which gave it a market share of 58 percent.

Tata Motors is clearly feeling the heat of the growing competition. As per Vahan data (December 1, 3pm), the longstanding electric car and SUV market leader sold 4,196 EVs in November 2024, down 18% YoY (November 2023: 5,124 units). This performance translates into its market share dropping sharply to 49% from 68% in November 2023 (5,124 units) as well as in January 2024 (5,790 EVs out of India ePV Inc’s 8,481 units). In October 2024, Tata Motors had sold 6,449 units (up 15% YoY) which gave it a market share of 58 percent.

The company has the largest e-PV portfolio in India comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers), Punch EV and the recently launched Curvv EV. Tata Motors’ cumulative January-November 2024 retails at 57,084 units are up by 4% (January-November 2023: 54,947 units) and give it an 11-month market share of 64 percent. The company, which had sold 60,004 EVs in CY2023, needs to sell 2,920 units more to surpass that total in CY2024.

Along with expanding its EV sales network across the country, Tata Motors is also offering six months of free charging at any of the over 5,500 Tata Power charging points across the country, as a value add.

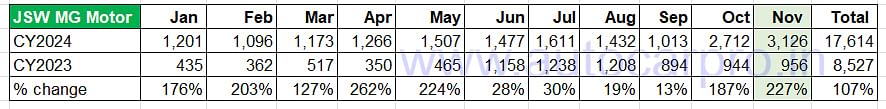

JSW MG MOTOR INDIA – November 2024: 3,126 units, up 227% YoY

JSW MG MOTOR INDIA – November 2024: 3,126 units, up 227% YoY

Market share: November 2024 – 36% / November 2023 market share: 13%

Jan-Nov 2024: 17,614 units, up 107% YoY (Jan-Nov 2023: 8,527 units), CY2023: 9,523 units Sometimes it is a new product and/or a new sales strategy that helps adds accelerate demand. The MG Windsor EV, JSW MG Motor India’s third electric vehicle after the ZS EV and Comet EV, has clearly added tailwinds to the company’s sales. At 3,126 units, November 2024 sales are the company’s best-ever EV monthly numbers and up 15% on October 2024’s 2,712 units.

Sometimes it is a new product and/or a new sales strategy that helps adds accelerate demand. The MG Windsor EV, JSW MG Motor India’s third electric vehicle after the ZS EV and Comet EV, has clearly added tailwinds to the company’s sales. At 3,126 units, November 2024 sales are the company’s best-ever EV monthly numbers and up 15% on October 2024’s 2,712 units.

Priced at Rs 13.49 lakh (ex-showroom) and billed as India's first intelligent Crossover Utility Vehicle (CUV), the Windsor EV combines features of both a sedan and an SUV. MG Motor India is also benefiting from its innovative Battery-as-a-Service (BaaS) program for its EVs. According to the OEM, this flexible ownership program eliminates the upfront cost of the battery, enabling customers to pay only for its usage. This subscription model lowers the per-kilometre expense significantly reducing the initial acquisition cost to ensure an economical ownership experience. Under BaaS, the Windsor is available at Rs 999,000 + battery rental @ Rs3.5/km, MG Comet EV starts at Rs 499,000 + battery rental at Rs2.5/km and the MG ZS EV is offered at Rs 13.99 Lakh + battery rental at Rs 4.5/km.

The company is also upping the ante on the sales network front by expanding to Tier 3 and Tier 4 cities as well as rural markets across India. There are plans to set up 100 new touchpoints by the end of 2024, and setting up 520 touchpoints in 270 cities by the end of March 2025.

This strong showing last month gives JSW MG Motor a market share of 36% in November (up from 13% in November 2023), and 20% for the January-November 2024 period’s cumulative retails of 17,614 units (versus 13% in CY2023). Not surprisingly, the company has easily surpassed its entire CY2023 total of 9,523 units.

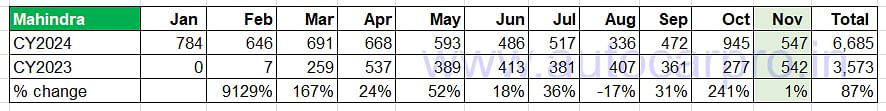

MAHINDRA & MAHINDRA – November 2024: 547 units, up 1% YoY

MAHINDRA & MAHINDRA – November 2024: 547 units, up 1% YoY

Market share: November 2024 – 6% / November 2023 market share: 7%

Jan-Nov 2024: 6,685 units, up 87% YoY (Jan-Nov 2023: 3,573 units), CY2023: 4,267 units Mahindra & Mahindra, the third-ranked EV OEM, sold 547 XUV400 electric SUVs in November 2024, up 1% on year-ago sales of 542 units in November 2023. This gives the company a 6% market share for November and a 7.46% share for the January-November 2024 period with total sales of 6,685 – up 101% YoY (January-November 2023: 3,573 units). M&M had sold 4,267 XUV400s in CY2023.

Mahindra & Mahindra, the third-ranked EV OEM, sold 547 XUV400 electric SUVs in November 2024, up 1% on year-ago sales of 542 units in November 2023. This gives the company a 6% market share for November and a 7.46% share for the January-November 2024 period with total sales of 6,685 – up 101% YoY (January-November 2023: 3,573 units). M&M had sold 4,267 XUV400s in CY2023.

The Mahindra XUV400 EV, which is currently priced between Rs 16.74 lakh and 17.49 lakh, comes with 34.5kWh and 39.4kWh battery options, with MIDC ranges of 359km and 456km, respectively. What should give a fillip to sales in the coming months is that the XUV400, in mid-November, achieved a top 5-star Bharat NCAP crash test rating.

M&M, which will have added manufacturing capacity of around 100,000 units for its upcoming Born Electric vehicles by end-March 2025, plans to invest Rs 12,000 crore towards its EV programme. On November 26, M&M launched the first of its two ‘Born Electric’ SUVs – the Be 6e (priced from Rs 18.90 lakh) and the XEV 9e (priced from Rs 21.90 lakh) – built on its innovative INGLO (Intelligent Electric Global) platform. Deliveries of the two new e-SUVs are slated to commence in end-February or early March 2025.

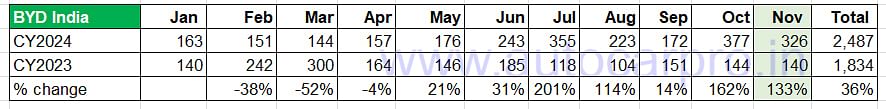

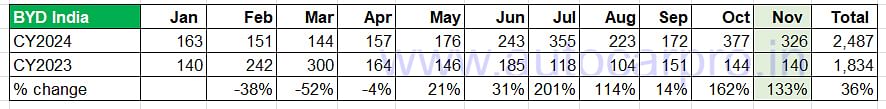

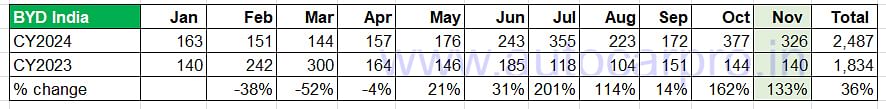

BYD INDIA – November 2024: 326 units, up 133% YoY

BYD INDIA – November 2024: 326 units, up 133% YoY

Market share: November 2024 – 6% / November 2023 market share: 2%

Jan-Nov 2024: 2,487 units, up 36% YoY (Jan-Nov 2023: 1,834 units), CY2023: 2,012 units

BYD India, which sells the all-electric Atto 3 SUV, Seal sedan and more recently the new eMAX 7 MPV maintains its No. 4 EV OEM position. In November 2024, BYD sold 326 EVs, up 133% on November 2023’s 140 units but below festive October’s 377 units, which has been its best-ever monthly sales. November retails take the Chinese EV OEM’s cumulative 11-month sales to 2,487 units, 475 EVs more than its entire CY2023 retails of 2,012 units.

BYD India, which sells the all-electric Atto 3 SUV, Seal sedan and more recently the new eMAX 7 MPV maintains its No. 4 EV OEM position. In November 2024, BYD sold 326 EVs, up 133% on November 2023’s 140 units but below festive October’s 377 units, which has been its best-ever monthly sales. November retails take the Chinese EV OEM’s cumulative 11-month sales to 2,487 units, 475 EVs more than its entire CY2023 retails of 2,012 units.

In an effort to further improve sales traction in the Indian market, BYD is exploring the introduction of a midsize electric SUV priced around Rs 20 lakh and is believed to be currently evaluating multiple models from its global portfolio. If this new model exercise for India proves fruitful, BYD India could enter the Rs 20 lakh EV segment by the second half of 2025 and take on Hyundai Motor India’s upcoming Creta EV and Maruti Suzuki India’s eVX. Most likely, the BYD e-SUV could be showcased at the Bharat Mobility Show to be held in New Delhi in January 2025.

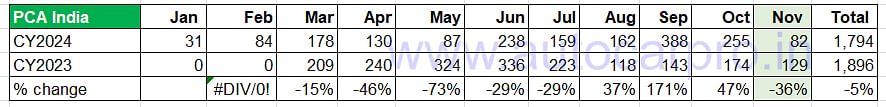

PCA MOTORS / CITROEN INDIA – November 2024: 82 units, down 36% YoY

PCA MOTORS / CITROEN INDIA – November 2024: 82 units, down 36% YoY

Market share: November 2024 – 0.95% / November 2023 market share: 1.71%

Jan-Nov 2024: 1,794 units, down 5% YoY (Jan-Nov 2023: 1,896 units), CY2023: 1,949 units

After hitting best-ever monthly sales of 388 units in September 2024, and following it up with sold 255 units in October, PCA Motors (Citroen India) registered retail sales of just 82 units in November 2024, down 36% YoY. The company, which retails the e-C3, the electric avatar of the C3 hatchback, has a fair number of bookings from EV fleet operators. The Citroen eC3, which has a 29.2kWh battery pack and an ARAI-claimed range of 320km, should see increased sales momentum later this year. Between March and June 2024, the e-C3 has received bulk orders for over 7,000 units from Blusmart, OHM E Logistics and Cab-E. In the first 11 months of CY2024, PCA Motors had clocked cumulative sales of 1,794 units, which 102 units shy of its CY2023 sales of 1,949 units.

After hitting best-ever monthly sales of 388 units in September 2024, and following it up with sold 255 units in October, PCA Motors (Citroen India) registered retail sales of just 82 units in November 2024, down 36% YoY. The company, which retails the e-C3, the electric avatar of the C3 hatchback, has a fair number of bookings from EV fleet operators. The Citroen eC3, which has a 29.2kWh battery pack and an ARAI-claimed range of 320km, should see increased sales momentum later this year. Between March and June 2024, the e-C3 has received bulk orders for over 7,000 units from Blusmart, OHM E Logistics and Cab-E. In the first 11 months of CY2024, PCA Motors had clocked cumulative sales of 1,794 units, which 102 units shy of its CY2023 sales of 1,949 units.

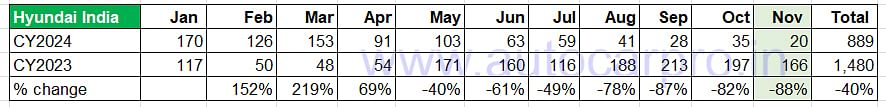

HYUNDAI MOTOR INDIA – November 2024: 20 units, down 88% YoY

HYUNDAI MOTOR INDIA – November 2024: 20 units, down 88% YoY

Market share: November 2024 – 0.95% / November 2023 market share: 1.71%

Jan-Nov 2024: 889 units, down 40% YoY (Jan-Nov 2023: 1,480 units), CY2023: 1,608 units

Hyundai Motor India, the second-ranked passenger vehicle manufacturer in India after Maruti Suzuki India, has hit its lowest monthly EV sales of just 20 units of the Ioniq 5 in November 2024, down 88% on the 166 units sold in November 2023. The company had registered three-figure retails for the first three months of this year but having discontinued the Kona in India in the middle of the year, it has seen sales slow down substantially since then. At present, Hyundai’s sole EV is the Ioniq 5. Hyundai, whose cumulative January-November 2024 sales at 889 units are down 40 YoY (January-November 2023: 1,480 units), had sold a total of 1,608 EVs in CY2023.

Hyundai Motor India, the second-ranked passenger vehicle manufacturer in India after Maruti Suzuki India, has hit its lowest monthly EV sales of just 20 units of the Ioniq 5 in November 2024, down 88% on the 166 units sold in November 2023. The company had registered three-figure retails for the first three months of this year but having discontinued the Kona in India in the middle of the year, it has seen sales slow down substantially since then. At present, Hyundai’s sole EV is the Ioniq 5. Hyundai, whose cumulative January-November 2024 sales at 889 units are down 40 YoY (January-November 2023: 1,480 units), had sold a total of 1,608 EVs in CY2023.

However, expect the Korean auto major to bounce back strongly soon. CY2025 and the fourth quarter of the current fiscal year will see Hyundai Motor India launch the much-awaited Creta EV, the all-electric avatar of the Creta midsize SUV, which is currently the best-selling model in its segment and has recorded wholesales of 113,913 units between April-October 2024. The recently listed company has outlined strategic EV launch game-plan which comprises four models including a mas-market model.

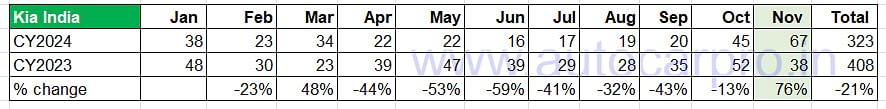

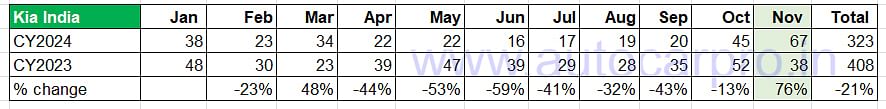

KIA INDIA – November 2024: 67 units, up 76% YoY

KIA INDIA – November 2024: 67 units, up 76% YoY

Market share: November 2024 – 0.77% / November 2023 market share: 0.50%

Jan-Nov 2024: 323 units, down 21% YoY (Jan-Nov 2023: 408 units), CY2023: 438 units

Kia India, like Hyundai, has seen a marked drop in its EV sales. Kia has sold 323 units between January and November, which gives it a minimal market share of 0.36%, down from the equally minimal share of 0.53% in CY2023 (438 units).

Kia India, like Hyundai, has seen a marked drop in its EV sales. Kia has sold 323 units between January and November, which gives it a minimal market share of 0.36%, down from the equally minimal share of 0.53% in CY2023 (438 units).

Till September, the company had only a single EV in the market – the EV6. In October, the company launched the six-seater EV9 SUV, priced at Rs 1.3 crore. The EV9 is being brought through the CBU route and is now Kia’s flagship offering in the country, sitting above the EV6. The EV9 has no direct rivals in India, but it gives some competition to luxury electric SUVs such as Mercedes EQS SUV, EQS SUV, BMW iX and Audi Q8 e-tron.

LUXURY EV MANUFACTURERS SELL 2,533 UNITS IN JANUARY-NOVEMBER, UP 12%

LUXURY EV MANUFACTURERS SELL 2,533 UNITS IN JANUARY-NOVEMBER, UP 12%

After achieving robust sales in the festive month of October (311 units, up 39%), demand for luxury electric cars, sedans and SUVs dropped sharply by 48% in November 2024 to 228 units as per Vahan retail sales data. Nevertheless, the cumulative sales of 7 OEMs for the first 11 months of CY2024 at 2,533 units are up 12% YoY (January-November 2023: 2,271 units). These seven OEMs combined sales in CY2023 were 2,643 units which means they need to sell 110 units in December 2024 to surpass last year’s luxury EV sales, which should be achieved in the first 10-odd days of this month.

BMW India, the luxury EV market leader (1,060 units in January-November 2024), has sold 94 units in November, down 67% YoY, and saw Mercedes-Benz India with 97 units go ahead, as it also did in October. BMW India has a luxury EV market share of 41% in November and 42% (948 units) for the first 10 months of this year.

Mercedes-Benz India sold 97 EVs in November 2024, which gives it a 42% share of the luxury EV market. Its January-November 2024 sales (833 EVs) are up 93% YoY (January-November 2023: 431 EVs) and give it a 33% share of the luxury EV market in the year to date. Importantly, for the German carmaker, it has raced past its CY2023 total of 516 units.

Mercedes-Benz India sold 97 EVs in November 2024, which gives it a 42% share of the luxury EV market. Its January-November 2024 sales (833 EVs) are up 93% YoY (January-November 2023: 431 EVs) and give it a 33% share of the luxury EV market in the year to date. Importantly, for the German carmaker, it has raced past its CY2023 total of 516 units.

While luxury EVs accounted for 2.65% of the overall ePV market in November, their share of the India electric car and SUV market in the first 11 months of this year is marginally higher at 2.82 percent.

ALSO READ: Ola sells 29,000 EVs in November, stiff TVS-Bajaj battle continues, Revolt sells 2,000 bikes

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

01 Dec 2024

01 Dec 2024

34538 Views

34538 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal