Industry sales drive downhill in April

With the compulsory implementation of the new safety and emission norms on new vehicles around the corner, the Indian auto industry has been observing a slump in sales and correspondingly has led to a decline in the production as well.

As India goes to polls, discretionary vehicle purchases have taken a breather too, with sales across vehicle categories plummeting in the starting month of FY2020.

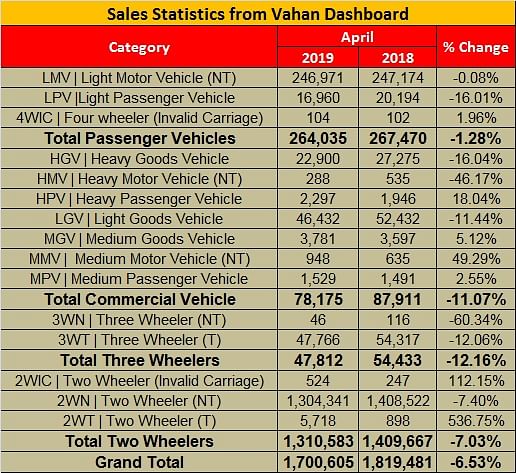

The Indian auto industry has registered substantial de-growth in sales across passenger vehicles, commercial vehicles, two-wheelers and three-wheelers in the month of April, what with subdued buyer interest and poor market sentiments in lieu of the undergoing general elections, holding buyers from loosening their purse.

While the slowdown is an extension of the tough festive season of FY2019, industry experts don’t foresee any progressive shift in performance until the next quarter of the ongoing fiscal. Where high fuel prices, low availability of funds and escalating acquisition costs have led to disinterest in most rural places, urban customers are finding more convenience in shared mobility, which is increasingly replacing new car ownership in the country’s key Tier 1 cities.

All key vehicle segments reported weak performance last month with passenger vehicles (PVs) and two-wheelers – the two key drivers - going into a double-digit dip. While PVs registered cumulative sales of 247,541 units in the month and declined 17.07 percent (April 2018: 298,504), two-wheelers too recorded a significant 16.36 percent drop in performance, with overall sales culminating at 1,638,388 (April 2018: 1,958,761).

Commercial vehicles (CVs) and three-wheelers were relatively better in comparison, but the industry in totality is submerged in a sea of red. CV sales at 68,680 units recorded a 6 percent slowdown (April 2018: 73,049), while three-wheelers declined 7.44 percent to close at 46,262 units (April 2018: 49,980).

Major PV players see double-digit decline

Within the PV segment, passenger cars observed a dramatic slump of 20 percent with a mere 160,279 units going home to buyers, as against the 200,183 units sold in April 2018. Moreover, UVs too saw a cut in demand with a 6.67 percent drop in sales, which were pegged at 73,854 units (April 2018: 79,136) by month end.

Almost all major OEMs are facing a crunch situation including country’s leading carmaker, Maruti Suzuki, which declined as high as 20 percent by being able to only sell 131,385 units (April 2018: 163,434). While Hyundai Motor India dropped 10 percent with sales of 42,005 units (April 2018: 46,735) and UV major Mahindra & Mahindra only sold 19,966 vehicles to de-grow 9 percent, Tata Motors took a sharp beating and declined 26 percent for its sales to land at 12,694 units (April 2018: 17,236).

The only respite for the PV segment came from the export figures where it registered a growth of 11.6 percent year-on-year.

Bracing for a revival with BS VI

We recently reported that the commercial vehicle segment sold a million units for the first time ever in a single year in FY2019. However, commercial vehicle (CV) sales have turned uncertain in the first month of FY2020. Market leader Tata Motors and challenger Mahindra Trucks & Buses’ sales in April 2019 saw de-growth while those of Ashok Leyland and VE Commercial Vehicles remained in positive territory.

The overall commercial vehicle segment registered a decline of 5.98 percent in April 2019 as compared to the same month last year. Medium & Heavy Commercial Vehicles (M&HCVs), with sales of 24,725 units declined 13.56 percent (April 2018: 28,604) and Light Commercial Vehicles (LCVs) sold 43,955 units and declined 1.10 percent (April 2018: 44,445). Marginal respite came from passenger carriers in each of the two sub-segments.

Low riding aspirations

Slump in sales has not spared the most voluminous segment either, with India’s two wheeler market recording a notable double-digit fall in sales over previous years. Hero MotoCorp (-17.24%) and Honda Motorcycles and Scooters India (-31.94%) posted shocking numbers in the month, hinting at the plight of the mass commuter two-wheeler segment, while Royal Enfield with a 20.76 percent decline, told buyer sentiments at the premium end.

The once accelerating scooter sub-segment recorded a new low of 26 percent with sales grounding to 489,852 units (April 2018: 661,007) and motorcycles observed de-growth of 11.81 percent with 1,084,811 units going home to buyers (April 2018: 1,230,046).

Levelling the scales with low inventory

With a similar or a marginally better result expected in the coming months until the newly elected government settles well into its place, the Indian auto industry is trying to squeeze out profit by reducing inventory costs, and trying to cope up excess inventory, which says dealer body FADA, has reached to astronomical levels of 45-50 days in many cases.

On the current inventory front, the average inventory for PVs range from 40 – 45 days, 2W range from 45 – 50 days and CV range from 45 – 50 days. The unified dealer body has already appealed for a lean inventory system to manage the situation better.

While the entire Q1 of FY2020 until June could be throwing similar numbers month after month, a slew of new product launches in the coming months, and in fact, in a few days’ time could create that much-needed market pull to turn around the tides. We will track how the story unfolds.

Also read: Slowdown hits India's two-wheeler market hard

PV makers record double-digit sales decline in April

RELATED ARTICLES

TVS Motor: The New King of India's Electric 2-Wheeler Market

January 2026 sees TVS Motor solidify its position with 34,558 units Bajaj struggles to keep pace.

Electric PV Sales Stabilize after GST Hit

Fresh FADA data shows January 2026 registrations surging 55% year-on-year, with Tata, JSW MG, and Mahindra all posting s...

Bajaj Chetak production plunges by 47% in July due to shortage of rare earth magnets

Bajaj Auto manufactured 10,824 Chetaks last month, 9,560 fewer units than the 20,384 Chetaks produced in July 2024. As a...

By Autocar Professional Bureau

By Autocar Professional Bureau

13 May 2019

13 May 2019

15359 Views

15359 Views

Angitha Suresh

Angitha Suresh

Arunima Pal

Arunima Pal

Ajit Dalvi

Ajit Dalvi