Kia, BMW, Mercedes-Benz, HMSI, VECV and Bajaj top FADA’s Dealer Satisfaction Study 2021

Kia India ticks all the right boxes for the dealer fraternity with one of the highest margins in the industry and speedy product delivery to showrooms across the country.

The Federation of Automobile Dealers Associations (FADA), the apex national body of automobile retail in India, has announced the findings of the Dealer Satisfaction Study 2021.

The study, undertaken in association with the Singapore-based PremonAsia, a consumer-insight-led consulting and advisory firm, saw participation from over 2,000 dealer principals. To ensure a balanced view, around 25 percent of dealer participation was from non-FADA members.

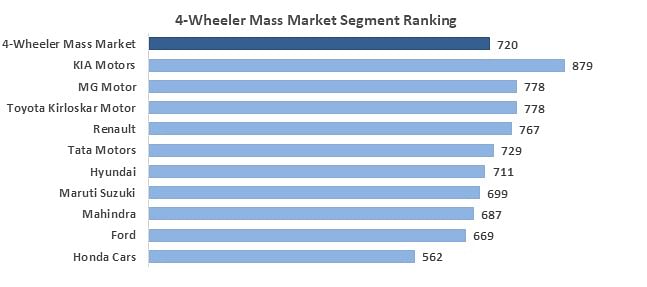

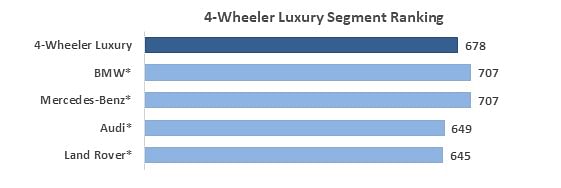

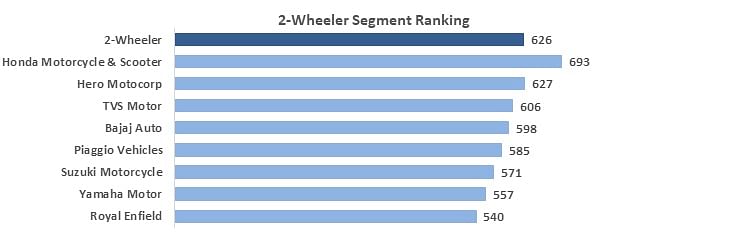

The first-ever study which was announced in February 2021 saw Kia India top the list in the overall and mass-market four-wheeler segment; BMW India and Mercedes-Benz India topped the luxury segment; Bajaj Auto in the three-wheeler segment; Honda Motorcycle & Scooter India in two-wheelers and Volvo Eicher Commercial Vehicles (VECV) in the commercial vehicle segment.

Interestingly, what made Kia India stand out and tick all the right boxes for the dealer fraternity includes offering one of the highest margins in the industry, and delivery time for Kia products being amongst the quickest, which leads to faster turnaround time. Higher percentage of settling of warranty claims in time and timely delivery of vehicles as per the specifications were also Kia's performance highlights.

According to Vinkesh Gulati, president, FADA, “FADA’s Dealer Satisfaction Study 2021 was initiated to examine the health of the relationship between auto dealers and their OEMs. The survey was undertaken to reflect the prevailing issues faced by the auto retail sector at large, thus making it the true voice of the dealers."

He added, "OEMs need to be cognisant of the evolving dealer expectations. While issues of concern such as dealership viability, support on sales and aftersales, openness to dealer inputs in decision making and designing long term policies are fundamental needs, there are clear signs that dealers expect their respective OEMs to go beyond. For example, there is a need to have technology solutions and analytics to intelligently mine transaction data for business gains. Also, creating a digital platform to measure the effectiveness of marketing expenditure is reflective of a changing mindset.”

C S Vigneshwar, secretary and chairman DSS-21, FADA said, “I am thrilled to say that FADA took more than 2,000 samples, the highest ever number which has been used for such a study in India. The survey being filled entirely by the dealer principals, or their CEOs, is a testimony of its accuracy and coverage of all aspects of dealerships in detail. DSS 2021 also has an equal distribution of samples from all four zones, coupled with the right urban and rural mix. I am thankful to the entire dealership fraternity for devoting a sizable time. I am also grateful to all OEMs who persuaded their dealers to do the needful.”

Rajeev Lochan, founder and CEO, PremonAsia said, “The industry average satisfaction score of 657 indicates that OEMs have a significant headroom to improve in meeting the needs of their channel partners, particularly for the two-wheeler and commercial vehicle segments. Kia Motors’ performance is commendable with segment and industry-leading ratings across all the factors. Not only are Kia’s dealers satisfied on most of the hygiene needs, but they are also truly delighted with the product and their business viability.”

Business viability a critical aspect for dealerships

As per the study findings, at the overall industry level, dealers attached high importance of 27% on business viability, making it a highly critical aspect where OEMs need to exhibit greater sensitivity, particularly since the current satisfaction level on this factor is weak.

On the positive side, dealers feel that products, both in terms of quality and range by and large meet the expectations of end-customers' current needs albeit the future will require more frequent refreshes. While dealers of mass-market PV remained most satisfied with an average of 720 on a scale of 1,000, the three-Wheeler segment scored the lowest, 610 on a scale of 1,000 amongst all segments.

In terms of segment-wise key learnings, the study found that in the mass-market passenger vehicle segment, while dealers raised their concerns about OEMs not being receptive to their inputs for keeping viable and long-term policy in mind, they also said that OEMs provide adequate training for frontline sales and service staff thus keeping the end customer satisfied.

In the passenger vehicle luxury segment, the study found that training cost-sharing arrangement by the OEMs was unsatisfactory, and OEMs ability to fulfill vehicle order in correct specifications and quantity coupled with non-flexibility to choose workshop equipments were cause of major concerns. The study also found that extended warranty policy and customer handling process were at satisfactory levels.

For the two-wheeler segment, respondents pointed out the biggest concern was that OEMs are not open to dealer inputs in terms of improving dealership cost structure from a viability and policy point of view. Similarly, there was no support from OEMs on the buyback of dead stocks of parts. On the positive side, the study found that OEMs were fair in acceptance and rejection of warranty claims.

The findings for the commercial vehicle segment reveal that while OEMs need to handhold dealers in improving sales efficiency and controlling the cost of sales, they are quite happy about the overall product range and quality of fully built vehicles. The dealers are also satisfied as they could directly communicate with OEMs senior leadership team for discussing business viability and long-term policies.

Addressing dealer concerns with OEMs

While OEMs continue to make investments in their products and marketing, it is important for them to also understand the dealerships' concerns, which acts as the face of the brand for the consumer. Interestingly, when queried about some of the names missing in the survey, Lochan pointed out that while they had reached out to all OEMs, the lack of significant responses from some of them led to some of the automakers not being listed out in the study.

The study aims to bring about awareness to the OEMs about dealer concerns, challenges and the way forward. Vigneshwar said, “The results will help OEMs in two aspects. The first is to benchmark versus the competition, and secondly, understand the state of health of their own dealerships. We have prepared a very detailed understanding of what the survey was all about for every OEMs.”

According to Vinkesh Gulati, FADA will be sharing the detailed study with OEMs in the coming months. He believes that the study will act as a reference point, which will happen every year. "On August 24, we will have our AGM, Conclave and Award ceremony. We will be having a panel discussion session with OEMs where will discuss the concerns of the dealer fraternity. Improvement cannot happen overnight but we expect it to improve gradually."

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

29 Jul 2021

29 Jul 2021

26949 Views

26949 Views

Autocar Professional Bureau

Autocar Professional Bureau