FADA calls for leaner dealer inventory of 21 days

FADA calls on OEMs to reduce inventory levels, expresses concern about unusually high number of auto dealership closures.

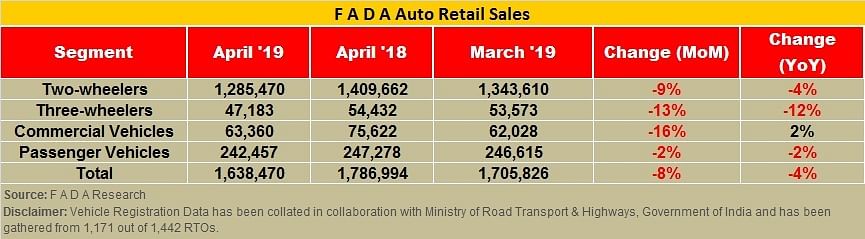

The Federation of Automobile Dealers Associations (FADA) today released the monthly vehicle registration data for April 2019. At 1,638,470 vehicles retailed in the country, it means a drop of 8 percent YoY and 4 percent on month-on-month basis.

Commenting on last month's sales performance, FADA president, Ashish Harsharaj Kale said, “April ended on a negative note. Amongst the categories on a YoY basis, commercial vehicles and three-wheelers, which registered highest growth during FY2019, witnessed the highest fall April, while two-wheelers and passenger vehicles degrew by 9 percent and 2 percent respectively.”

In terms of YoY sales performance, the data reveals that there was de-growth in all categories albeit on a very high base. The only segment which reported positive results, and that too, on a MoM (month-on-month) basis was the commercial vehicles category which grew by 2 percent.

In terms of segment-wise sales, two-wheeler retail sales for the month came at 1,285,470 units (-9% YoY & -4% MoM); three-wheelers at 47,183 units (-13% YoY & -12% MoM); CVs at 63,360 units (-16% YoY & 2%); PVs at 242,457 units (-2% YoY & -2% MoM).

“The near-term outlook continues to be negative to neutral with the absence of any immediate positive triggers which could affect retail sales. Despite the current negative retail situation, which we expect to continue for the next 8-12 weeks, we still believe that the outlook for auto retail can soon turn positive if below mentioned triggers turn positive — a stable government with continued development focus; an average to above average monsoons with an even spread and continued easing of liquidity by the RBI,” added Kale.

High inventory levels and liquidity remain a concern

In terms of high inventory levels, the retailer body has been calling for intervention from OEMs to tackle the situation and for April 2019, inventory levels continued to remain high and requires further correction than done in recent months. FADA suggests that a high inventory level at this time is an extra burden on auto dealers especially when the present environment is witnessing negative sales growth combined with extremely tight working capital availability for the retail sector.

FADA says looking at the overall degrowth in volumes, weak consumer sentiment, uncertainty in the market and entering a year which will witness BS-VI implementation impacting the dynamics of the industry, it will strongly advocate for a leaner dealer inventory of 21 days (15 days Inventory + 7 days of in-transit inventory) for its members to help reduce a huge cost burden and allow the dealers to stay afloat in these challenging times.

Consumer liquidity in April has seen marginal improvement but FADA says it continues to be tight and still far away from the levels seen in normal times. According to Kale, “FADA is extremely concerned at the dealer liquidity which continues to remain very tight and access to working capital for dealers has reduced further with the banking system taking a negative view towards auto retail in the current circumstances.”

Working with the new government and RBI

The auto industry is witnessing an unusually high number of auto dealership closures in recent times, especially in the metros and Tier 1 cities, of which a substantial number were due to financial stress caused by accumulated losses and reduced access to working capital needs, says FADA.

Following this concern, FADA will engage with the newly elected policymakers along with the Reserve Bank of India (RBI) to work upon a separate categorisation for auto retail and its funding requirements for long-term sustainability of dealers.

The retail body will also start engaging deeply with all stakeholders on the topic of dealer viability for long term profitable survival of the dealers.

“In a rapidly growing country like ours, which is heading towards being the global leader, the mobility needs of a growing nation are best served by the automobile sector. The fundamentals and the long-term prospect of the Indian auto industry and along with it the dealership business continues to be extremely strong and the auto dealership business will continue to be one of the highest employment generators and tax collectors as we navigate through this difficult period into good times," said Kale.

The auto retail body undertook its first online monthly survey among its members, which it says represents all categories of auto retail (2W, CV, 3W and PV), states and regions in the country with a healthy mix of urban and rural. The survey results on the current sentiments of the industry - 51 percent dealers rated it as Bad, while 42 percent dealers rated it Neutral. On the liquidity front - 47 percent of dealers rated it as Neutral, while 39 percent dealers rated it as Bad; On the current inventory front, the average inventory for PVs range from 40 – 45 days, 2W range from 45 – 50 days and CV range from 45 – 50 days.

FADA says going forward, the online survey will be scaled up even further to give an astute picture of the auto retail industry.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

08 May 2019

08 May 2019

8157 Views

8157 Views