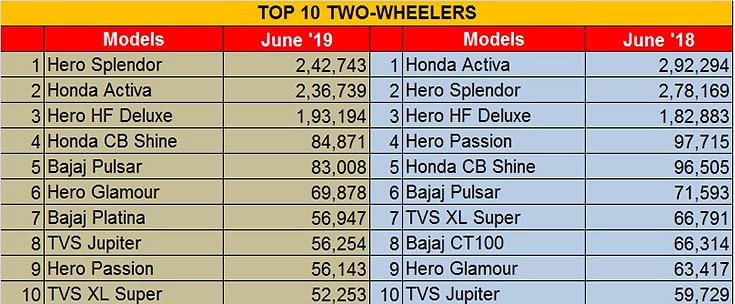

India’s Top 10 Two-Wheelers – June 2019 | 6,004 units stand between Hero No. 1 and Honda Activa

Having improved its monthly numbers, the Activa with 236,739 units falls a tad short of the crown.

The holds-no-barred battle between Hero and Honda, between motorcycle and scooter, but on two wheels only, continues between the Splendor and the Activa, both highest sellers in their respective segments. While the two have regularly traded places at the top, in June the two were separated by barely 6,004 units.

The Hero Splendor family of commuter motorcycles took the crown with a total of 242,743 units. The Hero Splendor commuter motorcycle, whose iSmart variant recently became the country’s first BS VI-certified two-wheeler, continues to rule the Top 10 two-wheeler chart for the third straight month.

Smarting from its loss by only 2,716 units to the Activa in FY2019, in April 2019 the Splendor wrested the crown with sales of 223,532 units, compared to the Activa’s 210,961 units – a difference of 12,571 units. In May 2019, the Hero Splendor sold a total of 267,450 units compared to the Honda Activa’s 218,734 units – a difference of 48,716 units.

The closing of the gap by the Honda Activa, which has improved its sales in June 2019 with 236,739 units, makes it a close second albeit considerably below year-ago sales of 292,294 units. This is the best yet in Q1 FY2020 considering Honda despatched 210,961 units in April 2019. In end-May, the company launched the Activa 5G Limited Edition, with prices starting at Rs 55,032 (for the Activa 5G Limited Edition STD) and going up to Rs 56,897 for the Activa 5G Limited Edition DLX). The company is aggressively readying up for the BS VI era and recently revealed its BS VI-compliant fuel-injected Activa 125.

The Hero HF Deluxe maintains its No. 3 position with despatches of 193,194 units, bettering its 183,255 units in May and 182,029 units of April 2019, indicating that the commuter bike is growing sales month on month, despite an overall downturn in the market.

At No. 4 is the Honda CB Shine with sales of 84,871 units, down on the 92,069 units in May 2019. Demand seems to be growing for this motorcycle and in a bid to increase sales, HMSI recently launched the CB Shine Limited Edition at Rs 59,083 for the drum brake model and Rs 63,743 for the disc brake variant.

Bajaj Auto enters the Top 10 chart with the Pulsar range at No. 5 and 83,008 units. Bajaj Auto, which was the biggest market share gainer in FY2019, will be looking to up the ante in the coming months. In Q1 FY2020, Bajaj Auto despatched a total of 610,936 motorcycles, which marks 2.81 percent year-on-year growth for the company.

At No. 6 is the Hero Glamour with 69,878 units , improving on its May 2019 tally of 69,379 units. The 124.7cc motorcycle was once a strong buy in the market but is in danger of losing its glamour. Expect Hero MotoCorp to come up with a new strategy designed to re-introduce some glamour into this executive commuter.

The Bajaj Platina, with 56,947 units, takes seventh place. The Platina, along with the CT100 and Discover, has been instrumental in driving Bajaj Auto's strong performance in FY2019 and also in the ongoing depressed market environment.

At No. 8 is the TVS Jupiter, the second-best-selling scooter in India after the Activa. In June 2019, the scooter sold a total of 56,254 units, similar to its May 2019 sales of 56,797 units. While the company must be happy that the numbers have not fallen in the depressed market, the Jupiter is not gaining speedier traction, remaining in the 50,000-60,000 unit monthly sales bracket.

On June 7, TVS launched two variants of the Jupiter ZX – drum and disc. While the drum-brake model has been priced at Rs 56,093, the front disc brake-equipped version costs Rs 58,645 (both prices, ex-showroom, Delhi). Both come equipped with TVS’ version of combined brakes, called SBT, as standard. The ZX variant now gets many new features, including an LED headlight and a digi-analogue instrument cluster.

Ninth place goes to the Hero Passion motorcycle with 56,143 units, 13,520 units less than the 69,663 units sold in May and a sizeable decline in monthly numbers.

Closing the Top 10 best-sellers' list is the toughie on two wheels which refuses to bow out in an era of fast-paced motoring: the TVS XL Super moped with 52,253 units, a tad more than the 52,109 units in May 2019.

Earlier this year, TVS Motor Co, the sole moped maker in India confirmed to Autocar Professional that it will make its mopeds BS VI compliant. Not surprising, considering that the company has sold a total of 7.65 million mopeds in India over a decade and remains the most affordable form of mobility on two wheels.

Read more: Top 10 Scooters in June 2019

Top 10 Utility Vehicles in June 2019

Top 10 Passenger Vehicles in June 2019

Bajaj Auto, TVS and Suzuki snatch Q1 2W market share

India Auto Inc sales tumble 3 quarters in a row

Hyundai records PV market share gains in a red-inked Q1

Hyundai Venue and Mahindra XUV300 drive UV market share gains in tough Q1

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

20 Jul 2019

20 Jul 2019

70036 Views

70036 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi