Two-wheeler OEMs ride rising wave of demand in July

Improved month-on-month growth in July 2021 indicates that the upward movement has finally begun but challenges remain for the scooter segment.

There’s a whiff of sales positivity in the air and the two-wheeler industry is sensing it. As the country and most States re-open and lift extended lockdowns, the need to travel is translating into demand for personal mobility solutions.

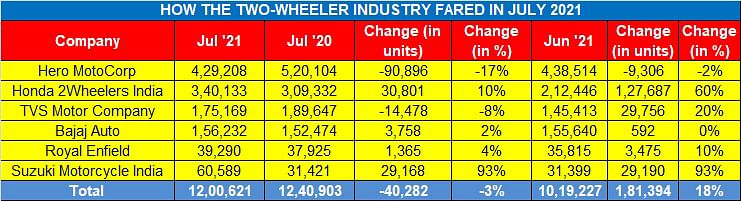

While cumulative sales numbers from six leading OEMs – 1,200,621 units – indicate a 3% year-on-year decline, a good and positive marker of growth is the rising month- on-month sales: 18% (June 2021: 1,019,227 units). It’s a trend also reflected in the passenger vehicle and commercial vehicle segments, which have recorded 15% and 28% month-on-month growth respectively. posted a 18% growth.

Here's looking at how some key players fared in July 2021.

Hero MotoCorp: 429,208 units / -17 %

Market leader Hero MotoCorp, with sales of 429,208 in July 2021, saw numbers decline by 17% (July 2020: 520,104 units). The total comprised 424,126 motorcycles and 30,272 scooters. Month on month too, the company saw a decline, albeit a marginal 2% (June 2020: 438,514), which indicates the upward movement has begun.

Last month, Hero launched two key products – the new Glamour Xtech commuter motorcycle and the 2021 Maestro Edge scooter – both designed to rev up the numbers in their segments.

The Glamour Xtec is priced at Rs 78,900 for the drum variant and Rs 83,500 for the disc variant. With demand from rural India, which is the mainstay for frugal commuter motorcycles in India, picking up the company is keen to drive demand for the Glamour. The 125cc gearless Maestro Edge has been launched in three variants with prices ranging between Rs 72,250 for the drum-brake version and Rs 79,750 ex-showroom, Delhi for the new variant with connected technology.

Honda Motorcycle & Scooter India: 340,133 units / +10%

Honda Motorcycle & Scooter India witnessed growth in July 2021, both YoY and month on month. At 340,133 units, it marked10% YoY growth and 60% MoM growth (June 2021: 212,446).

Yadvinder Singh Guleria, Director – Sales & Marketing, said, “Gradually ramping up production while monitoring the market situation, Honda’s sales momentum continues to accelerate with July month reaching closer to the 400,000-units mark. With the majority of our dealer network resuming operations across the country, a sharp surge in enquiries for scooters followed by motorcycles is being witnessed. Backed by a good monsoon, increasing preference for personal mobility and upcoming festival season, we expect faster recovery for the market.”

The company also expanded its premium BigWing network, opening BigWing Topline in Chennai and a BigWing outlet in Chandigarh.

A big 'win' for HMSI last month was topping the first-ever FADA Dealer Satisfaction Study, ahead of market leader Hero MotoCorp.

TVS Motor Co: 175,169 units / -8%

TVS Motor Company registered sales of 175,169 units in July 2021 compared to 189,647 units a year ago, down 8 percent. However, month-on-month, demand for TVS products is up with the company registering strong 20% growth.

Bajaj Auto: 156,232 units / +2 %

Bajaj Auto, with despatches of 156,232 units in July 2021, posted marginal 2% growth (July 2020: 156,232), which reflects that demand is yet to come its way in terms of entry level bikes. This is the affordable commuter bike segment, which has been affected the most by the massive job losses across the country and also also impacted sales of other OEMs and overall industry.

Royal Enfield: 39,290 units / +4%

The Chennai-based OEM sold 39,290 motorcycles last month, compared to 37,925 units in July 2020, up 4% growth. Month on month, this is a 10% increase (June 2021: 35,815).

Suzuki Motorcycle India: 60,589 units/ + 93%

The Japanese automaker clocked 93% growth with 60,589 units in July 2021, albeit on a low year-ago base (July 2020: 31,421). The company has ramped up production as demand gradually increases for some of its products.

Growth outlook

With most of the pent-up demand dissipated in July, the coming months will be the real indicators of growth in the two-wheeler sector. Most of India has opened up but given the fears of a third wave of Covid-19, industry is cautiously optimistic about sustained demand.

Other challenges include the wallet-busting petrol price across the country, shortage of semiconductors and the unabated rise in commodity prices resulting in higher input costs. There is also a worrying lack of demand for scooters in urban India, which is still seeing a large working population working from home. Furthermore, schools and colleges across most parts of the country continue to be shut, which means growth in the scooter market will continue to be subdued at least in the near future.

The big positive though is rural India, which seems to be fast back on the track, what with a bountiful monsoon enabling better produce. Two-wheeler industry stakeholders are keeping their fingers firmly crossed that August turns into an august month, with the festive season just beyond it.

RELATED ARTICLES

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

05 Aug 2021

05 Aug 2021

13029 Views

13029 Views

Ajit Dalvi

Ajit Dalvi