Slowdown hits India's two-wheeler market hard

Like the passenger vehicle and commercial vehicle segments, the ongoing slowdown has not spared the largest one of them all.

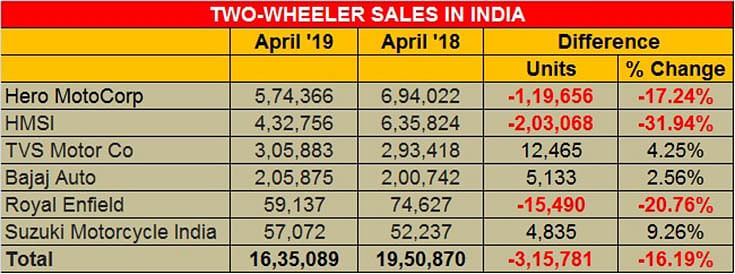

Like the passenger vehicle and commercial vehicle segments, the ongoing slowdown has not spared the largest one of them all: India's humungous two-wheeler market. See the gross total of six OEMs' sales in the table below and the year-on-year de-growth of 16 percent is stark pointer that all is not well with the industry on two wheels only.

In April 2018, market leader and the world's largest two-wheeler maker Hero MotoCorp sold 694,022 units, which was a 16.5 percent YoY growth. This April, the figure stood at 574,366 units, which is lower than the April 2017 figure of 595,706 units. The 17 percent YoY drop in Hero MotoCorp's sales last month in a way reflects the market environment, which includes correction of unusually high inventory levels.

Hero MotoCorp expects the first half of the current financial year to be challenging while the ride could improve during the second half. Its newest model, the XPulse, launched with an aggressive entry price tag of Rs 97,000, is aimed at reclaiming lost ground in the premium motorcycle segment. Starting this month, the OEM will also step up activities in the scooter segment with the introduction of a 125cc variant of the Maestro Edge. Hero MotoCorp has lined up Rs 1,500 crore for capital expenditure during the current financial year. A major chunk of it will be used for the company's new plant at Andhra Pradesh.

Honda Motorcycle & Scooter India, the No. 2 market player, has had a rough April. At 432,756 units sold last month, the company's sales are down a massive 32 percent YoY, given that it had sold 635,824 units in April 2018. Its FY2019 sales of 552,0617 units were down 4.4 percent on year ago sales. Given the ongoing market sentiment, HMSI like other OEMs is likely to see tepid sales for the next few months but the company is driving towards BS VI compliance speedily on the back of new platforms and is also readying the next-generation Activa which will be high on connectivity and a host of rider-friendly features.

Boosted by the performance of models launched last year in the motorcycle and scooter segments, TVS Motor Co has reported moderate YoY growth of 4 percent with sales of 305,883 units last month, compared to 293,418 units in April 2018. Sales of TVS scooters stood at 97,323 units, a 9 percent YoY growth over 89,245 units in April 2018. The company expects the overall scooter market to see renewed demand this year. Motorcycles clocked the same growth rate as scooters. 143,063 motorcycles were sold last month, compared to 131,704 units in April 2018.

TVS Motor says that the industry is still tackling the challenge of high inventory levels, but things should look up from Q2 onwards. It expects to outpace the industry's growth rate this year. The two-wheeler industry is expected to growth at around 5 percent in 2019-20. This year will also see TVS Motor enter the electric mobility space. The company's capex budget stands at Rs 650 crore for the year.

Bajaj Auto, which has successfully regained a good amount of lost ground in the motorcycle segment also posted a growth during last month. The OEM sold 205,875 units in April, which is a 3 percent YoY growth over 200,742 units sold in April 2018. Bajaj Auto gained 4 percentage points in the motorcycle market during 2018-19. "We had decided to concentrate our resources on the entry level segment which we expected to grow and the sports segment which is our stronghold. Our product innovations, their marketing and vigorous consumer engagement were very effective due to this focus," says Rakesh Sharma, executive director, Bajaj Auto.

Royal Enfield, which was once averaging monthly sales of over 70,000 units, is feeling the heat of growing competition and also dipping consumer sentiment. The Chennai-based bikemaker sold 59,137 units, down a sizeable 21 percent, compared to 74,627 units a year ago. In FY2019, the company recorded sales of 805,273 units, which marked single-digit growth of 3.80 percent. Expect the company management to be putting their heads together to come up with an aggressive new strategy to drive growth in FY2020 and beyond.

Suzuki Motorcycle India, which is gunning for the 1-million units mark in sales during 2019-20, posted a 9 percent YoY growth in the domestic market. It sold 57,072 units last month as against 52,237 units in April 2018. Acknowledging the "depressed industry sentiment", Devashish Handa, VP - Marketing, Sales & Aftersales, Suzuki Motorcycle India, says, "In this fiscal year, our focus is also to strengthen our dealer network and product portfolio with the addition of new premium products to our stable catering to a larger customer base.”

Damp the market environment maybe, but damned the industry player will be who will not plot multiple interventions in the form of products, marketing, retail and also financing strategies. So, it would be fair to expect a frequency of such activities this year that will be in contrast to the current depressed market environment.

Also read: Passenger vehicle makers record double-digit sales decline in April

Commercial vehicle sales begin FY2020 in the slow lane

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

04 May 2019

04 May 2019

18749 Views

18749 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal