At 355,000 units, September best month ever for carmakers in India

Much-improved chip supplies lead to increased production as carmakers look to make the most of festive season and also surge of consumer demand.

Passenger vehicle sales in India have banished the blues of the past two years and are back to pre-Covid levels. In fact, September 2022 wholesale numbers have set a new monthly benchmark: 355,946 units, which constitutes 26% month-on-month growth (August 2022: 281,210).

September 2022’s record wholesales better the previous highest – July 2022’s 341,370 units by 4%, October 2020’s 334,411 units by 6.5% and March 2021’s 316,034 units by 12 percent. Comparing last month’s sales to the Septembers of the past two years, September 2022’s record tally is a 121% increase over September 2021’s 160,070 units and 30% growth over September 2020’s 272,027 units.

Confirming the best-ever monthly sales, Vinkesh Gulati, chairman of FADA India Research & Academy tweeted: “Car despatches to dealers crossed 3.5 lac in September 2022. It should be the best month for PV segment ever!”

A number of growth-enhancing factors have led to the record wholesales including the easing of the vexing semiconductor supply chain issue, increased vehicle production and supplies to dealers across India as OEMs ramped up manufacturing and strong customer demand in the ongoing festive season. What’s not to like?

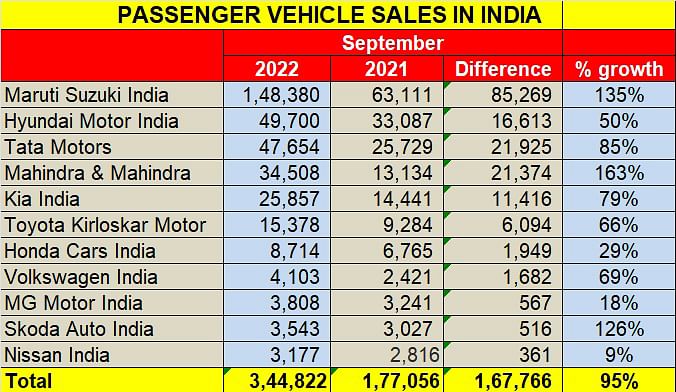

Here’s looking at 11 out of 16 PV OEMs’ wholesales – which total 344,822 units – last month. Five carmakers – Renault India, FCA India, PCA Motors India, Force Motors and Isuzu Motor India – have yet to release their September 2022 sales. Suffice it to say that the balance 11,124 units belong to these players who in August 2022 had accounted for 9,235 units between them.

Maruti Suzuki India: 1,48,380 units / 135% YoY

The PV market leader reported its best monthly sales in the six months of the ongoing fiscal year. Maruti Suzuki’s September 2022 wholesales of 148,380 units, depict 135% YoY growth but that is on September 2021’s 63,111 units. Due to a massive shortage of semiconductors, Maruti Suzuki had slashed production by 60% in September 2021, which in turn led to a 57% YoY decline in sales.

Demand looks to be strong across its portfolio. While it wouldn’t be correct to compare YoY growth with the truncated sales of September 2021’s, a comparison with August 2022 number offers more clarity. In September 2022, the entry level duo of the Alto and S-Presso account for 29,574 units, up 33% (August 2022: 22,162 units). Its six-pack comprising the Baleno, Celerio, Dzire (and Tour S), Ignis, Swift and Wagon R contributed 72,176 units, which is flat sales – 0.86% – versus August 2022’s 71,557 units.

The UVs – new Brezza, Ertiga, S-Cross, XL6 and the new Grand Vitara – contributed 32,574 units, up 21% on August 2022’s 26,932 units. This strong double-digit growth can be attributed to the demand for new Grand Vitara and new Brezza

Hyundai Motor India: 49,700 units / 50% YoY

Chennai-based Hyundai Motor India with 49,700 units recorded a strong 50% YoY growth (September 2021: 33,087). Demand remains robust for flagship SUV, the Creta which, according to Tarun Garg, Director (Sales, Marketing & Service), has seen an increase of 36% in bookings in September. Meanwhile, the Venue, Venue N Line and Tucson are said to have received “unprecedented customer response.”

Tata Motors: 47,654 units / 85% YoY

Just 2,964 units behind Hyundai is a hard-charging Tata Motors which is a on roll. It is a matter of time before the company surpasses the 50,000 monthly sales milestone.

Tata Motors, which grabbed the headlines with the reveal of its Tiago EV at a sub-Rs 10 lakh price last week, has notched its best-ever monthly sales yet. The carmaker’s 47,654 units in September 2022 beats its previous best of 47,505 units in July 2022 by 149 units. The September 2022 numbers, which comprise 43,999 IC engine PVs – the monthly highest – and 3,655 electric vehicles, are a robust 85% YoY growth (September 2021: 25,729 units).

Seen from the half-year perspective, Tata Motors' cumulative sales in H1 FY2023 at 272,450 units are up 84% (April-September 2021: 148,319) and already 73% of the company’s record annual sales of 373,138 units in FY2022. Q2 FY2023 (July-September 2022) numbers at 142,325 units are up 9.37% on Q1 FY2023’s (April-June 2022) 120,842 units, indicating that consumer demand is accelerating for the company.

Where Tata Motors has a strong advantage over its PV rivals is with its EV portfolio. At present, it has three models – the Nexon EV, Tigor EV and the fleet-only XPres-T EV – which with H1 FY2023 sales of20,805 units are a 370% YoY increase (H1 FY2022: 4,419 EVs).

The company, which is targeted production and sale of over 500,000 PVs, including 50,000 EVs, is well on track towards achieving its goal. In the first half of FY2023, average monthly sales of 45,408 units – 41,940 ICE and 3,468 EVs – augur well for the rest of the year. You can be sure its rivals are keeping a close watch on its moves.

Mahindra & Mahindra: 34,508 units / 163%

Mahindra & Mahindra, whose utility vehicle-laden portfolio comprises of 11 utility vehicles and the all-electric Verito sedan, is among the OEMs benefiting from the surging wave of demand for SUVs in India. Therefore, it is not surprising that the company continues to post record numbers month after month. In September 2022, it registered wholesales of 34,508 units, up 163% on year-ago 13,134 units.

On the UV front, the company has sold 34,262 UVs in September 2022, which makes it the third consecutive month that the company has scaled a new high in its UV sales, after August 2022’s 29,519 units and July 2022’s 27,854 units.

Autocar Professional learns that the best-selling model is the flagship XUV700, followed by the Scorpio, both in its N and Classic model form, the XUV300, the Bolero and Bolero Neo. With improved supplies of semiconductors and M&M judiciously managing its production operations it is expected that the waiting periods for most high-selling SUVs will come down.

At half-way stage in the fiscal, M&M has sold a total of 167,052 UVs, which makes for robust 82% YoY growth (H1 FY2022: 92,016 units). This total is already 75% of the company’s total sales of 223,682 UVs in FY2022, which were its best-ever UV sales. Given the strong market momentum, the unabating demand for SUVs and also safer vehicles, M&M could be headed to hit the 350,000 UV sales mark for the first time in FY2023.

Kia India: 25,857 units / 79% YoY

Kia India has reported its highest-ever monthly sales of 25,857 units, which is 79% YoY growth over the year-ago sales of 14,441 units, and betters June 2022’s 24,024 units. Kia’s best-seller remains the Seltos midsize SUV with 11,000 units, followed by the Sonet compact SUV with 9,251 units. The recently launched Carens MPV, with 5,233 units, is reflecting strong customer demand. The Carnival MPV sold 333 units last month.

Toyota Kirloskar Motor: 15,378 units / 66% YoY

Toyota Kirloskar Motor reported despatches of 15,378 units in September 2022. This constitutes a 66% year-on-year growth (September 2021: 9,284 units), and a month-on-month growth of 2.80% (August 2022: 14,959 units). The company’s cumulative sales for the first six months of FY2023 (April-September 2022) are 91,451 units, up 68% YoY (April-September 2021: 54,282 units).

Atul Sood, Associate VP, Sales, and Strategic Marketing, TKM said, “Last month, we launched Toyota Urban Cruiser Hyryder, the first self-charging strong hybrid EV in the B-SUV segment. The brand-new SUV from Toyota has received rave reviews, with booking orders exceeding beyond our expectations. Pricing for the new model has also been very well received by our customers and the market alike, as we have tried to price all the grades of the Hyryder very competitively. Despatches of the vehicle have begun recently."

He added, "Our segment-leading models like the Fortuner, Legender and the Innova Crysta Petrol continue to garner customer orders whilst models like the new Glanza continue to clock promising wholesales as well as customer orders.”

Honda Cars India: 8,714 units / 29%

Honda Cars India (HCIL) has registered wholesales of 8,714 units in September, a 29%YoY growth over September 2021’s 6,765 units. The carmaker, which introduced the strong-hybrid City sedan – City eHEV – in India in May at a price-tag of Rs 19.49 lakh, is bullish on the festive demand.

According to Yuichi Murata, director, Marketing and Sales, HCIL, “The festive demand has been strong and continues to show good momentum. On the supply side, we were able to increase our factory output compared to last month, which is a positive sign for the festive season in the sense that it ensures better availability of Honda’s cars during the period of Navratras, Dussehra and Diwali.”

Though it’s priced at a significant premium of Rs 417,000 over the comparable top-spec version of the petrol City automatic, the hybrid City eHEV boasts of a 44 percent higher fuel efficiency of 26.5kpl. “City eHEV is giving us additional opportunity to serve our customers with an advanced electrified mobility solution, and we are getting exceptional user feedback from them,” Murata added.

Honda Cars India continues to rely on the City and Amaze (compact sedan) as its two bread-and-butter models in India, until it arrives with a brand-new compact SUV – codename 3US – likely to be introduced by March 2023.

Volkswagen India: 4,103 units / 69% YoY

Volkswagen Passenger Cars India despatched 4,103 units in September 2022, up 69% on the year-ago 1,682 units. The company is seeing a resurgence of demand thanks to the Taigun midsize SUV and the more recently launched Virtus sedan. The Tiguan SUV continues to have its following in the Indian market.

MG Motor India: 3,808 units / 17.5%

MG Motor India has reported retail sales of 3,808 units in September 2022, up 17.5% (September 2021: 3,241). Cumulative sales for the first six months of FY2023 (April-September 2022) are 22,163 units, also up 17% (April-September 2021: 18,920 units).

The company, which launched the Advanced Gloster SUV exactly a month ago at Rs 31.99 lakh, says the model has “received an encouraging response.” Meanwhile, the all-new ZS EV has also performed well, and its “retail numbers are highest in this year so far” albeit specific numbers have not been released.

MG Motor India is among the automakers which continue to be impacted by supply chain constraints and the waiting period continues to be 3-6 months across some models. With the semiconductor availability issue persisting, MG is able to supply only the Astor MT model for the time being. The company though “is hopeful about commencing deliveries of the Astor automatic variants soon.”

Skoda Auto India: 3,543 units / 17% YoY

Skoda Auto India has reported wholesales of 3,543 units in September 2022, up 17% (September 2021: 3,027). Month-on-month, September 2022’s sales are down 19% on August 2022’s 4,222 units.

For the first six months of FY2023, Skoda's cumulative sales of 27,911 units are a sterling 126% YoY (April-September: 12,347 units), which can be credited to a strong market demand for its two new models – the Kushaq SUV and the Slavia sedan.

Petr Solc, Brand Director, Skoda Auto India said: “We are absolutely delighted to continue the success story of Skoda’s biggest year in India. This is an excellent result and a great recognition of all the hard work of our team and our dealer partners. The Kushaq and Slavia models have been successfully established in the market and drive the sales impetus. In addition, our D-segment products like the Octavia and Superb are leading their respective categories. Our focus is now on further enhancing customer satisfaction and increasing Skoda customer touchpoints across India.”

Nissan Motor India: 3,177 units / 9%

Nissan Motor India reported despatches of 3,177 units in the domestic market and export of 4,088 units.

Growth outlook: SUV-charged PV sales headed for record FY2023

September 2022's record sales can only spell good news for the Indian PV industry and for the overall automotive industry, as the benefits percolate to several ancillary sectors. Importantly, despite the overall recessionary trends in India and also globally, consumers are making a beeline for the best deals in a market thronging with new models and scores of variants, available at multiple price-points.

The surging demand for SUVs, which now account for nearly one out of every two cars sold in India, is reflected in the new charge in the PV market. All OEMs, with a strong and fresh SUV product portfolio are firing on all cylinders. While the compact SUV segment remains high on the consumer radar, the growing demand for midsize SUVs is apparent. Meanwhile, there is also a smart uptick for executive sedans.

With cumulative April-September 2022 sales crossing the 1.84 million mark and the market momentum being strong in the coming six months of FY2023, India Auto Inc could be looking at best-ever annual sales of over 3.5 million units.

ALSO READ

Tata Nexon stays on top as India’s No. 1 UV in April-August 2022

Export leader Maruti Suzuki takes strong lead in first five months of FY2023

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

02 Oct 2022

02 Oct 2022

24769 Views

24769 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau