Electric 3W battle heats up: Mahindra and Bajaj separated by 131 units in April, TVS grabs 2% share

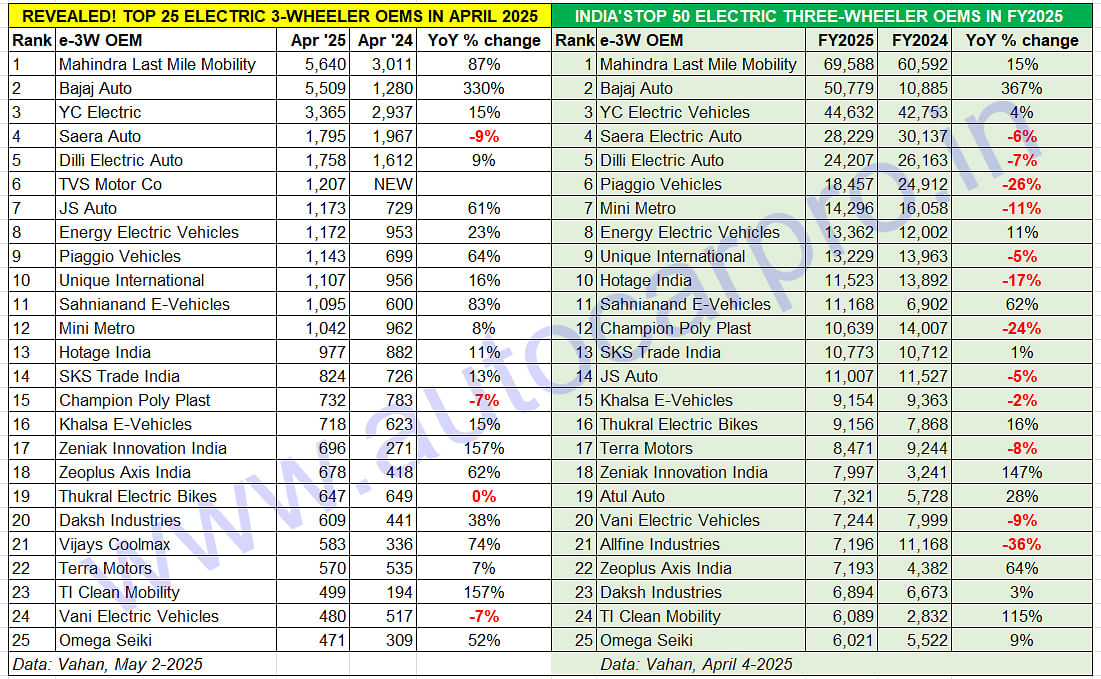

The electric three-wheeler industry has opened FY2026 with 62,533 units and 49% YoY growth. In a field of 550 players, legacy OEMs Mahindra Last Mile Mobility (5,640 units) and Bajaj Auto (5,509 units) battle for supremacy with an equal 9% market share. And TVS Motor, which has recently entered this segment, sold 1,207 units in April for a 2% share and sixth rank.

April 2025, the opening month of FY2026, has been a good opener for the Indian electric vehicle industry with total sales of 167,520 units. While the e-two-wheeler industry clocked best-ever April sales of 91,791 units and 40% growth, the e-three-wheeler segment has also packed a punch. The e-3W industry has clocked retail sales of 62,533 units in April 2025, an increase of 49% YoY (April 2024: 42,039 units) and sets the growth agenda for a strong fiscal. This segment had hit record sales of 699,073 units in FY2025 and accounted for 57% of the 1.22 million three-wheelers sold across all powertrains.

While the incentive to buy an electric three-wheeler remains strong, particularly in view of the lower cost of ownership (compared to IC engine, CNG and LPG options), the reduced subsidy compared to the FAME II scheme seems to have impacted demand.

The PM E-Drive scheme, valid from October 1, 2024 till March 31, 2026, offers the same subsidy as in the EMPS for the first year, and half of that in the second year. The PM E-Drive scheme incentivises purchase of 320,000 commercial e-three-wheelers. E-three-wheelers including e-rickshaws, get a subsidy of Rs 25,000 in the first year and Rs 12,500 in the second year. For the L5 category (cargo e-three-wheelers), the incentive is Rs 50,000 per unit in the first year and Rs 25,000 in the second.

RAPID INCREASE IN DEMAND FOR ELECTRIC 3-WHEELERS CONTINUES . . . EATS INTO CNG 3Ws

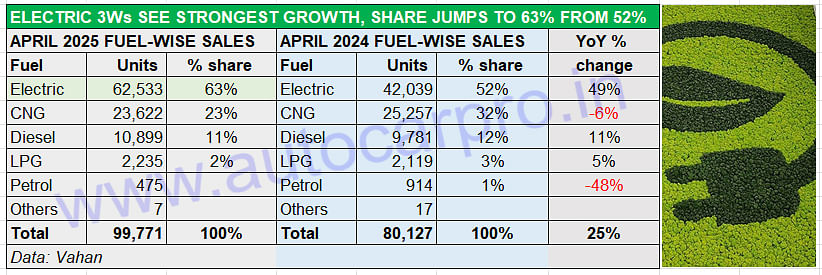

Of all the vehicle segments, it is the electric three-wheeler industry which is witnessing the fastest transition to electric mobility. In April 2025, a total of 99,771 three-wheelers (across all powertrains comprising electric, CNG, diesel, LPG and petrol) were sold across India (other than Telangana), as per Vahan data.

In April 2025, a total of 99,771 3Ws across all powertrains were sold in India. Of this, e-3Ws accounted for 63% (62,533 units), increasing their share from 52% in April 2024.

In April 2025, a total of 99,771 3Ws across all powertrains were sold in India. Of this, e-3Ws accounted for 63% (62,533 units), increasing their share from 52% in April 2024.

Electric 3Ws (62,533 units) accounted for the bulk of sales – 63% – increasing their share YoY by 11% from 52% in April 2024. Demand for CNG variants dropped by 6% YoY to 23,622 units with the CNG share of 3W sales dropping by 9% YoY to 23% in April 2025 – this can be attributed to CNG price increases in recent times, adding to the total cost of ownership. This also means e-3Ws are taking away market share from CNG-powered models. Meanwhile, diesel 3Ws

Like the e-two-wheeler industry, there’s fierce competition too in this segment, albeit amongst the Top 6 players – Mahindra Last Mile Mobility (MLMM), Bajaj Auto, YC Electric Vehicles, Saera Electric Auto, Dilli Electric Auto and Piaggio Vehicles. And TVS Motor Co has plugged into this segment only recently. The Top 10 OEMs, which comprise these six along with Mini Metro, Energy EV, Unique International and Hotage India, together sold 288,302 units or 41% of total sales in FY2025. However, the real battle is being fought at podium level between Mahindra Last Mile Mobility, Bajaj Auto and YC Electric Vehicles.

LEGACY PLAYERS MAKE STRONG GAINS: MAHINDRA AND BAJAJ BATTLE FOR HONOURS

Compared to the electric two-wheeler market which has only a few legacy players (TVS, Bajaj Auto, Hero MotoCorp, Honda Motorcycle & Scooter India, and Suzuki India), the electric 3W industry has eight – Mahindra & Mahindra, Kinetic Group, Atul Auto, Piaggio Vehicles, Omega Seiki, Bajaj Auto, Murugappa Group and TVS Motor Co. Other than these well-established legacy OEMs, the e-3W segment is currently populated by small and medium enterprises and the Vahan website lists the total number at 550 players in April.

Given the fact that the bulk of the market, mainly passenger models, remains an unorganised one the entry of well-established legacy OEMs is now having an impact in the market. While Mahindra Last Mile Mobility already has a strong footprint, the entry of Bajaj Auto (in June 2023) as also the Murugappa Group’s TI Clean Mobility, and more recently TVS Motor Co has seen a shift in demand dynamics.

MAHINDRA LAST MILE MOBILITY

MAHINDRA LAST MILE MOBILITY

April 2025: 5,640 units, up 87%

E3W market share: 9%

Mahindra Last Mile Mobility (MLMM), which checked out of FY2025 as India’s No. 1 commercial EV manufacturer for the fourth year in a row, has opened FY2026 with sales of 5,640 units in April 2025, an 87% YoY increase (April 2024: 3,011 units) translating into an additional 2,629 units. This gives it a market share of 9% for the month.

MLMM has the largest e-3W portfolio in the industry comprising the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Plus and e-Alfa Cargo which cater to multiple mobility operations in the passenger and cargo domains.

The Treo, Treo Plus and e-Alfa Plus are passenger-transporting models, the last being an e-rickshaw. While the Treo is powered by a 7.4 kWh lithium-ion battery which delivers an ARAI-certified range of 110km, the Treo Plus with a 10.24 kWh battery can travel 150km per charge. Both have a similar 55kph top speed with driver and three passengers. The E-Alfa Plus e-rickshaw has a 100km range with driver and 4 passengers.

There are three cargo-transporting models – the e-Alfa Cargo (310kg payload / 95km range), the Zor Grand (400kg payload / 90km range) and Treo Zor (500kg payload / 80km range) – designed for multiple operations.

BAJAJ AUTO

BAJAJ AUTO

April 2025: 5,509 units, up 330%

E3W market share: 9%

At 5,509 units sold in April, Bajaj Auto is just 131 units behind the market leader and has the same 9% share for the month. The YoY increase is 330% on a low year-ago base of 1,280 units but it also means that the company sold an additional 4,229 units YoY.

While the variant-wise sales splits are not available, Bajaj Auto, which sells only electric passenger and cargo 3Ws and is soon to enter the e-rickshaw segment, would likely have gone ahead of MLMM if only passenger and cargo variant sales are compared.

Bajaj Auto, India’s No. 1 3W manufacturer and exporter which entered the e3W market in June 2023, has rapidly moved up the ranks to take the No. 2 position and is hard on the heels of Mahindra. In FY2025, jumped 11 ranks to secure No. 2 position and a 7% market share.

Bajaj Auto has two products – the RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 in the fray. The Maxima XL Cargo E-Tec 12.0, which develops 5.5 kW power and 36 Nm, has a bigger battery and higher range of 183km per charge than the RE E-Tec 9.0 passenger model. In February 2025, Bajaj Auto launched the GoGo e3W brand designed to redefine last-mile mobility, for both passenger and cargo operations. Key highlights are a best-in-class range of 248km, a 5-year /120,000km battery warranty, and first-in-class tech features like auto hazard and anti-roll detection. There are two GoGo models for passenger transport (P70s and P50s) and three variants (P5009, P5012 and P7012). While the P5009 has a 9 kWH battery, the P5012 and P7012 are equipped with a 12 kWh unit.

YC ELECTRIC

YC ELECTRIC

April 2025: 3,365 units, up 15%

E3W market share: 5%

YC Electric, the longstanding No. 2 e-three-wheeler OEM which lost its rank to a hard-charging Bajaj Auto in FY2024, has sold 4,465 units in April, up 15% (April 2024: 2,937 units). YC Electric has five models on sale – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations – a market share of 6.38%, below MLMM’s 10% and 1% below above Bajaj Auto’s 7.26 percent.

SAERA AUTO

SAERA AUTO

April 2025: 1,795 units, down 9%

E3W market share: 3%

Saera Electric Auto, the manufacturer of the Mayuri brand of electric rickshaws, has all of nine models in the market. Based in the industrial hub of Bhiwadi, Rajasthan, it is the leading supplier of -rickshaw loader models like the Mayuri E-Cart Loader.

Like a number of other e-rickshaw players, Saera too has been impacted by the advance of legacy OEMs in the e-3W industry. Its retail sales of 1,795 units in April 2025 are own 9% YoY (April 2024: 1,967 units).

The company has three manufacturing plants. While the Bhiwadi plant has a production capacity of 24,000 units per annum, the Bawal (Haryana) plant has a 36,000 units per annum capacity. And the third facility at Kosi in Uttar Pradesh has recently commenced production.

DILLI ELECTRIC AUTO

DILLI ELECTRIC AUTO

April 2025: 1,758 units, up 9%

E3W market share: 3%

Just 37 units behind Saera Electric is Dilli Electric Auto. This Haryana-based company manufactures electric rickshaws (CityLife brand), a category which is now under pressure as legacy players target sales with better-built, safer products. Dilli Electric had sold 24,207 units in FY2025, down 7% YoY (FY2024: 26,163 units). Despite being available in only a few states like Uttar Pradesh, Bihar, Jammu & Kashmir, Delhi and Bengal, the TVS King EV Max sold 1,207 units in April.

Despite being available in only a few states like Uttar Pradesh, Bihar, Jammu & Kashmir, Delhi and Bengal, the TVS King EV Max sold 1,207 units in April.

TVS MOTOR CO

April 2025: 1,207 units

E3W market share: 2%

TVS Motor Co, the latest legacy OEM to plug into the e-3W market, has jumped into No. 6 position within months of launching its King EV Max. As per Vahan retail data, the company sold 1,207 units of this model in April, which gives it a 2% market share.

The zero-emission King EV Max, whose styling is close to the petrol-engined TVS King sibling, is powered by a 9.7 kWh lithium-ion LFP battery pack claimed to deliver a travel range of 179km per charge and a top speed of 60kph. The TVS King EV Max, which develops maximum power of 11 kW and 40 Nm of torque, has three riding modes with different top speed limits – Eco (40kph), City (50kph) and Power (60kph). As per the TVS King EV Max’s tech specs, 0-100% charging takes three-and-a-half hours while a 0-80% charge takes two hours and 15 minutes.

PIAGGIO VEHICLES

PIAGGIO VEHICLES

April 2025: 1,143 units, up 64%

E3W market share: 2%

With 1,143 units sold in April 2025, Piaggio is ranked No. 9 on the e-3W OEM sales scale after JS Auto (1,173 units) and Energy EV (1,172 units). This is a 64% increase YoY (April 2024: 699 units) and gives it a market share of 2% for last month. In FY2024, the company had sold 18,457 units and was ranked sixth. The company’s Apé E-City FX Max passenger model (with 145km range) and Apé E-Xtra FX Max cargo carrier (115km range) are fully assembled by an all-women team at its Baramati factory in Maharashtra.

Meanwhile, in a manner akin to Bajaj Auto’s speedy growth in the e-3W industry, Murugappa Group company TI Green Mobility (Montra Electric) is fast climbing up the ranks. In April, Montra Electric sold 499 e-3Ws, up 157% YoY (April 2024: 194 units). The company, which entered the e3W market in July 2023 and clocked annual sales of 6,089 units in FY2025, up 115% on FY2024’s 2,832 units, was ranked No. 24 last fiscal.

E-3W INDUSTRY GROWTH OUTLOOK: OPTIMISTIC

With a srong start to the new fiscal year, the Indian electric three-wheeler industry can be expected to maintain the momentum in the coming months and beyond. The key growth drivers are the continuing demand for last-mile mobility across the country, the optimised cost efficiency of e-3Ws which offer the lowest cost of ownership compared to other commercial vehicles and also elections in tke key state of Bihar later this year.

In FY2025, Bihar was ranked the fifth highest selling state for EVs with total sales of 113,645 units, which gives it an all-India share of 6 percent. The bulk of Bihar's EV sales came from e-3Ws (89,524 units / 13% share), followed by e-2Ws (23,064 units / 2% share), e-PVs (963 units / 1% share) and e-CVs (94 units).

That's not all. Maharashtra has recently announced its new EV Policy 2025 designed to accelerate sale of zero-emission vehicles. Though the state ranks much lower than Bihar in the all-India scale, the new policy offers a 15% subsidy on goods-transporting three-wheelers.

ALSO READ:

E2W OEMs open FY2026 with best-ever April sales, TVS tops for the first time

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

03 May 2025

03 May 2025

21495 Views

21495 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau