CV sales improve in July, e-commerce gives a boost

What is also benefiting the sector is the growing demand from the booming e-commerce industry, which is pushing last-mile deliveries with a vengeance.

The second wave of the Covid-19 pandemic has started receding in several parts of the country, and many states have lifted local lockdown measures, which have been in place for many months. This has led to an improvement in economic activities and in turn auto retail sales across segments, albeit in varying percentage levels. Passenger vehicle sales saw strong month-on-month growth, thanks to pent-up demand and also an uptick in sales from rural India.

The commercial vehicle sector, which has borne the brunt of the lack of demand even before the pandemic broke, was feeling the heat of slowing sales. In FY2021, the CV segment sold a total of 568,559 units, down 20.77% year on year. Segment-wise this constituted 160,688 M&HCVs (-28.40%) and 407,871 LCVs (-7.30%).

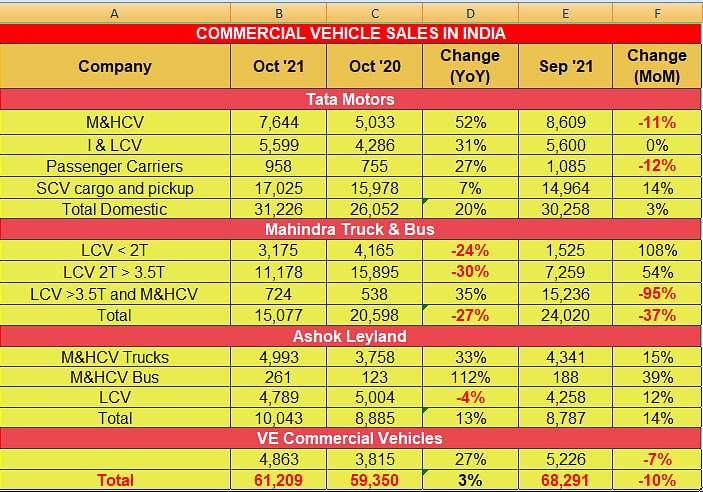

From the July 2021 sales numbers that four CV majors have announced, wholesales total 51,144 units, 64 percent higher than the year-ago sales (July 2020: 31,132 units), and 28 percent higher than June 2021’s 39,809 units. Like the PV segment, a combination of pent-up demand and gradual reopening of the economy has helped. What is also benefiting the sector is the growing demand from the booming e-commerce industry, which is pushing last-mile deliveries with a vengeance.

Market leader Tata Motors reported sales of 21,796 units (81% YoY) compared to 12,012 units in July 2020. The company saw growth in all segments including M&HCVs (5,416 units), I&LCVs (3,357 units), passenger carriers (825 units), SCV cargo and pickup (12,198 units).

For Mahindra & Mahindra, wholesales were 17,666 units (35% YoY) versus 13,103 units in July 2020. The LCV segment continued to contribute a significant portion to its overall sales with 13,445 units (18% YoY), mainly led by demand from last-mile deliveries and e-commerce platforms.

Ashok Leyland is in the black too with sales of 8,129 CVs (90% YoY), compared to 4,283 units for the same period last year. The uptick in sales was on the back of increase in demand for its M&HCV trucks and LCVs.

VE Commercial Vehicles (VECV) saw a 105% YoY growth in sales with 3,553 units being sold for the month of July, compared to 1,734 units for the same period last year.

Growth outlook

While things seem to be improving for the CV sector, the overall wholesales are not indicative of actual growth. Industry experts believe that sustainable growth is still sometime away, and the initial uptick has come on the back of gradual reopening of the economy. On the other hand, industry is hopeful that with the Vehicle Scrappage Policy kicking in, CV sales will get a fillip.

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

03 Aug 2021

03 Aug 2021

11378 Views

11378 Views

Shahkar Abidi

Shahkar Abidi