Tata Motors only 9,220 units behind Hyundai India halfway into FY2023

The battle for No. 2 position in the PV market hots up with Tata, which is aiming for 500,000-unit sales in FY2023, hot on the Korean carmaker’s heels.

With SIAM releasing India Auto Inc’s half-year wholesales numbers which at 1,09,88,305 units, constitute strong double-digit growth of 32% year on year, vehicle segment-wise analysis throws up some interesting revelations.

September 2022, with 355,043 units, was the best-ever month for the Indian PV industry, a number which could just be bettered by the festive month of October which saw Navratri in its first half and has Diwali in the second half.

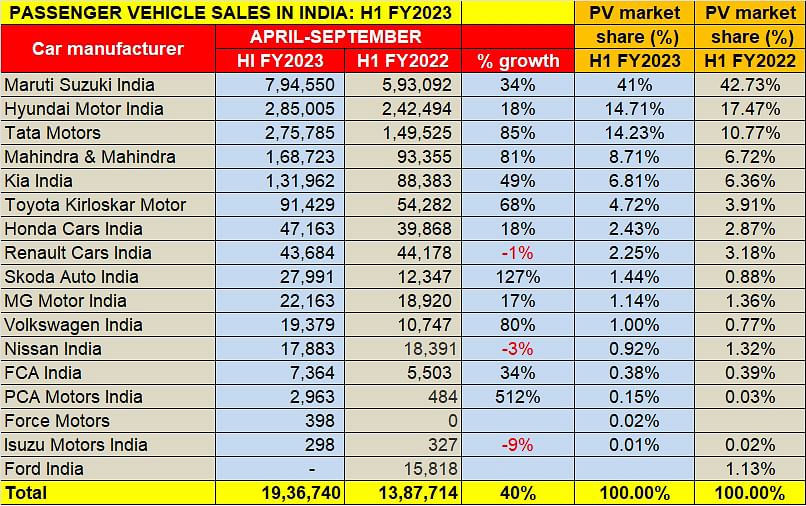

The passenger vehicle industry, which is on a roll, clocked wholesales of 19,36,740 units, which is 40% YoY growth (H1 FY2022: 13,87,714). Of the 15 OEMs fighting for a slice and more of the action of the competitive Indian marketplace, all but three OEMs have clocked year-on-year increases in the April-September 2022 period.

A closer look at the FY2023 first-half data table (below) reveals some rather interesting facts. The top six carmakers – Maruti Suzuki, Hyundai, Tata Motors, Mahindra & Mahindra, Kia India and Toyota Kirloskar Motor – account for 90% of overall PV sales, leaving the other nine players to fight for the balance 10 percent share. Of this lot, Skoda Auto India and Volkswagen India stand out with increasing market share, thanks to growing customer demand for new models like the Skoda Kushaq and Slavia, and the VW Taigun and Virtus.

Maruti, Hyundai see market share decline

While the sales per company per se indicate growth or otherwise, the market’s shifting dynamics which indicate slower demand for hatchbacks (up 29%) versus robust customer buying of utility vehicles (up 50%), the results are there to see in OEMs’ changing market share fortunes.

Given the massive demand for SUVs, the UV sub-segment with 982,456 units accounts for 51% of PVs sold in first-half FY2023, while cars accounted for 879,954 units have a 45% share. Vans, with 74,330 units, have a 3.83% share of PV numbers.

The carmakers with a strong or UV-focussed portfolio have made substantial PV market share gains in H1 FY2023 while the drive has been slower with a more balanced model range.

Case in point are Maruti Suzuki India and Hyundai Motor India, which while having clocked good YoY double-digit growth have seen their market share decline. Compared to H1 FY2022, when it had a 42.73% market share, Maruti Suzuki now has a 41% share. And Hyundai Motor India’s PV share has come down to 14.71% from 17.47% a year ago.

Battle for No. 2 position hots up

Making the most of the demand for SUVs are Tata Motors and Mahindra, whose new models are witnessing strong demand.

Tata Motors, which is on track to sell 500,000 PVs in FY2023 (which will translate into 34% YoY increase over FY2022’s 373,138 units) is particularly well placed. At half-way stage in the ongoing fiscal with 275,785 units and 85% YoY growth, it is just 9,220 units behind India’s No. PV OEM, Hyundai which has clocked cumulative wholesales of 285,005 units, up 18% YoY. Tata Motors has made the maximum gains in market share in H1 FY2023: up by nearly 3.5 percentage points to 14.23% from 10.77% a year ago.

While it can be expected that the Korean carmaker will do all to protect its position and turf, Tata Motors has the EV advantage with the Nexon, Tigor and the just-launched Tiago EVs. What’s more, being India’s most affordable electric hatchback, the Tiago EV can be expected to eat into ICE hatchback sales as well as of CNG models, given the rising price of CNG which has already seen all of seven price hikes this year.

Mahindra ups the ante

Mahindra & Mahindra, which has posted strong 81% YoY growth with 168,723 units, is the next best with market share gains – up by two percentage points to 8.71% from 6.72% a year ago. The company, which recorded its highest monthly sales for the third month in a row in September, With a sizeable backlog of bookings for popular SUVs like the XUV700, XUV300, Scorpio, Thar and the Bolero, the company will be looking to ramp up production to maximise deliveries.

Kia India, Toyota Kirloskar Motor, Skoda Auto India and Volkswagen India are other OEMs which have increased their market share.

With the PV industry headed to hit record numbers in FY2023, estimated to be in the region of 3.6 to 3.8 million units, this is one segment that’s going to unleash a few surprises in the coming months. The commercial vehicle sector too is firing on cylinders but that calls for a separate analysis. Watch this space.

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

16 Oct 2022

16 Oct 2022

23600 Views

23600 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi