PV makers record double-digit sales decline in April

Subdued consumer and purchase sentiment and the ongoing general elections impact passenger vehicle sales in the first month of the new fiscal year.

FY2019 was a year that the Indian automotive would like to forget in a hurry, what with single-digit growth (+5.5%) overall and 2.7 percent for the passenger vehicle (PV) industry impacted as it was by a slew of economic and consumer sentiment factors. FY2020, the new fiscal year, has begun on a similar note, if not worse. The overall subdued market sentiment continues to affect sales momentum and it might a few months before the market revives.

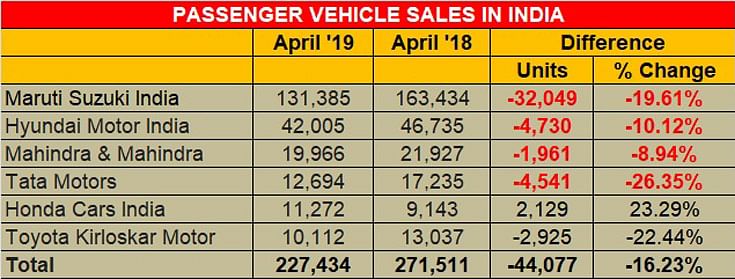

The PV industry, which is still coming to terms on Maruti Suzuki India’s big announcement to stop making diesel-engined cars from April 2020, has begun reporting its sales/despatch numbers for April 2019 and they do not make for good news. From the OEMs which have released their numbers, the entire lot, barring Honda Cars India, is in the red.

Maruti Suzuki India, which recently updated two of its models with a brand-new in-house developed 1.5-litre diesel motor, saw its sales slump 19.6 percent with overall 131,385 units going home to buyers (April 2018: 163,434). While the entry level passenger car duo of the Alto and old Wagon R hatchbacks sold a total of 22,766 units, down 39.8 percent year on year (April 2018: 37,794), the seven-model compact car lot (new Wagon R, Swift, Celerio, Ignis, Baleno, Dzire, Dzire Tour S) accounted for 72,146 units, down 13.9 percent (April 2018: 83,834).

The premium Ciaz sedan saw its sales fall sharply by 45.5 percent to 2,789 units (April 2018: 5,116) and the quartet of utility vehicles (Gypsy, Ertiga, S-Cross and Vitara Brezza) was the only segment to be in positive territory with sales of 22,035 units, up 5.9 percent (April 2018: 20,804).

No. 2 carmaker, Hyundai Motor India too recorded a substantial decline in sales, despite the new Santro and Grand i10 hatchback models being offered with substantial discounts to the tune of Rs 95,000. The company sold 42,005 units in April, registering a 10 percent decline (April 2018: 46,735). Hyundai unveiled its much-awaited Hyundai Venue sub-compact SUV earlier last month and is all set to launch the car in India on May 21. Bookings for the Venue have commenced and the company will be hoping the new SUV gives it new drive on the sales front.

Mahindra & Mahindra’s Passenger Vehicles segment (which includes UVs, cars and vans) sold 19,966 vehicles in April 2019. This marks YoY de-growth of 9 percent. The sales comprised 18,848 UVs, down 7 percent (April 2018: 20,371) and 1,118 vans, down 28 percent (April 2018: 1,556). Commenting on the April 2019 numbers, Rajan Wadhera, president, Automotive Sector, M&M, said: “The ongoing elections has subdued the purchase sentiment during April. This, according to us, is a temporary phenomenon. We believe, following the elections the auto industry will see a revival in consumer demand. Supported by a normal monsoon, we are confident of seeing higher sales in FY2020.”

Tata Motors, which has been on a strong footing for the past 18-odd months, too felt the pressure of slowing sales. Its PV numbers fell sharply by 26 percent to 12,694 units (April 2018: 17,235). The company, which launched the Harrier SUV in Q4 FY2019, sees the ongoing general elections across the country as a sales speedbreaker with consumers holding back on their discretionary purchases.

Honda Cars India, the sole player to have reported positive growth amidst a tough market, registered overall sales of 11,272 units in the month, albeit with the 23 percent uptick coming on the back of a low year-ago base (April 2018: 9,143) when it did not have its Amaze in production in the corresponding month last year, due to an imminent new-generation launch slated for May 2018. Rajesh Goel, senior vice-president and director, Sales and Marketing, Honda Cars India, said, “The ongoing elections and overall subdued market sentiment continues to affect the sales momentum. Going forward, the industry is heading towards a tougher year impacting sales due to volatility in fuel prices, increase in car prices owing to new regulations and stricter inventory control for smooth switchover to BS VI regime by year end.”

Meanwhile, Toyota Kirloskar Motor sold a total of 10,112 units in the domestic market in April 2019, 22 percent down YoY (April 2018: 13,037). Commenting on the sales performance, N Raja, deputy managing director, Toyota Kirloskar Motor, said, “The industry is currently experiencing a slowdown due to uncertainty of upcoming general elections that looms over the market and this slow pace is expected to continue until the new government is formed. Consumer sentiment has currently dampened due to several factors like tight liquidity, high insurance and high costs. We hope the sales growth momentum to pick up in the upcoming months after the election results are out.” Interestingly, Toyota is expected to launch its badge-engineered Maruti Baleno, christened the Toyota Glanza, in June.

As the political scenario in the country is under a very crucial phase, the impact on not just the auto industry, but the entire economy is expected to be a little tough over the next couple of months. A weak Q1 is what market experts are claiming with expectations of a revival sometime in Q2 of this fiscal. We will keep a tab on how things progress. Stay tuned.

Also read: Tata Motors, Mahindra CV sales begin FY2020 in slow lane

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

03 May 2019

03 May 2019

12472 Views

12472 Views

Shahkar Abidi

Shahkar Abidi