More than one in four cars sold worldwide this year set to be electric

The IEA’s latest Global EV Outlook states that global sales of electric cars are on track to surpass 20 million units this year, and will account for over a quarter of cars sold worldwide. In the first three months of CY2025, electric car sales have risen 35% YoY. While China maintains its position as the EV market leader, emerging markets like India and some Latin American countries are the new centres of growth.

The International Energy Agency (IEA) has, in its annual Global EV Outlook, forecast that despite significant uncertainties, electric passenger cars’ market share is on course to exceed 40% by 2030 as they become increasingly affordable in more markets.

Following another year of robust growth in CY2024, global sales of electric cars are on track to surpass 20 million in CY2025, accounting for over a quarter of cars sold worldwide. The report shows that despite recent economic headwinds that have put pressure on the auto sector, global sales of electric cars have continued to break records as electric models become increasingly affordable. Sales exceeded 17 million globally in 2024, putting EVs’ share of the global car market above 20% for the first time, as forecasted by the IEA previously. And in the first three months of 2025, electric car sales were up 35% year-on-year. All major markets, and many others, saw new records for first-quarter sales.

Emerging markets in Asia and LatAm new centres of growth

China maintains its position as the EV market leader, with electric cars accounting for almost half of all car sales in 2024. The number of electric cars sold in China last year (more than 11 million) is equivalent to the total sold worldwide in 2022. Emerging and developing markets in Asia and Latin America have also become new centres of growth, with total electric car sales across these regions surging by more than 60% in 2024 and the sales share almost doubled from 2.5% to 4%. This rapid growth has been strengthened by policy incentives.

Emerging and developing economies in Asia (excluding China) saw a large increase in electric car sales, reaching almost 400,000 in 2024, up over 40% from 2023.

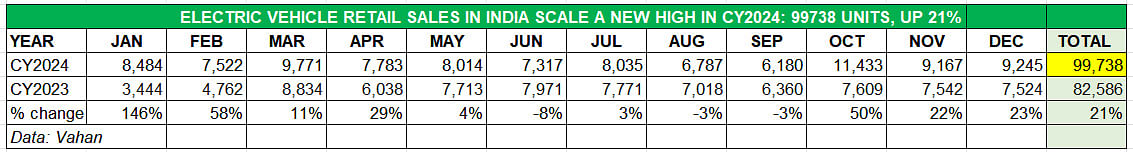

In India, demand for electric passenger cars has risen, particularly in the past year. In CY2024, 99,378 new electric cars were sold in the country, which constitutes YoY growth of 20% (CY2023: 82,563 units).

Sales of electric cars, SUVs and MPVs in India rose 21% YoY in CY2024 to a record 99,738 units.

Sales of electric cars, SUVs and MPVs in India rose 21% YoY in CY2024 to a record 99,738 units.

This best-ever annual sales record is set to be surpassed this year because in the first three months of CY2025, a total of 34,568 electric cars, SUVs and MPVs have being sold, up 34% YoY (January-March 2024: 25,777 units).

The Indian electric car market is currently witnessing a shakeout what with EV leader Tata Motors under pressure from JSW MG Motor India. SUV major Mahindra & Mahindra has also mounted a challenge with the recent launched on two new electric SUVs (BE 6 and XEV 9e). While Hyundai Motor India, the second-ranked passenger car maker, has launched the Creta Electric, the zero-emission avatar of the country’s best-selling midsize SUV, ICE market leader Maruti Suzuki will be launching its first EV (the e-Vitara) later this year, as will Toyota Kirloskar Motor (Urban Cruiser EV) as part of the global Suzuki-Toyota alliance.

Thailand remained the largest EV market in Southeast Asia, despite a 10% drop in electric car sales. This decline was outweighed by an even steeper 26% drop in conventional car sales, largely due to stricter lending criteria, meaning the electric sales share rose to 13% in 2024, up from 11% the previous year. Within the region, Indonesia and Vietnam also stood out, respectively tripling and nearly doubling their sales numbers and reaching sales shares comparable to countries such as Spain or Canada. In many Southeast Asian countries, BEVs are the most popular electric car type, with over 90% of all electric car sales being fully electric.

In Latin America, sales volumes and penetration rates doubled in many countries, with electric cars reaching a market share of 4% in 2024. Brazil towered over other countries in the region with nearly 125,000 electric car sales, more than twice the number of 2023 sales, and the electric sales share doubled to 6.5%. Costa Rica, Uruguay and Colombia also achieved impressive sales shares of around 15%, 13% and 7.5%, respectively. These increases are in large part the result of government incentives such as tax exemptions, reduced registration fees, a relaxation of traffic restrictions for EVs, and relatively high fossil fuel prices.

In Africa, electric car sales more than doubled to reach nearly 11,000 in 2024. Sales shares remained low, at under 1%, though there was growth in several countries, such as Morocco and Egypt, where new electric car sales increased to more than 2 000.

EV sales grow in the US, stagnate in Europe

In the United States, electric car sales grew by about 10% year-on-year to 1.6 million units in CY2024, reaching more than one in 10 cars sold. However, growth slowed down significantly in 2024, increasing by just 10% compared to 40% in 2023. While the Tesla Model Y and Model 3 have been the two best-selling models in the United States since 2020, the 110 new models that have entered the market since then have driven the market share of Tesla down from 60% in 2020 to 38% in 2024.

Europe saw sales stagnate as subsidy schemes and other supportive policies waned, though the market share of electric cars remained around 20%.

About one in five new cars sold on the European market was electric in 2024, maintaining the sales share of CY2023. The electric sales share increased in 2024 in 14 out of 27 EU member states, while it either stalled or decreased in the rest, including in several larger markets, such as Germany and France, largely as a result of subsidies being phased out or reduced.

Besides subsidies, the policy design of the European Union CO2 standards may also have held back further growth of the electric car market in 2024. As new targets come into effect every 5 years, car makers had no incentive to push sales of electric cars further in 2024 (in anticipation of strengthened targets in 2025). This is in contrast to markets such as the United Kingdom, where annually increasing targets move original equipment manufacturers (OEMs) towards electrification each year.

In the United Kingdom – the second-largest car market in Europe – electric car sales reached a share of nearly 30%, up from 24% in 2023. The year 2024 was the first under the Vehicle Emissions Trading Scheme, which required 22% of all new registrations to be BEV or fuel cell electric vehicle (FCEV). Norway reached near-total electrification of sales, with 88% of car sales being battery electric and just under 3% plug-in hybrid. As a result of the growing stock of electric cars, Norway’s oil consumption for road in 2024 decreased by 12% compared to 2021. From April 2025, a tax increase on conventional internal combustion engine (ICE) cars and PHEVs is expected to further increase the battery electric share towards meeting the Norwegian government’s 2025 goal of 100% zero-emissions car sales. In Denmark, the electric sales share increased by 10 percentage points to reach 56%, with nearly 100 000 electric cars sold.

“Our data shows that, despite significant uncertainties, electric cars remain on a strong growth trajectory globally. Sales continue to set new records, with major implications for the international auto industry,” said IEA Executive Director Fatih Birol.

He added, “This year, we expect more than one in four cars sold worldwide to be electric, with growth accelerating in many emerging economies. By the end of this decade, it is set to be more than two in five cars as EVs become increasingly affordable.”

Uncertainties over global economic growth and the evolution of trade and industrial policies could affect the outlook. But sales of EVs are being supported by their increasing affordability, the report finds.

Purchase gap with conventional cars still persists

On a global level, the average price of a battery electric car fell in 2024 amid growing competition and declining battery costs. In China, two-thirds of all electric cars sold last year were priced lower than their conventional equivalents, even without purchase incentives. However, the purchase price gap with conventional cars persisted in many other markets. The average battery electric car price in Germany, for example, remained 20% higher than that of its conventional counterpart. In the United States, battery electric cars were still 30% more expensive.

EVs remain consistently cheaper to operate across many markets, based on current energy market prices. Even if oil prices were to fall as low as $40 per barrel, running an electric car in Europe via home charging would still cost about half as much as running a conventional car at today’s residential electricity prices.

According to the report, almost one-fifth of electric car sales worldwide are of imported vehicles. China, which accounts for more than 70% of global production, shipped nearly 1.25 million electric cars to other countries in 2024. This included to many emerging economies, where electric car prices fell considerably on the back of Chinese imports.

Main report: Courtesy IEA

ALSO READ: India’s EV industry sales jump 27% in CY2024 but miss 2-million mark by a whisker

RELATED ARTICLES

TVS Motor: The New King of India's Electric 2-Wheeler Market

January 2026 sees TVS Motor solidify its position with 34,558 units Bajaj struggles to keep pace.

Electric PV Sales Stabilize after GST Hit

Fresh FADA data shows January 2026 registrations surging 55% year-on-year, with Tata, JSW MG, and Mahindra all posting s...

Bajaj Chetak production plunges by 47% in July due to shortage of rare earth magnets

Bajaj Auto manufactured 10,824 Chetaks last month, 9,560 fewer units than the 20,384 Chetaks produced in July 2024. As a...

19 May 2025

19 May 2025

19001 Views

19001 Views

Angitha Suresh

Angitha Suresh

Arunima Pal

Arunima Pal

Ajit Dalvi

Ajit Dalvi