TVS is No. 1 e2W OEM for second week in a row in January, Ola moves up to No. 3

While the TVS iQube with retail sales of 9,804 units has held onto its lead and stays ahead of the Bajaj Chetak (8,694 units), Ola Electric, which was ranked fourth in January Week 1, has taken third position with 6,655 units, ahead of Ather Energy’s 5,360 units. These four OEMs account for 84% of the total 36,234 e-two-wheelers sold in the first two weeks of January 2025.

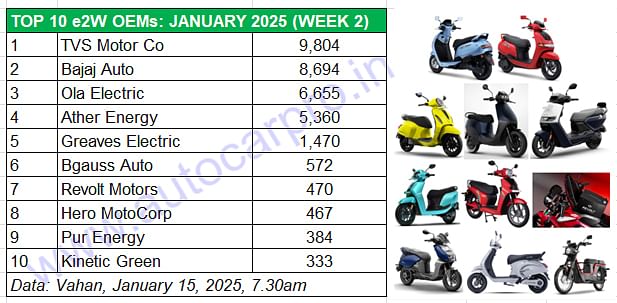

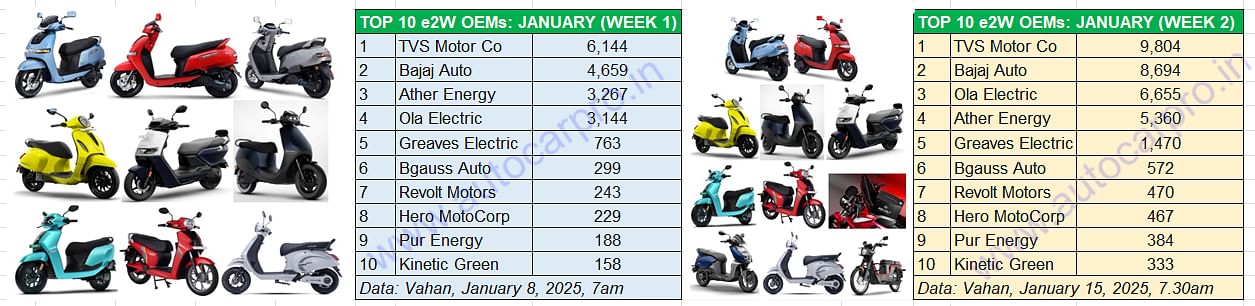

TVS Motor Co and its iQube electric scooter have maintained the lead they had in January Week 1 in the Week 2 (January 8-14). As per the latest retail sales data on the Vahan portal (as of January 15, 7.30am), the iQube has registered retail sales of 9,804 units, which is an increase of 3,660 units over the 6,144 units it had in Week 1.

This gives TVS a 27% share of the total 36,234 e2Ws sold in the month to date (see Top 10 OEMs data table below). In CY2024, TVS Motor Co was ranked No. 2 with total sales of 220,577 units which gave it a market share of 19% from the total India 2W Inc sales of 1,148,683 units.

Combined sales of TVS, Bajaj, Ola and Ather, at 30,513 units constitute 84% of the total 36,234 electric two-wheelers retailed between January 1-14.

Combined sales of TVS, Bajaj, Ola and Ather, at 30,513 units constitute 84% of the total 36,234 electric two-wheelers retailed between January 1-14.

Bajaj Auto, the No. 1 e2W OEM for the first time in December 2024, has also held onto its second rank with 8,694 units, having sold 4,035 additional units in January Week 2. This retail sales performance gives the Bajaj Chetak a current market share of 24 percent. The Pune-based OEM, which launched the new Chetak with enhanced 153km range last month, will be looking to maintain the same momentum it had last year. In CY2024, Bajaj Auto sold 193,494 Chetaks for a 17% market share and was ranked third.

Ola Electric, which was ranked No. 4 in Week 1, has now gone ahead of Ather Energy to take No. 3 position for the January 1-14 period.

Ola Electric, the e2W market leader in CY2024 with a 35% share and 400,000-plus units, which was ranked fourth in January Week 1 (3,144 units), has moved up one rank in Week 2. With total retails of 6,655 units – an additional 3,511 units – Ola has gone ahead of Ather Energy. This gives the company a current market share of 18%, up from the 15% it had in Week 1. Expect Ola Electric, which launched two new products in November 2024 – the S1 Z priced at Rs 59,999 and the S1 Z+ which costs Rs 64,999 – as well as the Ola Gig, a dedicated product for the gig economy, priced at an extremely affordable Rs 39,999, to see a strong 2025. Deliveries of the S1 Z, S1 Z+, Gig and Gig1 are slated to later this year, around April-May.

Ather Energy, which markets the Rizta, 450S and 450 Apex e-scooters, has dropped one rank to now be at No. 4 in January 2024 Week 2 with 5,360 units. This translates into an additional 2,093 units sold between January 8-14, which gives Ather a current market share of 15% which is the same as in Week 1. The Rizta family e-scooter, launched in April and the winner of Autocar India’s Electric Two-Wheeler of 2025 Award, is witnessing growing demand. While the S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. The Rizta’s highlights include the largest two-wheeler seat in India and storage space aplenty. In CY2024, Ather Energy had sold 126,218 EVs which gave it an 11% market share.

Combined sales of TVS, Bajaj Auto, Ola Electric and Ather Energy at 30,513 units constitute 84% of the total 36,234 e-two-wheelers sold by India e2W Inc in the first two weeks of January 2025.

Greaves Electric Mobility, which is seeing growing traction for its Nexus e-scooter, retains its No. 5 position in January Week 2 with 1,470 units, having sold 707 units between January 8-14. This gives it a 4% share for the January 1-14 period.

Bgauss Auto is ranked No. 6 with 572 units, followed by electric motorcycle maker Revolt Motors (470 units). Hero MotoCorp, with its Vida brand of e-scooters and the recently launched Vida 2, is at No. 8 with 467 units. Pur Energy, with 384 units, is ninth. Kinetic Green, which entered the Top 10 chart for the first time in Week 1, holds onto its No. 10 position with retail sales of 333 units in the first two weeks of January.

There are 17 days still left to go before the month changes into February. Will TVS maintain its decent lead over Bajaj Auto? Or will Ola sales accelerate enough to take it up the ladder board? Stay plugged in as we bring you up-to-date on the retail sales story on electric two-wheelers.

With two weeks left in January 2024, it remains to be seen how the final Top 10 e2W OEMs rankings shape up.

2W SHARE OF EV RETAILS AT 54% IN FIRST TWO WEEKS OF JANUARY

Between January 1 and 14, a total of 66,921 EVs across all segments have been sold, as per Vahan data. They comprise 36,234 two-wheelers (54% share), 25,103 three-wheelers (37.51% share), 5,259 passenger vehicles (8% share) and 320 commercial vehicles (0.47% share).

Even as the two legacy OEMs at the top (TVS Motor Co and Bajaj Auto) have outsold their start-up rivals (Ather Energy and Ola Electric), another legacy rival and the ICE scooter market leader has entered the e2W market. Honda Motorcycle & Scooter India has opened bookings for the Activa e: and QC1 and will officially announce the pricing for the Activa e: and QC1 at the Bharat Mobility Global Expo which opens later this week on January 17. Clearly, there’s plenty of exciting action in this segment of zero-emission mobility. Stay plugged in as we bring you the latest reports and in-depth number-crunching analyses.

ALSO READ:

E2W sales jump 33% to 1.14 million units and 59% of India EV market in CY2024

Bajaj Chetak outsells Ola and TVS to become India’s No. 1 e2W OEM in December

Revolt Motors sells nearly 10,000 electric motorcycles in CY2024

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

15 Jan 2025

15 Jan 2025

18721 Views

18721 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau