India is world’s largest electric 3W market for second year in a row

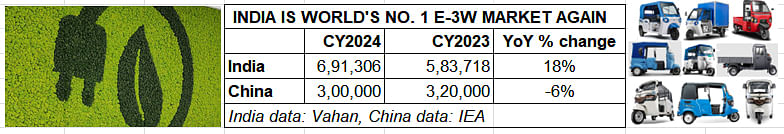

India, which overtook China to become the world’s largest electric 3-wheeler market for the first time in CY2023, maintains its No. 1 position in CY2024 with record sales of nearly 700,000 units and 18% YoY growth. In comparison, China sold around 300,000 units and posted a YoY decline of 6 percent.

Confirmation of India being the world’s largest electric three-wheeler market for the second year in a row has just come in. In its latest Global EV Outlook 2025 report, the International Energy Agency (IEA) has stated that China, the world's largest electric vehicle market, registered electric three-wheeler sales of 300,000 units in CY2024, down 6% year on year (CY2023: 320,000 units). This is far less than India, which clocked record retail sales of nearly 700,000 e-three-wheelers in , up 18% YoY.

In CY2023, India had overtaken China in the electric three-wheeler market for the first time. The Global EV Outlook is an annual publication that identifies and assesses recent developments in electric mobility across the world. It is developed with the support of members of the Electric Vehicles Initiative (EVI).

According to the IEA report, “Electrification of three-wheelers in China has stagnated at less than 15% over the past 3 years. In 2023, India overtook China to become the world’s largest market for electric 3Ws, and it maintained this position in 2024, with sales growing close to 20% year-on-year to reach nearly 700,000 vehicles.”

While demand for electric 3Ws continued to slow down in China, India registered record retail sales of 691,306 units in CY2024 to maintain its No. 1 position for the second straight year.

While demand for electric 3Ws continued to slow down in China, India registered record retail sales of 691,306 units in CY2024 to maintain its No. 1 position for the second straight year.

The IEA report states that despite the global three-wheeler market shrinking 5% from CY2023, electric 3W sales increased by more than 10% to surpass a million units in CY2024 with India and China accounting for more than 90 percent of total sales. This means that electric 3W sales represented almost one-quarter of all three-wheeler sales, up from one-fifth in CY2023 with India continuing to drive most of the growth in the global electric three-wheeler market.

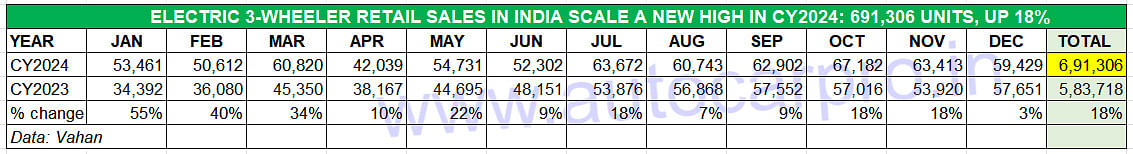

The Indian e-three-wheeler market scaled a record high of 691,306 units retailed in CY2024, up 18% YoY (CY2023: 583,718 units). As the Vahan sales data table for CY2024 below depicts, the industry registered YoY growth in each of the 12 months, hitting peak monthly sales of 67,182 units in October 2024.

The Indian e-3W industry registered growth in each of the 12 months of CY2024 but missed the 700,000 sales milestone by just 8,694 units.

The Indian e-3W industry registered growth in each of the 12 months of CY2024 but missed the 700,000 sales milestone by just 8,694 units.

This translated into e-3Ws having a record 57% share of the overall Indian 3W market of 1.22 million units (12,21,878 3Ws across electric, CNG, LPG, diesel and petrol powertrains). This performance was an improvement over the 53% share e-3Ws had in CY2023 (11,05,438 3Ws). In comparison, demand for CNG 3Ws has slowed down – 349,539 units in CY2024, just 4,901 units more YoY with the CNG share of overall 3W sales in India dropping to 29% in CY2024 from 31 percent.

OVER 235,000 E-3Ws SOLD IN INDIA IN FIRST 4 MONTHS OF CY2025

The e-three-wheeler sub-segment, which comprises passenger-transporting e-rickshaws and cargo-carrying three-wheelers in India, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

In the first four months of this year, 235,157 units have been sold, up 14% YoY (January-April 2024: 206,932 units). The incentive to buy an electric three-wheeler in India remains strong, particularly in view of the lower cost of ownership (compared to IC engine, CNG and LPG options) and the PM E-Drive scheme, valid from October 1, 2024 till March 31, 2026. The PM E-Drive scheme incentivises purchase of 320,000 commercial e-three-wheelers. E-three-wheelers including e-rickshaws, get a subsidy of Rs 25,000 in the first year and Rs 12,500 in the second year. For the L5 category (cargo e-three-wheelers), the incentive is Rs 50,000 per unit in the first year and Rs 25,000 in the second.

FIERCELY COMPETITIVE MARKET IN INDIA

Similar to the Indian e-two-wheeler industry, there’s fierce competition too in this segment, albeit amongst the Top 6 players – Mahindra Last Mile Mobility (MLMM), Bajaj Auto, YC Electric Vehicles, Saera Electric Auto, Dilli Electric Auto and Piaggio Vehicles. And TVS Motor Co has recently plugged into this segment. The real battle is being fought at podium level between Mahindra Last Mile Mobility, Bajaj Auto and YC Electric Vehicles.

The Indian e-3W market which comprises all of 550-odd players is currently witnessing a shakeout as legacy OEMs (Mahindra & Mahindra, Kinetic Group, Atul Auto, Piaggio Vehicles, Omega Seiki, Bajaj Auto, Murugappa Group and TVS Motor Co) are making a strong impact and grabbing market share.

According to the IEA Global EV Outlook 2025 report, two- and three-wheelers remained the most electrified road transport segment in 2024, with more than 9% of the global fleet now electric. The global sales share of electric models remained at around 15% in 2024 with total electric model sales reaching 10 million units. The electric sales share stalled in 2024, mostly due to the shrinking Chinese electric 2- and 3W market, although growth in other regions was steady. China, India and Southeast Asia remain the world’s largest 2- and 3W markets, accounting for around 80% of 2024 global sales, with 2- and 3Ws serving as the primary mode of private passenger transport in India and Southeast Asia.

ALSO READ:

India beats China again to be world’s largest electric 3W market

Electric 3W industry scales new high in FY2025 but misses 700,000 milestone by 900 units

Electric 3W battle heats up: Mahindra and Bajaj separated by 131 units in April, TVS grabs 2% share

RELATED ARTICLES

Bajaj Chetak production plunges by 47% in July due to shortage of rare earth magnets

Bajaj Auto manufactured 10,824 Chetaks last month, 9,560 fewer units than the 20,384 Chetaks produced in July 2024. As a...

TVS eyes new markets for iQube e-scooter in rural India

TVS Motor Co, which has topped the electric two-wheeler market for the past four months, looks to expand the predominant...

More than one in four cars sold worldwide this year set to be electric

The IEA’s latest Global EV Outlook states that global sales of electric cars are on track to surpass 20 million units th...

19 May 2025

19 May 2025

20325 Views

20325 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau