Car sales in July ride on green shoots of recovery

OEMs benefit from pent-up demand after lifting of second round of lockdowns as well as bountiful monsoon that has triggered rural bounce-back.

In what is welcome news for the Indian passenger vehicle industry, sales in July 2021 have registered a strong increase in volumes. Clearly, they are benefitting from the pent-up demand after the second Covid wave-induced lockdowns earlier this year, as well as a good monsoon that is getting rural demand back on track.

PV market leader Maruti Suzuki India’s sales, at 133,732 units and a year-on-year increase of 37 percent (July 2020: 97,768 units) indicate that the marketplace momentum is returning. Industry experts tell that despite the high petrol and diesel prices, the need for personal mobility over public transport has sustained. This has led to demand returning “very strongly” after the lockdowns being gradually eased over the past couple of months.

“One of the key reasons is that customers really want personal mobility and. therefore, a car at their disposal whenever they need it,” said Tarun Garg, director, Sales, Marketing and Service, Hyundai Motor India, in an interview. “Moreover, they really want to travel together with their families safely and, therefore, products which are high on safety, connectivity and features are driving the market right now,” Garg added.

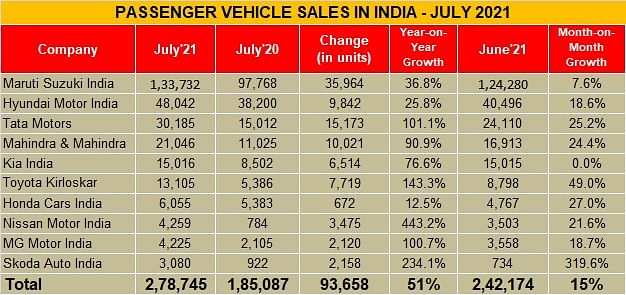

Let’s take a close look at company-wise sales of some key players:

Maruti Suzuki India: (133,732 / +37%)

The bellwether of the Indian automobile industry inched closer to its July 2018 sales level of 152,427 units. On a month-on-month basis too, MSIL registered an uptick of 7.60 percent over 124,280 units sold in June 2021.

The entry-level duo of Alto and S-Presso posted 13 percent month-on-month growth at 19,685 units (June 2021: 17,439), while the Wagon R, Swift, Celerio, Ignis, Baleno, Dzire and Tour S sold a total of 70,268 units (June 2021: 68,249 / +2%). The SUV line-up of its Vitara Brezza, Ertiga, S-Cross, Gypsy and XL6 went home to 32,272 buyers, recording a 14.5 percent uptick over June’s 28,172 units.

Hyundai Motor India: (48,042 / +25.8%)

Hyundai too witnessed the return of demand last month with 48,042 units, an almost 26 percent YoY growth over 38,200 units of July 2020. On a month-on-month basis, it saw over 18 percent growth versus the 40,496 units sold in June 2021.

While the Creta is commanding market dominance in the midsize SUV segment, the newly-launched Alcazar seven-seat SUV is also witnessing good traction. “We are seeing a good response on both six- and seven-seat variants. The Alcazar is getting new customers to the Hyundai fold, those who were probably not Hyundai customers in the past,” said Tarun Garg.

Tata Motors: (30,185 / +101%)

The homegrown carmaker registered significant YoY growth and doubled its July sales to 30,185 units over 15,012 units sold in July 2020. The company also recorded over 25 percent growth on a month-on-month basis with June 2021 sales pegged at 24,110 units.

Tata Motors is seeing good traction for its latest models, including the Safari, Altroz and the Dark Edition limited variants. Alongside, its Nexon and Nexon EV duo continue to woo compact SUV buyers both in the conventional and EV space.

Mahindra & Mahindra: (21,046 / +91%)

At 21,046 units, M&M posted strong 91 percent growth over the 11,025 sold in July 2020. Month on month, last month's numbers are a 24.43 percent growth over June 2021’s 16,913 units.

While the company is witnessing heightened activity levels in terms of fresh enquiries, it is still critically impacted by the ongoing semiconductor shortage that is resulting in longer waiting periods for some tech-heavy products like the XUV300 and higher variants of the newly-launched Bolero Neo. M&M is also gearing up to showcase the upcoming XUV700.

“The supply of semiconductors continues to be a global issue, we are doing everything to address it on priority,” says Veejay Nakra, CEO, Automotive Division, M&M.

Kia India: (15,016 / +76%)

Kia, which has topped the 2021 FADA Dealer Satisfaction Study, sold 15,016 units, notching 76 percent YoY growth (July 2020: 8,502) albeit month-on-month growth is flat when compared to June 2021's 15,015 units. The Kia Sonet compact crossover, with 7,675 units, accounted for 50 percent of the sales, followed by the Seltos (6,983) and Carnival (358).

According to Tae-Jin Park, chief sales and business strategy officer, Kia India, “We are optimistic that the supply chain will get further streamlined in the coming weeks to enable us to make mobility more accessible to our customers.”

Toyota Kirloskar Motor: (13,105 / +143%)

TKM’s domestic sales in July were pegged at 13,105 units, a significant 143 percent growth over July 2020's 5,386 units, albeit that month was amidst the height of the pandemic. Month on month growth is a good 49 percent over June 2021’s 8,798 units.

Toyota attributes the higher numbers to “already encouraging” pending orders as well as significant surge in fresh demand. The Fortuner and Innova Crysta continue to be the key growth drivers.

Honda Cars India: (6,055 / +12.48%)

At 6,055 units, YoY growth for the Japanese carmaker was 12.48 percent over the 5,383 units sold in July last year. On a month-on-month basis, Honda recorded 27 percent growth (June 2021: 4,767 units).

According to Rajesh Goel, SVP and director, Marketing and Sales, HCIL, “We achieved our production ramp up from the last week of July and have streamlined supplies in line with market activity. The market sentiment has improved amidst the lower rate of infection, and we expect the upcoming festive period to help the industry maintain its momentum.”

Nissan Motor India: (4,259 / +443%)

Nissan Motor India sold 4,259 units last month to register a significant six-fold growth over 784 units sold in July 2020, albeit on a very low year-ago base. Month on month, this marked 21 percent growth over 3,503 units sold in June 2021.

The new Nissan Magnite has been the key turnaround model for the company, driving demand and sales, due to its value-for-money positioning. According to Rakesh Srivastava, MD, Nissan Motor India, “Customer sentiment has improved with opening up of most markets and we have increased production of the Magnite by starting a third shift at the plant. Although supply chain challenges continue, our endeavour is to reduce the waiting period further.”

MG Motor India: (4,225 / +101%)

The company sold 4,225 units last month to double sales over July 2020’s 2,105 units. MG registered an 18.74 percent growth on a month-on-month basis with June 2021 sales being pegged at 3,558 units.

While the MG Hector and ZS EV have further gained momentum, according to Rakesh Sidana, director, Sales, MG Motor India, “The severe shortage of chips is expected to continue for some time and will lead to further supply constraints. We are also being cautious of the potential threats of a third Covid wave.”

Skoda Auto India: (3,080 / +234%)

Nothing like a new model to infuse freshness into a carmaker's portfolio. The recently launched Kushaq SUV has done just that for Skoda which sold 3,080 units across the range, recording 234% YoY growth (July 2020: 922). On a month-on-month basis, the company has grown almost five times over the 734 units sold in June 2021.

Skoda claims the Kushaq has received over 6,000 bookings within a month of launch.

Growth outlook

While the impact of the pandemic somewhat weaning off and the passenger vehicle segment is showing signs of recovery riding on the green shoots of pent-up demand and a market tilt towards personal mobility, there are some factors that could limit the potential.

“The key issue of demand-supply mismatch continues due to the global semiconductor shortage. If the production gets normalised, the segment would easily be able to tap up to 10 percent more volumes,” said Vinkesh Gulati, president, Federation of Automobile Dealers Associations.

Gulati concluded saying, "A good monsoon also augurs well to spur rural demand further, which could see positively impacting sales in the festive season."

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

02 Aug 2021

02 Aug 2021

10449 Views

10449 Views

Ajit Dalvi

Ajit Dalvi